To: ExxonPatrolUs

Almost no correlation? 1985 and following looks a little different than the previous period.

2 posted on

11/28/2012 11:57:54 AM PST by

DBrow

To: ExxonPatrolUs

Figures do not lie, but liars figure.

This dude is trying to defy common sense. If more money is confiscated from anyone’s capital gains, one has less left to invest or spend.

What the idiot is essentially saying is that private spending is no better than government spending. Tell that to the socialist countries and ask them how prosperous they are.

3 posted on

11/28/2012 12:02:16 PM PST by

entropy12

(The republic is doomed when people figure out they can get free stuff by voting democrats)

To: ExxonPatrolUs

He is saying there is no correlation no the macro level between gdp growth and capital gains tax rate. I think the chart suggests that, but I think it shows things are better when investors know what a stable tax structure is, which for the last few decades, they don’t.

4 posted on

11/28/2012 12:08:08 PM PST by

DonaldC

(A nation cannot stand in the absence of religious principle.)

To: ExxonPatrolUs

It is not a place to necessarily look for an immediate link. The damage is long-term. For assets held a long time, what happens is that there is an actual confiscation of Capital, itself; as much or even all of the "gain" in dollar pricing, may merely reflect the declining value of the dollar--i.e., monetary inflation.

See Capital Gains Taxation.

This form of taxation reflects the basic Socialist hostility to private reserves; private resources. But it is the healthy private reserves, that Americans managed to accumulate from colonial days on, that made it possible for us to once out-produce everyone else on earth, both in total & per capita. Those capital reserves, are the vehicle that enables the entrepreneur to obtain the funds for meeting a human need or aspiration, with an idea that draws investment.

William Flax

5 posted on

11/28/2012 12:16:47 PM PST by

Ohioan

To: ExxonPatrolUs

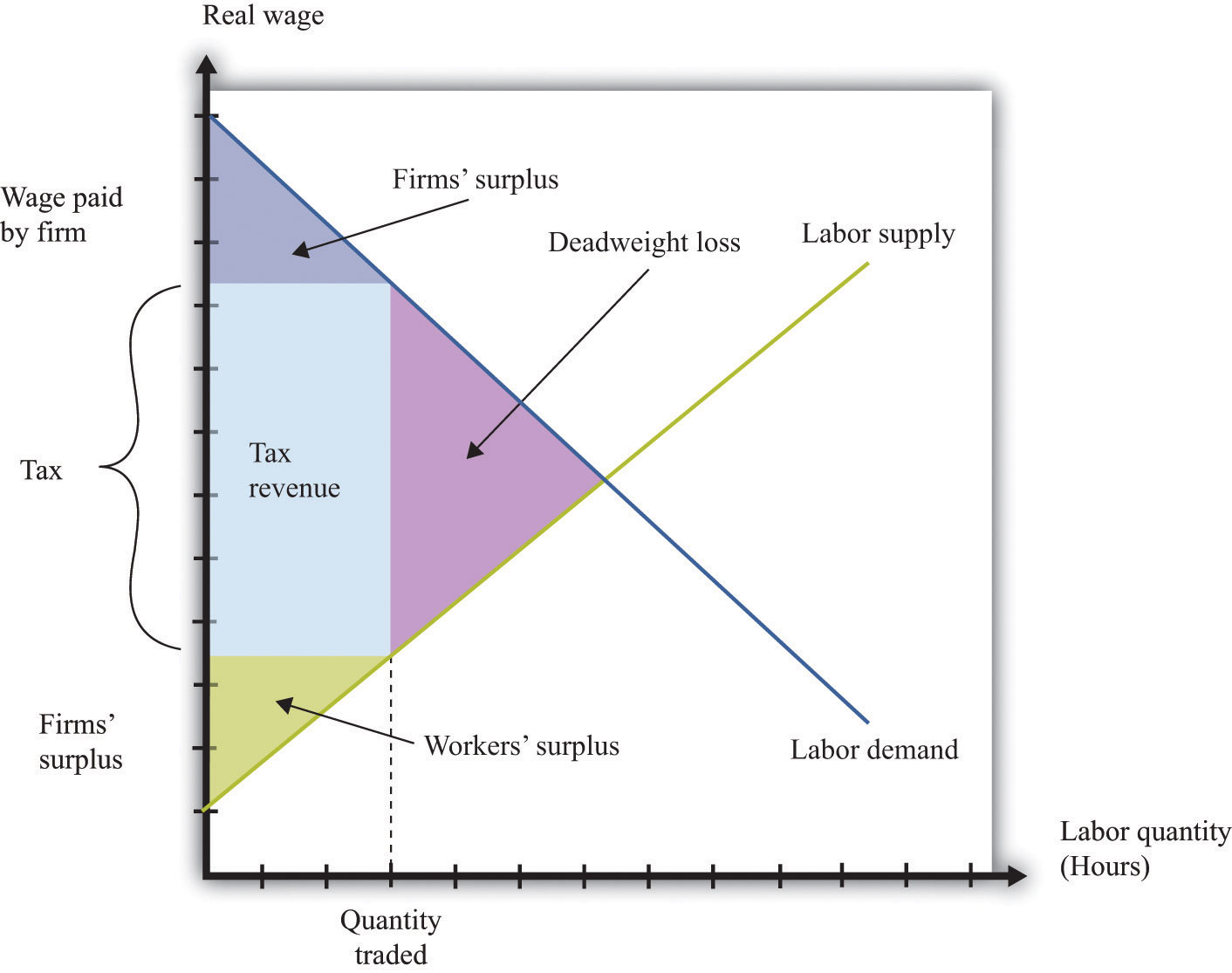

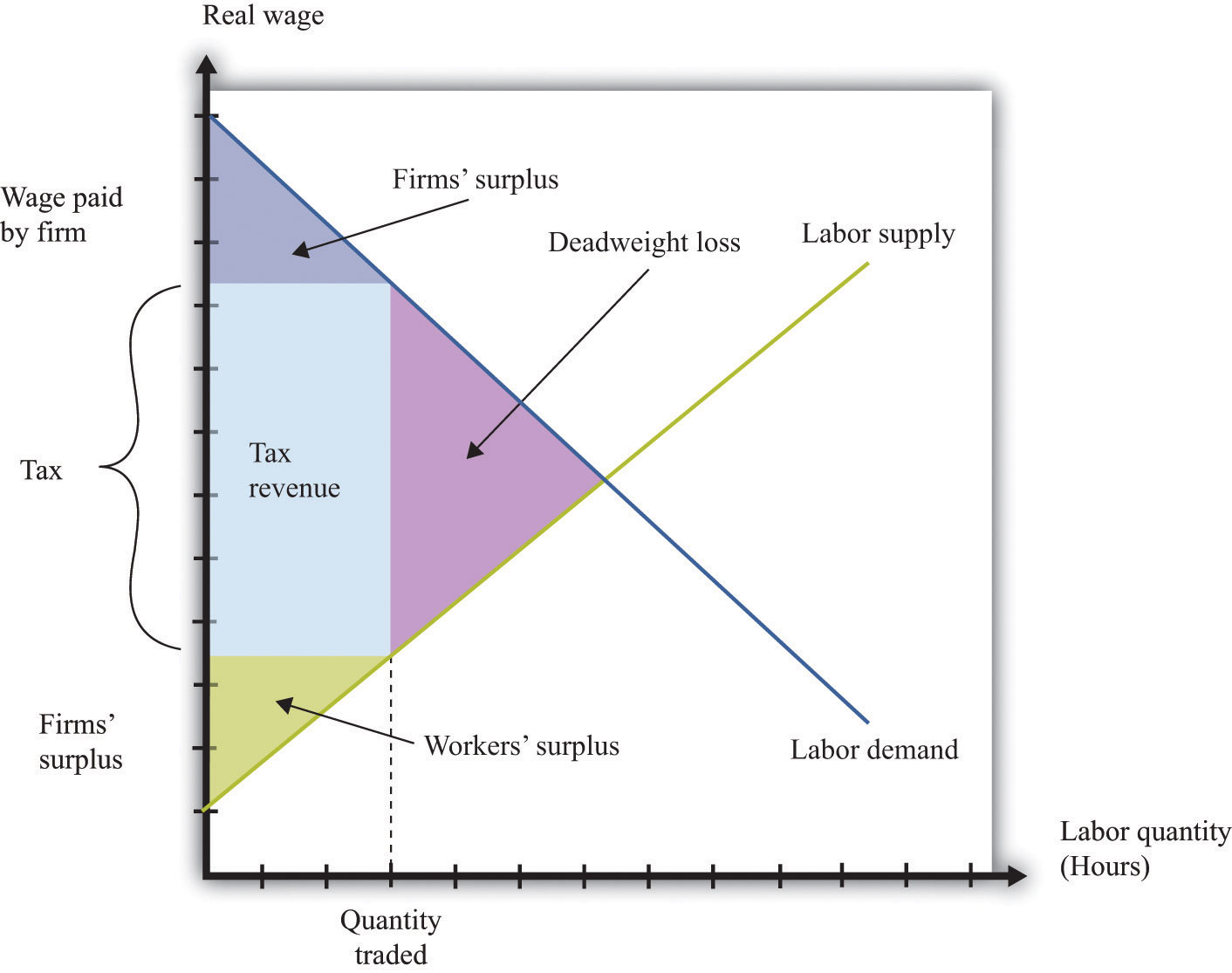

Let's review Econ 101:

Taxes have a "Wedge Effect" between Supply and Demand, which causes a "Deadweight Loss" for the economy, shared between producer and consumer depending on the elasticity of supply and demand respectively.

Raising taxes always has this effect, regardless of what form they take. Businesses will always try to pass on tax increases to customers, and customers will balk at the higher prices. NO MATTER WHAT. So, it is impossible by definition for a tax not to have an adverse impact on the volume of goods and services an economy produces.

6 posted on

11/28/2012 12:17:37 PM PST by

Uncle Miltie

(Working is for suckers.)

To: ExxonPatrolUs; ksen

Arthur Laffer laughs:

The lower the Capital Gains Tax Rate, the higher the revenues (Capital Gains Realizations) to the Treasury!

9 posted on

11/28/2012 12:28:32 PM PST by

Uncle Miltie

(Working is for suckers.)

To: ExxonPatrolUs

It's the

marginal rate that has the impact.

Effective rates less so.

Marginal rates can most certainly be shown to have a strong negative correlation with GDP in the first years of a change.

To: ExxonPatrolUs

I wouldn’t use GDP as a measure of effectiveness of investment income, but if I did, I wouldn’t expect to see appreciable change for 24-36 months on the reduction side, and 9-16 months on the increase side.

So what is a good indicator of how capital gains tax affects things?

18 posted on

11/28/2012 1:00:27 PM PST by

Usagi_yo

To: ExxonPatrolUs

Oooooh, can I play? I have charts showing the amount of toilet paper I use to wipe my a$$ has no correlation to the GDP!

21 posted on

11/28/2012 1:24:55 PM PST by

Fledermaus

(The Republic is Dead: Collapse the system. Let the Dems destroy the economy!)

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson