Posted on 04/19/2021 10:09:36 AM PDT by SeekAndFind

There is no way this bull market doesn’t end very badly. We all know that is the reality of this liquidity-fueled market, but we keep investing for “Fear Of Missing Out.”

An excellent example of investor exuberance came recently in “Investors Go All In:”

“More importantly, over the past 5-MONTHS, more money has poured into the equity markets than in the last 12-YEARS combined.”

If that chart alone doesn’t get your “Spidey senses” tingling, I am not sure what will. However, I have a few more charts to share with you.

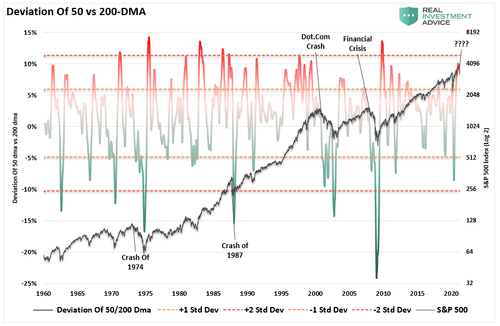

In the short term, fundamentals don’t matter. Such is because over a few days, weeks, or even months, what drives prices higher or lower is the psychology of investors. As such, we can look at technical deviations to determine how exuberant or not the market currently is.

For moving averages to exist, prices must trade both above and below that average. As such, moving averages act like gravity on prices. When prices deviate too far from the moving average, eventually, prices will revert to, or beyond, that average.

We can visualize the reversion in the chart below of the S&P 500 index versus its 200-dma. With the index currently more than 14% above its 200-dma, such should be a short-term warning to investors.

The following chart says much the same. Currently, the 50-day moving average is also significantly deviated above the 200-dma. Such suggests that not only will prices retest the 50-dma but eclipse that level in a reversion back to the 200-dma.

Notably, technical deviations in the short term do NOT mean the market will “crash” tomorrow. Markets can remain deviated for quite some time. However, when the deviations begin to diverge from the price index negatively, such has previously preceded more important corrections and bear markets.

“Margin debt isn’t an issue. It provides the fuel for asset prices higher.”

That is a correct statement.

Rising levels of margin debt are a measure of investor confidence. Investors are more willing to take out debt against investments when shares are rising. The more prices increase, the more they can borrow. However, the opposite is also true. Falling asset prices reduce the amount of credit available, and the liquidation of assets must occur to bring the account back into balance.

As discussed previously, “negative cash balances” are at a record.

I want to make a critical point here. Margin debt, like valuations, are “terrible market timing” indicators and should not be used as such. I agree and disagree that margin debt levels are simply a function of market activity and have no bearing on the outcome of the market.

As we saw in March of 2020, the double-whammy of collapsing oil prices and economic shutdown in response to the coronavirus triggered a sharp sell-off fueled by margin liquidation.

However, since then, the surge in margin debt has reached extreme levels. More importantly, as shown in the chart below, it isn’t the “level” of margin debt that reflects investor exuberance but rather the rate of change. In this case, we can see a very sharp spike in debt from the previous 12-month low. Such has only occurred near previous market peaks and bear markets.

As Jason Zweig recently penned:

“Where ignorance is bliss, ‘tis folly to be wise,” wrote the British poet Thomas Gray. One of these days, perhaps sooner rather than later, stocks will stop going up and the importance of understanding what you own will reassert itself. For the time being, though, investors who used to think of themselves as wise may continue to look foolish.”

As stated above, in the short term, fundamentals do not matter. However, in the long term, they matter a lot.

Currently, investors are overlooking fundamentals on the expectation the economy and earnings will improve to justify the market overvaluation. There is scant evidence over the last 20-years such will be the case.

The “Economic Activity Index” is an average of the 4-most essential components of organic economic activity. Interest rates have a long historical correlation to economic activity, along with inflationary pressures. Without productivity and business investment, jobs do not get created to support consumption which is ~70% of the GDP calculation.

Through the first quarter of 2021, the economic recovery expected by economists is running well ahead of what the index approximates. Furthermore, given much of the market’s advance is based on optimistic expectations, there is potential for disappointment.

Such is where fundamentals become extremely important. When, or if, expectations of recovery are disappointed, the market will begin to reprice itself for its intrinsic value. Given that the market is currently trading more than twice the level of underlying economic growth, which is where corporate profits come from, such suggests a significant risk.

The level of price versus sales, which occurs at the top of the income statement (and much less subject to manipulation, also suggests a risk.

10-year forward returns are below zero historically when the price-to-sales ratio is at 2x. There has never been a previous period with the ratio climbing to near 3x.

Of course, with markets trading well above 20x earnings, history further suggests that investors are likely to be disappointed in the future as markets reprice value.

Such is particularly problematic when investors chase stocks with no profits.

What could go wrong?

While we remain long-biased in our equity portfolios, we are chasing performance like everyone else. As I noted in “Fully Invested Bears:”

“While the mainstream media continues to skew individual’s expectations by chastising them for “not beating the market,” which is impossible to do, our job is to participate in the markets with a bias toward capital preservation. As noted, the destruction of capital during market declines has the most significant impact on long-term portfolio performance.

From that view, as a portfolio manager, the idea of ‘fully invested bears’ defines the reality of the markets we live with today. Despite the understanding that the markets are overly bullish, extended, and valued, we must stay invested or suffer potential “career risk” for underperformance.

Such is the consequence of the Federal Reserve’s ongoing interventions. Portfolio managers must chase performance despite concerns of potential capital loss. In other words, we are all ‘fully invested bears.’ We are all quite aware this will eventually end badly. However, in the short-term, no one is willing to take the risk of being grossly underexposed to Central Bank interventions.”

While it certainly may “feel” like the market “can’t go down,” it is worth remembering the sage words of Warren Buffett.

“The market is a lot like sex, it feels best at the end.”

We remain “bullish” on the markets currently as momentum is still in play. However, we are also continually taking precautions to monitor and manage risk accordingly.

For us, that means putting a spin on Warren’s quote:

“If you engage in the market in an unprotected fashion, you may not want the unexpected surprise.”

Because of a divorce, I was forced to sell - just before the dot-com bust.

Two things:

1. The Lord really has been protecting my wife and I for our entire time together.

2. There are times when the financial sky really does fall (2007-2008 comes to mind as well).

I won’t touch crypto. It’s value is only in the heads of those that give it value. That said, my nephew put 40k into one and it is now worth $750k. But at the end of the day, it’s only worth what you get when you SELL it.

Crypto (and to some extent gold) is the only true hedge against this madness.

Crypto is pretty easy for governments to simply shut down, if they so desire and think it’s worth the fallout. That’s one of the problems.

Business profits weighed against CD’s can tell you why Capital Investments have been so strong.

CD levels have been so far below real inflation levels that the other options look great.

The current of “surge” amid the ComDem_Insanity say, we will hang with capital investment until such time as fixed interests offerings are worth the risk.

Now if the New Communists succeed in collapsing the US economy and they kill capitalism as they advocate they will.

Then the profit and loss will be gauged in blood and lead.

Those lighters?

You must live in a legal weed state.

I watched some cryptos someone said “buy now buy now buy now it’s going to go up up up up...” down 25% over the two days he told me it will go through the roof. I just politely nodded and didn’t buy anything. I will play with crypto like I would at a casino slot machine. But not for investments. Strictly for gambling. The big wildcard I see in all the big cryptos is the leveraged position people have bought Bitcoin and ETH using Tether. Tether has little money backing them yet have convinced people they do. And when people sell their BTC and try to cash out their Tether for USD? BOOM. If I miss the boat, oh well, I didn’t lose anything, nor did I gain anything. I’ve always had a solid return keeping up on machinery and other business investments.

Bull markets always end eventually. For those who "buy and hold" mutual and index funds for the long term - I'm talking over decades - they do not need to worry about when a bull market is ending. Over time, any bear market will recover and then reach new highs in a new bull market.

During the bear markets, long term investors continue to buy shares, only they are now getting them at a lower price, so when the funds eventually go back up, they now have all the more shares to accumulate value on. This is the basic principle of dollar cost averaging.

For the long term investor, bear markets are a GOOD thing.

I rode out 2007 and 2008, kept dollar cost averaging into a S&P index fund just as I have been doing since 1986 and still do. Came out fine. Went down, went back up. Just like always.

I loath these doomsayers more than BLM rioters and Chinese communist flu manufacturers put together. OTOH I’ve always had a 30-50 year timeline.

These jackwagons looking for ‘the end’, be it economic or eschatological are a blight on this country and humanity.

Thank you for saying that.

Anyone trying to time the market, or buy/sell individual stocks, I have no sympathy for. Market as a whole, 20-30 year timeframe, anything else is just gambling and you deserve what you get.

See my post #28 - we think exactly the same!

I seem to recall a financier who said that when his

shoeshine boy started giving him stock tips he knew it was

time to get out of the market...he did and survived.

I work with some ‘nerds’ who tried to get me to ‘invest’ in bitcoin about 8-9+ years ago...

They don’t work anymore..

C’est la vie..

The Housing crash of 2008 involved just under 3% of all US homes getting foreclosed upon. Thanks to the Biden ban on foreclosures for Covid, once the ban is lifted, TEN percent of all US homes will be subject to possible foreclosure. It

is not going to be pretty.

I think there WILL be an “end” simply because Fiat Currency eventually collapses. The juggling act is to keep inflation going, but not too fast. It’s like trying to run a nuclear power plant. Actions take a while to have an impact, and you could cause a runaway chain reaction.

I heard an economist that had been remarkably accurare in his predictions for a long time but his prediction about the next crash didn’t happen. He was asked by an interviewer what went wrong. His answer was interesting, and I paraphrase: I simply misjudged just how long they could keep kicking the can down the road.

FWIW, it almost happened in 2008. That is why we got QE.

For those who “buy and hold” mutual and index funds for the long term - I’m talking over decades - they do not need to worry about when a bull market is ending.

He who does not use STOPS is lost...........

The only “get rich quick” schemes we remember are the ones that worked for a time. A lot of people got rich with Amway too. And Amaazon, and Microsoft, and Google. And a lot more people lost a LOT in others that didn’t do so well.

Hindsight is always 20/20, though.

If things get really, really ugly, I’d rather have several hundred Franklin’s in my leather wallet than whatever the equivalent value of bitcoin would be in my digital wallet.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.