Posted on 09/24/2025 9:35:29 PM PDT by SeekAndFind

We sure have seen a lot of really crazy things happen so far this year. But in the minds of most Americans, there is one crisis that far outweighs everything else. As I have been documenting for years, our standard of living has been collapsing as the cost of living has risen must faster than our incomes have.

As a result, 67 percent of U.S. workers are now living paycheck to paycheck.

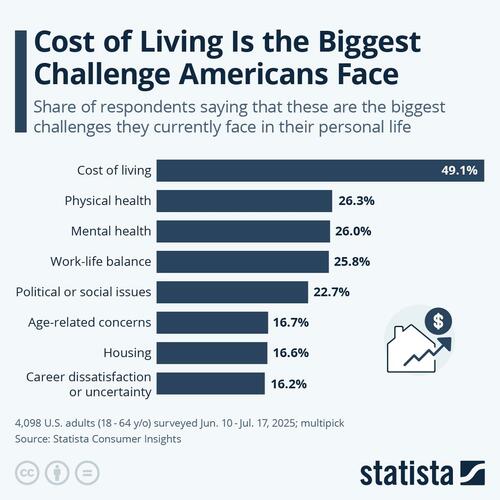

We are in the midst of the worst cost of living crisis in modern history, and Statista has found that Americans consider it to be the biggest challenge that they are facing by a very large margin…

Those results are stunning.

The cost of living won this survey in a blowout, but that shouldn’t be a surprise to any of us.

There are countless videos on social media where ordinary Americans are complaining about how oppressive the cost of living has become. Zac Rios has compiled some of the most poignant videos that have been posted lately, and when you watch them back to back it really is heartbreaking…

This is what life is like in America in 2025.

And as economic conditions continue to deteriorate, it is going to get even worse.

Are you ready for that?

Many Americans are going deep into debt in a desperate attempt to stay afloat, and one recent survey found that nearly half of all Americans now worry about debt every single day…

Debt weighed heavily on daily life for many participants. Just under half (46.5%) said they worry about debt every day. Half admitted to avoiding their bank statements, a behavior that could worsen financial problems by delaying action.

Shame was another theme. More than half of respondents (54.6%) said they felt embarrassed about their debt, even though nearly everyone surveyed (98%) reported owing money.

When asked about specific concerns, the most common answers included falling behind on payments (53.7%), not having enough for retirement (53.7%), discovering higher balances than expected (53.5%), losing homes or belongings (53.3%), and leaving little to children (51.8%).

It is easy to tell people that they should get out of debt.

But for the two-thirds of the country that is living paycheck to paycheck, there is never an opportunity to get ahead of the game.

And a lot of people that are living on the financial edge are now losing their jobs.

During the second quarter of this year, a whopping 17 trucking and logistics companies went bankrupt…

At least 17 trucking and logistics companies filed for bankruptcy in the second quarter of 2025 alone, Equipment Finance News reported.

While dry van truckload contract rates were flat in the first half of 2025 from the same period a year ago, as FreightWaves reported, trucking spot rates, which shippers pay carriers for a one-time shipment, however, finished the first half below year-over-year levels.

Long-haul truckload demand reportedly plummeted by 25% in the first half of 2025, with trucking becoming more of a short-haul delivery method for the final leg of freight movement.

At this moment, we are in a trucking recession.

If the economy was moving in the right direction, that would not be happening.

The retail industry is experiencing a tremendous amount of pain as well.

This may be difficult to believe, but the largest shopping mall in San Francisco is now 93 percent empty…

The largest shopping mall in San Francisco is now reportedly 93% vacant and has seen its value plunge by 25% over the past year, as high rents and retail crime continue to batter the Northern California city.

A new appraisal has slashed the value of San Francisco Centre, located at 865 Market Street, to $195 million, which is a 25% decrease since August 2024 and more than $1 billion below its valuation in 2016, the San Francisco Chronicle reported, citing research from Morningstar.

The 1.4 million-square-foot mall has become largely deserted, with 93% of its property now empty, according to the San Francisco Chronicle.

I haven’t written about it for a while, but our rapidly growing commercial real estate crisis is reaching a crescendo.

As large numbers of commercial mortgages go bad, many of our financial institutions suddenly find themselves in very hot water.

Meanwhile, a residential real estate crisis is quickly developing. In some of the markets that were once the hottest, condo prices have begun to crash…

Condo prices in Killeen, TX, a little over an hour north of Austin, have collapsed by 40% since the peak in mid-2022 and have given up the entire 52% spike from mid-2020 to mid-2022, plus some. The spike had been driven by FOMO-madness and the Fed’s Free Money policies. This is one of the fastest-growing cities around; its population has surged by 35% in the past 15 years to 160,000 in 2024.

But Killeen and other cities like this with condo markets in free-fall don’t qualify for our list here because they’re too small.

Several additional cities made it onto this list because the August price drop brought the total price drop from the peak to 12%, including Phoenix, AZ, and Orlando, FL.

In so many ways, it is starting to feel like 2008 all over again.

Of course it isn’t just the U.S. that is experiencing significant economic pain.

