Posted on 05/12/2022 11:58:26 AM PDT by blam

Americans are feeling the pinch of inflation. Wages are up but consumers are worse off. Average hourly earnings have risen by 5.5% over the last year. But factoring in rising costs, real earnings are down 2.6%. So, how are Americans making ends meet?

They’re charging it.

Consumer debt continues to climb at a staggering rate.

Total consumer debt rose by $52.4 billion in March, a 14% increase according to the latest data released by the Federal Reserve. Outstanding consumer debt now stands at $4.54 trillion.

The Federal Reserve consumer debt figures include credit card debt, student loans and auto loans, but do not factor in mortgage debt. When you include mortgages, US consumers are buried under more than $15.8 trillion in debt.

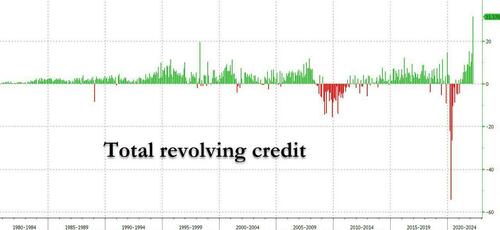

With stimulus money long gone and savings depleted, Americans have clearly turned to credit cards to keep up with rapidly rising prices. Revolving credit, primarily reflecting credit card debt, rose by 35.3% in March. American consumers added $31.4 billion to their credit card bills in a single month. US credit card debt now stands at just under $1.1 trillion and is fast approaching all-time highs.

Not only are credit card balances growing; consumers are trying to find ways to borrow even more. According to Fed data, Americans opened 229 million new credit card accounts in the first quarter. That was higher than prepandemic levels.

With interest rates rising, Americans will soon be paying more in interest charges every month, and many will see minimum payments rise. Average annual percentage rates (APR) currently stand at just over 16%. Analysts say they may well rise above 18% by the end of the year, breaking the record high of 17.87% set in April 2019.

Non-revolving credit including student loans and auto loans also continues to rise steadily. It jumped by $21 billion, a 7.4% year-on-year increase. Americans now owe $3.44 trillion in non-revolving debt.

Americans, by and large, kept their credit cards in their wallets and paid down balances at the height of the pandemic in 2020. This is typical consumer behavior during an economic downturn. Credit card balances were over $1 trillion when the pandemic began. They fell below that level in 2020. We saw small upticks in credit card balances in February and March of last year as the recovery began, with a sharp drop in April as another round of stimulus checks rolled out. But Americans started borrowing in earnest again in May. Since then, we’ve seen a steady increase in consumer debt culminating in March’s decades-high surge.

Officials at the Federal Reserve insist they will be able to raise interest rates and tighten monetary policy because the economy is strong (despite a big contraction in GDP during the first quarter). But the rising levels of debt seem to indicate that apparent economic strength is a smokescreen. Running up credit cards is not a sustainable economic model. Americans can make ends meet by borrowing on plastic for a while, but credit cards have limits. And rising interest rate will push balances toward those limits even faster.

In a nutshell, the Federal Reserve and the US government have built a post-pandemic “economic recovery” on stimulus and debt. It is predicated on consumers spending stimulus money borrowed and handed out by the federal government or running up their own credit cards.

The stimulus is gone. Savings are running out.

Plastic is delicious. With some melted butter on the side - yummy!

We are doing just the reverse. We are curtailing the use of our credit card, paying cash most of the time now. Stocking up on non perishable goods, building up our firewood supply.

Same here. Paying off debts and stockpiling meat in the freezer.

The cash back cards are great as long as the balance is paid in full every month, prior to the payment due date. Otherwise, smart folks pay with cash or debit card.

I am the opposite of you.

I use plastic exclusively, rarely pay or carry cash.

I have a stash of cash at home, just in case, but I have used credit cards for most of my adult life.

The cards get paid off every month, meaning that I incurr no interest charges, plus I get a discount on everything I buy, in the form of cash back or rewards.

