Posted on 10/18/2024 7:37:28 AM PDT by SeekAndFind

Many Americans continue to find homeownership financially out of reach due to rising house prices and stagnant wages, among other contributing factors. But which U.S. cities are the least affordable?

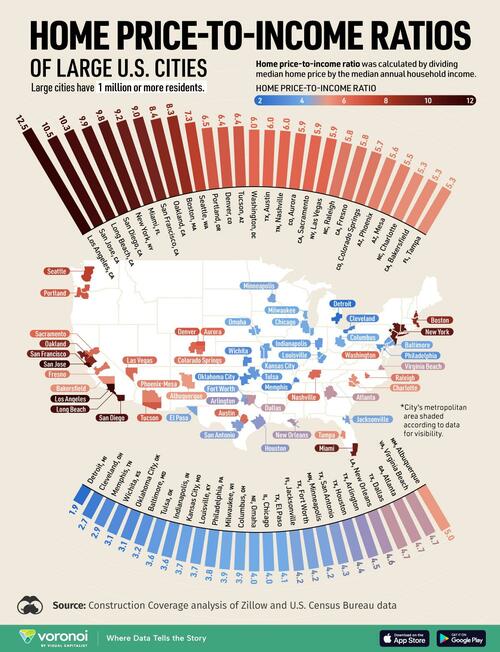

One way to assess housing affordability is through the home price-to-income ratio, which measures the ratio of the median home price to the median household income.

This map, via Visual Capitalist's Kayla Zhu, shows the home price-to-income ratio of 54 large cities (population over one million) in the U.S. using data from Construction Coverage’s analysis of Zillow and U.S. Census Bureau data.

Below, we show the home price-to-income ratio, median home price, and median household income, for 54 large cities in the United States of America.

| Rank | City | State | Price-to-income | Median home price | Median household income |

|---|---|---|---|---|---|

| 1 | Los Angeles | CA | 12.5 | $953,501 | $76,135 |

| 2 | San Jose | CA | 10.5 | $1,406,957 | $133,835 |

| 3 | Long Beach | CA | 10.3 | $825,502 | $80,493 |

| 4 | San Diego | CA | 9.9 | $994,023 | $100,010 |

| 5 | New York | NY | 9.8 | $732,594 | $74,694 |

| 6 | Miami | FL | 9.2 | $558,873 | $60,989 |

| 7 | San Francisco | CA | 9 | $1,236,502 | $136,692 |

| 8 | Oakland | CA | 8.4 | $780,188 | $93,146 |

| 9 | Boston | MA | 8.3 | $718,233 | $86,331 |

| 10 | Seattle | WA | 7.3 | $847,419 | $115,409 |

| 11 | Portland | OR | 6.5 | $524,870 | $81,119 |

| 12 | Denver | CO | 6.4 | $563,372 | $88,213 |

| 13 | Tucson | AZ | 6.4 | $327,123 | $51,281 |

| 14 | Washington | DC | 6 | $610,180 | $101,027 |

| 15 | Austin | TX | 6 | $533,719 | $89,415 |

| 16 | Nashville | TN | 6 | $432,592 | $71,767 |

| 17 | Aurora | CO | 5.9 | $483,228 | $81,395 |

| 18 | Sacramento | CA | 5.9 | $472,412 | $80,254 |

| 19 | Las Vegas | NV | 5.9 | $407,969 | $68,905 |

| 20 | Raleigh | NC | 5.8 | $434,407 | $75,424 |

| 21 | Fresno | CA | 5.8 | $370,798 | $64,196 |

| 22 | Colorado Springs | CO | 5.7 | $449,123 | $78,568 |

| 23 | Phoenix | AZ | 5.6 | $422,001 | $75,969 |

| 24 | Mesa | AZ | 5.5 | $434,369 | $79,496 |

| 25 | Charlotte | NC | 5.3 | $391,750 | $74,401 |

| 26 | Bakersfield | CA | 5.3 | $380,862 | $72,017 |

| 27 | Tampa | FL | 5.3 | $375,241 | $71,089 |

| 28 | Albuquerque | NM | 5 | $321,411 | $64,757 |

| 29 | Virginia Beach | VA | 4.7 | $391,244 | $83,245 |

| 30 | Atlanta | GA | 4.7 | $390,373 | $83,251 |

| 31 | Dallas | TX | 4.7 | $307,990 | $65,400 |

| 32 | New Orleans | LA | 4.6 | $241,369 | $52,322 |

| 33 | Arlington | TX | 4.5 | $315,222 | $70,433 |

| 34 | Houston | TX | 4.4 | $264,626 | $60,426 |

| 35 | San Antonio | TX | 4.3 | $253,762 | $58,829 |

| 36 | Minneapolis | MN | 4.2 | $312,872 | $74,473 |

| 37 | Fort Worth | TX | 4.2 | $302,359 | $71,527 |

| 38 | Jacksonville | FL | 4.2 | $294,450 | $69,309 |

| 39 | El Paso | TX | 4.1 | $216,673 | $52,645 |

| 40 | Chicago | IL | 4 | $284,818 | $70,386 |

| 41 | Omaha | NE | 4 | $272,286 | $67,450 |

| 42 | Columbus | OH | 3.9 | $238,286 | $61,727 |

| 43 | Milwaukee | WI | 3.9 | $191,149 | $49,270 |

| 44 | Philadelphia | PA | 3.8 | $215,593 | $56,517 |

| 45 | Louisville | KY | 3.7 | $233,464 | $63,049 |

| 46 | Kansas City | MO | 3.7 | $230,526 | $62,175 |

| 47 | Indianapolis | IN | 3.6 | $218,591 | $61,501 |

| 48 | Tulsa | OK | 3.6 | $194,784 | $54,040 |

| 49 | Baltimore | MD | 3.2 | $177,786 | $55,198 |

| 50 | Oklahoma City | OK | 3.1 | $198,826 | $63,713 |

| 51 | Wichita | KS | 3.1 | $186,528 | $59,277 |

| 52 | Memphis | TN | 2.9 | $144,347 | $50,622 |

| 53 | Cleveland | OH | 2.7 | $100,734 | $37,351 |

| 54 | Detroit | MI | 1.9 | $68,379 | $36,453 |

Cities on the West Coast, particularly in California, face the most significant housing affordability challenges.

The top four cities with the highest ratios are all in California, while other major West Coast cities like San Francisco, Seattle, and Portland rank among the top 15.

The top five cities, including New York City, have a home price-to-income ratio more than double the national average of 4.7, making them highly unaffordable.

While median household income in cities like San Francisco, San Jose, and Seattle are among the highest in the country, they also have some of the most expensive house prices in the country.

The Midwest and parts of the South have much lower ratios, including Detroit (1.9), Cleveland (2.1), and Memphis (3.1). Midwest cities consistently rank among the most affordable for housing and cost of living.

To learn more about the U.S. housing market, graphic that 10 fastest-growing housing markets in the U.S., based on their housing stock growth between 2013 and 2022.

That's why I live happily in nowhere vile.

Most of Alabama is around 2.0.

The worst are Montgomery - 1.6 and Birmingham - 3.3, with the suburbs at 4.6. In Mobile, the home price to income ratio is 3.1, and Huntsville is 3.0.

Define terrible. The majority of people would find what I think is ideal as terrible to them.

I love the country, middle of nowhere, no traffic, fields, forests, streams, rivers, lakes and nature without a lot of people.

I like few stores, gas stations, commercial enterprises and no multi-family housing.

Where you live and where I live sound very similar. I like it very much.

What I was trying to say is that according to their chart of cities, Baltimore is relatively affordable. But I don’t want to live in Baltimore: it’s terrible. Also, Detroit is relatively affordable. But I don’t want to live in Detroit: it’s terrible. And on the other end of the spectrum, “glamorous” New York City is very unaffordable. But I also don’t want to live in New York City: it’s terrible.

I live on a dirt road in the middle of nowhere. It’s wonderful. But, full disclosure: I’m in Massachusetts, but my quiet little patch of nothing is also unaffordable.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.