Posted on 03/06/2022 8:58:28 PM PST by blam

All hell is breaking loose in the Sunday evening session where S&P equity futures and Asian markets tumbled, while havens such as sovereign bonds and gold soared amid fears of an inflation shock in the world economy as oil soared on the prospect of a ban on Russian crude supplies.

Emini futures were down 1.6% as of 9:00pm ET, while Nasdaq 100 futures plunged 2% and European futures were down 3%.

Meanwhile, the stock MSCI Asia-Pac index was on course for a bear market — a drop of more than 20% from a February 2021 peak, while Hong Kong’s Hang Seng index plunged more than 5%…

… as Brent oil briefly hit $139 a barrel at the open when stops were hit, and West Texas Intermediate $130 a barrel, before trimming some of the rally…

… even as Jen Psaki earlier tweeted a humorous tweetstorm about how the US plans to achieve energy security in 9 “specific” steps:

When it comes to U.S. energy production – and how we achieve energy security – it’s important to look at the facts. So here are 9 specifics..

— Jen Psaki (@PressSec) March 6, 2022

The catalyst for the sharp move higher in oil was the earlier commentary from Secretary of State Antony Blinken who said the U.S. and its allies are looking at a coordinated embargo following Russia’s invasion of Ukraine, while ensuring appropriate global supply.

It is the latest spike in energy prices, which are now dangerously close to levels last seen in 2008 just before everything collapsed, that threaten to spark a global recession, something we have been warning about for months, and is a risk that is sending tremors across markets.

The risk carnage sent funds flowing into safe havens such as the swiss franc, which broke below parity with the euro for the first time since the SNB depegged back in January 2015, even though a governing board member of the Swiss National Bank said it’s ready to intervene to tackle rapid strengthening.

..

… while 10Y yields have tumbled back below 1.70%.

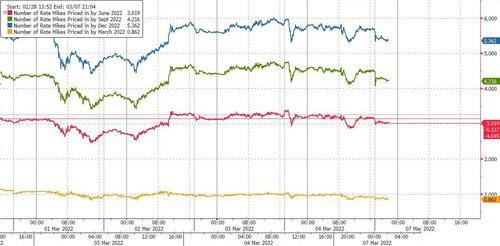

… sending odds of a March rate hike down to just 0.86%.

,/A>

,/A>

Having ignored it for long – despite our repeated warnings to the contrary – traders are finally realizing that stagflation is here: “for the U.S. economy, we now see stagflation, with persistently higher inflation and less economic growth than expected before the war,” Ed Yardeni, president of Yardeni Research, wrote in a note. “For stock investors, we think 2022 will continue to be one of this bull market’s toughest years.”

Making matters worse, there is absolutely nothing central banks can do to offset the commodity supply shock which as Zoltan Pozsar explained earlier today, threatens to spill overs into a “classic liquidity crisis.”

“Central banks are facing an exogenous stagflationary shock they cannot do much about,” Silvia Dall’Angelo, senior economist at Federated Hermes, wrote in a note.

And if comparisons to 2008 were not enough, markets now also have to freak out about the possibility of another Russian default which led to the 1998 collapse of LTCM.

As we discussed earlier, Russian president Vladimir Putin signed a decree allowing the government and companies to pay foreign creditors in rubles, seeking to stave off defaults while capital controls remain in place. Sanctions will determine if international investors are able to collect payments, the Finance Ministry said.

Meanwhile, as Bloomberg notes, fears about the war overshadowed China’s signal that more stimulus is on the cards after officials set an economic growth target that topped forecasts. Premier Li Keqiang vowed at the opening of the National People’s Congress to take bold steps to protect the economy as risks mount.

Finally, those wondering what happens next, may want to reread our Friday post “”A World At War” – Global Recession Next, And Then QE5“

Economic shakedown throught the economic systems world wide. But then they knew it would be so.

They have their fingers on levers they can push when they’re ready.

2008 repeat........and guess who will come to the rescue this time????

Oil is the most widely traded commodity in the world. Every aspect of our lives is tied directly or indirectly to the price of oil. Imagine if you will if inflation went up to 18% in a year. Economic devastation. Oil contributes to the price of everything. Everything. Food. Transportation. Every thing in every sector. If 18% in a year causes problems, imagine how everybody is freaking out when a major component of inflation, oil, goes up 18% in 30 seconds. I’ve never seen it. I’m not even sure if it has ever happened before. Probably it has, but it freaked out EVERYBODY on the trading platforms i am on.

We have to treat climate change like the existential threat it is. As president, I will:

- End subsidies for fossil fuel corporations

- Ban new drilling on federal lands & waters

- Hold oil executives accountable

- Rally the world to raise the commitments of the Paris Agreement

9:34 PM · Mar 15, 2020

Let's Go Brandon.

of course its fair. They did everything they could to cripple our domestic oil production. we were the worlds leading exporter of oil the day blubbering joe got elected. Now we spend 45 million a day to buy Russian oil. They should be blamed because it was predicted and they did it. Screw them all.

I’m buying 4 tickets to Europe next fall for a family wedding. I called American tonight to pay the $1100 each (SF to London to Barcelona and back to SF) and they wouldn’t sell me anything. Told me to call back tomorrow. Very ominous.

And check where it was canned.

I've been buying extra canned foods every trip to the store these past 3 months. In a few weeks I'm strategically relocating to rural TN, where I think I have the best chance of making it through the sh&t storm that is coming.

Jet fuel is such a huge component of ticket costs they probably want to make sure they are not selling you a money loser. SouthWest famously hedged all of their fuel costs in 2008 at something like the $67 barrel level when oil went to $140, so they could keep fares much lower than competitors. Maybe you can find an airline that did they same thing now.

over the last 3 trading days, gold has moved about 3%. nothing too crazy and well within norms.

WTG Brandon!

“Oil is the most widely traded commodity in the world. Every aspect of our lives is tied directly or indirectly to the price of oil. Imagine if you will if inflation went up to 18% in a year. Economic devastation. Oil contributes to the price of everything. Everything. Food. Transportation. Every thing in every sector. “

Most Americans are ignorant of the importance of oil. Oil effects everything. Declaring war on the industry and relinquishing the America’s “Swing Supplier” position was beyond stupid.

Church where it was canned is big! How the f are we importing canned fruit from China?

Mandarin oranges in a can are alll China except trader Joe. They ha BFF e them from Spain

Short it if u can

China touted today ‘rock solid’ ties with Russia .... offers to mediate Ukraine conflict.

We need a speech from Kamala!

“oil, goes up 18% in 30 seconds. I’ve never seen it. I’m not even sure if it has ever happened before. Probably it has, but it freaked out EVERYBODY on the trading platforms i am on.”

Try up about 100% in that same timeframe. A few days before the Gulf War air campaign started, James Baker went into negotiations with Saddam’s guy. Oil was trading about 40. The longer the talks went, the more the various markets reversed out from war leveks, thinking a settlement was at hand and they would give up Kuwait. Baker gets out, goes up to the microphone and says “Regressably...” POW! Oil shoots from 20 to 40.

I see oil futures going 7% from opening to the peak in about 2 minutes, 121 to 130. The open was at 121. It didnt trade from 115 to 121.

Good, the two criminal regimes can get a room together.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.