Posted on 04/17/2022 9:22:50 AM PDT by blam

For his entire life, Roy Walters managed bars and restaurants: upscale Italian eateries, dive bars and even strip clubs. Then, in March 2020, the pandemic shuttered his livelihood.

A truck driver buddy suggested that the newly unemployed Walters join him in the industry. So Walters drove an 18-wheeler around the country, seeing places like Seattle and the Grand Canyon, before he decided to own his own fleet. Today, the Clearwater, Florida, resident operates seven trucks.

Walters mostly stays at home, but sometimes he gets behind the wheel again. “For me, it’s almost like a vacation, except I get paid,” he said.

One trucking fleet owner said, “The way the rates are, you have to run twice as hard to make ends meet.”

The trucking business has been burgeoning since he got into it. The pandemic sparked historic demand for durable goods, which is the kind of stuff Walters and his employees haul in their dry vans. But a maelstrom of inflation, rising diesel prices and overcapacity in the trucking market is sparking a sudden tumble of freight rates. “It’s been a struggle,” Walters said. “That’s for sure.”

The indicators are worrisome

Demand for freight has undeniably slowed. And, at FreightWaves, we believe a recession in trucking might be next.

Wednesday, the much-adored Cass Transportation Index Report declared that the freight market is in a slowdown, though the index’s experts said it’s too soon to declare a recession. Banks like Cowen and Bank of America have recently downgraded trucking stocks in their own notes to investors.

Dry van rates have tanked by 37% from Dec. 31, according to an April 8 transportation note by Bank of America analyst Ken Hoexter. Those rates are on the spot market – where loads are picked up on demand, rather than through a contract. The spot market is just a fraction of the trucking world, but spot numbers point to where contract rates will go.

Another indicator of a downturn is the drop in contracted loads rejected by carriers. Contrary to the, um, idea of a contract, truckers can reject loads they previously agreed to carry. Usually, they reject a contract load if they can get a better job on the spot market. Analysts follow the outbound tender reject index to see if the trucking market is hot or not.

Compared to last year, the market is decidedly not. Only 11% of loads are getting rejected right now, way down from 25% at this time last year.

(FreightWaves SONAR)

Through the end of 2020 and throughout 2021, trucking was “white-hot,” said Amit Mehrotra, managing director of transportation and shipping research at Deutsche Bank. As Avery Vise of FTR Transportation Intelligence told The Wall Street Journal on Wednesday, trucking companies could expect to simply “print money” amid this market.

Now, truck drivers who have entered this industry in recent months are scrambling to stay profitable – and some have already stopped driving.

What happened?

Demand for random crap softening amid influx of driving capacity

If your high school economics education was as prestigious as mine, you know that high supply or low demand leads to decreased prices. Right now, there’s both an increase of supply (truck drivers) and decrease of demand (loads for drivers to move).

The supply of truckers is way up. Thousands of new fleets are registered each month in the U.S., and it’s reached a fever pitch in recent months. In February alone, a record 20,166 trucking companies entered the market. (Keep in mind, the typical trucking company is very small; 89% have one to five trucks.)

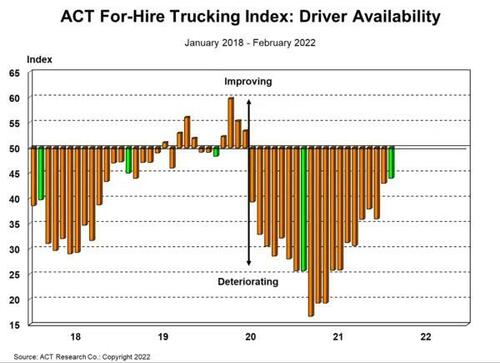

The labor market for truckers was unusually tight through the end of 2020 and throughout 2021 , but an ACT Research survey of trucking companies shows that driver availability has been improving. Mehrotra told me workers have finally depleted the savings they built up during the pandemic and are returning to work.

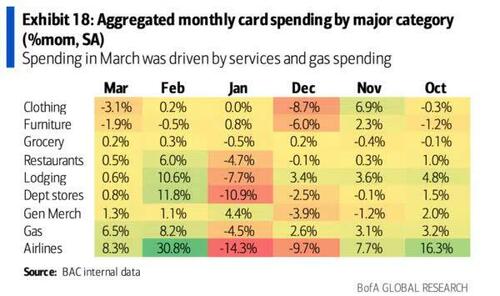

Meanwhile, demand for truckers has softened. Consumers are slashing their spending – particularly when it comes to buying more and more stuff. Core retail sales fell by 1.2% in February, the most recent number available from the feds. Those sales will likely continue to soften. In response to historic inflation, 84% of Americans surveyed by Bloomberg News said they would cut back spending. Some have already been forced to cut back, according to a CNBC poll.

And those who are still spending are increasingly going to restaurants and concerts instead of, say, buying lots of stuff from Amazon. The latter requires far more truck drivers than the former.

There are lots of truck drivers who entered the industry when our only hobby was online shopping. But, amid inflationary pressures and a society that’s mostly reopened, consumers are buying less of those durable goods. It’s an overlap of the Venn diagram that might result in a lot of new fleets being flushed right back out of the market.

I’ll let Walters explain:

“With rates being so high, everyone and their uncle bought a truck. I wish that it had a little more stability for the drivers and the small carriers. With more trucks on the market, the shippers and brokers can kind of dictate the price – because somebody is going to take the freight.”

Return of the bloodbath?

This normalization in trucking shouldn’t come as a surprise, Mehrotra said. “It’s totally reasonable to assume the white-hot demand environment we’ve been in the past two years is going to moderate,” he told me.

Still, the plummeting freight rates are stressing out the many, many new truck drivers who started their own fleets or entered this industry in the past two years. Their experience of running a trucking business has been in an unusually favorable market. Some might not have previous experience running a business. So the plummeting rates, coupled with the spike in diesel, are a slap in the face.

It’s all reminiscent of the 2019 trucking bloodbath (which I wrote about quite a bit at my old gig at Business Insider). In 2018, trucking was booming. Drivers were receiving record-high raises amid a capacity shortage that year. Many joined the industry. Unfortunately, demand for trucking services sank at the same time. That’s a very short explanation for why 1,100 trucking companies went out of business in one year.

Despite this history, some drivers aren’t worried. Travis Ludi, who is based outside of Oklahoma City, has been a truck driver for 10 years. He opened his own trucking authority just one and a half months ago. He said his realm of trucking – hauling grain for animal feed – is much steadier than the dry van world. (There is one downside to this recession-proof sector, however. Ludi also hauls the “left remnants” of kill plants to pet food factories, which he confirmed to me does not smell good!)

“A lot of companies or other owner-operators get in over their heads as the rates go up,” Ludi said. “They’re buying brand new trucks at higher prices due to inflation. Whenever rates go down to a normal level, they have to go out of business.”

Others are feeling more cautious. David Guzman in San Antonio has already parked some of his trucks.

Guzman bought three “dirt cheap” trucks from a liquidation company in early 2020. It turned out, those trucks were previously owned by Celadon, a company that pulled in $1 billion in revenue before filing for bankruptcy amid the 2019 trucking bloodbath.

When diesel started to spike this year, Guzman ran the numbers and realized he wouldn’t be able to run those trucks. He has a separate fleet that runs Amazon loads and has his equipment paid off, which is helping make ends meet. “I can’t imagine what folks that have payments on their equipment are going through right now,” he said. “The way the rates are, you have to run twice as hard to make ends meet. I can’t help but feel for my fellow truck drivers.”

In the meantime, it’s another bloodbath that these Celadon trucks might be sitting out.

My company buys freight - about 30 loads a week.

Prices certainly have not dropped for our lanes (we also sometimes need specialty tankers, which are not in big supply) - but it seems they have stopped rising so quickly.

[My company buys freight - about 30 loads a week.

Prices certainly have not dropped for our lanes (we also sometimes need specialty tankers, which are not in big supply) - but it seems they have stopped rising so quickly.]

Fuel surcharge rates have risen dramatically since Biden. My original fuel surcharge rate was less than 15% when diesel was $2.00/gal - now it’s 46%. I’ve got a propane transport, so it’s specialized. Glad I’m not in the regular freight business.

we use a mix of smaller carriers and local/regional agents. We face many constant changes from warehouse waiting times, to receiver unloading schedules, etc... and it seems the smaller guys are more willing / able to adjust.

