US Market Sector Performance 6th to 14th November - Simply Wall St

Posted on 11/18/2024 8:34:03 AM PST by SeekAndFind

Donald Trump and the Republican Party made a clean sweep in the US election. Some aspects of Trump’s campaign were a little vague, but we can be fairly certain of lower taxes and deregulation.

That, and the strong US economy, should lead to higher corporate profits. On the other hand, the policies he plans to enact could be inflationary, and US government debt doesn’t look like it’s coming down anytime soon.

This week we are having a look at what a second Trump presidency could mean for investors in the US and elsewhere.

Here’s a quick summary of what’s been going on:

⛏️ Gold price falls most since 2022 as investors pile into equities ( CNBC )

🪙 iShares Bitcoin ETF is now bigger than its gold counterpart ( CNBC )

💸 China sells USD bonds in Saudi Arabia ( FT )

💰 Buffett’s Berkshire Is Being Packaged Into a Leveraged ETF ( Bloomberg )

🏗️ Homebuilder deal activity is surging, fueled by major Japanese buyers ( CNBC )

📉 US Inflation ticks up while jobless claims fall to lowest in six months ( Reuters )

⚖️ Meta hit with €797 million EU fine for breaking antitrust rules ( Fortune )

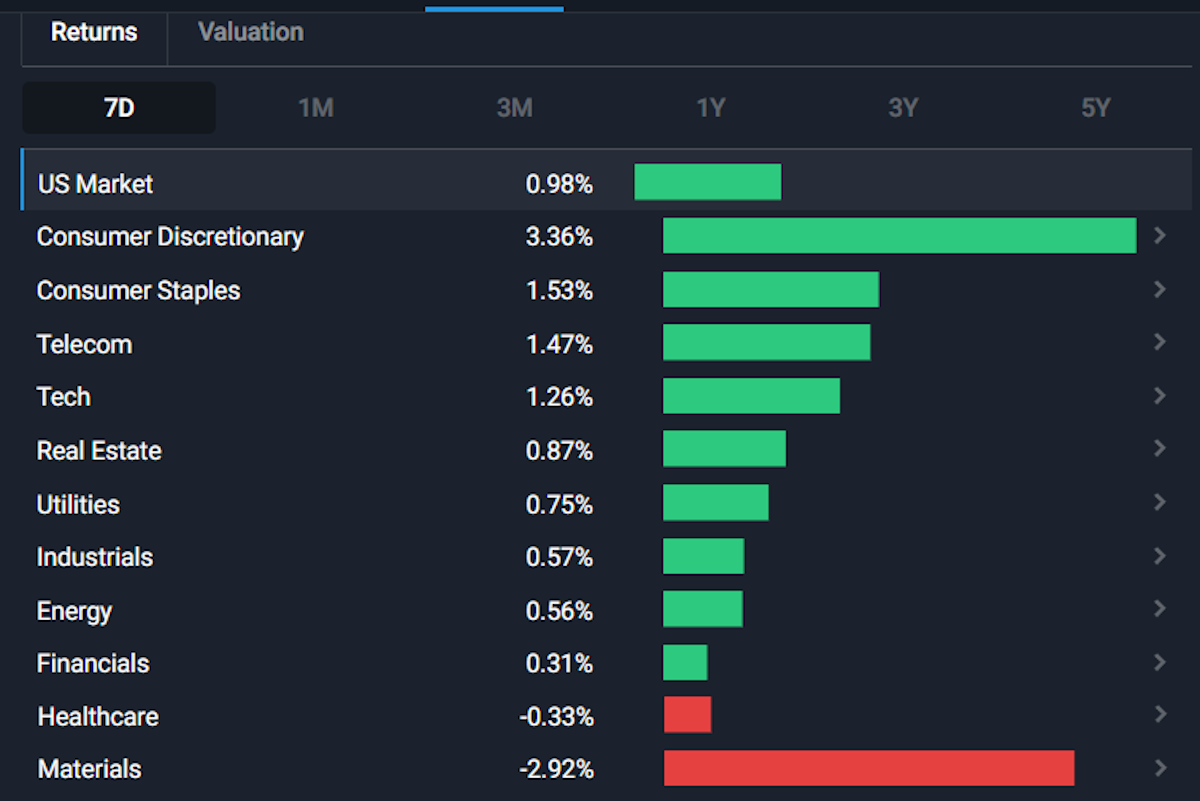

US equities rallied when it became clear that Donald Trump would be returning to the White House. The market’s response was in part a relief rally after the outcome became clear early on, but some sectors certainly began to price in Trump’s pro-business stance.

