Posted on 11/16/2019 3:43:24 PM PST by Openurmind

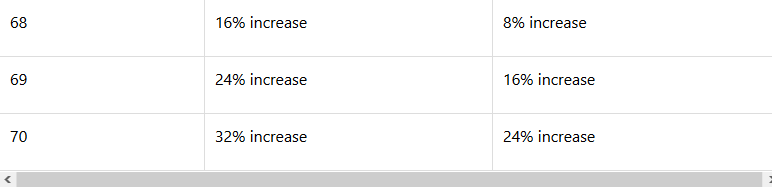

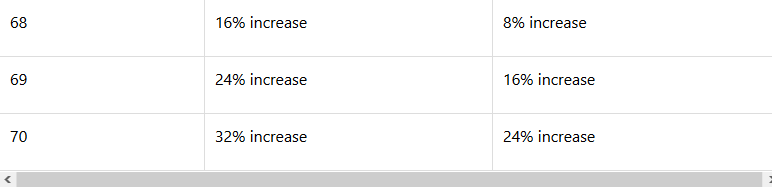

One of the most important decisions you'll have to make as you approach retirement is when to start Social Security benefits. The soonest you can begin claiming is 62, which remains the most popular age to start. It's not necessarily the wrong choice -- you'll still get a sizable amount of money over your lifetime -- but it might not be the best option if you're interested in maximizing your benefits. Here's a closer look at how the age you begin Social Security affects the size of your checks.

(Excerpt) Read more at fool.com ...

saving

Do note your wife’s SocSec is a % of your draw, so there is someextra incentive to wait till 67 or 70 if your better half is considerably younger and may rely more on SocSec after your own death.

This place ages you.

I was MUCH younger when I signed up...

I’ll be 62 in a few months. I’m divorced, living with my son, and I have health issues.

I’m taking the earliest retirement I can.

Nobody lives forever.

Me too

Now I’m actually reading this kind of stuff instead of blowing past it

I reach FRA this month, and filed to begin the month after. I was kind of impressed at how fast and easy the process, and how good the communication, were.

I guess, from stories I’ve heard, that I expected it to take a long time and be full of glitches...

Getting close,thanks for the info.

BTT

If you are no longer contributing to your social security account,

there is no reason to wait beyond the earliest retirement age,

because your benefit will never increase if you are no longer working.

This examines the issue in isolation.

Useful, but doesn’t take into account everyone’s situation.

There is also a break-even point, that may be 10-15 years out.

And of course, if you are not living on SS alone, you can invest it.

In that case, take it early.

Why the different FRA?

You have to think about what you can do with that money by filing before 70 - against how long you expect you might live.

Unless we already have an unhappy diagnosis, none of us knows how long we might live.

It’s based on when you were born.

IIRC, my break even point is 80. I’d rather start earlier and have more spending money in my 60s & 70s than have greater wealth to pass to my kids after I die...

Right now I plan to wait until 64-65. That will be long enough.

No, but the percentage of your full benefit will.

Bookmark.

Have you applied for social security disability? I retired at 62 and have an arthritic neck. I could still work at another job other than the one I retired from after 32 years. While filing for my benefits the social security rep suggested I try for disability. 60 days later I was approved and I began drawing at the full 67 year old rate (plus $700/month). Depending on your issues, it can’t hurt trying.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.