How does this article square with the ones saying we are short 80,000 truck drivers?

P.S. If you are a Pooty or Vax Shill I’m declaring a temporary ceasefire fire so we can discuss this topic... lol

They have lowered from a month or so ago.

I personally believe this article is exaggerated. Yes, high freight prices have probably attracted some new drivers. The story of the former restaurant manager going from driver to owning seven rigs in 18 months seems exaggerated. That's a lot of money to invest in such a short time, plus he'll need to set up accounting and dispatch systems, even if small-scale. But supply overall will not expand that quickly, and the USA definitely needs more drivers.

I see two different trends at work - older truckers/baby boomers are definitely leaving the industry. Gen Z kids are not picking up the slack. On the other hand, we are seeing more and more immigrants driving trucks. It used to be Mexicans, but now it is particularly South Asians. chain migration and cousin-marriage will bring over a relative who has no skills, barely speaks English - what do they do? Drive a truck. These guys will literally live in their trucks for many weeks on end. They have to pay off whoever brought them into the USA too, but its still a better life than what they had in their Pakistani mountain village.

I follow a truck driver on YouTube. The market has nearly stopped for him. There just arent many loads moving. It tells me we are about too enter a huge recession. If goods aren’t moving commerce is stopping

Thank You for pointing this out. I was going to point out the same until you posted this and you must have read the same article yesterday I did....80,000 to the number short.

I don’t know what to make of articles like this. I’m older Gen X still trying to make a go of a career I chose long ago although if my current gig doesn’t work out I’m finally cashing in the chips and going for commercial drivers license or at least some kind of blue collar offering if such a thing hasn’t yet been offshored or had the worker “in-shored” from Serbia or New Dehli.

I thought I had heard that logistics were trying to figure out how to consolidate what would normally have been sent OTR truck onto trains. Trend being to get more trucks off the interstates and make a sizeable chunk of trucking mostly day trips to the extent possible.

For YEARS we’ve heard that the trucking industry couldn’t attract enough drivers… now truckers are going out of business for lack of work? Damn.

There was a period of time there when we couldn’t get outbound pickups for days. They would cancel day after day. And then the customers couldn’t get deliveries for even longer. Shipments would arrive at the local hub, but then sit for a week before it could get dropped off.

Currently, that problem has gone away and things are going fairly smoothly.

But I have tried to rent a trailer for storage and am being told there are none available near me. I can get a container but not one with wheels that a driver can move. I think there is a shortage of warehouse space. We as a country were backed up as we re-opened post Pandemic restrictions that caused the trucking shortage, but now demand is slowing and there is a lot of supply of goods. (as an aside, I know of at least 4 warehouses full of hand sanitizer they can’t give that stuff away right now).

Yes I agree, there is a recession coming very soon. Warehouses are overfull.

I know commercial rental rates are up 40% in my area since 2019. And last year you couldn’t get one unless you were way ahead (had a broker working for you and all your papers ready because you had to sign within days) but right now, rates are high but there is more availability.

It’s very strange. I’d divest from commercial REITS if I were in the market.

This article indicates demand for dry hauling is down due to inflation-reduced elective buying of items on Amazon & Walmart online. If this is the case, then diesel, while being more expensive, might not be in short supply in the near future.

Those trucks need to keep rolling. Kroger, Walmart & Publix don’t have farms, dairies, canneries and packaging facilities in the back of their stores!

Just another reason to say: FJB and all his filthy, vile, commie/globalist ilk.

why is Wal Mart looking for drivers and starting there own training program????

Pay increased to 110,000 per year

Georgia has been trying to do that with “inland ports”, the idea being to get trains from the Port of Savannah out to locations in the state that help avoid increasing truck traffic in Savannah and Atlanta. There’s one in place up towards Chattanooga, and another under construction up 985 towards Gainesville, GA, which can serve the huge warehouses and manufacturers in the I-85 corridor NE of Atlanta.

“I thought I had heard that logistics were trying to figure out how to consolidate what would normally have been sent OTR truck onto trains. “

But how does that square with the articles stating there is shortage of “train space” due to oil pipelines getting shut down or not aproved and that oil has to now go by train?

“Will the real story please stand up.”

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.