Posted on 05/12/2022 11:58:26 AM PDT by blam

Americans are feeling the pinch of inflation. Wages are up but consumers are worse off. Average hourly earnings have risen by 5.5% over the last year. But factoring in rising costs, real earnings are down 2.6%. So, how are Americans making ends meet?

They’re charging it.

Consumer debt continues to climb at a staggering rate.

Total consumer debt rose by $52.4 billion in March, a 14% increase according to the latest data released by the Federal Reserve. Outstanding consumer debt now stands at $4.54 trillion.

The Federal Reserve consumer debt figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt. When you include mortgages, US consumers are buried under more than $15.8 trillion in debt.

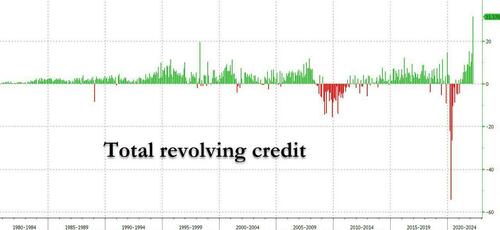

With stimulus money long gone and savings depleted, Americans have clearly turned to credit cards to keep up with rapidly rising prices. Revolving credit, primarily reflecting credit card debt, rose by 35.3% in March. American consumers added $31.4 billion to their credit card bills in a single month. US credit card debt now stands at just under $1.1 trillion and is fast approaching all-time highs.

Not only are credit card balances growing; consumers are trying to find ways to borrow even more. According to Fed data, Americans opened 229 million new credit card accounts in the first quarter. That was higher than prepandemic levels.

With interest rates rising, Americans will soon be paying more in interest charges every month, and many will see minimum payments rise. Average annual percentage rates (APR) currently stand at just over 16%. Analysts say they may well rise above 18% by the end of the year, breaking the record high of 17.87% set in April 2019.

Non-revolving credit including student loans and auto loans also continues to rise steadily. It jumped by $21 billion, a 7.4% year-on-year increase. Americans now owe $3.44 trillion in non-revolving debt.

Americans, by and large, kept their credit cards in their wallets and paid down balances at the height of the pandemic in 2020. This is typical consumer behavior during an economic downturn. Credit card balances were over $1 trillion when the pandemic began. They fell below that level in 2020. We saw small upticks in credit card balances in February and March of last year as the recovery began, with a sharp drop in April as another round of stimulus checks rolled out. But Americans started borrowing in earnest again in May. Since then, we’ve seen a steady increase in consumer debt culminating in March’s decades-high surge.

Officials at the Federal Reserve insist they will be able to raise interest rates and tighten monetary policy because the economy is strong (despite a big contraction in GDP during the first quarter). But the rising levels of debt seem to indicate that apparent economic strength is a smokescreen. Running up credit cards is not a sustainable economic model. Americans can make ends meet by borrowing on plastic for a while, but credit cards have limits. And rising interest rate will push balances toward those limits even faster.

In a nutshell, the Federal Reserve and the US government have built a post-pandemic “economic recovery” on stimulus and debt. It is predicated on consumers spending stimulus money borrowed and handed out by the federal government or running up their own credit cards.

The stimulus is gone. Savings are running out.

Very similar.

Paying down debt, buying necessities for the long-haul, and food stocking.

What I do not understand is how they say the economy good, when people are resorting to credit to survive.

When this crashes, and it is going to crash in waves like a tsunami, it is going to be unlike anything we have seen in our lifetimes.

We do not need ‘techies’ in the Oval Office. WE need business people who know how to produce and what it takes to get an organization to the top.

All this culture BS, is nothing but distraction, from reality.

It is a Visa Credit Card. It is not a debit card.

Money is a tool.

If you know how to use the tool, you come out ahead.

There are exceptions to this rule.

I recently dumped amex.

I sent my electronic transfer over early every month.

I got a late payment notice and charge.

When I called, they said it took them 5 days to process, so even though I paid early, it was posted late.

I asked them how I was responsible for their internal problems.

The guy just said that I owed it.

Dropped them right then and there.

I re read your post.

Sorry

Thanks.

I make ends meet by stealing from people poorer than me.

My tax dollars subsidize their lifestyle so anything they have belongs to me first.

We’re doing the same. We have plenty of dry goods (beans, rice, etc) socked away. We’re building up the canned goods now. All it takes is buying a few extra cans of soup on each shopping trip.

Thanks for your concern.

Years ago, one of our not too bright younger relatives learned the hard way via a bank debit card.

We might consider putting our 2 debit cards into our gun safe and just writing a check for a couple of hundred $’s and cashing them in at our bank. Again, with the Covid stuff the 2 other branches have been closed, and the ATM at the bank is on a side road and exposes you.

A Wharton grad relative is pushing getting cash back with a $50-$100-? cash limit at the grocery store or whatever, when we use a credit card. She says that it is safer and less costly for the stores versus armored car pickup. She also, say that after this economic downswing is over, more and more stores will not accept checks at first and then no cash.

Thanks again for your concern.

Dave

Americans are doing exactly what they are damming their gvt for: spending money they don’t have. Foolish as hell. We really need to get our heads on straight.

The info provided by joe fonebone is partially incorrect. Years ago, debit cards offered no protections against fraud. However, that has changed.

I recommend doing a web search on "debit card liability for fraudulent charges". The following information is copied from an on-line article:

"If you report a missing debit card before any unauthorized transactions are made, you aren’t responsible for any unauthorized transactions. If you report a card loss within two business days after you learn of the loss, your maximum liability for unauthorized transactions is $50.

If you report the card loss after two business days but within 60 calendar days of the date your statement showing an unauthorized transaction was mailed, your liability can jump to $500. Finally, if you report the card loss more than 60 calendar days after your statement showing unauthorized transactions was sent, you could be liable for all charges. This includes money taken from accounts linked to your debit account.

What if you notice an unauthorized debit card transaction on your statement, but your card is still in your possession? You have 60 calendar days after the statement showing the unauthorized transaction is sent to report it and avoid liability."

Personally, I only use my debit card for ATM withdrawals. I would never use a debit card for on-line purchases.

joe fonebone has a "No debit card" policy. I respect his position and would never criticize anyone that refused to use a debit card.

Not to be argumentative, but wouldn’t the $50-$100 cash back at the store charged on your CC incur the high interest rate of a cash advance?

Thanks for taking your time to explain this issue.

Thanks

“Not to be argumentative, but wouldn’t the $50-$100 cash back at the store charged on your CC incur the high interest rate of a cash advance?”

I don’t know,and it may vary from state to state.

For some reason, I seem to remember clerks asking if we wanted cash back on a credit card purchase. We never did that, and you are probably correct.

“For some reason, I seem to remember clerks asking if we wanted cash back on a credit card purchase”

Perhaps I’m just cynical (I hear that comes with age) but in retail, everyone is out for the “up sale”. Could even be some sort of reward for the clerk involved for all we know. Remember, CC cash advances start charging interest from the day they are tendered...not at the billing cycle due date.

“Personally, I only use my debit card for ATM withdrawals. I would never use a debit card for on-line purchases.”

We are in the same boat here.

Why use it to purchase items when you can use a credit card and the float to the next billing cycle and points.

We may just keep them in our gun safe and use them whenever we do rarely need cash.

I believe that is an excellent idea.

Whenever you go to the ATM, you could get "extra" cash, up to your daily limit. Then put the unused cash in your gun safe. Next time you need cash, grab it from the gun safe and skip the trip to the ATM.

I like to keep about $1000 in my gun safe. Whenever the amount drops below $500, I go to the ATM and replenish my cash supply.

Why use it (debit cards) to purchase items when you can use a credit card and the float to the next billing cycle and points.

Agree!!!

“Whenever you go to the ATM, you could get “extra” cash, up to your daily limit. Then put the unused cash in your gun safe. Next time you need cash, grab it from the gun safe and skip the trip to the ATM.

I like to keep about $1000 in my gun safe. Whenever the amount drops below $500, I go to the ATM and replenish my cash supply.”

We used to do that during the Clintoon Crime years.

Your suggestion may be timely again.

Thanks!

GMTA and You are welcome.

We have zero problems doing what you posted!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.