Posted on 01/27/2021 6:41:58 PM PST by SeekAndFind

On the back of disappointing earnings from Facebook and Netflix, AAPL stock dipped into its earnings release, but as the company's stellar results just showed this may have been a bit premature, because Tim Cook's company just reported blockbuster earnings including its first ever $100BN quarter, around in its iPhone 12 release quarter.

Here are the details:

Some more details from the quarter:

Tim Cook gave some additional numbers, noting that AAPL now has an active installed base of 1.65bln devices, of which more than 1 billion iPhones; perhaps more importantly, AAPL has 620 million paid subscribers now as part of its ecosystem.

Of note: Mac sales were strong yet not strong enough to beat estimates despite soaring laptop sales which have surged during work and study from home. As Bloomberg notes, "there might be a bit of disappointment with that one". Still solid growth and a high number, and sales will likely skyrocket this year with redesigns coming to nearly the entire line.

One potential counter: as Bloomberg notes, "one of the major factors weighing on hardware sales has been global shortages of components. That might be what’s hurt Mac sales. Investors will be listening in closely on that front. Perhaps Apple’s switch to supplying itself with processors will alleviate that risk going forward?"

On the positive side, the Wearables, Home and Accessories boost is due to major updates in that line, including two new Apple Watch models, the AirPods Max headphones, and the HomePod mini. Apple went all out on accessories this past quarter

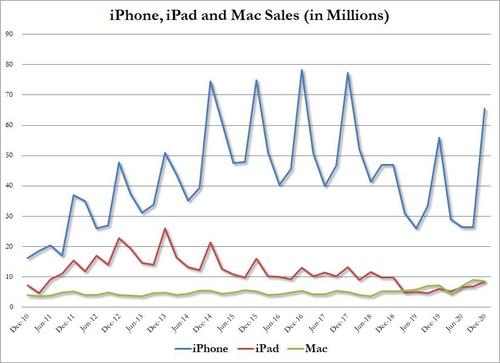

One potential negative: even in the company's record quarter - the one where the iPhone 12 was introduced - the company still can't meet its iPhone sales hit back in 2016-2017, confirming that Apple's iphone is no longer the must have accessory it once was.

This may explain why as Walter Piecyk notes, "that's the first time $AAPL R&D/revenue has dropped y/y since the June quarter in 2015, the year of the iPhone 6."

That's the first time $AAPL R&D/revenue has dropped y/y since the June quarter in 2015, the year of the iPhone 6. — Walter Piecyk (@WaltLightShed) January 27, 2021

The closely watched Services soared to $15.76BN, beating expectations of $14.89B...

... and up 23.9% from the $12.7BN a year ago.

Service revenue is likely to remain strong, likely due to the App Store, Apple Music, and iCloud subscriptions. Furthermore, the newest offerings - Fitness+, TV+, Arcade, News+, and Apple Card - all still appear to not have any material impact on the company.

Also remarkable was the surge in Chinese revenues, which soared by a whopping 57% Y/Y...

... to a record $21.31BN from $13.6Bn a year ago.

Discussing the quarter, Tim Cook said that “this quarter for Apple wouldn’t have been possible without the tireless and innovative work of every Apple team member worldwide. We’re gratified by the enthusiastic customer response to the unmatched line of cutting-edge products that we delivered across a historic holiday season. We are also focused on how we can help the communities we’re a part of build back strongly and equitably, through efforts like our Racial Equity and Justice Initiative as well as our multi-year commitment to invest $350 billion throughout the United States.”

Luca Maestri, Apple’s CFO, also chimed in saying that the "December quarter business performance was fueled by double-digit growth in each product category, which drove all-time revenue records in each of our geographic segments and an all-time high for our installed base of active devices. These results helped us generate record operating cash flow of $38.8 billion. We also returned over $30 billion to shareholders during the quarter as we maintain our target of reaching a net cash neutral position over time.”

And in keeping with this, Apple’s Board of Directors has declared a cash dividend of $0.205 per share of the Company’s common stock. The dividend is payable on February 11, 2021 to shareholders of record as of the close of business on February 8, 2021.

In his take on the quarter, Bloomberg analyst Anand Srinivsana said “No major surprises here - iphone was great -- services great -- drove margins higher. China did well. PC units have been strong but disproportionately driven by the low end. Macs are about 2x the average selling price of the average PC."

And some more color from Shannon Cross of Cross Research:

“It was an extremely strong quarter, what’s likely weighing on the stock at the moment is that they didn’t give guidance. Clearly iPhone was the strength, China was up significantly, reflecting that consumers in China were waiting for 5G iPhones.”

“As always, there are questions about the sustainability of the App Store and services. Clearly the strength this quarter shows continued solid growth.”

“Apple is continuing to benefit from work from home. Keep in mind last time there was a stimulus, iPhone shipments increased.”

One final potential disappointment: Apple once again didn’t provide investors with a forecast for the current period. That’ll make every statement on the earnings call all the more important as analysts will beg for a clue as to what to project going forward.

Perhaps indicative of just how priced to perfection Apple was, however, the stock has barely budged and after some initial kneejerk moves both lower and higher, it was virtually unchanged from the close.

Indeed, as Bloomberg explains the lack of reaction, "expectations had been sky high for the company on suggestions of a new iPhone “super cycle,” spurring a stock surge in recent months. Apple also recently introduced other new devices, including an updated Apple Watch, and demand increased for iPads, Mac computers and services from consumers working and studying from home during the pandemic."

So yes - amazing quarter, but not that amazing to push the stock to a new permanent plateau.

Hell, I can't afford a $1500 phone either. But not everyone needs/wants the high-end offering. I finally replaced my ancient, way-out-of-support 5c last year with a new-release SE for about a quarter of that high-end price.

About the same thing can be said of your rants. One way for sure that you can avoid being upset over Apple users is to not read Swordmaker's comments. Just to upset you a little more I just bought the wife a MacBook Air, we liked it so much I ordered two more for the grand kids. I got a mini to play with and i outperforms my old Mac Pro at a fraction off the cost. About the same cost as a decent video card.

Pacific Time Zone, where Apple has its headquarters in Cupertino, California.

Thanks, that’s what I woulda guessed, but Wall Street is still NYC centric and the Feds are Eastern Time centric too.

Apple has iPhones models retailing from $399 up to $1399, even at it’s most robust US configuration it doesn’t reach your exaggerated price. Why do you always jump to the highest configuration model and then exaggerate the price to claim that everyone is going to be buying that?

Also, China also has a burgeoning middle class that can afford cars, iPhones, homes, and luxuries.

Apple ramps up iPhone, iPad, Mac production shift out of China Wednesday, January 27, 2021 3:38 pmApple is ramping up the production of iPhones, iPads, Macs and other products outside of China, Nikkei Asia reports on Wednesday, in a sign that the Cupertino Colossus is continuing to accelerate its production diversification efforts.

Apple logoLauly Li and Cheng Ting-Fang for Nikkei Asia:

Sources said iPad production will begin in Vietnam as early as the middle of this year, marking the first time that the world’s biggest tablet maker will build a significant number of the devices outside of China. The California tech giant is also stepping up iPhone production in India, its second-largest production base for the iconic device, sources added, with plans to start producing the latest iPhone 12 series — the company’s first 5G smartphones — there as soon as this quarter.Apple is also increasing production capacity for smart speakers, earphones and computers in Southeast Asia as part of its ongoing diversification strategy, the sources added.

Apple has relocated some production of the Mac mini, one of its desktop computers, to Malaysia, another person familiar with the matter told Nikkei, and the company is also set to move a part of its MacBook production to Vietnam this year.

Apple’s moves are part of a larger trend of global tech giants reducing their production dependence on China, long known as the world’s factory. The country’s rising labor costs, the prolonged trade tensions between Washington and Beijing and the outbreak of the coronavirus pandemic that severely disrupted the supply chain have all driven home the risks of depending too heavily on one country. The U.S. government, moreover, has initiated a “supply chain restructuring” campaign and urged tech suppliers to move away from China, the Nikkei reported earlier.

MacDailyNews Take: Former U.S. President Richard Nixon, who opened relations with China in the early 1970’s, just before his death in 1994 remarked on China: We may have created a Frankenstein.

Apple cannot divest their dependence on China quickly enough (because they started years too late).

It’s smart for both Apple and Foxconn to diversify assembly outside of China. There’s no sense having all of your eggs in one basket. — MacDailyNews, April 2, 2019

Did you even NOTICE the date of that article I posted???? Or read it?

Apple ramps up iPhone, iPad, Mac production shift out of China

Wednesday, January 27, 2021 3:38 pm It’s dated seven days post inauguration of President Joseph R. Biden. So much for your specious argument.

The Chinese government will make sure that Apple devices are the most purchased in that country, simply because, Apple has huge parts of their manufacturing in that country. And, China, like a lot of other countries do, will be discounting prices (IOW, subsidizing) Apple's devices so that people will be able to 'afford' them. So, no matter which devices the Chinese buy, low-priced or higher, the Chinese people cannot afford them, because, to a huge portion of the people there, an Apple device might require a year's salary to purchase.

ROTFLMAO!

Apple sold $65.6 Billion in iPhones in the 1st Quarter of 2021. Let’s assign 5% of that for assembly costs. Heck, let’s assign 10%! (Actually, China gets around $8 to $12 per iPhone manufactured because many of the components are made elsewhere. But let’s go with the 10%) That’s $6.5 billion... and Apple says that 19% of all Apple’s sales, or about $21 billion were in Greater China... that doesn’t leave much for China to subsidize sales of iPhones for its consumers. China’s GNP for 2020 is an estimated (final figures not yet in) $14.5 Trillion... so your oh so important Apple segment of their economy is a minuscule 0.045%... Actually, at an average ~$10 per iphone, it’s even smaller, about 0.025%.

Why, oh why, would the CCP want a Capitalist company’s smartphone which is non-transparent to their spying be the best selling phone, when their CCP Military owns Huawei lock-stock-and-barrel and phone production including the custom version of Android it uses? That’s the number one selling phone in China, and it IS subsidized in China.

You really do not know what you are blithering about with your fanboi sputtering and lack of economic knowledge at all. You’ve been hoist on your own petard several times in this thread, and several of us with with actual real world knowledge have, when you hit apogee, have fired off your petard once again, launching you higher and higher. You are welcome to your own opinion, but you are not welcome to create your own “facts” which are based only on your belly button speculation.

Back in the saddle again, eh? Glad you are back - it gets lonely with all the Apple haters - something I find hard to understand.

Oh sure I am a liberal that though Reagan was too liberal. Trump was closer to being conservative than Reagan was, but so was Pat Buchanan.

I use Apple products because they work for me, have never had a problem that wasn't easily solved for free. The Windows world was always about the bucks nothing for free except Viri/viruses and malware.

I’ve been maintaining the Apple Ping List on FR no composed of now over 800 of your fellow Freepers because they asked me to, for about 17 years. Your point is specious.

Did you even NOTICE the date of that article I posted???? Or read it?

Besides the point. Apple talked about divesting and bringing back jobs to the U.S., only after Trump got involved. That is something that occurred a few years ago.

OK, you obviously did not bother to read the article or obviously did not notice the date of January 27, 2020 on the article. You just plowed ahead with your ignorant rant.

More of your total ignorance of Apple. Apple started assembling iMacs in Elk Grove, California, and Cork, Ireland, in 2010, and completely manufacturing Mac Pros in Austin, Texas in 2013. Where was Trump and his influence in those years??? Keep dancing with your myths, you don’t know what you think you know. Apple is still moving iPhone, iPad, and Mac production out of China despite your blithering anti-Apple lack of information.

Foxconn is a Taiwanese independent multinational company operating assembly plants in china as well as in many other countries. China is making noises about invading and taking over Taiwan. It looks as if the Biden Administration is going to be fine with China doing that, despite long standing treaties requiring us to defend Taiwan’s independence. Trump would have honored those treaties, but the Democrats and particularly Biden’s crime family won’t. Foxconn may have to move their headquarters elsewhere to keep operating independently from Chinese control.

What you post is copy/paste advertising, and I’m not a fanboi of Apple, therefore I wont be reading what does not interest me.

Maintaining a ping list should not constitute a license to post advertising for and by Apple. Perhaps linking to the ads might be enough?

Experts have no problems with either platform but most user/owners are not experts. Windows is and always will be a problem because it is a feature.

I have problems with Windows because it is a cheap copy of Mac OS and is not now or has it ever been as usable or secure.

Your two granddaughters can be expert Windows users and still be at a disadvantage because you chose to indoctrinate them with your skills. Did you know that Chinese or North Korean children can be excellent Communists?

China is getting rich, and the number of rich people there is growing rapidly.

Their model is a big challenge to the West.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.