Posted on 03/06/2022 8:58:28 PM PST by blam

All hell is breaking loose in the Sunday evening session where S&P equity futures and Asian markets tumbled, while havens such as sovereign bonds and gold soared amid fears of an inflation shock in the world economy as oil soared on the prospect of a ban on Russian crude supplies.

Emini futures were down 1.6% as of 9:00pm ET, while Nasdaq 100 futures plunged 2% and European futures were down 3%.

Meanwhile, the stock MSCI Asia-Pac index was on course for a bear market — a drop of more than 20% from a February 2021 peak, while Hong Kong’s Hang Seng index plunged more than 5%…

… as Brent oil briefly hit $139 a barrel at the open when stops were hit, and West Texas Intermediate $130 a barrel, before trimming some of the rally…

… even as Jen Psaki earlier tweeted a humorous tweetstorm about how the US plans to achieve energy security in 9 “specific” steps:

When it comes to U.S. energy production – and how we achieve energy security – it’s important to look at the facts. So here are 9 specifics..

— Jen Psaki (@PressSec) March 6, 2022

The catalyst for the sharp move higher in oil was the earlier commentary from Secretary of State Antony Blinken who said the U.S. and its allies are looking at a coordinated embargo following Russia’s invasion of Ukraine, while ensuring appropriate global supply.

It is the latest spike in energy prices, which are now dangerously close to levels last seen in 2008 just before everything collapsed, that threaten to spark a global recession, something we have been warning about for months, and is a risk that is sending tremors across markets.

The risk carnage sent funds flowing into safe havens such as the swiss franc, which broke below parity with the euro for the first time since the SNB depegged back in January 2015, even though a governing board member of the Swiss National Bank said it’s ready to intervene to tackle rapid strengthening.

..

… while 10Y yields have tumbled back below 1.70%.

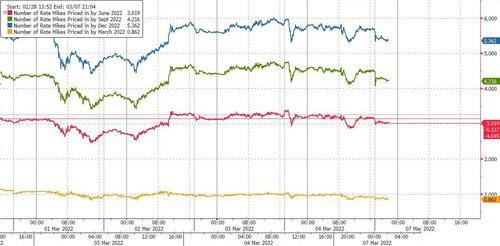

… sending odds of a March rate hike down to just 0.86%.

,/A>

,/A>

Having ignored it for long – despite our repeated warnings to the contrary – traders are finally realizing that stagflation is here: “for the U.S. economy, we now see stagflation, with persistently higher inflation and less economic growth than expected before the war,” Ed Yardeni, president of Yardeni Research, wrote in a note. “For stock investors, we think 2022 will continue to be one of this bull market’s toughest years.”

Making matters worse, there is absolutely nothing central banks can do to offset the commodity supply shock which as Zoltan Pozsar explained earlier today, threatens to spill overs into a “classic liquidity crisis.”

“Central banks are facing an exogenous stagflationary shock they cannot do much about,” Silvia Dall’Angelo, senior economist at Federated Hermes, wrote in a note.

And if comparisons to 2008 were not enough, markets now also have to freak out about the possibility of another Russian default which led to the 1998 collapse of LTCM.

As we discussed earlier, Russian president Vladimir Putin signed a decree allowing the government and companies to pay foreign creditors in rubles, seeking to stave off defaults while capital controls remain in place. Sanctions will determine if international investors are able to collect payments, the Finance Ministry said.

Meanwhile, as Bloomberg notes, fears about the war overshadowed China’s signal that more stimulus is on the cards after officials set an economic growth target that topped forecasts. Premier Li Keqiang vowed at the opening of the National People’s Congress to take bold steps to protect the economy as risks mount.

Finally, those wondering what happens next, may want to reread our Friday post “”A World At War” – Global Recession Next, And Then QE5“

Sunday night unleaded gas futures are up 28 cents from the Friday close. Fill up first thing Monday. Usually it take 2-3 days for these prices to make it out to retail.

Heating oil up 34 cents. Those who can get oil tanks filled do so instantly. Or if you you have enough to finish off the season, wait till summer/fall to fill.

So if Stock futures are down that means Dow will be up 700+ tomorrow

” China’s signal that more stimulus is on the cards after officials set an economic growth target that topped forecasts.”

In 2008-11, China printed an enormous amount of yuan and most of that money went into make work actity - GHOST CITIES. And why? Just to show phony GDP numbers. Looks like they are up to their old tricks again.

It will most likely finish up for the day. Big daily swings (over 1%) aren’t rare anymore. Besides, Brandon still has tons in his slush fund to throw around to his Wall Street cronies. I don’t see stocks tanking until the Fed cranks up interest rates a few times.

This will cause the real estate house of cards comes tumbling down again ala 2008. These banks are still giving loans away to people who won’t be able to pay adjustable rates when they skyrocket. My area of NJ is extremely overvalued and I expect a correction sometime in the near future.

What good is gold melted by a mushroom cloud

Anyone notice the price of corn over the last week? It ain’t good.

i am currently trading futures and across the board all the different oil futures spiked 15-20% in 30 seconds. It was unreal.

Once the wealthy and elites have squeezed the little investors it will.

not surprising

gas prices went up about $1 this last week

Oh goodie...

Futures were down -450 and now are at -255. What plunge?

Explain more why that is so odd and how that works. Thanks.

Just sayin'.

Good luck with that. The Dems are certainly going to get wiped out this Fall. I don’t know how they hang on. These sorts of events, regardless of who is at fault, will be blamed on who is in office at that time. It may not be fair, but it is what it is.

Simple, impeach Democrat, Fake POTUS, Joe Biden and the entire Democrat Party and send Biden Son, Hunter to jail...where he belongs!!!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.