US Market Sector Performance 6th to 14th November - Simply Wall St

As we’ve mentioned previously, elections tend to have less impact on the overall economy and stock market than leaders like to think. But, this election could be more consequential than usual for a few reasons:

In short, the market appears to be anticipating higher growth, along with higher inflation and interest rates. The way things actually play out will depend on if, when, and how his policies are implemented.

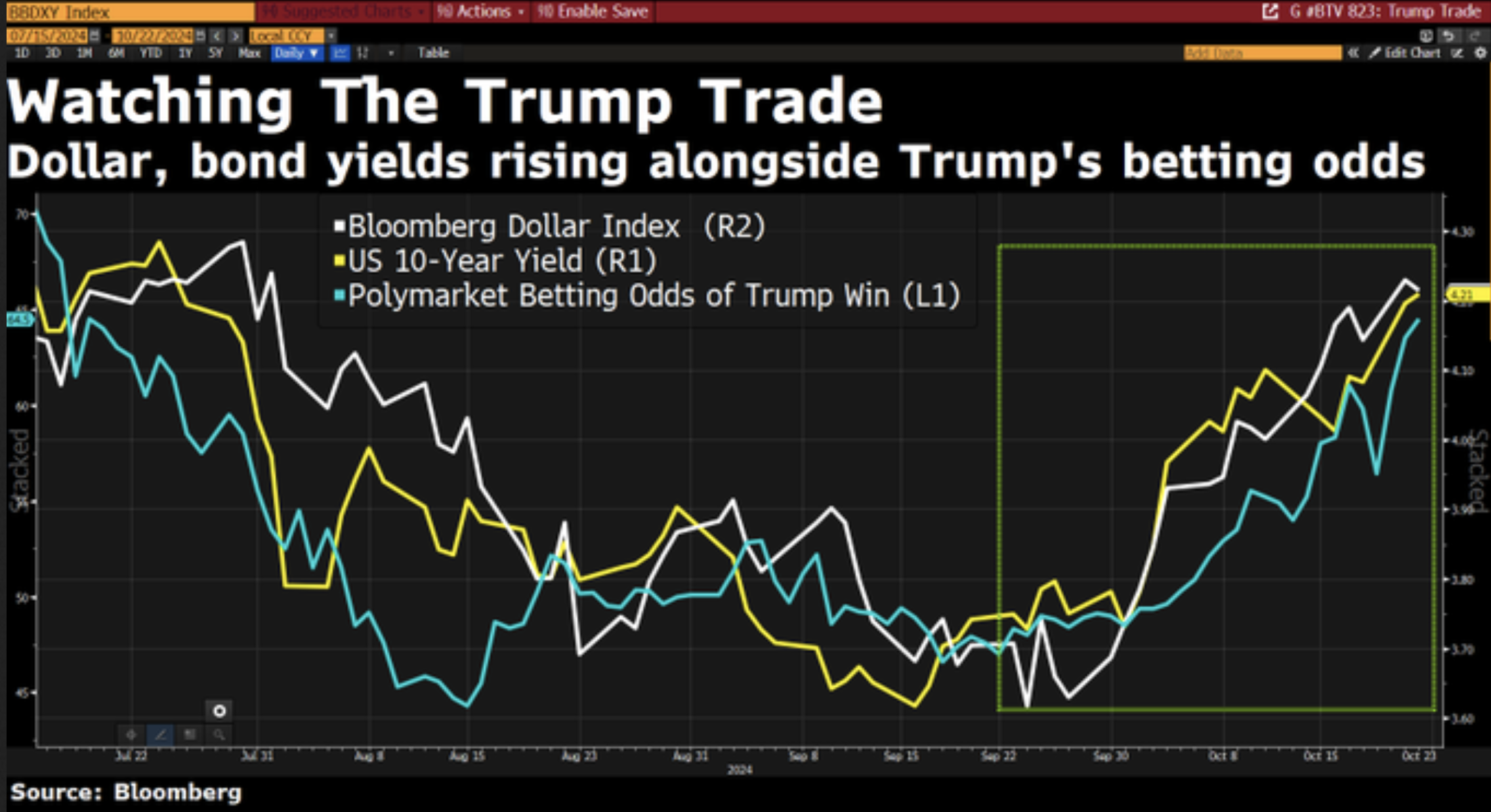

In the run-up to the election, investors were aware that a Trump Presidency could lead to a rebound in inflation. The yield on 10-year treasuries rose as Trump’s poll numbers and the odds on betting platforms rose. This also occurred after the Fed cut rates by 50 basis points.

