Skip to comments.

Want to Buy a House Now? Mortgage Rates Jump Above Six Percent for First Time Since 2008

Red State ^

| 09/15/2022

| Bob Hoge

Posted on 09/15/2022 8:43:04 PM PDT by SeekAndFind

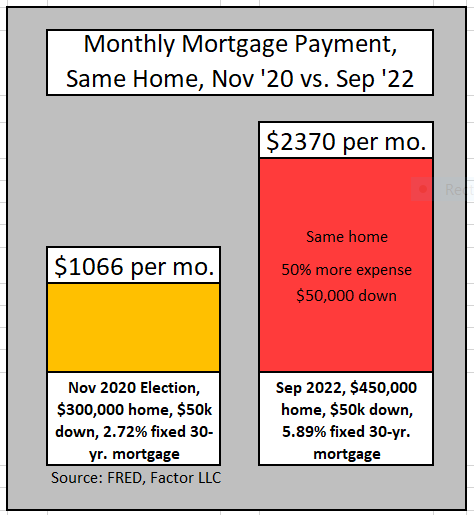

Mortgage rates when President Joe Biden took office? 2.65 percent. Today? 6.28 percent.

On Tuesday, Biden held a weird celebration of his “Inflation Reduction Act” on the lawn of the White House. Why was it weird? Because at the very same time as Democrats were applauding themselves, the U.S. Labor Department was releasing figures that showed an “unexpected” rise in inflation, with the cost of rent, food, and other basic necessities continuing to skyrocket.

Now we learn that mortgage rates have climbed above six percent for the first time since 2008. Wonder what kind of party Biden has planned for this milestone?

Why is this happening? The explanation is simple: the economy is experiencing high inflation, so the Federal Reserve keeps raising interest rates in an attempt to cool the economy. Mortgage rates are tied to the Fed’s rate, and so hence are rising.

I often wonder, what do we tell our kids? Housing prices are already at an all-time high; now you add in unaffordable mortgage rates and few can maintain any dream of owning their own home anytime soon. “I’m sorry, son. You see what we have, but unfortunately, the world has changed and you have no reasonable hope of obtaining it.”

It’s heartbreaking. From the Wall Street Journal:

A borrower who buys a $500,000 house with a 20% down payment and a rate of 2.86% could expect to pay about $200,000 in interest over 30 years for their $400,000 loan. If their rate is 6.02%, they could pay $465,000 in interest, according to a mortgage calculator by Bankrate.com.

Homeownership is “one of the most consistent ways to build a financial bedrock for future generations,” according to the North Carolina Housing Finance Agency (and most wealth advisors; that’s just the quote I chose to use). Unfortunately, that path is closed off for the majority of today’s youth. Messages like these read hollow to them:

Here’s the daunting reality of what they face:

With a down payment of 10 percent on the median home price listed in the database on Realtor.com, the typical monthly mortgage payment is now roughly $2,352, up 66 percent from $1,416 a year ago, taking both higher home prices and interest rates into account.

And that doesn’t account for other expenses — like potentially higher closing costs, along with property taxes, homeowner’s insurance and mortgage insurance, which is often required on down payments of less than 20 percent.

(Emphasis mine.)

Up 66 percent from a year ago? That’s staggering. And by the way, I don’t mean to imply that this just affects young people—it affects anyone who’s been striving to get off the rent hamster wheel and start building some wealth. A relative of mine in Southern California has been working for 30 years at decent jobs and recently got promoted to a senior management position in which she’s well paid.

And yet… the enormous sums to even contemplate buying into SoCal real estate has left her disheartened, and with mortgage rates exploding as they have, all hope is lost. She’s lucky enough to have upgraded her apartment with her new salary, but that’s as far as it goes.

Further adding to the misery, as more and more people give up on owning a home, quality rentals become more and more desirable. Guess what happens? Rent goes up.

Inflation is a pernicious enemy, and while it can sound like an economics-nerd term, it affects our daily lives. Biden’s insistence on throwing more and more taxpayer dollars into insane spending bills like the Inflation Reduction Act has serious consequences and is lowering the quality of life of everyday people. He can throw celebrations all he likes, but he’s ruining people’s lives.

TOPICS: Business/Economy; Society

KEYWORDS: housing; interestrates; mortgage; realestate; unexpected

To: SeekAndFind

How many people were foolish enough to take an ARM when 30 year fixed were below 3%. Anyone adjusting a $300,000 or $400,000 or more mortgage might get adjusted right out of the house.

