From Baltimore – Wide-ranging tariffs are scheduled for March, yet it’s not clear to most Americans – including this one – exactly what the impact will be.

We all know that tariffs are taxes on imports, of course. But how much? And what is taxed? And who will pay for them?

Well, sometimes a few good charts can shed light on just such a matter. And I recently came across two that speak volumes.

First, however, what is the Trump administration’s tariff plan?

Well, the White House has already put an additional 10% tariff on goods from China. A 25% tariff on imports from Mexico and Canada will take effect on March 1. And a 25% tariff on all steel and aluminum imports will start in mid-March.

Trump is betting that even if these three nations enact retaliatory tariffs (which they are likely to do), the U.S. will continue to have most of the leverage. The White House fact sheet on tariffs points out that while trade accounts for 67% of Canada’s GDP, 73% of Mexico’s GDP, and 37% of China’s GDP, it accounts for only 24% of U.S. GDP.

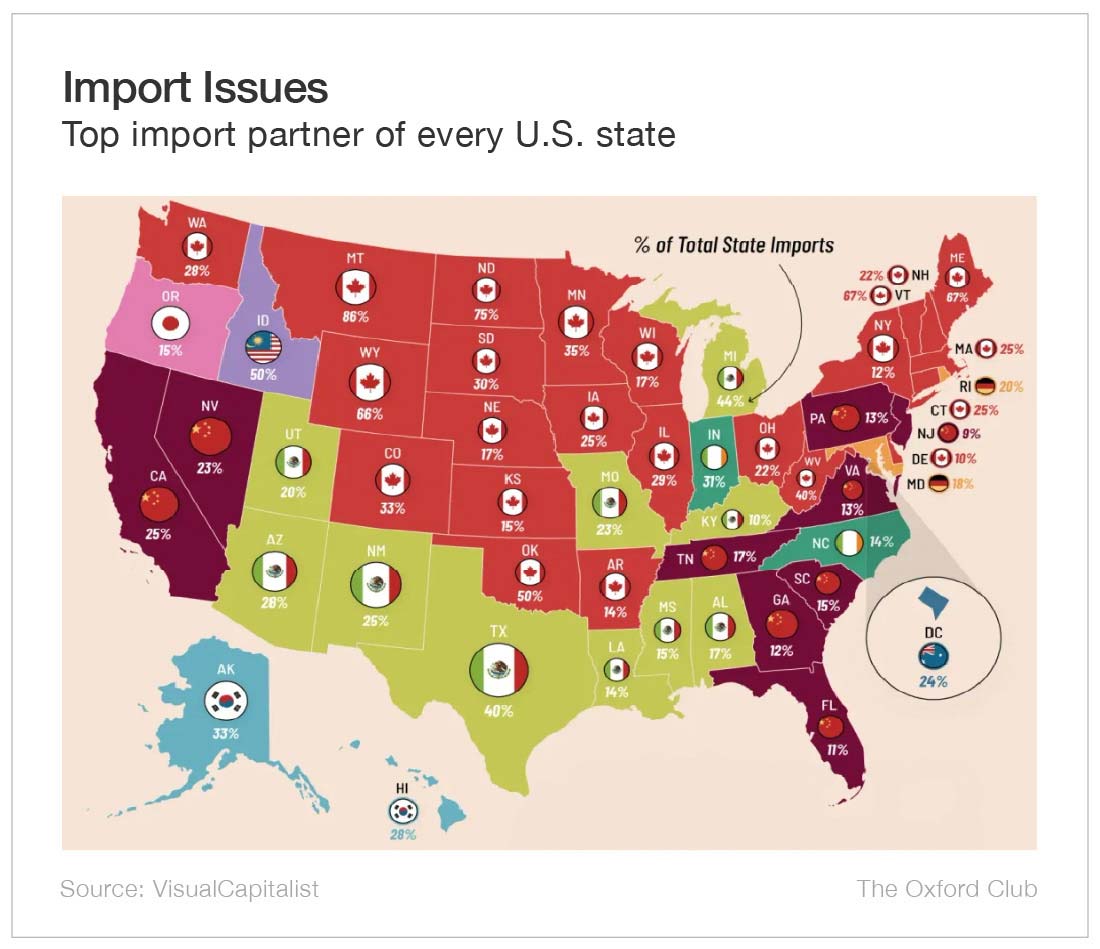

But don’t tell that to the people of 23 states for whom Canada is the biggest source of imports. Our northern neighbor is the largest supplier of grain, livestock, meat, and poultry to the U.S.

And be careful when you speak about tariffs in the 10 states for which Mexico is the biggest import partner. I’m looking at you, Texas, where 40% of all imports come from the southern border.

