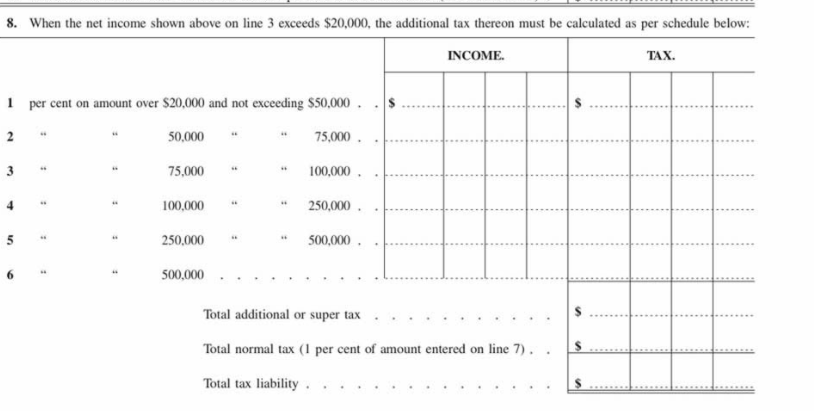

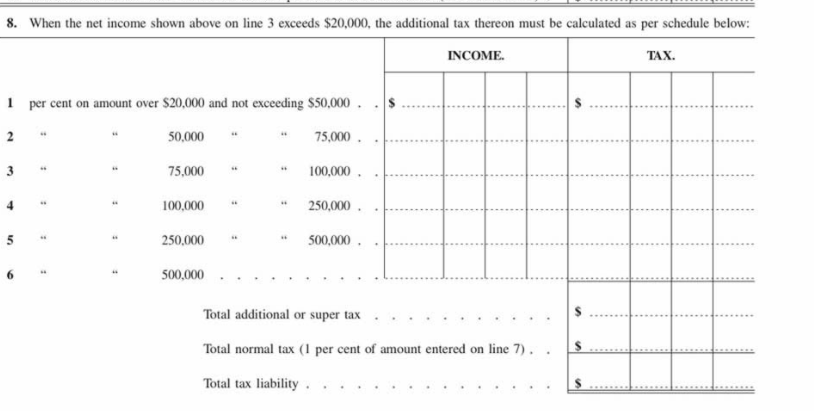

Here's the tax table. Note that if you make $20,000 or less you owe nothing.

Posted on 04/11/2022 12:22:57 PM PDT by nickcarraway

The U.S. federal tax code, ratified in 1913, started at around 27 pages, but is now estimated to be 6,571 pages for the 2021 tax year. If the dense language has you frustrated, you’re not alone. Tax laws can be complicated, whether they’re federal or state. There are many confusing laws with seemingly undecipherable sentences or weird distinctions between what is and is not taxable — the difference can seriously impact your money.

We all know we need to get our taxes wrapped up before the April 18 deadline, but if you feel like procrastinating, let’s take a break from the serious tax stuff. Instead, enjoy a look at some weird tax laws and exemptions in every state.

Alabama: Taxing playing cards

Alabama imposed a 10 cent tax on every deck of playing cards with 54 or fewer cards, along with an annual licensing fee of $2 to stores selling the cards. The tax was repealed in 2015.

(Excerpt) Read more at finance.yahoo.com ...

My state, Florida, has No State Income Tax, does NOT TAX Groceries OR Medicines, prescription or OTC, and has a State Sales tax of 6% with each county and school board can add 1/2% local option IF their VOTERS approve it, but for only 3 years..............

Oh yeah? Well MY state of Michigan has a 6% state sales tax, plus a state income tax, plus a local property tax.

And our roads still suck...

Our local property taxes are low as well.............

NH does not yet have state income tax nor sales tax, not for lack of trying on the part of the democrats, though.

We have a current use tax, which taxes undeveloped parts of your property at a much lower rate than the parts you are actually using for living on. It’s an effort to keep NH as undeveloped as possible.

There is also a view tax for people with exceptional views of the scenery that increase their property value. For that reason, many people who could have nice views, don’t cut down trees to keep their taxes lower.

My county (Erie County, in New York State) implemented a ‘temporary’ one year 1% county sales tax in addition to the state tax.

30 years ago.

They don’t even go through the farce of voting to ‘renew’ it every year, anymore.

What kind of idiot devised that? Aren't views subjective anyway?

Do you get a tax deduction if you live near a rendering plant?

Louisiana: Tax holiday

Every Labor Day weekend in Louisiana, a second amendment sales tax holiday provides “a local sales and use tax exemption on any consumer purchase of firearms, ammunition, and hunting supplies.” The tax exemption even includes lawn chairs explicitly purchased for hunting.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.