Posted on 11/20/2024 9:07:02 PM PST by SeekAndFind

With steadily increasing home prices and stagnating wages among lower-wage workers, home ownership for many Americans has become increasingly unaffordable.

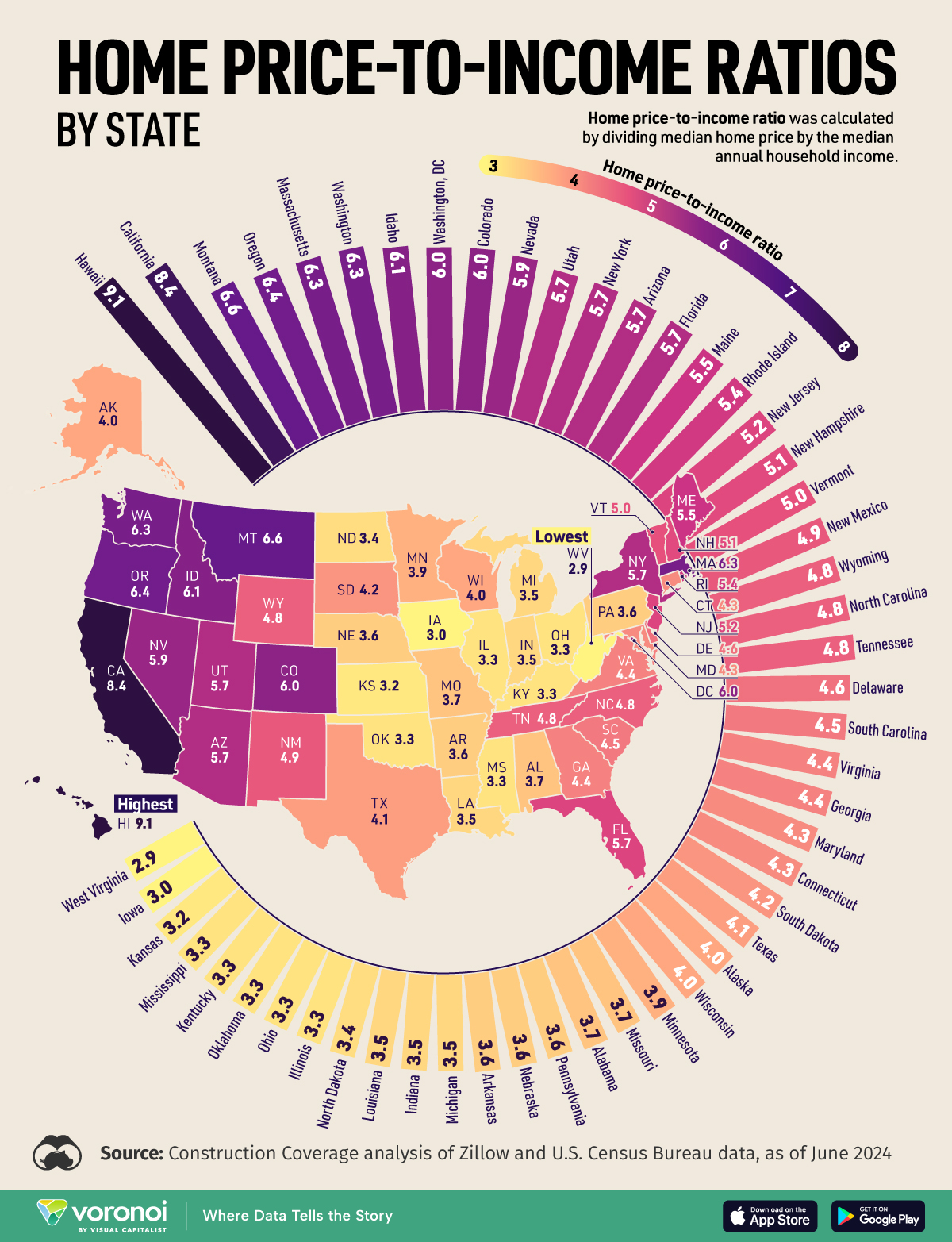

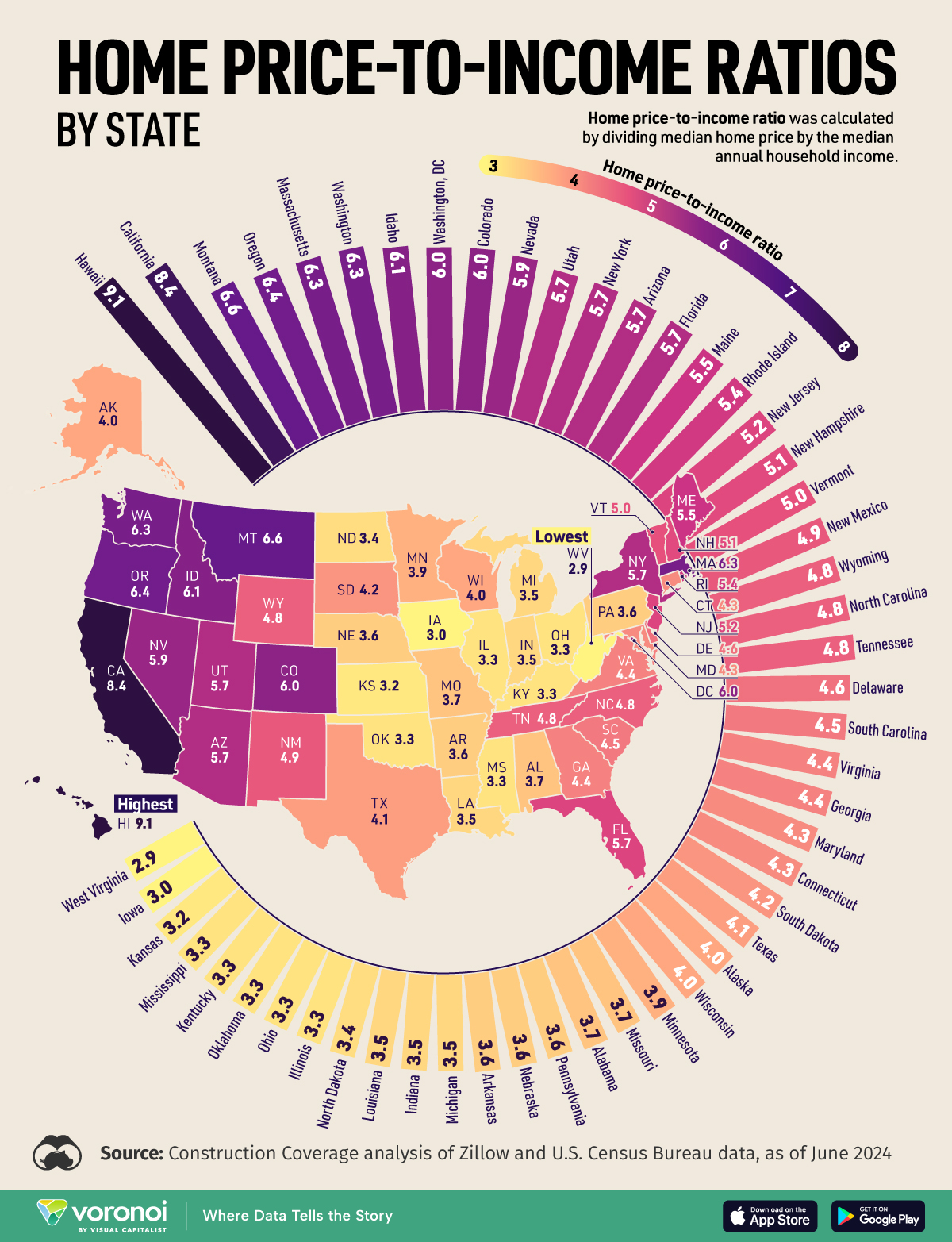

The home price-to-income ratio measures the relationship between the median home price and the median household income. This metric is often used to gauge housing affordability, accounting for variations in the cost of living.

This map, via Visual Capitalist's Kayla Zhu, shows home price-to-income ratio of each U.S. state, using data from a Construction Coverage analysis of Zillow and U.S. Census Bureau data as of June 2024.

The table below shows the home price-to-income ratio for each U.S. state, where Hawaii (9.1) and California (8.4) at the top—both well over the national average of 4.7.

