Posted on 02/27/2025 8:05:50 AM PST by SeekAndFind

Home ownership has been the foundation of middle-class stability and security for so long that it defines middle-class status as much as income. From the end of World War II in 1945 on, the deal was simple: buy a house and you'll build equity that's even better than a savings account because you get the tax break of deducting mortgage interest and you get a roof over your head at a cost that's equal to or even lower than renting a house. Once you've paid off the mortgage, the costs of ownership drop, enabling a secure retirement.

Every one of these assumptions has either crumbled or is now in doubt. A recent report in The Guardian sketches out the forces undermining housing as the source of security:

'I feel trapped': how home ownership has become a nightmare for many Americans Scores in the US say they're grappling with raised mortgage and loan interest rates and exploding insurance premiums.

"I've come to view home ownership and healthcare as destabilizing forces in my life," said Bernie, a 45-year-old network engineer from Minneapolis. To finance owning his and his wife's $300,000 home and saving for the future, the couple was foregoing medical and dental treatment of any kind and cutting back on expenses everywhere, he said, despite a pre-tax household income of more than $250,000.

Let's break down what's changed:

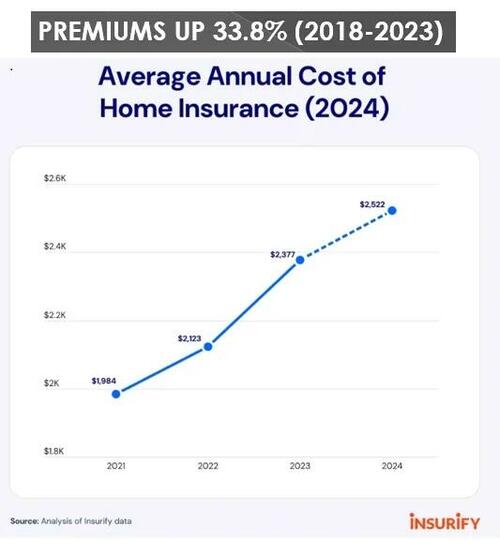

1. The non-mortgage costs of ownership are no longer predictable or affordable. For decades, the cost to insure one's home was modest and predictable, not changing much year to year. Now that insurers are losing billions of dollars as a result of increasingly extreme weather events, rates are rising even in places outside flood, fire and hurricane zones.

Insurance rates are doubling or tripling in a few years, and insurers are leaving markets entirely or increasing the deductible that must be paid by the owners before insurance kicks in, and reducing the coverage.

Property taxes are soaring in many locales. Property taxes were another cost that was relatively modest and predictable. Those conditions no longer apply in many locales: local governments are jacking up property taxes, and / or soaring home valuations are pushing taxes up to nosebleed levels. (I just looked up the annual property tax on a friend's house in California: north of $18,000 a year. And no, it's not a mansion in Malibu, and he bought it 20 years ago.)

The costs of home repairs and maintenance are also skyrocketing. The average age of homes in the U.S. is around 40 years, but closer to 50 years in slow-growth states. As the quality of materials and construction have slowly declined, even houses that are 25 years old or less may require costly repairs--especially if construction defects were undiscovered until major damage had been done.

Routine work such as trimming large trees that pose risks to houses now cost a small fortune. The Guardian article noted estimates for a new roof of $60,000, a sum that equals the construction cost of an entire new house two generations ago. Eye-watering costs of materials are now the norm.

Again, the major changes are not just in costs, but in the loss of predictability. What was modest in cost was not just modest, it was predictable. Now the costs are far higher and future costs cannot be assumed to be affordable.

2. Mortgage costs are also higher, and there's no guarantee interest rates will fall back to 3.5% mortgage rates. As this chart illustrates, the cost of servicing today's mortgages is significantly higher than in years past.

3. Those who locked in low mortgage rates are trapped in their current homes, as they can't afford to move and pay interest rates that are 50% to 100% higher than the low rates they secured years ago. The Federal Reserve intervened massively in the private mortgage market in the post 2008 era, effectively socializing the mortgage market as the means to push mortgage rates down to encourage "growth."