Earlier today, I came across an article that was posted on Zero Hedge that warned that “the collapse of the German economy continues unabated”…

The collapse of the German economy continues unabated. The German Engineering Federation (VDMA) now expects a dramatic decline in production this year and lashes out at the federal government.

A rebound in the German economy this autumn has failed to materialize. Just a week ago, the Federal Statistical Office revised the country’s GDP decline for Q2 2025 from –0.1% to –0.3%. Now, the German machinery association follows suit with its forecast for the full year, confirming the ongoing downward trend in production: “We had previously expected a decline of 2 percent, now we anticipate minus 5 percent for 2025,” says VDMA President Bertram Kawlath, who expects production to grow by just 1 percent in 2026. Was 2025 really the trough?

I have been watching Germany for quite some time.

This is not a good sign at all.

I will probably have much more to say about the deteriorating situation in Europe in future articles.

At this stage, the entire global economy has reached a critical tipping point.

It certainly wouldn’t take much to push us into a worldwide economic nightmare, and I am expecting so much chaos in the months ahead.

A lot of people out there seem to think that they have no need to prepare for what is coming.

They are wrong.

Yes, things are bad now, but what is on the horizon is going to be much worse.

So I would encourage you to do what you can to get prepared, because the collapse of our standard of living is only going to escalate.

I was in maxed out credit card debt.

Means you aren’t really making it across the circus trapeze leap from paycheck to paycheck because you live on the margin of your available credit after interest and minimum payments due and the max credit limit. You pay the cost of a luxury car on the interest which 1950s loan shark gangsters were imprisoned for charging to victims.

Hell on earth. Apparently millions are living through that now.

The biggest challenge is getting the Senate to do something to protect voter integrity before the midterms. I would go on to add getting Congress to codify some of this year’s Executive Orders and pass a balanced budget but that’s not just a challenge, that’s crazy talk. Oh what the heck, let’s throw in term limits too.

I have been nearly maxed out, many years back. It took time to get ahead of everything, but I did.

I feel for everyone in this situation.

I'm not sure enough American are aware of that.

It's like the boiling frog. The rot has been setting in slow enough so not enough people notice.

Gen Z doesn't realize how much better we Boomers had it. Not only financially, but socially and culturally.

We had privacy. We didn't have to worry that our every public act or comment might be recorded, then have out of context snippets of it go viral on social media.

Too much of the money is in the hands of too few

We have too many living on the backs of others

Soon it will be game over.

Surviving the Democrat party

and what they have done and

will do to America.

Trump is going to get blamed for it. It is going to be like GWB’s second term, and it is likely more government intervention is in the future.

A look to the bottom of the web page show that he happily accepts donations, and "As an Amazon Associate I earn from qualifying purchases."

My low-end renters are living paycheck to paycheck. But every child has a screen phone. They own a TV in every room and have $300 cable bills. I know because the bills keep coming when I throw them out for nonpayment. They pay the cable bills because the service will get cut off but they don’t pay the rent because that’s optional. They buy fifty-dollar lotto tickets.

It’s not all a problem with the economy.

A debt based economy where everyone finances everything and everything has to be the latest shiny thing can never be "the right direction". Most everyone at work finances a vehicle. They'll pay three times the cash price and pay for full insurance. But it's new and shiny and a status symbol along with their $1,200 cell phone.

Heard Tim Burchett say he’s put forward 17 bills to codify Trump EOs and can’t get a single one through committee even.

The Economic Collapse Blog?

Really?

> It took time to get ahead of everything, but I did.<

Good for you!

Following my divorce I was in the same situation. I did the unthinkable. I borrowed from my 401k to pay off the 29% credit cards. I then proceeded to get rid of all of the cards but one. That I pay off every month.

It takes mental effort to do it. But in the end, it was the road to wealth building.

EC

“I have been nearly maxed out, many years back. It took time to get ahead of everything, but I did.”

Good for you. I sold my house for a small, but decent profit, rented an apartment, finished up my car loans, paid off my credit cards and now I bank every payday. I only use American Express because I get hotel points. I pay that one off every month. I’m not buying a new car anytime soon, I am not buying a house anytime soon and I retire in two years. Until then, I am banking every available penny I have.

I took a look at credit score percentages. ~71% of people have good, excellent or exceptional credit scores. Those people are paying their bills on time..

That is a good strategy to have. Edmunds says 26.6% of car trade ins have negative equity that get rolled into the new loan. Yikes.

Bkmk

If you’re unemployed with your money tied up in your investments and you’re sticking to a tight budget, it can seem like you’re not getting anywhere, especially when you know you can still perform at your chosen profession. With the current job market being how it is, you know it’s going to be another long and boring winter but at least you can watch your money grow.

Same here.

We woke up one morning and had a wave of reality come over us. What followed was 56 months of austerity with a side order of frugality. Completely changed our lives. No more debt, no credit cards, no mortgage, no personal loans, no car loans, nothing. We keep all but a tiny sliver to pay bills, the rest goes into savings and investments. We live like we are broke. Yes, I feel bad for those struggling but 10 years ago we were struggling. True, some are delt a bad hand, but many are in their situation due to poor lifestyle decisions. It can be fixed, I know because we fixed it for us. It was not fun, but the best thing we have done for ourselves in a long time. Changes everything.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.