Posted on 09/24/2025 9:35:29 PM PDT by SeekAndFind

We sure have seen a lot of really crazy things happen so far this year. But in the minds of most Americans, there is one crisis that far outweighs everything else. As I have been documenting for years, our standard of living has been collapsing as the cost of living has risen must faster than our incomes have.

As a result, 67 percent of U.S. workers are now living paycheck to paycheck.

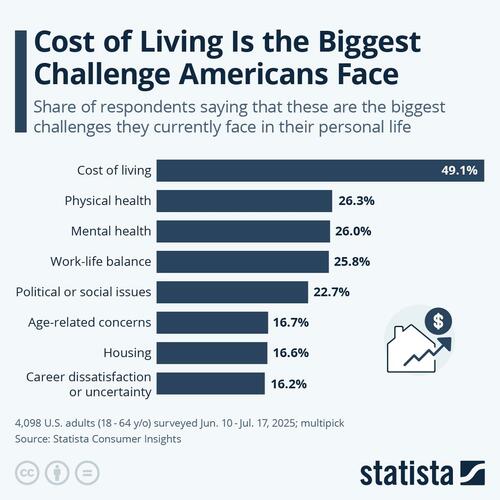

We are in the midst of the worst cost of living crisis in modern history, and Statista has found that Americans consider it to be the biggest challenge that they are facing by a very large margin…

Those results are stunning.

The cost of living won this survey in a blowout, but that shouldn’t be a surprise to any of us.

There are countless videos on social media where ordinary Americans are complaining about how oppressive the cost of living has become. Zac Rios has compiled some of the most poignant videos that have been posted lately, and when you watch them back to back it really is heartbreaking…

This is what life is like in America in 2025.

And as economic conditions continue to deteriorate, it is going to get even worse.

Are you ready for that?

Many Americans are going deep into debt in a desperate attempt to stay afloat, and one recent survey found that nearly half of all Americans now worry about debt every single day…

Debt weighed heavily on daily life for many participants. Just under half (46.5%) said they worry about debt every day. Half admitted to avoiding their bank statements, a behavior that could worsen financial problems by delaying action.

Shame was another theme. More than half of respondents (54.6%) said they felt embarrassed about their debt, even though nearly everyone surveyed (98%) reported owing money.

When asked about specific concerns, the most common answers included falling behind on payments (53.7%), not having enough for retirement (53.7%), discovering higher balances than expected (53.5%), losing homes or belongings (53.3%), and leaving little to children (51.8%).

It is easy to tell people that they should get out of debt.

But for the two-thirds of the country that is living paycheck to paycheck, there is never an opportunity to get ahead of the game.

And a lot of people that are living on the financial edge are now losing their jobs.

During the second quarter of this year, a whopping 17 trucking and logistics companies went bankrupt…

At least 17 trucking and logistics companies filed for bankruptcy in the second quarter of 2025 alone, Equipment Finance News reported.

While dry van truckload contract rates were flat in the first half of 2025 from the same period a year ago, as FreightWaves reported, trucking spot rates, which shippers pay carriers for a one-time shipment, however, finished the first half below year-over-year levels.

Long-haul truckload demand reportedly plummeted by 25% in the first half of 2025, with trucking becoming more of a short-haul delivery method for the final leg of freight movement.

At this moment, we are in a trucking recession.

If the economy was moving in the right direction, that would not be happening.

The retail industry is experiencing a tremendous amount of pain as well.

This may be difficult to believe, but the largest shopping mall in San Francisco is now 93 percent empty…

The largest shopping mall in San Francisco is now reportedly 93% vacant and has seen its value plunge by 25% over the past year, as high rents and retail crime continue to batter the Northern California city.

A new appraisal has slashed the value of San Francisco Centre, located at 865 Market Street, to $195 million, which is a 25% decrease since August 2024 and more than $1 billion below its valuation in 2016, the San Francisco Chronicle reported, citing research from Morningstar.

The 1.4 million-square-foot mall has become largely deserted, with 93% of its property now empty, according to the San Francisco Chronicle.

I haven’t written about it for a while, but our rapidly growing commercial real estate crisis is reaching a crescendo.

As large numbers of commercial mortgages go bad, many of our financial institutions suddenly find themselves in very hot water.

