Skip to comments.

Mapped: The Average Credit Card Debt in Every U.S. State

Visualcapitalist ^

| November 28, 2024

| Pallavi Rao

Posted on 11/28/2024 3:47:50 PM PST by ChicagoConservative27

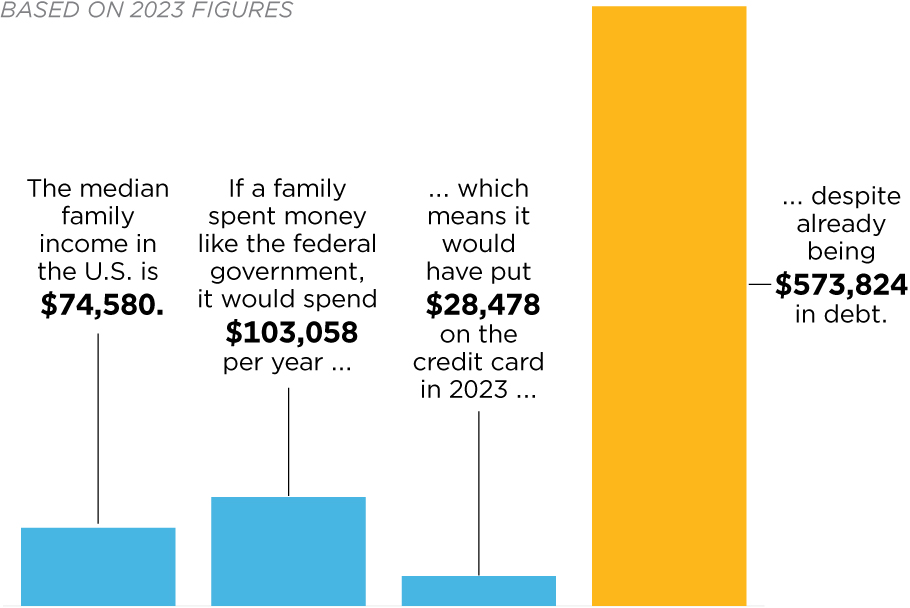

This map visualizes the average credit card debt held by households in each U.S. state and ranks the states where residents pay off the debt the fastest and slowest.

Data is sourced from Bankrate (2024) who also used average monthly household income to calculate how long it takes to pay off balances.

Households in Alaska and Washington D.C. are carrying more than $7,000 in credit card debt, the highest across the country. However, with average annual household incomes of $109,000 and $149,000, residents in both states can pay off their debt in about 15–20 months.

In fact, glancing through the numbers below reveals a pattern.

(Excerpt) Read more at visualcapitalist.com ...

TOPICS: Business/Economy; Education; Reference; Society

KEYWORDS: average; ccdebt; creditcard; debt; state; stateslist

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41 next last

Wow just wow

To: ChicagoConservative27

My Credit Card debt: $0.00 I grew up despising debt, and I still do to this day.

2

posted on

11/28/2024 3:51:18 PM PST

by

EvilCapitalist

(Pets are no substitute for children)

To: ChicagoConservative27

3

posted on

11/28/2024 3:53:53 PM PST

by

Libloather

(Why do climate change hoax deniers live in mansions on the beach?)

To: ChicagoConservative27

6k to 7k is about our average. We have on average 2 months of charges. We charge everything we can to get points that reduce our costs by at least 2%. We scheduled each card to be paid off monthly.

4

posted on

11/28/2024 3:54:12 PM PST

by

Raycpa

To: ChicagoConservative27

The averages are not that far apart between the states.

5

posted on

11/28/2024 3:54:29 PM PST

by

Wuli

To: EvilCapitalist

My credit card debt is also 0. Have one business card that I pay off every month. I think many Freepers are also in the same position.

6

posted on

11/28/2024 3:55:02 PM PST

by

pnut22

To: EvilCapitalist

My credit card debt stays at $0.00, too.

I pay it off every month.

7

posted on

11/28/2024 3:55:46 PM PST

by

gitmo

(If your theology doesn’t become your biography, what good is it?)

To: ChicagoConservative27

That is $1,200 in interest per year paid on top of the ‘cut’ that the card issuer gets for every transaction or if you pay hundreds just to have the credit card.

8

posted on

11/28/2024 3:56:05 PM PST

by

jdt1138

(Where ever you go, there you are.)

To: ChicagoConservative27

I fit right in the FL stats, but I have a good excuse. A years ago I had the house ductwork replaced, and I signed a finance agreement thinking it was a loan like a car loan. It turned out to be a credit card application, and the loan was a credit card purchase at a special rate. So now I have a credit card balance which I’m paying off double time so I can go back to zero balancing my cards every month.

9

posted on

11/28/2024 3:56:12 PM PST

by

chajin

("There is no other name under heaven given among people by which we must be saved." Acts 4:12)

To: ChicagoConservative27

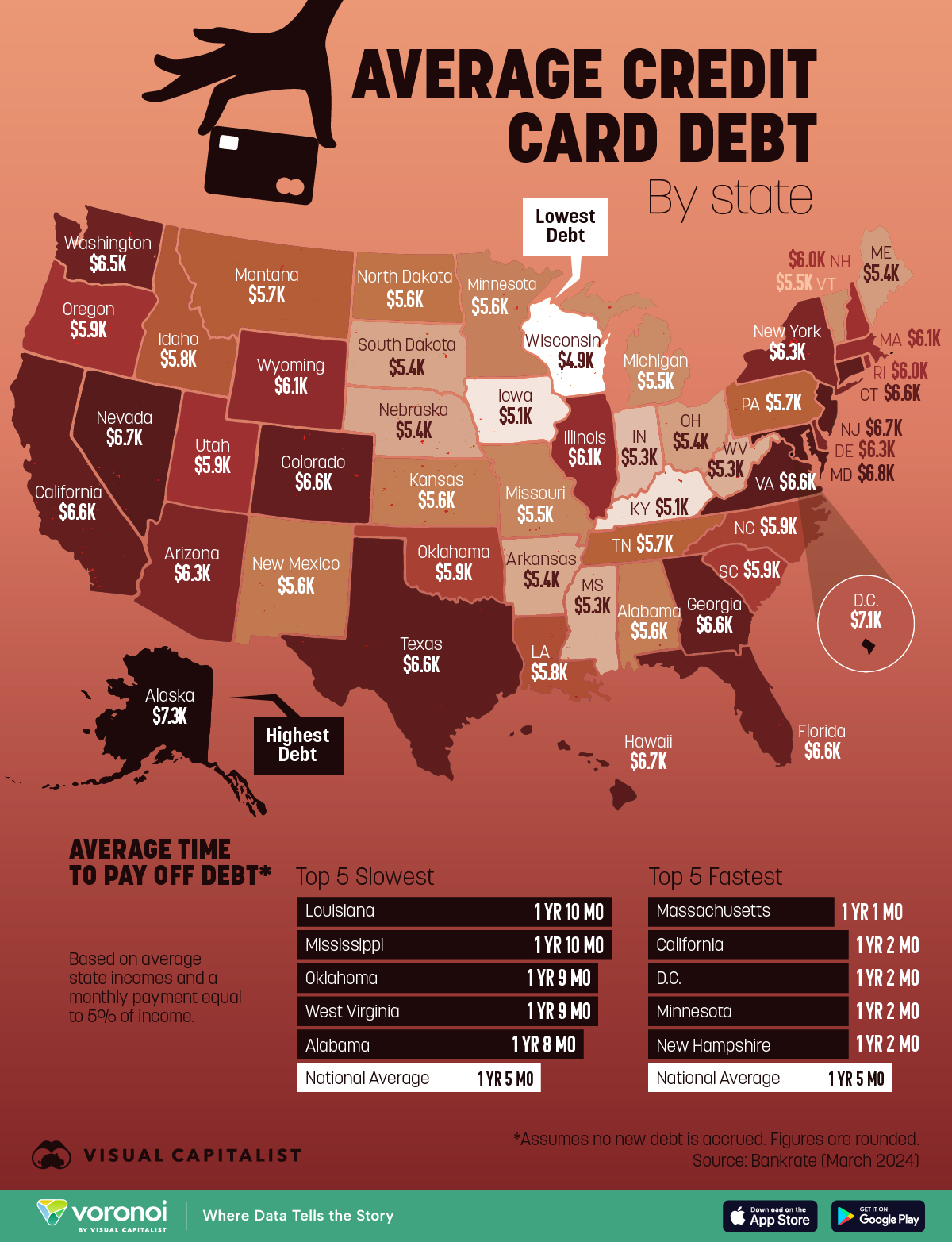

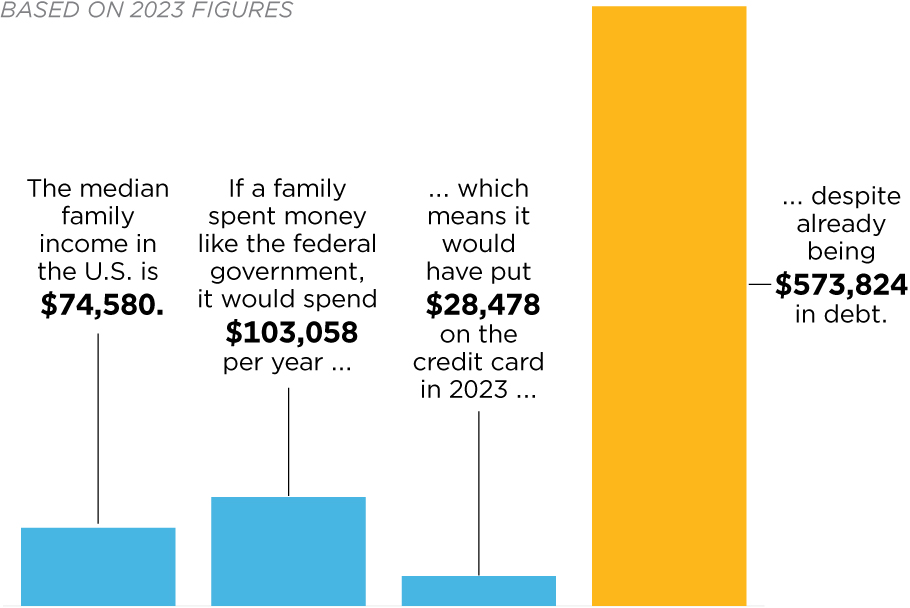

Per AI

- Per Household Debt: The national debt equates to $272,173 for every household in the U.S.

- Debt-to-Income Ratio: If a median-income American family spent money like the U.S. government, it would have spent all of its earnings and then put over $28,000 on a credit card in 2023, while already being $573,000 in debt.

- Debt vs. Consumer Debt: The national debt is 77% more than the combined consumer debt of every household in the U.S.

10

posted on

11/28/2024 3:57:21 PM PST

by

Responsibility2nd

(Climate Change is Real. Winter, Spring, Summer and Fall.)

To: ChicagoConservative27

I posted data in post 10 just to show how little the average family debt is in comparison to the US debt.

11

posted on

11/28/2024 3:59:17 PM PST

by

Responsibility2nd

(Climate Change is Real. Winter, Spring, Summer and Fall.)

12

posted on

11/28/2024 4:01:43 PM PST

by

Chode

(there is no fall back position, there's no rally point, there is no LZ... we're on our own. #FJB)

To: EvilCapitalist

You’re not alone. same here.

Which means that somewhere, someone is making up for it to make that high of an average.

13

posted on

11/28/2024 4:12:44 PM PST

by

metmom

(He who testifies to these things says, “Surely I am coming soon.” uitAmen. Come, Lord Jesus”)

To: chajin

We almost got scammed like that once many years ago.

We were in an airport and these guys were at a table promoting frequent flyer miles. Sounded real good but it turned out to be that you signed up for a credit card, but they weren’t telling you that part.

We were PISSED when we found out. Read the company the riot act about fraudulently representing the card, and got out of it, and NEVER fell for anything like that again.

14

posted on

11/28/2024 4:17:09 PM PST

by

metmom

(He who testifies to these things says, “Surely I am coming soon.” uitAmen. Come, Lord Jesus”)

To: EvilCapitalist

Same here. Don’t even use credit cards.

To: metmom

Don’t forget the fee that cards charge the merchants. In other words, the card companies make money even when we charge on it but pay it off with no interest.

16

posted on

11/28/2024 4:22:54 PM PST

by

Tell It Right

(1 Thessalonians 5:21 -- Put everything to the test, hold fast to that which is true.)

To: EvilCapitalist

I buy almost everything with a credit card. Between I an my wife about 2500 dollars a month. I pay it all monthly and have not paid any interest on a card for over 33 years. I treat my card as if was cash from my bank account and it is.

17

posted on

11/28/2024 4:25:30 PM PST

by

cpdiii

To: ChicagoConservative27

I just paid mine off, but at my income level, that won’t last long.

But $7,000 in debt average per household? I was recently in that situation once, and I swiftly paid that down from another source. Didn’t like the notion of being stuck with hundreds of dollars in interest.

To: metmom

Airline miles and other “perks” enjoyed by those comfortable enough to rack them up are fully funded through higher interest and late fees coughed up by those who aren’t.

19

posted on

11/28/2024 4:34:56 PM PST

by

daler

To: metmom

Cabela’s tried that in Boomtown. Same technique. I locked up when they asked for my SS#.

Paid cash.

20

posted on

11/28/2024 4:36:04 PM PST

by

sasquatch

(Do NOT forget Ashli Babbit! c/o piytar)

Navigation: use the links below to view more comments.

first 1-20, 21-40, 41 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson