Posted on 10/18/2024 7:37:28 AM PDT by SeekAndFind

Many Americans continue to find homeownership financially out of reach due to rising house prices and stagnant wages, among other contributing factors. But which U.S. cities are the least affordable?

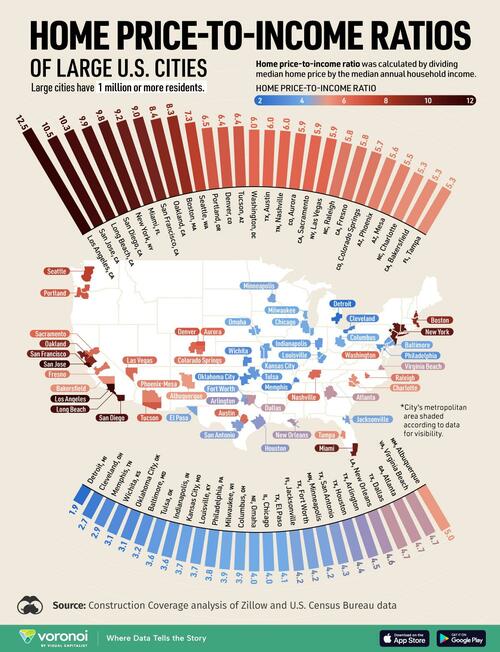

One way to assess housing affordability is through the home price-to-income ratio, which measures the ratio of the median home price to the median household income.

This map, via Visual Capitalist's Kayla Zhu, shows the home price-to-income ratio of 54 large cities (population over one million) in the U.S. using data from Construction Coverage’s analysis of Zillow and U.S. Census Bureau data.

Below, we show the home price-to-income ratio, median home price, and median household income, for 54 large cities in the United States of America.

| Rank | City | State | Price-to-income | Median home price | Median household income |