Meanwhile, a residential real estate crisis is quickly developing. In some of the markets that were once the hottest, condo prices have begun to crash…

Condo prices in Killeen, TX, a little over an hour north of Austin, have collapsed by 40% since the peak in mid-2022 and have given up the entire 52% spike from mid-2020 to mid-2022, plus some. The spike had been driven by FOMO-madness and the Fed’s Free Money policies. This is one of the fastest-growing cities around; its population has surged by 35% in the past 15 years to 160,000 in 2024.

But Killeen and other cities like this with condo markets in free-fall don’t qualify for our list here because they’re too small.

Several additional cities made it onto this list because the August price drop brought the total price drop from the peak to 12%, including Phoenix, AZ, and Orlando, FL.

In so many ways, it is starting to feel like 2008 all over again.

Of course it isn’t just the U.S. that is experiencing significant economic pain.

Earlier today, I came across an article that was posted on Zero Hedge that warned that “the collapse of the German economy continues unabated”…

The collapse of the German economy continues unabated. The German Engineering Federation (VDMA) now expects a dramatic decline in production this year and lashes out at the federal government.

A rebound in the German economy this autumn has failed to materialize. Just a week ago, the Federal Statistical Office revised the country’s GDP decline for Q2 2025 from –0.1% to –0.3%. Now, the German machinery association follows suit with its forecast for the full year, confirming the ongoing downward trend in production: “We had previously expected a decline of 2 percent, now we anticipate minus 5 percent for 2025,” says VDMA President Bertram Kawlath, who expects production to grow by just 1 percent in 2026. Was 2025 really the trough?

I have been watching Germany for quite some time.

This is not a good sign at all.

I will probably have much more to say about the deteriorating situation in Europe in future articles.

At this stage, the entire global economy has reached a critical tipping point.

It certainly wouldn’t take much to push us into a worldwide economic nightmare, and I am expecting so much chaos in the months ahead.

A lot of people out there seem to think that they have no need to prepare for what is coming.

They are wrong.

Yes, things are bad now, but what is on the horizon is going to be much worse.

So I would encourage you to do what you can to get prepared, because the collapse of our standard of living is only going to escalate.

How many years has this guy been saying this?

I guess he has to go by his blog name, to keep the clicks coming.

Bingo! There is a major cause and effect disconnect in play; when only 22% of the responses cite "Political or Social issues." That should be a wake-up call.

See the Dems, for instance, who sabotage every effort our government makes to sort out its financial house.

The background music is the creeping socialism that is invading more and more of our larger cities, the lowering of standards and norms via DEI, and the importation of the world's neediest refugees.

The reason our standard of living is dropping is painfully obvious to all, or should be.

I was having problems with my business and using the credit cards and an unsecured loan to get me through.

Unfortunately, I just needed to close it up and work elsewhere.

Same here. In the 90s I was badly in credit card debt for a while. It took several years to pay it off, and there were months in there when I was putting 75% of my take-home pay against the debt.

After that, things got better. Retired now, still owe some on the mortgage. Not rich, but getting by for now. I pay off my one credit card each month, and don't take out loans for cars or anything else. No idea what my credit score is, because I'm not looking to borrow any money.

We paid off all of our debt except our mortgage. All of our assets are in real estate and PM. We keep very little cash in the bank. Our house will be on the market soon and we’re moving to our rural property which has no mortgage. The next several years are likely to be chaotic. Defeating the Deep State is no easy thing.

Yup—I had a bad period in my younger days where I was broke and in debt.

I would not wish it on my worst enemies.

The way out:

1. Slash expenses to the bone.

2. Get a higher paying job.

You know you have finally “made it” when you don’t care what your credit score is because you have no need to borrow money for anything any more.

My big breakthrough was when I went to the home of a black friend. It was a manufactured home that he owned outright. It was NICE! I’d been programmed for a McMansion. I sold mine during the 2008 lunacy and paid off the mortgage. Used the extra to buy a distressed mobile home on six acres in the wood’s way out of town. I’d never been happier. Sold it years later at a big profit. All the while I was buying and refurbishing crappy mobile homes on acreage which I’m now renting out. If it weren’t for that, living on Social Security would be my option. As it is, I have more than enough. I could buy more homes as the market gets good about every eight to ten years. But I’m too old for the work now. But the deals are out there. I know a 23-year-old kid who recently did the same thing I was doing but he started decades sooner, age-wise. It can be done.

I think a lot of this concern about the cost of living is self-imposed. People want to live at a higher level than their income will allow them.

We were just being dumb with our finances. Thankfully no more of that!

I see a lot of them in comments on TikTok and YouTube that do and they are resentful of it.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.