By popular thinking, the key driver of economic growth is increases in the total demand for goods and services. It is also held that the overall output increases by a multiple of the increase in expenditure by government, consumers and businesses.

Following this way of thinking it is not surprising that most commentators are of the view that by means of fiscal and monetary stimulus it is possible to prevent the US economy falling into a recession. For instance, by increasing government spending and central bank monetary pumping it is held that this is going to strengthen the production of goods and services, i.e., the overall supply.

It follows then that by means of increases in government spending and central bank monetary pumping the authorities can grow the economy. This means that demand creates supply. However, is it the case?

Shrinking Savings Poses a Threat to US Economy

We suggest that without the expansion and the enhancement of the production structure, it is going to be difficult to increase the supply of goods and services in accordance with the increase in the total demand.

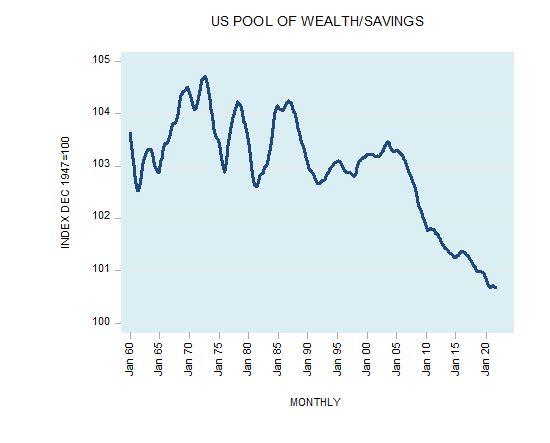

The expansion and the enhancement of the infrastructure hinges on the expanding pool of savings. (This pool comprises of final consumer goods). The pool of savings is required in order to support various individuals that are employed in the enhancement and the expansion of the infrastructure. Given all the past and present reckless fiscal and monetary policies, we have estimated that the US pool of savings is currently most likely under severe downward pressure (see chart).

Furthermore, neither government activities nor monetary pumping generates wealth. Consequently, within all other things being equal, in the absence of increases in wealth it is not possible to have increases in savings as a result of increases in government outlays and increases in the money supply.

Why Supply Precedes Demand?

Now in the free unhampered market economy, wealth generators do not produce everything for their own consumption. Part of their production is used to exchange for the produce of other producers. Hence, in the free unhampered market economy production precedes consumption. This means that something is exchanged for something else. This also means that an increase in the production of goods and services sets in motion an increase in the demand for goods and services.

Increases in government spending result in the diversion of savings from the wealth-generating private sector to the government thereby undermining the wealth generating process. Likewise, monetary pumping sets in motion the wealth diversion from wealth generators towards wealth consumers by setting an exchange of nothing for something. Now, since government activities do not generate wealth these activities amount to consumption without the preceding production of wealth. Likewise, increases in money supply sets in motion consumption without the preceding production; i.e., an exchange of nothing for something. Hence, increases in government outlays and increases in monetary pumping result in consumption without the backup from production.

Therefore, increases in total demand because of government spending and central bank monetary pumping is bad news for economic growth. Note that the unbacked by production consumption results in the decline in the flow of savings. This in turn weakens the capital formation process thus undermining prospects for economic growth.

Shortages and Monetary Pumping

We suggest that the currently observed massive shortages of various factors of production such as labor and raw materials are in response to enormous monetary pumping by the Fed and massive increases in government outlays.

Again, the aim of these measures has been to stimulate overall demand and in turn, overall output. We hold that in a free unhampered market the emergence of shortages signifies that the market did not clear. Once the clearing takes place, the so-called shortages disappear.

We hold that huge government outlays and massive monetary pumping caused large increases in the demand for goods and services. This increase was not supported by a corresponding increase in the supply. As a result, this generated enormous increases in the prices of goods and services.

Supply shocks on account of the lockdowns have further intensified prices increases. What we have here is more money per goods and services. Observe that a price of a good is the amount of money paid per unit of the good. Note that in February this year the yearly growth rate of our monetary measure AMS for the US jumped to 79 percent against February 2020 of 6.5 percent. The average increase in this period stood at 43 percent.

As a result, the yearly growth rate of the CPI climbed to 6.8 percent in November this year from 1.2 percent in November 2020 (see chart).

Also, note that, the yearly growth rate of workers’ wages in the private sector adjusted for the yearly growth rate of the consumer price index (CPI) stood at negative 2 percent in November against negative 1.4 percent in October and 3.3 percent in November 2020 (see chart).

Now, the labor market is subject to various regulations and controls, i.e., does not adjust quickly to various large outside changes such as massive increases in the total demand because of colossal monetary pumping and very large increases in government outlays.

Consequently, at a given real wage, there is currently a much greater number of workers demanded versus the number of workers willing to be employed. Hence, the workers shortages is at the given real wages.

This means that once an upward adjustment in workers’ real wages is going to take place the labor shortages are going to decline. Moreover, the government generous handouts during the lockdowns have further contributed to the stifling of the labor market. Many workers found it beneficial to them to have more leisure than to work in particular when the growth rate of real wages displays a visible decline.

What we are currently observing is not supply shortages because of the COVID19 as the popular thinking has it but shortages because of government and central bank responses to the COVID19 and the absence of free markets.

Most commentators are of the view that the massive government outlays and enormous monetary pumping by the Fed have kept the US economy strong. We suggest that this so-called strength is in terms of real gross domestic product (GDP). The yearly growth rate of this indicator stood at 4.9 percent in Q3 this year against 2.3 percent in the Q3 2020. We hold that the increase in this indicator is because of aggressive government and the Fed’s measures. Hence, the increase in the growth rate of real GDP reflects the consumption of savings.

If the pool of savings is still expanding then the government and the Fed’s aggressive policies are going to result in the strong real GDP growth rate. If however, the pool of savings is declining then the so-called real economic activity is going to follow suit. As we suggested at the beginning of this article, we hold that the pool of savings is at present under strong downward pressure.

Conclusions

By popular thinking, increases in government spending and central bank monetary pumping strengthens the economy’s overall demand. This in turn, it is held, sets in motion increases in the production of goods and services, i.e., increases in the overall supply. What we have here that “demand creates supply.”

This view is questionable if individuals did not allocate enough savings in order to support increases in the production of goods and services. Also, note that to be able to exchange something for goods and services individuals must have this something. This means that in order to demand goods and services individuals must produce something useful first. Hence, supply drives demand and not the other way around.

We also suggest that the currently observed shortages of workers and materials coupled with the large price increases of goods and services is because of aggressive monetary pumping of the Fed and massive government outlays. These huge increases coupled with various impediments in particular in the labor market have prevented rapid individuals’ responses to counter these surges.