2

posted on

09/15/2022 8:49:28 PM PDT

by

hardspunned

(former GOP globalist stooge)

To: SeekAndFind

A couple questions immediately come to mind...

1. How high will rates really have to go wring Biden’s inflation out of the economy? Frankly, Volcker’s 21% of 1981 sounds about right. Not that I think there’s the political will for that to happen, though.

2. How stupid are the American voters? If they focus on preserving their rights to fetal honicide, swallow the woke media’s propaganda and reward Biden and the Dems in November for their disastrous economic policies, then this country is truly screwed. I remember Tom Sowell on Mark Levin’s TV show before the 2020 election saying something to the effect of “Every four years, both side pain the election as a make-or-break point for the country. This is the first time I suspect that might be right. If Biden wins, we get to a point of no return.”

To: SeekAndFind

When I bought my first house in 1990, the interest rate was 10%. 6.28% isn’t the end of the world.

4

posted on

09/15/2022 9:02:55 PM PDT

by

Blood of Tyrants

(Inside every leftist is a blood-thirsty fascist yearning to be free of current societal constraints.)

To: Blood of Tyrants; SeekAndFind

Our first home in 1985 was at 14.5%, since we were young and they could gouge us a little more. I think that prime was about 12% back then.

One consequence is that homes appreciated very little. Yes, in a somewhat bad part of Dallas and the selling price increased only about 4% over 12 years.

Soon we will be wishing for the good ole days of Carter ...

5

posted on

09/15/2022 9:07:56 PM PDT

by

texas booster

(Join FreeRepublic's Folding@Home team (Team # 36120) Cure Alzheimer's!)

To: SeekAndFind

Yet another resounding and spectacular success story from Xiden the great.

6

posted on

09/15/2022 9:19:41 PM PDT

by

Newtoidaho

(All I ask of living is to have no chains on me.)

To: SeekAndFind

It might be possible to buy a 50% share with a ten-year option to buy the remaining 50% at the same price (or say half the latest assessed value at time of completed purchase).

It would be like a 3% interest rate.

The 50% share not purchased might be rented by paying the property tax on it as well plus say $100/month.

To: SeekAndFind

Buying a share of a property is common in England.

To: irishjuggler

“How high will rates really have to go wring Biden’s inflation out of the economy?”

Inflation really can’t be stopped by raising mortgage rates, most especially when those mortgage rates are less than the inflation rate.

Inflation is based on monetary policy.

Homebuyers also need to be better informed, such as being given complete financial information (such as a copy of every invoice) when buying a new house.

My neighbor is putting on a metal roof. Three hombres will take about 4 to 5 days to do it.

To: hardspunned

In the UK, five-year ARMs were very common at one time.

It was stupid to lend money at less than 3% for 30 years in Trump’s time given the possibility of Biden-based inflation.

Also, in the UK, interest is not tax deductible for resident homeowners.

To: SeekAndFind

On the flip side - your savings account interest will not rise commensurately - just another “anomaly” of the F’n Senile Pedo Bidenomics.

11

posted on

09/16/2022 4:53:11 AM PDT

by

trebb

(So many fools - so little time...)

To: Blood of Tyrants

Guess the he didn’t cost as much compared to your income as is the case for most nowadays.

To: SeekAndFind

The last time I refinanced my home, before paying the loan off, the rate was 6.375%. At the time, that was a gift.

13

posted on

09/16/2022 7:17:02 AM PDT

by

CodeJockey

("The duty of a true Patriot is to protect his country from its government.” –Thomas Paine)

To: irishjuggler

1. How high will rates really have to go wring Biden’s inflation out of the economy? Frankly, Volcker’s 21% of 1981 sounds about right. Not that I think there’s the political will for that to happen, though.If that were to happen we could see CD rates near 15%! I'm no economist, but I guess that would tank the markets?

14

posted on

09/16/2022 7:26:21 AM PDT

by

CodeJockey

("The duty of a true Patriot is to protect his country from its government.” –Thomas Paine)

To: SeekAndFind

I often wonder, what do we tell our kids? Biden stole your house. Well, if we want to be honest with them...

15

posted on

09/16/2022 7:27:25 AM PDT

by

Mr. Jeeves

([CTRL]-[GALT]-[DELETE])

To: SeekAndFind

The stock market doesn’t effect the economy

Joe Biden 9/22

16

posted on

09/16/2022 8:27:38 AM PDT

by

Vaduz

( )

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson