Posted on 06/06/2022 1:09:28 PM PDT by blam

U.S. natural gas fundamentals remain bullish as above-normal temperatures drive cooling demand and dwindling supplies that would’ve been used for the next winter season cause market tightness, sending futures for July delivery soaring 9.5% to $9.340/mmbtu as of 1315 ET.

Houston-based energy firm Criterion Research sheds more color on the natgas fundamentals driving prices higher. They report a combination of factors, including above-average temperatures in the Lower U.S. 48, natgas demand, slumping natgas production, and below-average national stockpiles, which have driven July contracts above $9.

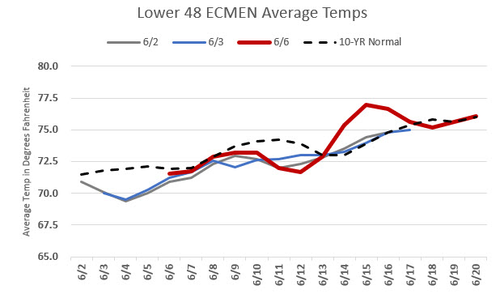

The Lower 48’s weather outlook has come in warmer this morning, with the latest models showing a warmer than average forecast for mid-June (versus the ten-year average.)

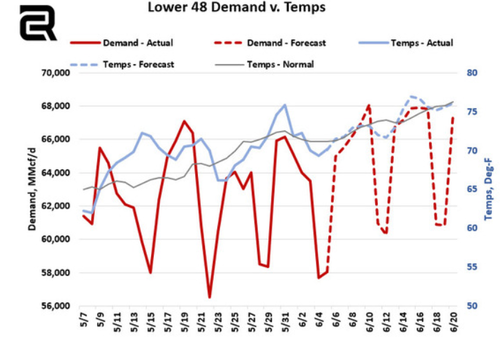

The week ending 6/17 should bring impressive natural gas demand numbers of 65.5 Bcf/d, marking the highest we’ve seen this summer.

,/A>

,/A>

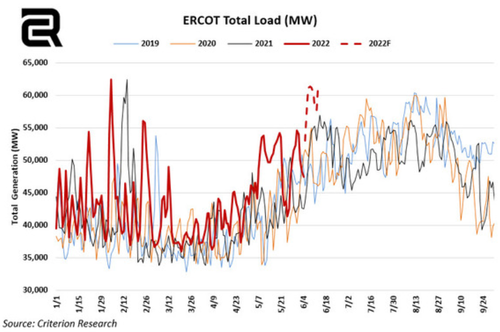

The warmer trend can especially be seen in states such as Texas, where ERCOT is forecasting record-high summer generation.

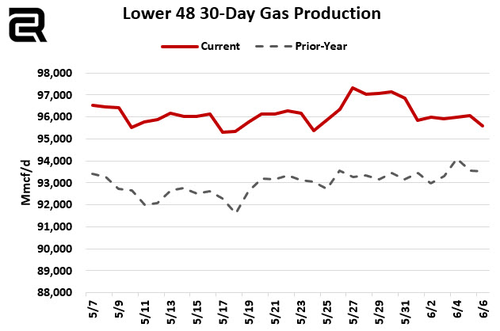

While the demand side of the equation comes in strong, U.S. natural gas production has been struggling since the start of June. Volumes quickly fell after June 1 and have remained off of the May highs.

Although general production growth is widely expected through year-end by most energy analyses, the speed at which that production comes online is the main concern. Higher production rates will be needed to fill national storage inventories before the winter, especially if summer temperatures continue to come in above-average.

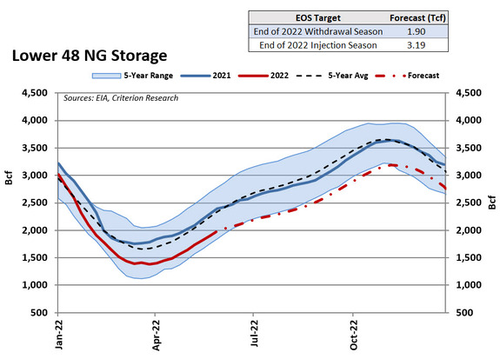

At Criterion, the latest iteration of our long-term supply & demand forecast, we have adjusted our Fall EOS target to a lower 3.19 Tcf, which marked a drop from the last forecast for a 3.25 Tcf level.

The current situation may remain uber bullish and could push natgas prices even higher as summer begins and driving season is underway, which puts upward pressure on energy markets.

Higher U.S. demand versus Europe has compressed the E.U.-U.S. natgas spread (1mo ahead vs. futs).

And in fact, US natgas futures are now trading at a premium to Day-Ahead EU NatGas prices.

Soaring natgas prices will only mean the cost of power will rise. We outlined the cities where power bills will skyrocket this summer as threats of rolling blackouts increase.

“Perfect Storm Of Factors Sends US Natural Gas Prices Soaring “

Perfect Storm Of Democrats’ economic plans Sends US Natural Gas Prices Soaring

There, fixed it

When they are hungry and cold

Aka when it’s to late.

They will blame Republicans. Just like they did when the grid failed before

And natural gas doesn’t truck or train as well as oil. Pipe is really the only way

Perfectly planned, never forget Pelosi’s crooked, evil laugh, “Open Biden.( aka Open sesame)”

85 cent move in /NG...that’s amazing. I think I recall some $1.07-$1.20 moves in 2014, but I could be mistaken. Nat gas typically moves 3-4-5-6-7 cents a day.

We are such frickin’ morons allowing this to happen. We shouldn’t be anywhere close to this.

Biden could end this in 15 mins if he wanted to.

+1

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.