Posted on 05/18/2022 2:06:30 PM PDT by blam

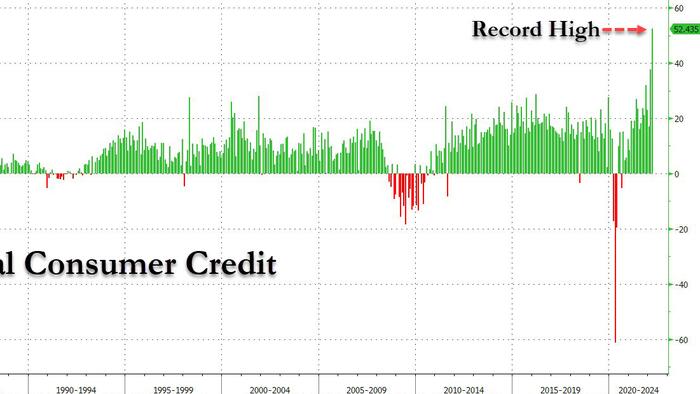

A little over a week ago, when looking at the latest consumer credit data from the Federal Reserve, we were shocked to learn that in March, credit card debt soared by a record $52.4 billion, the biggest monthly increase on record and more than double the expected change.

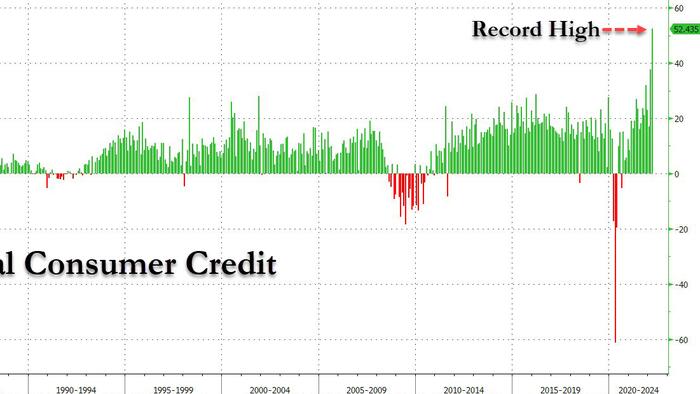

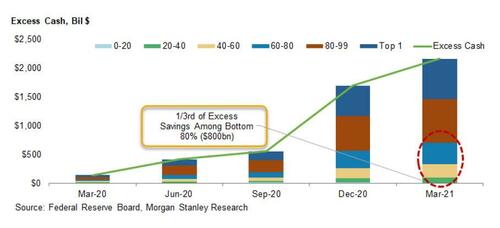

Summarizing our views on this historic surge in credit-fueled purchases, we said that “while this unprecedented rush to buy everything on credit at a time when there were no notable Hallmark holidays should not come as much of a surprise, after all we have repeatedly shown that for the middle class any “excess savings” are now gone, long gone…

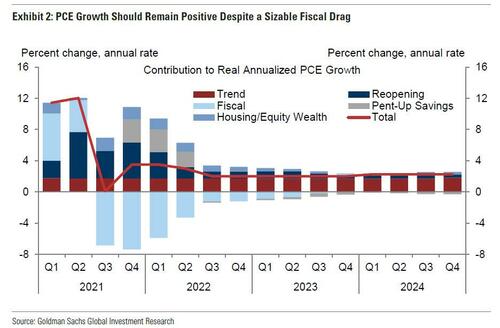

… the fact is that most economists – such as those at Goldman Sachs – had previously anticipated that continued spending of savings by consumers (who they fail to realize are now tapped out) is what will keep the US economy levitating in 2022. Unfortunately, as today’s consumer credit numbers clearly demonstrate, any savings that US middle class households may have stored away courtesy of stimmies, are long gone.”

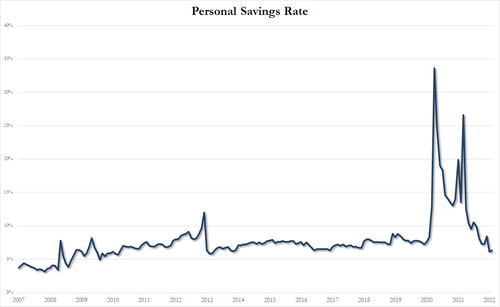

Hilarious, yesterday it was none other than the person who in late 2021 predicted – incorrectly – that “pent up savings” would provide a major boost to the US economy in Q1 and Q2 of 2022, much to our amusement and criticism (as we discussed here)…

… who admitted that US consumers, drowning in inflation, are “already relying on leverage to some extent to fund their spending.”

We are talking, of course, about Goldman chief economist Jan Hatzius, who no longer sees any “pent-up savings” offsetting either the fiscal or the hyperinflationary drag (unlike what he said in October) and instead speaking on Bloomberg TV, said that “borrowing is going to be a short-term driver of spending, and I think has been to some degree already.” Did the explosive growth in credit card borrowing tip him off?

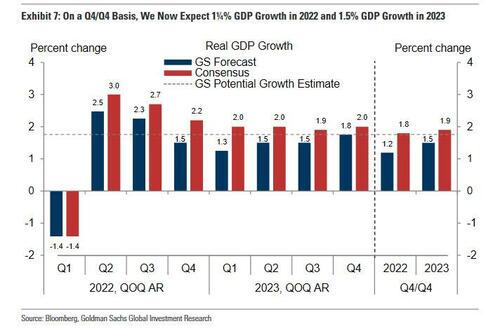

Sarcasm aside, Hatzius was at least was correct in saying that “consumer spending is going to be relatively slow. Income is going to be quite weak in 2022” which is also why the bank slashed its GDP forecast over the weekend and now see only a 1.25% gain in gross domestic product in the fourth quarter of 2022 compared with the same period of 2021.

Echoing verbatim what we have said since late 2021, Hatzius also said that not only is consumer credit on the rise, but there has been a pickup in mortgage-equity withdrawal where homeowners take out a loan against the appreciated equity in their property, and concluded that both dynamics are supporting spending. Well of course. The question is what happens when those credit cards are maxed out.

The Goldmanite’s remarks contrast with the view of some (idiot) economists who see bloated stockpiles of savings, thanks especially to government transfers during the pandemic, as a major pillar of support for consumer demand. Newsflash: as we have said since the summer of 2021, those “excess savings” are gone… all gone. In other words, take the whole “consumer is strong” narrative and shove it.

Which is a problem since Goldman (for now) is sticking with its call that the Federal Reserve will raise its benchmark rate to a 3%-to-3.25% range. “The risk case is that they have to do more and that then also raises the risk of a hard landing,” Hatzius said. Meantime, consumers’ reliance on leverage “supports spending in the short term but ultimately is not going to be a sustainable source of big increases in spending,” Hatzius said. “So it builds in a slowdown, sort of down the road.”

You mean, precisely what Zero Hedge said in October in counter to the cheerful optimistic econotakes by… Jan Hatzius last October. Yes, why yes indeed.

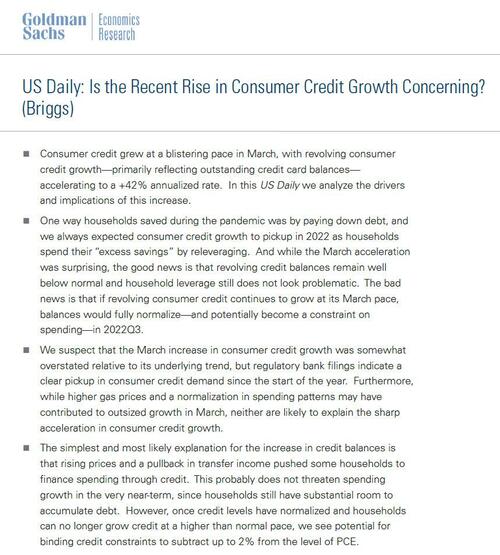

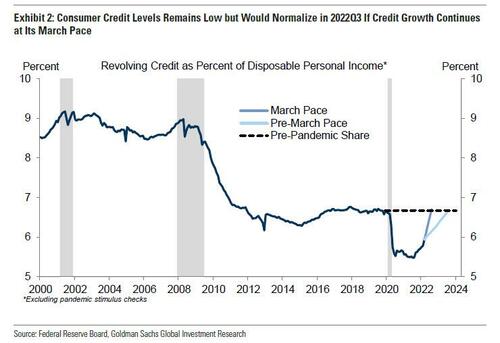

And yes, for those wondering, Goldman did actually publish a note a few days ago (available to professional subs), explaining why the surge in consumer credit is quite concerning…

… concluding that “once credit levels have normalized and households can no longer grow credit at a higher than normal pace, we see potential for binding credit constraints to subtract up to 2% from the level of PCE.”

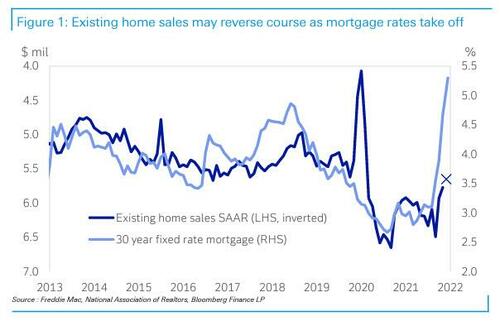

In conclusion, Hatzius said that the timing of a downturn in housing will determine the turning point, he said. While that’s not yet evident in the data, it’s bound to come given the surge in mortgage rates.

The implications, as we correctly said two weeks ago, are profound: any model that projected that US spending will be fueled by “savings” can now be trashed. And since this is most of them, the consequences are dire as they confirm – once again – that the Fed is tapering, QTing and hiking right into a consumer-driven recession which was not visible until new precisely because of all the credit-card fueled spending, which according to Deutsche Bank will begin in late 2023 and which according to Morgan Stanley can start in as little as 5 months. Today’s data suggests that Morgan Stanley is right.

Especially with rising interest rates.

— Ronald Reagan, 28 October 1980

I’m trying to do the opposite.

Pay the darn thing off.

The American people are fast approaching a come to Jesus meeting...

That’s perfect.

Ok seeing as the 40 billion going over to Ukraine (LOL) is in the works kick 20 of it to the CC companies and consider it another stimulus! As Hillary once said “at this point what difference does it make?” The God forsaken thieves in Washington and entrenched in the executive branch agencies are doing the devils work and the shine will fade. I have no room in my heart for those that subvert America for their own gain, do or say what you will there is no better place to live than our lower 48. Thank you lord God for your blessings and protection. Please God carry this nation as you had carried me for so many years until my surrender...Thank you Jesus.

About the same time food prices will really hit and who knows how high fuel prices will be by then.

I am surprised these economists are surprised. During runaway inflation, of course the consumer would used credit to accelerate purchases to avoid perceived higher prices down the line.

Of course patient people will wait for the price to inevitably plunge, then buy. Those who owe on assets which are now worth considerably less will complain and look for relief.

Just try to wrap your head around how much utter catastrophe started almost exactly on January 20, 2021. Frankly, I cannot think of anything that hasn’t turned to complete chaos and destruction. It’s actually difficult to fathom. I mean everything has gone down the flusher.

“Please God carry this nation as you had carried me for so many years until my surrender...Thank you Jesus.”

Amen!

This is sorta how I envisioned the way to fight in the on coming Civil War. Get as many Credit Cards as possible and buy long term necessities with them At the same time using cash to to buy gold. Then stop making your payments. Then watch the Woke system scream.

While credit card companies are billion dollar concerns, they is no way for them to cover cardholders debt, so they must issue bonds to raise money to do so.

And this is their big vulnerability. If investors do not buy up their bond issue, the credit card companies are in trouble. A single issue failure is not critical, and has happened several times before, but if three issues in a row fail, the credit card company is in danger of failing.

After the first or second issue failure, the credit card company will *cancel* cards that are unprofitable to them.

These are not just unused cards, but cards that are paid off every month. And cancellation are not individual, but are done in blocks of cards. And the companies do not share what cardholders are in which blocks.

So if there is an economic downturn strong enough to cause the credit card companies bond issues to fail, you might be unable to purchase on credit anymore, with little or no warning.

Such a downturn might include a banking collapse. So then what would you do?

Not to worry, vrbo is doing great business here. It used to be summer vacation began at the end of the school year but this year it began a month ago. The average night’s stay around here is $1000 and tack on cleaning fees, pet fees, boat rentals, etc.

Just charge it! The government will take care of these fools when they have no money for food.

With the merger of corporatists, fascists and the deep-staters, you can expect debtor's prisons to come back into vogue.

Use the cash I have stashed away. And then, if necessary, begin using the junk silver I have. Then the gold. Then go to barter. I'm just one person with no debts or bills.

I have a store charge 2% at the register today for using a credit card. This was a first. Yeah, we all know it’s usually a hidden fee. Ticked me off they didn’t tell me this when I called and they knew I was coming in for a part.

If you don’t use your cards, the card company will cancel your account so you need to use the occasionally and keep them paid off. A catch 22.

I suggest a rapid development of a local ‘scrip’ system.

https://en.wikipedia.org/wiki/Scrip

It first came about in a big way during the Great Depression, and made life a lot easier for those who were part of the system. Think of it as “barter plus”.

It is legal.

You need a person of trust who acts as an issuing authority, and some way to assure authenticity of the scrip, like a data matrix bar code.

https://en.wikipedia.org/wiki/Data_Matrix

The more businesses and people using the scrip, the stronger it is. It can also be used in tandem with coin and currency.

I put everything on my credit card from my car insurance, cell phone, Xfinity bill, grocery store; even a $.59 soda at Costco.

I also pay it off every month; not just the statement balance, but the entire balance.

I’ll get $100 in cash once in a while, and it will last me at least 3 months.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.