The Fed's intervention helped inflate Housing Bubble #2, just as the subprime excesses of the early 2000s helped inflate Housing Bubble #1. These distortions were intended to fuel home buying, but they also fueled massive increases in housing valuations.

4. The total costs of ownership--the monthly nut including mortgage and other costs--now exceeds the peak in Housing Bubble #1. Buying a house now is not a guaranteed pathway to financial security, it's a wager that valuations will continue to soar ever higher, generating capital gains that will offset the decades of higher costs of ownership.

5. The triple-whammy of soaring valuations, mortgage rates and other costs of ownership has made housing unaffordable in many locales. By any measure, housing affordability has declined to levels that equal or exceed the trough of Housing Bubble #1.

The Case Shiller National Housing Index offers a snapshot of Housing Bubble #2.

6. Land, materials and labor are no longer cheap. In traditional economics, the high costs of housing can be reduced by reducing demand or increasing supply. Increasing supply at affordable prices is far more challenging now than in the postwar decades. The easy-to-build land was built out long ago, and high-rise condominiums come with higher construction costs and the uncertainties of common-area expenses, which in some cases skyrocket to equal or exceed the costs of ownership.

Proponents of building more housing in urban / suburban areas--YIMBYs--yes in my back yard--face hurdles of geography, aging infrastructure, parking, and the high costs of insurance, mortgages, materials and labor, along with many restrictive zoning and planning regulations designed to maintain the status quo.

As for reducing demand: the population of the U.S. was 265 million in 1995, and it's now 345 million: an increase of 80 million people, roughly the same as the entire population of Germany (83 million).

7. The costs of housing have opened generational and regional divides. Boomers and Gen-Xers who bought homes decades ago in the 1990s or early 2000s locked in much lower purchase prices and had multiple opportunities to refinance mortgages at lower rates as the Fed interventions pushed rates down. Recent buyers have no equivalent set of built-in advantages.

Regional divides are increased. A modest home purchased in a middle-class urban area decades ago has increased 10-fold in some areas and not even kept up with inflation in others. The winners are now sitting on a million dollars in equity, a windfall the less fortunate did not reap.

As the urban winners cash in their equity and move to desirable towns, they quickly bid up housing to the point local residents can no longer afford to buy a home in their hometown. And since the wealthy also snap up housing as investment properties--short-term vacation rentals--households that would be considered middle-class by income are doomed to being renters.

"Middle class" is no longer middle-class, it's a seat in the casino that most exit as losers.

8. Renting is no longer a cheaper option. Rents have soared along with home prices, and once again, the predictability of future costs has vanished: rents can increase 30% overnight, just as insurance and property taxes can leap up far beyond anyone's projections.

Bottom line: with the loss of predictability, we've also lost any sense of future financial security. Buying a house is now a wager: a wager that the costs of ownership won't stair-step up to eat us alive, and a wager that valuations will continue to rise, offsetting the high costs of ownership with future capital gains.

Should Housing Bubble #2 pop--and all bubbles eventually pop--then homeowners will be dealt a future of ever-higher costs of ownership even as their equity diminishes. Those sitting on a wealth of equity now may find the assumption that this equity is predictably permanent is itself a wager.

The middle class was fundamentally defined by predictable financial security and social stability. Now everything is a wager with unknowable odds. Rather than being a source of stability, housing is now a source of instability for many--and potentially for every homeowner, should costs of ownership continue increasing as Housing Bubble #2 pops.

yes, above certain thresholds.

more specifically capital gains tax.

Whomever owns the note is getting a low return on their money. It’s still better than a default.

OK thanks. I’ve done some “back of the envelope” calculations and discovered I would owe substantial capital gains tax if I ever sold my house. So I’ve put off any such thoughts of selling.

I would have hoped most saw the writing on the wall when Barry the Muslim was elected. I changed my whole life around, was already debt free except 2 mortgages, but I sold one, paid off the other, then I bought another house, paid it off in 10 months and built a new house all cash(took 4 years). So here I sit with 3 paid for houses, about to retire in 6 months, will sell one then buy another for cash somewhere close to my daughter and grandchildren. It will cost me about 1/3 of what I sell one of the California houses for.

Having NO BILLS for the last 13 years has been Wonderful and I will never borrow another nickel for anything. I pay cash for new vehicles when I need one and just bought my wife a new car 6 months ago.

GET OUT OF DEBT, DON’T BORROW MONEY

????

I thought Free Republic conservatives are against all this globalization of recent decades? Some here are in favor of that?

True.

Sometimes people ask, why do so many mothers work? Why aren’t there more stay at home moms nowadays?

A key answer is that it takes two incomes to pay the mortgage on a house, which our parents and grandparents could afford on one income.

If a European investor bought a U.S. mortgage bond paying 3% interest on the day I closed on my home, they would have earned a 3% annual rate of return in dollars ... but the value of the bond would have increased by 11% when measured in euros just from the weakening of the euro against the dollar.

I was not able to to that with college and with a working spouse.

1. The U.S. emerged from WW2 as the only major industrial power that had not been devastated by the war. Our standard of living rose to unsustainable levels simply because we had no competitors on the world stage.

2. When I was a kid in grade school, it seemed like one out of every two or three classmates of mine had a grandparent living in their homes with them -- usually a widowed grandmother. I don't think those were cases of "one income" paying the mortgage at all; the pension and/or Social Security check was helping to pay the cost of the home.

Item #2 is critical here. One of the biggest factors in rising housing costs in the U.S. today is that our median household size is smaller than ever.

Uh, yea....interesting find.

The lack of affordable housing is all part of the plan.

The elites realized that home ownership by middle class people lead to “family” formation, that is, parents having kids. As far as the WEF leadership is concerned, that’s bad.

So unaffordable housing is all part of the population reduction program.

WEF “Fewer Forward into a Bleaker and lonely Future”.

I’ve owned my own home since I was 18. Paid off my mortgage at 45... 30 years ago. After the Almeda fire and getting screwed by Biden, my income is $800 a month less and housing is 2 1/2 times as much. I can no longer afford a home or to even get back to my community. I’ll die in a strange place in a cold scary old trailer.

the first $250,000 of gains are excluded if you are single and $500,000 if you are married filing jointly.

That’s what I think. My kids own their home, but have trouble making payments on it. However, they have a cleaning service, eat out frequently, and take lavish vacations at least twice a year. Yes, they both work hard, but they spend more money than they should be. It’s going to bite them in the butt hard sometime. They live pretty high on the hog. They don’t see it though, because everyone around them lives this same way. It’s extravagant.

I find it bizarre how these corrupt SOBs in government ever pushed through these punitive property taxes.

Pay taxes all your life, finally after decades of paying taxes and mortgages on your home they finally pay it off, Yet those in government still demands they pay them to live in their now paid off homes?

All their doing is renting from the corrupt government as those in government keep charging them more and more just to live in their paid off homes!

And the old folk on fixed incomes? They’re f*****! They just loot the sh*t out of those folks hoping they can seize their homes!

I find it bizarre how these corrupt SOBs in government ever pushed through these punitive property taxes.

Pay taxes all your life, finally after decades of paying taxes and mortgages on your home they finally pay it off, Yet those in government still demands they pay them to live in their now paid off homes?

All their doing is renting from the corrupt government as those in government keep charging them more and more just to live in their paid off homes!

And the old folk on fixed incomes? They’re f*****! They just loot the sh*t out of those folks hoping they can seize their homes!

I’m to the point in life where I will never be able to afford to purchase a home. I’ll be a renter until I pass from this mortal coil.

“I just looked up the annual property tax on a friend’s house in California: north of $18,000 a year. And no, it’s not a mansion in Malibu, and he bought it 20 years ago.”

Complete BS. Prop 13 limits property taxes to 1% of the value when the property is purchased and limits yearly increases to 2-3%.

That would mean he brought the property 20 years ago for ~ 1.5 million.

Not sure about the rest of the article but if he is that sloppy about this item, I wonder how accurate the rest of the article is.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.