Posted on 06/14/2022 10:29:51 AM PDT by blam

An “economic hurricane” is coming. That ominous warning comes from Jamie Dimon, CEO of J.P. Morgan Chase.

“I said there were storm clouds. But I’m going to change it. It’s a hurricane. Right now it’s kind of sunny, things are doing fine, and everyone thinks the Fed can handle it. That hurricane is right out there down the road coming our way. We don’t know if it’s a minor one or Superstorm Sandy. You better brace yourself.”

Of course, he isn’t the only CEO feeling this way. The most recent CEO Confidence Index suggests that most leaders are concerned about the economy over the next few quarters.

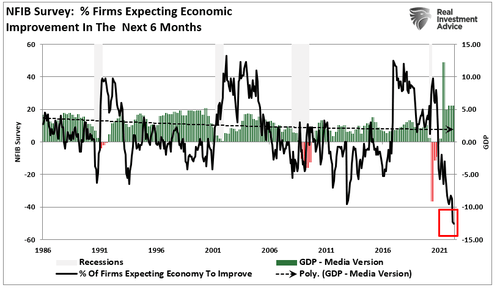

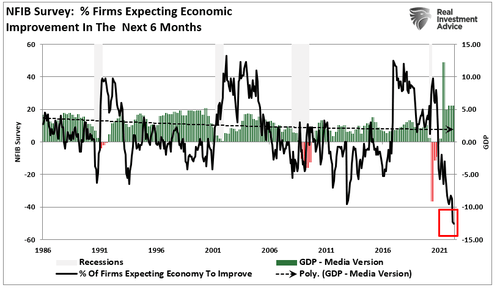

Adding to that, the NFIB Small Business Survey also suggests that the economic backdrop is deteriorating rapidly. The chart below shows the number of firms expecting an economic improvement over the next 6-months. t number plunged to the lowest reading ever.

Of course, businesses are gloomy because consumer confidence, which is where they derive their revenue and profits, suggests dismal growth ahead. Our consumer confidence composite index (UofM and Conference Board measures) of expectations less current conditions is already at levels associated with previous bear markets and corrections.

So, is Jamie Dimon being hyperbolic, or is there a genuine concern for an economic hurricane?

Storm Clouds Are Closer Than They Appear

Dimon’s two primary concerns about the economy are valid – the risk of a Fed policy mistake and the war between Russia and Ukraine. I am personally concerned about the first risk more than the second.

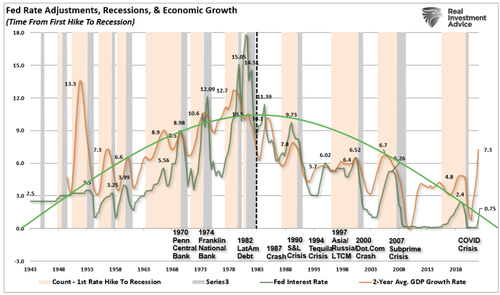

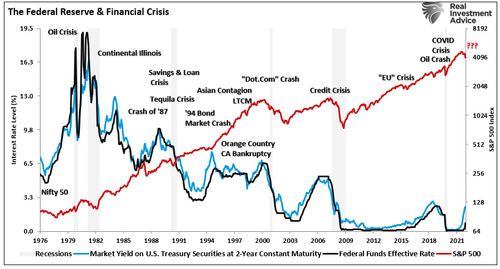

An honest review of history shows the Fed is consistently a “day late and a dollar short” regarding monetary policy. The history of “financial accidents” due to the Fed’s monetary intervention schemes is evident. Not just over the last decade, but since the Fed became “active” in 1980.

What should be evident is that before the Fed became active, economic growth was accelerating. There were few crisis events, and economic prosperity was broad. However, post-1980, the trend of economic growth declined. There are many reasons leading up to each event. However, the common denominator is the Fed tightening monetary policy.

Notably, Fed rate hiking campaigns correlate with poor financial market outcomes, as higher rates impacted the credit and leverage markets.

Such is where I agree with Dimon considering his comments on monetary policy.

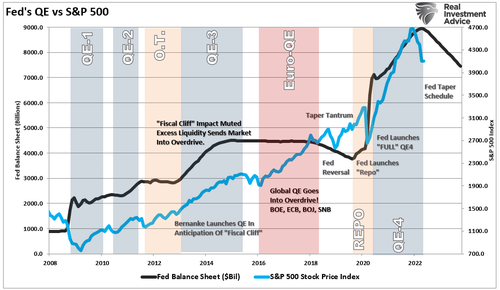

“We’ve never had QT like this, so you’re looking at something you could be writing history books on for 50 years,”

When the Fed reduced its balance sheet in 2018, it ran at a pace of $30 billion monthly with very low inflation. Starting this month, the Fed will be ramping up that reduction to 3-times the previous run rate, with inflation at nearly 9%.

While they believe they can achieve this reduction without disrupting the equity markets or causing an economic contraction, history suggests otherwise.

The Russia/Ukraine conflict, rising interest rates, and soaring commodity costs exacerbate the collapse in confidence. Such has already significantly tightened monetary policy, elevating the risk that the Fed will again make a “policy mistake.“

Preparing For An Economic Hurricane

From our perspective, I had often disagreed with Mr. Dimon’s outlooks (see here), like in December 2019 when he stated:

“This is the most prosperous economy the world has ever seen. It’s going to be a very prosperous economy for the next 100 years.” – Jamie Dimon

That statement didn’t age well. Just 3-months later, the economy plunged into the deepest recession since the “Great Depression.”

However, this time I don’t. The risk of an “economic hurricane” is certainly elevated. But as someone who grew up on the Gulf Coast, Hurricanes can be unpredictable. More than once, my Dad and I boarded up windows and stocked up on non-perishable food and water, only to see the storm change course at the last minute. However, the preparation, while wasted, was better than the alternative.

Between soaring inflation, falling wages, slowing economic growth, and a Fed bent on tightening monetary policy, there is a storm on the horizon. The magnitude, timing, and location of the “economic hurricane” are still anyone’s best guess.

All we can do is prepare for the storm and then cross our fingers and hope for the best. The guidelines are simplistic but ultimately effective.

1.Raise cash levels in portfolios

2.Reduce equity risk, particularly in high beta growth areas.

3.Add or increase the duration in bond allocations which tend to offset risk during quantitative tightening cycles.

4.Reduce exposure to commodities and inflation plays as economic growth slows.

If the hurricane hits, preparing for the storm in advance will allow you to survive the impact. It is a relatively straightforward process to reallocate funds to equity risk if it doesn’t.

Given the numerous shocks to the system happening concurrently, I think investors will need more than just an umbrella to survive it.

The good news is there is always enough taxpayer dollars to bail out politically connected corporations. Always.

That's what you want to hold during a period of exploding inflation - cash. Because it sits under your mattress and loses value with every inflationary increment.

Lol.. that’s what crossed my mind too.I remeber reading about people in various countríes with runaway inflation…particularly in Germany during the Weimar Republic…coming down the street with wheelbarrows full of useless cash just to buy a few loaves of bread.

Glass is going up between 30% and 40% at the start of third quarter (in two weeks). This could devastate the building industry.

There doesn’t seem like a good alternative.

I’m sitting in mostly cash right now. The inflation numbers (at least the cooked numbers they are reporting) show me losing about 9% over the next year. Even if real inflation is twice that, it still seems like a better option.

The S&P is down 20% since January. NASDAAQ even worse. Then individual “solid” equities like APPL, AMZN, Ford, etc. are now 30%-60%.

And real estate very much looks like a bubble about to pop as well.

Whats left? NFTs?

“This is the most prosperous economy the world has ever seen. It’s going to be a very prosperous economy for the next 100 years.”

“Therefore, I am voting for Joe Biden to f... er I mean louse it up.”

Jamie Dimon

Remember the famous Margaret Thatcher Quote, paraphrasing, the problem with socialism is eventually you run out of other people’s money.

Perhaps we’ve reached that point.

I agree with your cynicism on that cash thing.

How about this one: “reduce exposure to commodities”; huh? what?

The solution is oil.

I always loved the joke in your scenario where the mother, on her way to market, with the wheelbarrow of cash gets robbed. The crook dumps the money and runs off with the wheelbarrow.

Lol! On the serious side, I think we’re in Weimar Republic territory here.

Yes. We all know that commodities get less expensive during inflationary periods. Gas prices go down, lumber goes down, pork bellies go down, it all goes down.

Once again: we deserve to be cynical on these humpty-dumpties. How can we out here in blogville know this stuff, but the experts are in foul territory?

Because the experts sit inside the swamp and are on the receiving end of the huge ever inflating moneyball that rewards folks who are in on the game and don't actually do anything that looks like productivity.

At the top end its running hedge funds to buy cheap and sell at inflated prices using the FED supplied liquidity as capital. At the mid level its having a high level gubmint job writing masking protocols and rules for proving how many faux vaxxes you have had. At the bottom level its being an illegally invited immigrant who is promised lots of free stuff.

And being in on this game means being clever. It doesn't mean you are smart because if you were you would have had an exit strategy. And it means you may have a woke compass but you sure don't have a moral compass.

And we got there through hard and persistent work.

Fed’s gonna raise interest rates bigly today.

Paraphrasing (Shane to Joey re: quick-draw techniques): your take on the matter “is as good as any, better than most”.

Wait a minute.

What about my inflation check from the government.

The fix for inflation. Print more money and hand it out to people to relieve the effects of inflation caused by printing more money.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.