| Rank | State | Ratio |

|---|---|---|

| 1 | Hawaii | 9.1 |

| 2 | California | 8.4 |

| 3 | Montana | 6.6 |

| 4 | Oregon | 6.4 |

| 5 | Massachusetts | 6.3 |

| 6 | Washington | 6.3 |

| 7 | Idaho | 6.1 |

| 8 | Washington | 6 |

| 9 | Colorado | 6 |

| 10 | Nevada | 5.9 |

| 11 | Utah | 5.7 |

| 12 | New York | 5.7 |

| 13 | Arizona | 5.7 |

| 14 | Florida | 5.7 |

| 15 | Maine | 5.5 |

| 16 | Rhode Island | 5.4 |

| 17 | New Jersey | 5.2 |

| 18 | New Hampshire | 5.1 |

| 19 | Vermont | 5 |

| 20 | New Mexico | 4.9 |

| 21 | Wyoming | 4.8 |

| 22 | North Carolina | 4.8 |

| 23 | Tennessee | 4.8 |

| 24 | Delaware | 4.6 |

| 25 | South Carolina | 4.5 |

| 26 | Virginia | 4.4 |

| 27 | Georgia | 4.4 |

| 28 | Maryland | 4.3 |

| 29 | Connecticut | 4.3 |

| 30 | South Dakota | 4.2 |

| 31 | Texas | 4.1 |

| 32 | Alaska | 4 |

| 33 | Wisconsin | 4 |

| 34 | Minnesota | 3.9 |

| 35 | Missouri | 3.7 |

| 36 | Alabama | 3.7 |

| 37 | Pennsylvania | 3.6 |

| 38 | Nebraska | 3.6 |

| 39 | Arkansas | 3.6 |

| 40 | Michigan | 3.5 |

| 41 | Indiana | 3.5 |

| 42 | Louisiana | 3.5 |

| 43 | North Dakota | 3.4 |

| 44 | Illinois | 3.3 |

| 45 | Ohio | 3.3 |

| 46 | Oklahoma | 3.3 |

| 47 | Kentucky | 3.3 |

| 48 | Mississippi | 3.3 |

| 49 | Kansas | 3.2 |

| 50 | Iowa | 3 |

| 51 | West Virginia | 2.9 |

Despite Hawaii and California ranking in the top five for median income (adjusted for cost of living), both states also consistently rank first and second respectively when it comes to median home prices.

Hawaii and California also rank second and third, respectively, when ranking states by the highest salary needed to live comfortably for a single working adult.

According to ATTOM, Hawaii has the highest median house prices in the U.S., at around $852,000.

The Aloha State’s limited land availability, strict housing regulations, and high demand for housing in a desirable climate, are some contributing factors to its high home prices.

Californian cities Los Angeles, San Jose, Long Beach, and San Diego are the top four large U.S. cities with the highest home price-to-income ratios.

Home prices in California have reached unprecedented highs due to a persistent imbalance between high demand and limited supply, which is exacerbated by strict zoning laws, geographic constraints, and a robust economy attracting high-income residents.

To learn more about housing affordability, check out this graphic that shows the top 10 global markets by median price-to-income ratio.

If I hadn’t paid for my home many years ago, I sure couldn’t even consider it now. Lucky to have it paid for some years ago.

What about mining? The reason Montana has been so purple is the UMW. Are the ore bodies that gone or is the knowledge base still there to crank it up again?

Washington DC is not a state.

Not shocking about Florida. The housing is cheap but so is the salaries. Good news is most are retirees who move from northeast and sold their home for 800K and bout a home for 350K. Not needing a salary.

Read later.

Median Sales Price of Houses Sold for the United States [MSPUS] 1963 to recently:

https://fred.stlouisfed.org/series/MSPUS

“Houses that sold for $300K in 2018 now sell for $650-700K, in a state that has virtually no manufacturing jobs, just construction and hospitality. Thus the adverse price to earnings ratio.”

In Bozeman things are more expensive than you state, however we have LOT’s of high-tech employers (Oracle for instance) and the University pays very well. You leave out tourism — Bozeman is the only town in Montana with year-around tourism. We have Simms Fishing Products and others for manufacturing. Lastly there are 200+ non-profits that have offices in Bozeman, like the Sonoran Institute...This raises salaries and RE prices as well.

“The last time I was in Montana (Red Lodge)...”

We call it Rock Dodge and it’s a small town with a lot of out of towners...not a real example of Montana anymore than White Sulphur Springs is to the rest of WV. I have to say I really like WV having been there several dozen times. Good folk there.

“Why the hell is Montana so expensive?”

Because.

There are a number of positive desirability factors that drive housing prices:

1. local climate (California, Hawaii)

2. airline service (LAX, JFK, Heathrow)

3. amenities (beaches, skiing, college town, mountains)

4. economic strength of an area (Greensville factories)

5. schooling K-12 (Scarsdale), university (vicinity)

Two economic factors that drive housing prices:

1. common stock ownership (Silicon Valley, metro NYC & Boston, Pelosi’s SF)

2. high-paying employers (...)

“ No one wants to live in flyover country”

The reality is that people are pouring into flyover country.

Big cities aren’t cool anymore

“location, location, location”

That was in common use 60 years ago.

A townhouse in the Upper East Side might have fetched $125,000 and a similar townhouse could be had for a tenth the price in some other parts of Manhattan.

“Why the hell is Montana so expensive?”

mountains, airports, roads and other amenities

Like gold and sizable diamonds, things like beachfront lots and beautiful mountain view estates are comparatively rare.

The rich like nice things and have the ability and willingness to pay for them.

That’s because of property taxes.

In states like NYS, you don’t own your home you rent it from the government.

If they can’t hike your tax rate, they hike your assessment.

We know folks who can’t sell their existing homes, NOT McMansions, because nobody wants to assume an annual property tax bill in the mid to high four figures.

This sounds like Freeper myth. People are flocking to Florida and Texas, but not the interior hinterlands.

They are clearly not, when seen by the chart above. Everyone is moving west or to Florida.

“ This sounds like Freeper myth. ”

No myth.

I’m doing mortgage loans for them and leasing properties I own to them.

Why do you have a negative view of the best and most conservative parts of the nation ?

Sounds like coastal elite snobbery.

Yes, it’s nice here.

Look at house Prices in Elmo, Montana. avg was 1 mill last I looked.

Lots of CA Money moving up to Montana along with Idaho, probably a lot of Work from home MS money from Seattle too.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.