|---|---|---|---|---|---|

| 1 | Los Angeles | CA | 12.5 | $953,501 | $76,135 |

| 2 | San Jose | CA | 10.5 | $1,406,957 | $133,835 |

| 3 | Long Beach | CA | 10.3 | $825,502 | $80,493 |

| 4 | San Diego | CA | 9.9 | $994,023 | $100,010 |

| 5 | New York | NY | 9.8 | $732,594 | $74,694 |

| 6 | Miami | FL | 9.2 | $558,873 | $60,989 |

| 7 | San Francisco | CA | 9 | $1,236,502 | $136,692 |

| 8 | Oakland | CA | 8.4 | $780,188 | $93,146 |

| 9 | Boston | MA | 8.3 | $718,233 | $86,331 |

| 10 | Seattle | WA | 7.3 | $847,419 | $115,409 |

| 11 | Portland | OR | 6.5 | $524,870 | $81,119 |

| 12 | Denver | CO | 6.4 | $563,372 | $88,213 |

| 13 | Tucson | AZ | 6.4 | $327,123 | $51,281 |

| 14 | Washington | DC | 6 | $610,180 | $101,027 |

| 15 | Austin | TX | 6 | $533,719 | $89,415 |

| 16 | Nashville | TN | 6 | $432,592 | $71,767 |

| 17 | Aurora | CO | 5.9 | $483,228 | $81,395 |

| 18 | Sacramento | CA | 5.9 | $472,412 | $80,254 |

| 19 | Las Vegas | NV | 5.9 | $407,969 | $68,905 |

| 20 | Raleigh | NC | 5.8 | $434,407 | $75,424 |

| 21 | Fresno | CA | 5.8 | $370,798 | $64,196 |

| 22 | Colorado Springs | CO | 5.7 | $449,123 | $78,568 |

| 23 | Phoenix | AZ | 5.6 | $422,001 | $75,969 |

| 24 | Mesa | AZ | 5.5 | $434,369 | $79,496 |

| 25 | Charlotte | NC | 5.3 | $391,750 | $74,401 |

| 26 | Bakersfield | CA | 5.3 | $380,862 | $72,017 |

| 27 | Tampa | FL | 5.3 | $375,241 | $71,089 |

| 28 | Albuquerque | NM | 5 | $321,411 | $64,757 |

| 29 | Virginia Beach | VA | 4.7 | $391,244 | $83,245 |

| 30 | Atlanta | GA | 4.7 | $390,373 | $83,251 |

| 31 | Dallas | TX | 4.7 | $307,990 | $65,400 |

| 32 | New Orleans | LA | 4.6 | $241,369 | $52,322 |

| 33 | Arlington | TX | 4.5 | $315,222 | $70,433 |

| 34 | Houston | TX | 4.4 | $264,626 | $60,426 |

| 35 | San Antonio | TX | 4.3 | $253,762 | $58,829 |

| 36 | Minneapolis | MN | 4.2 | $312,872 | $74,473 |

| 37 | Fort Worth | TX | 4.2 | $302,359 | $71,527 |

| 38 | Jacksonville | FL | 4.2 | $294,450 | $69,309 |

| 39 | El Paso | TX | 4.1 | $216,673 | $52,645 |

| 40 | Chicago | IL | 4 | $284,818 | $70,386 |

| 41 | Omaha | NE | 4 | $272,286 | $67,450 |

| 42 | Columbus | OH | 3.9 | $238,286 | $61,727 |

| 43 | Milwaukee | WI | 3.9 | $191,149 | $49,270 |

| 44 | Philadelphia | PA | 3.8 | $215,593 | $56,517 |

| 45 | Louisville | KY | 3.7 | $233,464 | $63,049 |

| 46 | Kansas City | MO | 3.7 | $230,526 | $62,175 |

| 47 | Indianapolis | IN | 3.6 | $218,591 | $61,501 |

| 48 | Tulsa | OK | 3.6 | $194,784 | $54,040 |

| 49 | Baltimore | MD | 3.2 | $177,786 | $55,198 |

| 50 | Oklahoma City | OK | 3.1 | $198,826 | $63,713 |

| 51 | Wichita | KS | 3.1 | $186,528 | $59,277 |

| 52 | Memphis | TN | 2.9 | $144,347 | $50,622 |

| 53 | Cleveland | OH | 2.7 | $100,734 | $37,351 |

| 54 | Detroit | MI | 1.9 | $68,379 | $36,453 |

Cities on the West Coast, particularly in California, face the most significant housing affordability challenges.

The top four cities with the highest ratios are all in California, while other major West Coast cities like San Francisco, Seattle, and Portland rank among the top 15.

The top five cities, including New York City, have a home price-to-income ratio more than double the national average of 4.7, making them highly unaffordable.

While median household income in cities like San Francisco, San Jose, and Seattle are among the highest in the country, they also have some of the most expensive house prices in the country.

The Midwest and parts of the South have much lower ratios, including Detroit (1.9), Cleveland (2.1), and Memphis (3.1). Midwest cities consistently rank among the most affordable for housing and cost of living.

To learn more about the U.S. housing market, graphic that 10 fastest-growing housing markets in the U.S., based on their housing stock growth between 2013 and 2022.

The affordable places are terrible places.

But, actually, the unaffordable places are also terrible places.

Cities are just a bad idea at this point.

Or, divide that median price by 5 to get the 20% down you would want for a 15 or 30 year fixed.

Do keep in mind that politicos are copying the Aussie practice: enact laws that spike ownership and then buy properties (perhaps burned out by AntifaBLM rioters?) and rent them out.

Completely unmentioned in Campaign 2024: someone has to fix our screwed up cities.

That’s insane. How does someone making $76k get a loan for $953k? And pay taxes?

“The affordable places are terrible places. But, actually, the unaffordable places are also terrible places. Cities are just a bad idea at this point.”

I noticed the same. Much more important would be the cost of housing when you’re in a built-up area, but outside of the DEI Zone.

Back in the day, young couples purchased fixer-uppers as first homes.

Nowadays you can’t do that because those fixer-uppers are located in high crime areas.

If cities were fixed, there would be no purpose for democrat politicians. They exist to talk about fixing cities and to complain about Republicans not doing anything.

Once again I’m reminded why I live in rural fly over country.

Not all affordable cities are bad.

Indianapolis or Omaha and some other places i do not personally know, seem OK. The Midwestern cities are just kind of boring. Flat and far to the Oceans. The industry left for China, there is just nothing much to do.

That why their housing is kind of depressed.

I’ve heard one good thing about Indianapolis vs endless streams of bad things.

Yes - nothing suprises me on these. I’d like to see rural vs city by state.

Enjoy, east and west coast liberal home-buyers.

Did a recent business trip to Oklahoma City and found the place delightful. Fort Wayne is not on the list, but the little I have seen of it was nice. Virginia Beach has a lot of retired Navy and seemed very nice to me.

I don’t believe that the median income in New York is only $74,694. I think it is closer to 150,000.

“The affordable places are terrible places.

But, actually, the unaffordable places are also terrible places.”

Sorta. I live in California, and it’s certainly a lot worse than it used to be. And leftism has caused huge problems with drugs, homelessness, businesses leaving, etc. etc. NEVERTHELESS, despite the foregoing, take a walk around some of the nicer neighborhoods of San Francisco or San Diego on a sunny day in February... and then hop on a plane the next day and stroll around Detroit or Cleveland... and it’ll be pretty obvious why some cities are at the top of the list and others are at the bottom.

RE: I don’t believe that the median income in New York is only $74,694. I think it is closer to 150,000.

Are you looking at the ENTIRE state of New York? Or just NYC and suburbs?

Bingo! Democrat policies are a hard sell for happy, prosperous people.

This article is about the city.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.