Why would you use your own cash or debit card, when if properly done, you can use someone else’s, and get paid to do it?

Paying down here too. I do order stuff from AMZ, have their Prime Chase card, which gives me a discount. Never more than $100 on that card, pay it off every month. AMZ has a lot of food. King Oscar sardines from Norway are xlnt protein source. Use Visa for everything else, have a very low balance there, pay far more than I owe every month. Could pay it all, but keep it under $500. They keep offering me better terms.

Bought cans and cans of organic beans, a really good protein source, and some canned veggies too (though kinda yuk, far prefer fresh). Fred Meyer/Kroger has excellent organic soup and broth in cartons and nice coconut milk in cartons too. Have lots of those, buying more tomorrow.

I live in a second floor apartment, woman downstairs keeps me warm. My electric bill last month was $40. And I love hot weather, don’t turn on AC til it’s 96. Boy, am I a cheap date.:)

Veto!

(The girl)

Credit cards paid off every month, my ex-wife did teach me that, it was a good lesson. Have not had a balance going forward in 20 years.

Cancel your subscriptions, drop your cell phones, eat at home for a while. You’ll get by. Probably reduce monthly costs by anywhere from $200-500/month doing the first 2. Add the 3rd and you can bump it up to $700. Most Americans have no idea what being poor is.

That me, my routine.

Credit card loan forgiveness would make a heck of a Democrat vote getter. I’ll send Nanzi and Chuckie an email.

Even before the Covid1984 panic checked in, more and more stores either stopped accepting checks first and then even cash.

My wife has been basically a cash only person since she was graduated from Nursing school, decades ago. (She is 82 now).

Walmart and some of her shopping for non groceries went to credit cards or cash and no checks. She didn’t want to carry a couple of hundred in cash for groceries or whatever. So she was moving to credit cards. She liked the shopping on line for Walmart, Costco and other big stores.

The Covid1984 panic closed 2 of the 3 bank branches, that we used in a quick manner. So suddenly, there were long lines of unhappy cash only people inside our bank or outside at the ATM for the Cash people like her.

One trip took over 20 minutes to get her monthly cash due to all the people in one line. I said not for me any more. So, she went to her bank Visa card, and its payment is automatically deducted and paid for by the bank via our checking acct..

She is recovering from hip replacement surgery and has a $10 co~payment for each visit. So she gives the clinic checkin person a $20 bill and gets back 2 fives. Some of the clerks will let her trade several $20’s into 5’s. She likes $5’s for tips.

95%+ of my purchases are via a credit card.

We have never been late on paying any bill and our credit rating is in the mid 800’s.

I retired in Dec 2018, cut EVERY card in half paid off every ounce of debt including mortgage I buy NOTHING anymore unless I can pay cash!! I was doing great until Biden, I had to take a part time job, I honestly can’t believe how damned expensive EVERYTHING has become it is ridiculous I don’t know how people with kids, mortgage, or rent are surviving today!!!

During Trump’s presidency, we started prepping for hard times. Went full on Dave Ramsey. Pay cash or don’t buy.

My kids are grown and gone and everything is paid for. House and cars. I am still driving a beater, but it still runs and gets me to South Texas and back.

Plastic must be delicious! something has been gnawing away at the water meter cover made of plastic.

The credit card companies call folks like us deadbeats. Ha!

Let’s go Brandon and his Dem Party.

Walmart has a rewards credit card with 5% cash back for Walmart online purchases, 2% cash back for purchases inside Walmart, at restaurants and on travel, and 1% cash back on everything else.

You, like me, are able to spend with your brain rather than your emotions. I also have one checking acct. set up strictly to pay my CC bills on time, automatically every month to make sure I never miss a payment...no usurious interest and 1.5% or 5% discount on EVERYTHING I purchase.

No No No!!!!

A debit card is the worst financial tool out there...

If someone gets ahold of your number and pin, they can drain your account, and the bank is under no legal or moral responsibility to investigate or return your money.

They might do you a favor and half heartedly investigate, but you are SOL.

Just say no

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.