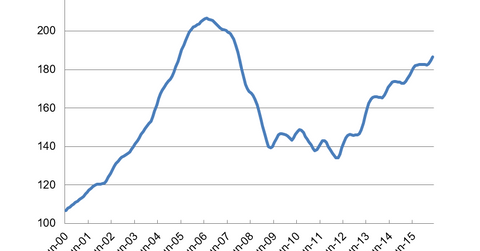

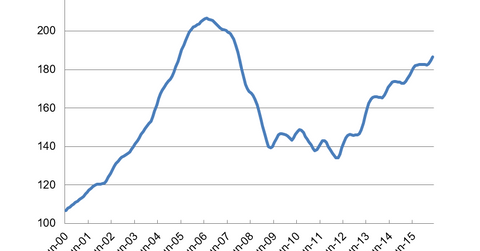

There was a bit of a stabilization in early 2010 because of the (government manufactured, of course) first-time homebuyer tax credit, but when that expired, values continued to declined, although more modestly, up until 2012.

Posted on 12/19/2022 6:41:53 AM PST by Kaiser8408a

The highest interest rates in 15 years are delaying home dreams, putting business plans on ice and forcing many Americans to agree to loan terms that would have been unimaginable just nine months ago. Biden’s anti-fossil fuel policies are helping drive up prices and The Federal Reserve is hiking rates to cool it off.

Most of all, the surge in borrowing costs is punishing the cash-poor. And it’s about to get worse as the Federal Reserve carries on with its anti-inflation campaign and keeps hiking rates next year.

As the Fed’s most aggressive interest-rate hike cycle in a generation filters through the US economy, the gap is widening between the haves and the have-nots. Even without a recession, households and businesses are feeling the financial pain.

Here’s a look at pockets of the economy that are bearing the brunt of the impact.

Housing in Holding Pattern

To trim expenses amid soaring consumer prices, the couple recently bought a freezer and stocked it with a quarter cow and half a pig sourced from an agricultural school. But they shelved their plan to upgrade to a single-family home for the time being.

“We would like to buy some land to build on, but these rates aren’t making it attractive, so we are in a holding pattern,” said Waits, who receives disability benefits.

Even in the once red-hot market of Tampa, Florida, a few people showing up at an open house is now considered a good day. “People are just waiting on the sidelines,” said Rae Anna Conforti, a realtor with Re/Max Alliance Group.

The higher rates, coupled with a surge in home values during the pandemic, pushed the monthly mortgage payment on a median-priced house to more than $2,000, up from about $1,100 just before Covid-19 hit.

(Excerpt) Read more at confoundedinterest.net ...

Good luck gen x, y, z, etc trying to buy a house in the future. Not only that, but large home builders don't build 'starter' homes like in the past. Nimby and local interest also prevent the building of smaller 'affordable' homes.

woodbutcher1963Biden has created a natural gas shortage even though we have more natural gas reserves than any other country in the world.

The US has pumped a record amount of natural gas in 2022 and 2023 is going to be even greater. Why it is high for the consumer in the US is much of it is being exported out raising up the price.

Gas companies right now are working on a deal with China to supply them with gas for 20 years. It will rake in the trillions. Mass bipartisan support due to the amount of money involved.If it comes to pass it will be the largest gas deal ever set up in our history. Politicians fromboth sides want it due to the taxes it will generate

2009 and 2010 actually saw mortgage rates decline from 2007/8, pre burst.. so there wasn’t a downward pressure on prices coming from the financing side, money was actually cheaper in 2009 and 2010 than it was in 2007.

If rates stay at 7-8%, you will see the market adjust... the market was a balloon around me, and I live in Pittsburgh region.. and like I always say, when a trend hits Pittsburgh, its pretty much over.

The market here was briefly like california where houses would sell for tens of thousands over asking in a day with bidding wars... which is just now how things are here, it was a bubble, builders were jacking up new construction prices 10% every few months...

Now things have calmed down, and prices are declining.. not falling off a cliff yet, but they will come down. Pittsburgh historically has been pretty insulated from this craziness, other than a few neighborhoods that will get “popular” and run up...but as a whole, slow and stead few percentage point growth a year.

Nationally Existing home sales are down about 30% from last year... Cost of money has more than doubled, prices will go down... it won’t happen overnight, but it will happen... and just like housing inflation is not universally equal, neither will the decline, but it will happen.. if rates remain at 6-8%, or higher, you will see prices adjust. Yes the folks who don’t NEED to sell can sit it out, but there are always those who have to sell, and while no one likes to lower their price, especially if it puts them under water, it will happen.

Won’t be a sudden collapse, and won’t be universal, but it will happen, already happening in my market. Prices are still too high IMHO, but you aren’t getting 300K+ and sold in a day anymore for a modest/average home in a lower middle class neighborhood any longer.

Your analysis is only partially correct.

The government is not the only entity that “issues” money.

Every time a private entity—bank, credit card etc.—issues a loan they are “creating” money.

It is the private piece that takes a hit when interest rates rise.

I remember that we were happy when we bought our first home because we got 9 7/8%.

I want to know how in the hell Bite-me is popping 54% approval.

In the areas where I was living and working at the time, there were at least a half-dozen cases involving people I knew vaguely whose homes were in foreclosure. In two of those cases the homeowner went to the bank and was ready to just hand over the keys.

None of the banks took possession of the properties. Instead, they let the occupants live there indefinitely and asked them to simply maintain the homes, insure them, and pay the taxes on them. That’s it. In one case, the occupant stated there for more than THREE YEARS without ever making a mortgage payment.

The banks eventually sold the homes at prices that were high enough to cover the outstanding mortgages along with other administrative costs.

That’s it in a nutshell. Actually it’s much more than energy policy, but generally the problem is conflicting policies between the Biden Administration and The Fed. Until there is a change the economy will remain in the dumpster.

Is that high fot the area?

300k where I live will not even buy a one bedroom 676 square foot condo.

We are. Mini-splits are becoming a thing. To be fair to the central air proponents, it does reduce mold which is a real problem. For those of us in which mini splits would be a problem (because part of my finished downstairs is in the ground which is common in my part of hilly and tornado-prone Alabama), variable speed heat pumps are a thing. My variable speed heat pump runs almost constantly to reduce the humidity in the home (which adds to the comfort bigly in humid Alabama), but uses a lot less energy through the year than my prior A/C and natural gas furnace it replaced.

And don't get me started on energy savings that can happen during construction, some of which can be cost prohibitive to add later (i.e. don't want to tear up sheetrock walls to add more insulation and better caulk around windows). But some of which can be done later yet few people do it anyway (i.e. insulating the attic, caulking the cracks you can reach with minimal effort, replacing the old water heater either with a tankless water heater or a hybrid water heater).

If you want to be creative, you can do with your water heater what I did right after I added solar, but it isn't necessary to have solar to get lots of benefits from it. I replaced my natural gas water heater with a hybrid water heater. They "hybrid" isn't part power part nat gas. It's all electric and can run in one of two modes: either with normal electrical heat strips or with an energy saving heat pump that's built into the top of the water heater. Thus, it heats the water tank with the heat it draws from the air it pulls into the intake air vent -- then it outputs cold air from the outflow vent. If you spend a lot of energy cooling your home (like we do in Alabama), that free cool air coming from the water tank after every shower is used to help cool the home (so my home heat pump doesn't have to work as hard to keep the house cool during the 8 warm months of the year). During the cool months I flip a wye lever and duct the cool air from the water heater up into the attic (so my home heat pump doesn't have to work harder to keep the home warm).

What about the air coming into the water heater? I have a solution for that too to preserve energy. Just like I use the output cold air for cooling the house like I need to do anyway, I duct warm air from the attic to the intake of the water heater's heat pump. Thus, most of the months through the year it has air much warmer than my home's air to easily draw heat from to heat the water tank. Bonus points since I often take two showers in a day in the warm months (once in the morning, then another later in the day after doing sweaty chores outside). Thus, the very hot attic air in an Alabama summer is free heat for my water heater's heat pump to use to heat the water tank at the time of year I consume more hot water anyway. I mean, the hot air's already in the attic for free - might as well put it to good use. Just like the cold air coming from the heat pump is free -- I use that to help cool the house during the warm 8 months.

The end result: it consumes only 2 to 2.5kWh every morning after our morning showers (plus a little more later in the day when we consume hot water for other things) -- even while it helps lower our A/C use in the warm 8 months of the year.

Well, now we have inflation AND mean tweets

I was talking with my buddy who is a retired LEO and now does construction, He told me a square foot of cedar shaking (composite for siding) is well over $200. That’s insane.

US 30-year mortgage rates hit highest rate since 2001 ...

Sounds ominous, except that a 5%-6% interest/mortgage rate was historically considered 'the norm' going into the Carter years and 8%-10% was 'the norm' until the GWB real estate crisis that shrank interest/mortgage rates to historically low levels that continued to shrink to cover O's ass.

1920-34 near 6% mortgage average1

1935-45 just under 4.5% mortgage average1

1960 - 5.1% mortgage average2

1971 - 7.3% mortgage average1

1980 - 13.7% mortgage average2

1981 - 16.6% to 18.45% mortgage average2

1990 - 10.1% mortgage average2

2000 - 8.1% mortgage average2

2010 - 4.7% mortgage average2

2020 - 3.1% mortgage average2

sources:

1Mortgage Rate History: Check Out These Charts from the Early 1900s

2Here's how much home prices have risen since 1950

You have to “buy it” but you are going to live through it.

Yeah, my first home was under that carter nitwit, but it was only 14% interest. That was pretty good back then.

Replacing an old central heater with a ductless heater works real well. You have a unit mounted on one wall of your living space kicking out heated or cooled air 24/7. You keep your bedroom doors open to get circulated into. Big rebates for replacing central heating with these Ductless heaters.

Those numbers were from actual home sales, pulled up my my Wife — a Realtor Broker Owner.

She pulls these stats up each year for her business Christmas card.

I expect fewer sales next year and prices to climb some (not as much of course).

Merry Christmas.

That's a very good question. The answer is that it makes overall prices go down for products or assets that are purchased based on monthly payments rather than actual prices.

HamiltonJay does a good job of explaining it in Post #10. In the scenario he describes, notice that the vast majority of home buyers make decisions about the home they can afford based on the monthly mortgage payment, not the actual price of the home. If rates are low they can afford to pay more. When rates go up they can't afford the same homes they were considering 1-2 years ago.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.