US 10-year yields, US index and Trump Betting Odds - Finbold

Two of Donald Trump’s biggest election promises were the mass deportation of illegal immigrants and tariffs on imports to the US. Both would probably be inflationary, depending on how or when they are implemented.

💱 Tariffs

Trump has pledged to impose a 10% tariff on all imports, and a 60% tariff on goods from China. Tariffs would result in higher prices for US businesses and consumers. Tariffs would also incentivize local manufacturing, but it’s unlikely that prices would be competitive with low-cost manufacturing hubs, even with the tariff.

Import duties result in a one-time increase in inflation, but inflation tends to ripple through the entire economy. The inflationary effect could also be offset - or amplified - by whatever happens to energy prices and the USD at the time.

✨ A new round of tariffs could also result in trade partners responding with tariffs of their own. That would hurt US exporters - but could also lead to new trade deals being negotiated.

🛫 Mass Deportations

It’s estimated that there are 10 million or more undocumented immigrants in the US, many of whom are part of the labor force. Plans to deport these people at a time when the unemployment rate is historically low could result in a labor shortage. That would be good news for US workers, particularly those in low-paying jobs.

However, it would also be inflationary, and could leave companies struggling to replace workers.

The sectors that would be most affected include hospitality , construction , and agriculture where most undocumented immigrants work.

In the case of both tariffs and deportations, the impact will depend on how far and how fast the administration implements these policies. The market will probably be quick to react, in which case implementation may be reassessed.

Which companies would be shielded or benefit from these policies? Companies with little exposure to imports, and those that benefit from higher interest rates. would be best positioned. This includes smaller companies, banks and technology companies.

✨ On the losing side of the equation, the valuations on growth stocks with high multiples and little to no earnings may need to adjust to higher discount rates.

The US national debt used to be a big talking point for politicians. The topic barely came up during this election cycle, and it looks like it will be a problem for the winner of the 2028 election to deal with.

Tax cuts were another key part of Trump’s campaign. He intends to extend the tax cuts he made in 2017 which are due to expire at the end of 2025. He has also pledged to make other tax cuts for individuals and businesses.

With Republicans in control of both branches of Congress, there should be little resistance to these extensions and new tax cuts. That means the budget deficit will widen unless corresponding spending cuts are made.

US Deficit Forecast with and Without Tax Cut Extension - Julius Baer

Trump has also pledged to cut wasteful and unnecessary spending, but it's unlikely that spending cuts will offset lower tax rates. So unless corporate profits and incomes rise enough to offset the lower tax rates, US government debt is going to continue to rise.

Higher deficits mean more supply in the bond market (i.e. higher yields), and rising inflation expectations also mean higher yields. Let’s hope there’s still an appetite for those bonds.

It’s no surprise to see Trump pledging to drill, drill, drill, and increase US oil and gas production. OPEC members can’t be happy about that as they cut production to support the price.

Oil and gas stocks responded positively to Trump’s win, but we will have to see how it actually translates to profits. More supply would result in lower oil and gas prices, and the largest oil producers are currently aiming to be leaner and more profitable, rather than as big as possible.

Still, it’s probably inevitable that new investments in production and refining capacity will be made. This could be good news for oil and gas service companies - have a look at this Oil and Gas screener for some ideas in that space.

It’s also no surprise to see renewable energy stocks on the back foot. Trump isn’t a fan of wind or solar, and he’s also pledged to unwind the Inflation Reduction Act which makes funding and tax credits available for clean energy production. Ending this legislation may be tricky, as some of its programs are popular and have created jobs.

Regardless of what happens to the IRA, it's probably safe to say that there won’t be many new incentives for solar and wind energy. We will have to see what happens to tax credits for EVs now that Elon Musk is an advisor to the incoming administration. Early reports seem to indicate that the Trump administration wants to kill off the EV tax credits , which is interesting, as that’d actually impact American EV manufacturers more than it would foreign competitors.

Solar and wind projects have already reached a point where subsidizing them was becoming too expensive. It’s now a question of market dynamics. Some of the leading solar panel manufacturers have already moved production to the US - which means tariffs on Chinese imports help them.

Solar stocks have been among the worst performers of 2024 - at some point the price might be right.

The re-emerging nuclear energy industry could benefit during the Trump presidency. Trump is in favor of nuclear - and of deregulation. This is a key point as nuclear projects face regulatory hurdles - many of which have nothing to do with safety. Amazon’s proposed deal with Talen Energy was recently blocked by regulators. Be sure to check out our screener for US Nuclear stocks that could be big winners with greater deregulation.

After previously calling Bitcoin a scam, Donald Trump has now embraced the world of cryptocurrencies. He’s hinted at building a strategic reserve of 1 million Bitcoin. The US government already controls 200,000 Bitcoin which were confiscated from Silk Road, so that leaves another 800,000 which is most of what's left to be mined.

Building up a reserve like that would probably force other countries, or their central banks, to do the same. But they would also need to accept the potential volatility and work out how to fund those purchases.

For the rest of the crypto industry, a more accommodating stance would also be very welcome. The lack of clear policies and regulations is holding the industry back as much as it’s preventing wider adoption. Proper regulation would allow traditional assets to be tokenized, and bring cryptocurrencies into the mainstream financial system.

How far Trump plans to go isn’t clear yet - but there could be big changes on the horizon.

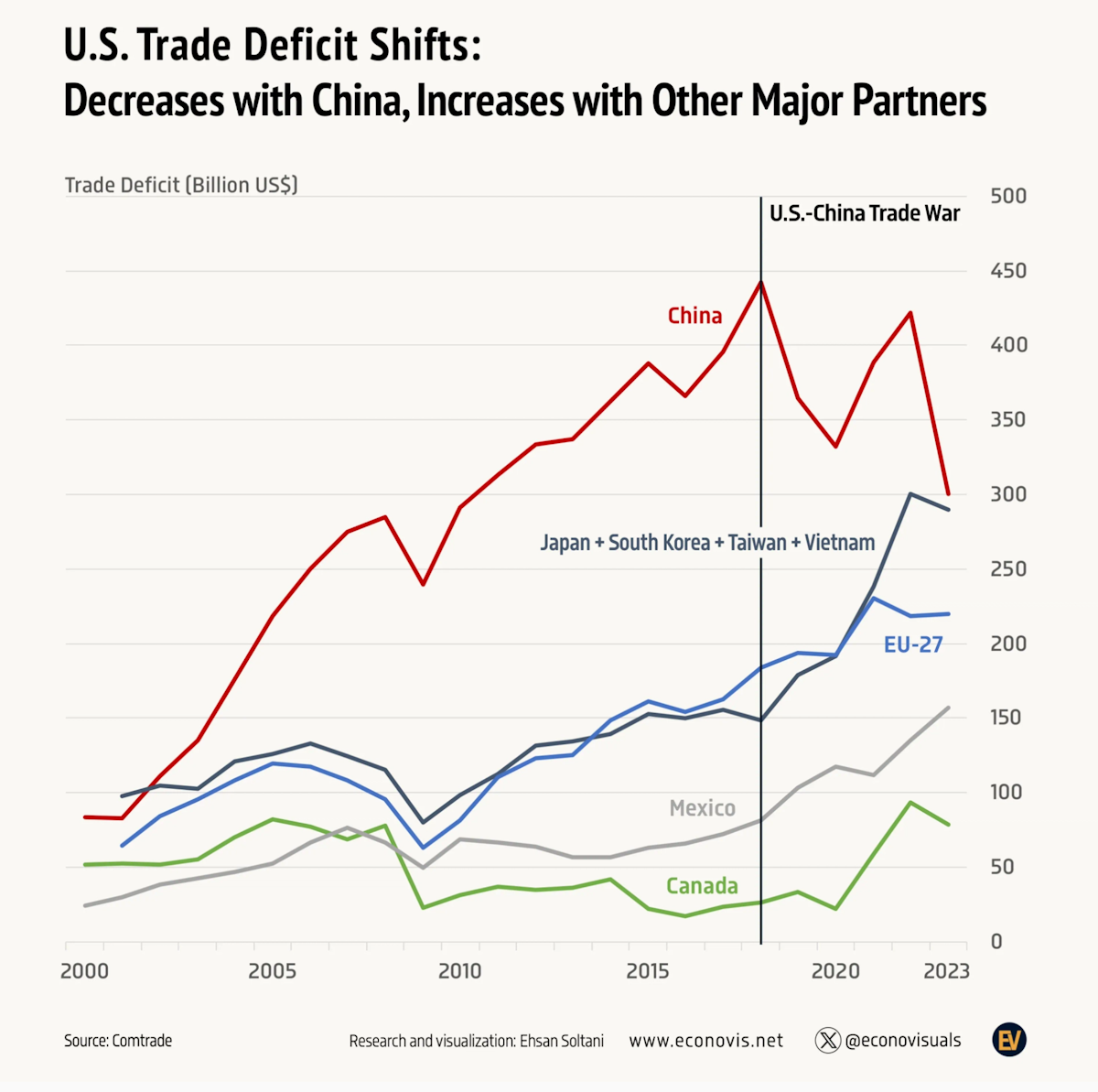

Trump’s first trade war with China resulted in less trade between the two countries, but it also led to more trade with other partners, and particularly with other low-cost manufacturing hubs like Mexico, Vietnam, and Indonesia. US Trade Deficits with Leading Trade Partners - VoronoiApp

US Trade Deficits with Leading Trade Partners - VoronoiApp

What happens now will depend on the next round of tariffs. If a 60% duty is imposed on China, with just 10% on imports from elsewhere, it could be a positive for countries like Mexico. If tariffs are equal across the board it’ll probably hurt a lot of global business.

✨ Emerging economies are also contending with a strong USD (which makes their imports more expensive) and the prospects of higher rates. This is happening just as those countries were hoping for lower rates and increasing demand.

Trump’s election is ushering in another round of de-globalization. That means companies and countries with less dependence on US trade may be better off. India is one country that stands out, as it’s less exposed to US trade and has a growing local economy. Elsewhere, companies with a local focus like banks, retailers, and food producers should be less exposed.

As mentioned, this could be one of the more consequential elections for the US economy and for the global economy. But market forces sometimes get in the way of policy implementation.

For investors, it’s worth treading cautiously rather than assuming any particular outcome. The higher for longer scenario for inflation and interest rates seems likely - but the outlook for cryptocurrencies, energy and other parts of the economy could be quite fluid.

Dollar-cost averaging is a good way to approach a changing market environment. By staggering your buys and sells, you take trying to ‘time the market’ off the table, and you can adjust your plan if necessary.

There are some sectors and industries that we haven't mentioned here, including healthcare and defense. Right now, there isn’t a lot of clarity on what Trump’s second term could mean for those sectors. The potential impact of deregulation will also depend on who ultimately gets appointed to key positions. We will do a follow-up in the new year if, or when, there is more clarity.

One of my small stock portfolios just took a big jump.

Perhaps the most contentious aspect of Trump’s economic policy was his approach to trade, particularly with China. The imposition of tariffs led to increased costs for businesses reliant on global supply chains and created uncertainty in the markets.

However, many investors saw these moves as part of a broader strategy to level the playing field for American businesses.

Add it all up, and this mix of lower taxes, lower regulatory burden, and America-first dynamics were a boon for corporate profits, which drive stocks. The market roared higher during Trump’s 1st term. Even when the pandemic hit, Trump’s combination of aggressive stimulus along with the Fed’s extraordinary actions resulted in a rapid recovery.

Lower regulations, simplified approvals, govt not making itself the center of all R&D and business activity and America First industrial and trade policies = Tech and US Economy increase way beyond (those taking foreign bribes to hold it back) can limit it.

The Insight: Expect The Unexpected

That reminds me of President Harry Truman's remark “Give me a one-handed economist."

I moved most of my portfolio into cash the last few years under Biden: Money Markets, CD’s, short term US Treasuries. Since Trump won I have been slowly moving some of it back into 2 mutual funds(tech/large cap) that have done well for me long term.

We are both retired (me 8 years, my wife 3 years) and have kept about 55% in equities. It’s been unnerving to ride the ups and downs, but it’s really paid off for us. My financial advisor and I frequently discuss when to trim equities, but the cash returns have been terrible.

Yeah I retired in 2022, and moved from from about a 70/30 equity/bonds portfolio to about an 80/20 cash/equity portfolio in 2024 (election years presidential & midterms have been where my mutual funds have had negative returns the most in the past). I have been buying back into my funds on market down days like last Friday, but still with some trepidation. I am at a 65/35 cash/equity split now, and will work towards a 50/50 split as Trump takes office in January. Still leery of a black swan event, and with Biden’s OK for Ukraine to strike deeper into Russia, who knows what will happen.

“Still leery of a black swan event, and with Biden’s OK for Ukraine to strike deeper into Russia, who knows what will happen.”

I know what you mean. We’ve had so many financial crises (2008 real estate, Asian) but we’ve weathered them. I bailed out of equities when the Internet bubble popped in 2000 (was it 2001? ‘02?) and it took me a while to get back in, so I missed the huge run-up when the market got back to normal. So, since then, it’s been steady as she goes.

bump for later

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.