(Mexico is the largest supplier of fruits and veggies to the U.S., by the way.)

And China is the biggest importer to Florida and California (two of the biggest state economies).

Recently in The Oxford Insight, Alexander Green wrote about how tariffs are taxes paid by American consumers, not foreign businesses. And a bunch of studies of the tariffs enacted in the first Trump administration found that U.S. importers incurred almost the full cost of those tariffs, with almost no offsetting reduction in price from foreign exporters. And importers pass those higher costs on to consumers.

You can see from the map that consumers in many states will likely be hit hard by these new tariffs.

Because of Trump’s tariffs in his first term, the consumer price of solar panels and washing machines rose by more than the tariff.

And what about inflation?

Well, inflation is a tricky thing, because it’s strongly influenced by expectations.

Reigniting Inflation

If businesses expect prices to rise in the future, they will hike their prices faster. If workers expect prices at the supermarket to go up in the near future, they’ll demand higher wages to offset that. And if consumers expect prices to rise soon, they’ll frontload their purchases, which can suddenly increase demand for goods and services and lead to higher prices.

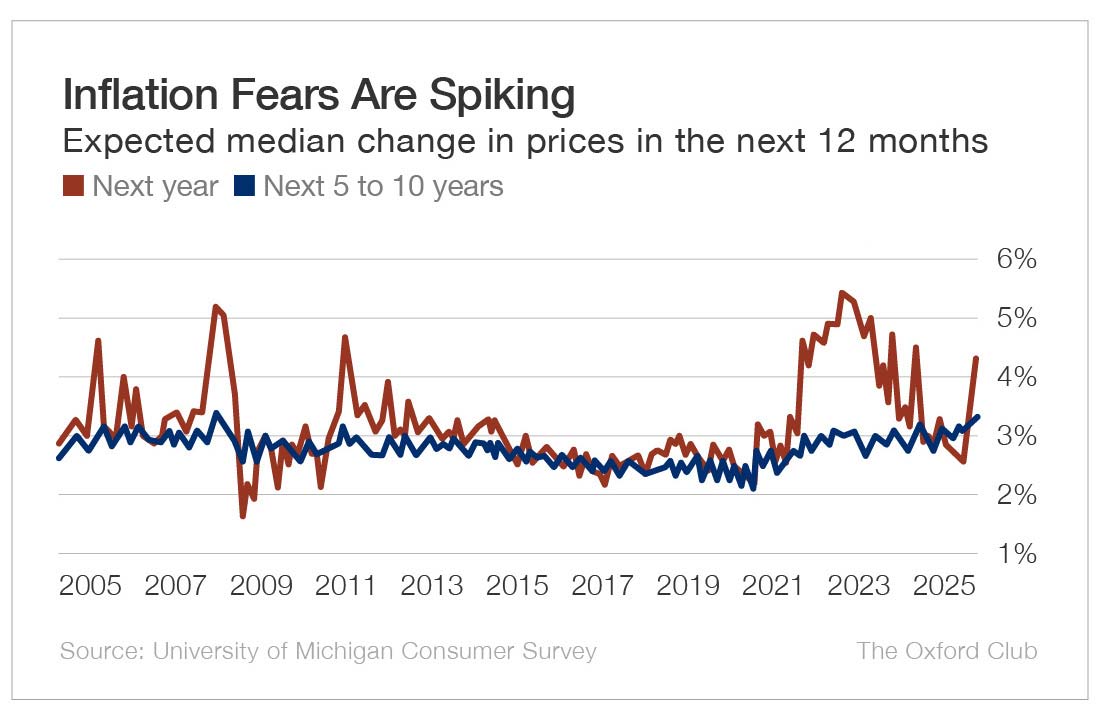

And suddenly, because of all the tariff threats, inflation expectations are spiking again. They jumped a few years ago when supply constraints during the COVID-19 pandemic pushed both inflation and expectations higher. And then when those limitations receded – factories opened up again, ports became unclogged, etc. – expectations of inflation fell off.

But as you can see in the graph below, they’re spiking again.

The University of Michigan, which conducts the survey for that data, attributes the spike in inflation expectations to announcements by Trump on tariffs, as many interviewees mentioned them.

And CEOs are certainly thinking about the impact of tariffs. Half of the chief executives of S&P 500 companies that have reported their quarterly results this earnings season have mentioned tariffs in earnings calls, according to FactSet, which tracks earnings. That’s the highest percentage of CEOs mentioning tariffs since 2019 (when Trump was last in office). Apparently, they’re worried about the impact on their profits from the new administration’s tariff policies.

Investors should be worried too, as higher input costs weigh heavily on companies’ profitability and thus their share prices.

Invest wisely,