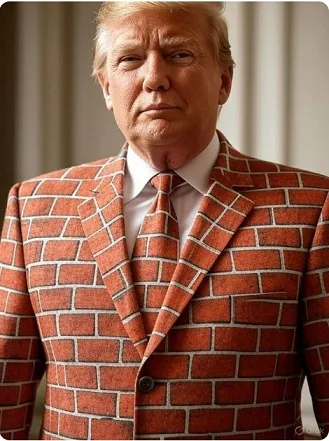

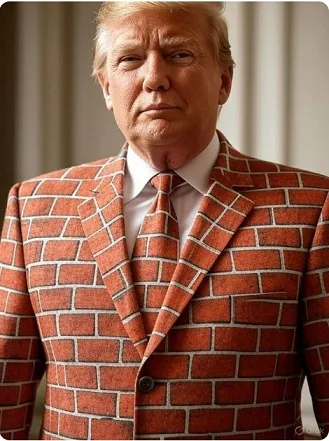

Trump spotted Brick Suit in the crowd in Iowa last night. The president said, “I like that suit. I'll wake up one day and I'll be dressed like a wall, just like you.”

Posted on 07/04/2025 5:52:52 AM PDT by Rummyfan

Oh, and he is much better than they are at talking!

... Congress passed the cornerstone legislation of Trump’s second presidency, eclipsing my desire to look at past Fourth of July jubilations.

The Big Beautiful Bill was worthy of our Founding Fathers, who would be appalled by the size and breadth of the government. DC controls just about every facet of a citizen’s life while siting on a mountain of IOUs no one ever will collect.

The bill, which will become law when President Trump signs it tonight at 5 PM Eastern (Lord willing), trims spending for the first time in memory and cuts income taxes on tips and overtime and sorta exempts Social Security with a $6,000 tax deduction for those of us 65 and older.

The bill also makes the 2017 tax cut permanent. That is very important to the economy because the that bill cut the federal corporate income tax rate to a flat 21%. The USA’s old tax rate was 35%—the highest in the world. This led to corporations moving their headquarters off shore.

Republicans talked a good game about luring them back. Democrats came up with a tax scheme to force them back.

Trump just did it. He made no special favors and he punished no one. Instead, he solved the real problem: the tax was too damn high.

(Excerpt) Read more at donsurber.substack.com ...

Trump spotted Brick Suit in the crowd in Iowa last night. The president said, “I like that suit. I'll wake up one day and I'll be dressed like a wall, just like you.”

Yeah I heard that too. Good stuff. So, we got an email from SS yesterday stating most social security recipients wouldn’t have their payments taxed. But, no mention of when that will kick in. Or I missed it. Got any idea on that? Will it be at signing? Could be $300+ a month since we both get SS. Have an awesome 4th!

“cuts income taxes on tips and overtime and sorta exempts Social Security with a $6,000 tax deduction for those of us 65 and older.“

The promise was clear, no taxes on SS, overtime and tips. People heard the words repeatedly. Taking 6k off taxable income for 3 years within a formula is not exempting social security. And now as they strut around crowing, they feel no reason to ever fulfill the promise.

They flipped the finger to SS, tops are the sand but you have to claim it at tax time and it’s only partially sheltered to 25k. Overtime is a grand total of 10k exempted. And all of that is only for 3 years.

The republicans are running a scam. The only good part it continuing the 2017 cuts.

Trump promised no tax on SS. This bill doesn’t do that. So, where’s Trump’s promise fulfilled??? I heard him last night. He’s still saying there’s no tax on SS. He doesn’t know what he’s talking about.

I wonder why the SSA would send us an email telling us it does eliminate income tax for most recipients then. Just sayin’. Have a good 4th.

Posts like yours remind me of a former neighbor who complained that the Republican town council members who ran on a tax-cutting pledge “only” reduced her property taxes by $150. So she either stayed home or voted for a Democrat the next Election Day. After the Democrats took control of the town council, her taxes were hiked by about $1,200 per year for the next two years. She sold her home and moved out of town because she couldn’t afford to live there anymore.

Trump just has to sign a paper. The hero in this is Mike Johnson.

Trump is much more than just another brick in the wall. Mainly, he IS the wall.

This was all that was available under reconciliation. A separate bill is needed. It would also smoke out the democrats who vote against it right before the mid-terms.

EC

Trump is a businessman.

He knows why businesses are leaving the country and knows how to bring them back.

And democrats HATE to see America successful, prosperous, and free. It threatens their grip on power and their ability to control people.

And she probably never made the connection between her bad decisions and the tax increase.

Idiots like that are what is ruining the country.

there is SO MUCH great stuff!!! I have no idea what you are talking about!!!

https://www.cnbc.com/2025/07/03/trump-big-beautiful-bill-tax-changes.html

Over promising, such as saying no tax on Social Security, is really stupid. Any reduction in taxes on Social Security would have been considered a plus if there had not been an over promise. Now, many people are going to be angry and vote against Republicans or stay home at the midterms. Trump repeated again during his speech last night that there will be “no taxes on Social Security”. That was probably what he wanted in this bill but could not get it in a reconciliation bill. I was shocked to hear it.

Bravo.

Its never enough for some people, is it?

The SS provision was predicated on Treasury info that the majority of 58 million SS recipients receive a benefit of about $24 K. Like, 88% of them.

The new plan gives every taxpayer a standard deduction of 15,700+, Srs get a $2,000 Sr “ bonus” exemption that was preexisting, plus a new $6,000 Sr bonus exemption….so almost $24,000 of Sr income is exempted from taxation. That is Per person. Double it for a couple.

Taking into account that SS is/was taxed at 85%…this gives 88% of SS recipients the entire amount or more of their income from SS payment…as exempt from taxation.

All doubled for a couple- that can exclude $48k of income from taxation.

It’s never enough, is it? Gray heads will be out there protesting with signs printed with Soros money claiming “ Trump lied’

That’s one of the limitations of having a lot of MAGA supporters who are just as stupid as their leftard counterparts.

The President of the United States cannot compel Congress to do anything. He can “promise” all he wants, but he can’t deliver a single vote in Congress on his own. Anyone who doesn’t understand this is, frankly, too ignorant to breathe.

1. Cash tips are practically non-taxable anyway, since there’s no way for the IRS to effectively enforce them.

2. Taxing tips on credit card transactions is an enormous pain in the ass for employers.

3. With some states passing new minimum wage laws that require restaurant employees to be paid no differently than anyone else, I can see a scenario where customers stop tipping these staff.

4. In any industry other than restaurants, it’s impossible under the law to differentiate between a “tip” and a “gift.” If I buy lunch for the contractor who is working on my deck, is that a “tip” that needs to be reported on someone’s tax return? Even the formal term for a tip — “gratuity” — suggests that it is something other than payroll income.

I like the headline. I consider Democrats to be predatory and evil, and Republicans to be moronic and cowardly. I consider Trump to be neither since he has enemies on both sides.

And then when Trump gets praise they will turn it into Republican praise, like they are responsible and share in it as well. If something is criticized, they are the first to slink away and plea that “its Trump, not Republicans...”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.