Posted on 01/06/2022 9:19:02 AM PST by SeekAndFind

Home prices and rent are soaring faster than wages. This shattered home buying plans of generations Y and Z and put them in a rent squeeze as well.

Things have really changed in three years according to Yardi's latest Generational Survey on Homeownership Dreams.

Three years ago Yardi found that Gen Z was enthusiastic about the prospect of owning a home, whereas Millennials were pessimistic about their homeownership outlook.

Nearly two years into the COVID-19 pandemic and its economic and societal fallout Yardi has different findings.

Affordability concerns have noticeably risen in the past 3 years, with home prices unaffordable for 66% of renters.

1 in 5 adults living with family say they can’t afford rental costs while 56% of non-owners have nothing saved for down payment.

Gen Z’s expectations for homeownership tempered in last 3 years with increasing concerns around credit scores & job security.

Millennials are still behind homeownership, with 55% of them dissatisfied with their current home – the lowest of any generation.

Nearly 40% of Millennials & Gen Z postponed buying a home due to the pandemic.

Suburbia becomes top option for Gen Z and even formerly city-minded Millennials, while Gen X’s interest in rural living grows

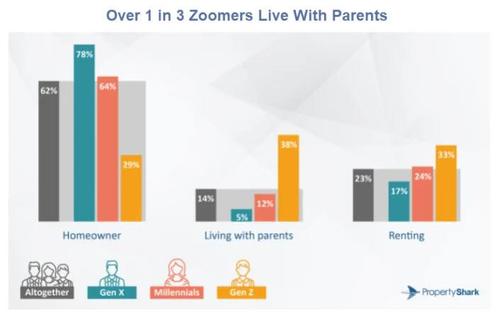

38% Live With Parents

33% Rent

29% are Homeowners

In the previous survey 83% of Zoomers expressed a desire and planned to buy a home within five years of 2018.

Only 29% of adult Zoomer respondents are now homeowners.

Millennials remain the most disgruntled generation, with respondents from this generation reporting the lowest levels of satisfaction with their homes (55%), as well as the highest levels of outright dissatisfaction (17%).

For Gen Xers, the home’s state of repairs is the most significant worry with one in five dissatisfied with it, while more than one in five Millennials and Gen Xers are unhappy with the size of their home.

26% of all respondents who were unhappy named the home being too small as the main factor. This was closely followed by insufficient space for work and insufficient space for recreational activities, while one in five named overcrowding as the main factor. Only 3% of our pool of respondents said that their home was too large.

Just over half (52%) reported no effects on their homeownership plans, while 41% of Millennials and 36% of Gen Z non-owners had to delay buying their own homes. Furthermore, 4% of all non-owners reported losing their homes due to COVID-19, with Millennials most affected at 5%.

With the eldest Gen Xers now 56 years old, elder Millennials looking at 41 this year, and the forefront of Gen Z hitting 27 in 2022, homeownership rates among respondents from the three generations stand at 78%, 64% and 29%, respectively.

So, what’s keeping 22% of Gen X, 36% of Millennials and 71% of adult Zoomers out of the housing market?

The main issue is affordability. Of all non-owners who participated in our survey, 53% view today’s housing market as just as inaccessible or even more inaccessible than in 2018, with Millennials most pessimistic. And, for those living with parents or other family members, the outlook is even more stark than it is for renters, with 59% of Millennials who live at home feeling that the prospect of homeownership is now even further removed.

No, but it sure didn't help either.

The real issue is wages have not kept up with prices making saving a nonpayment difficult if not impossible.

My charts show the problem.

Home prices have soared out of site. But rents are rising so fast that Zoomers and Millennials want out.

Home prices have seriously disconnected with rent.

But compounding the problem for Zoomers and Millennials, rent and OER (Owners' Equivalent Rent) have been rising way faster than the CPI and wages since 2013.

Earlier today I noted Real Hourly Wages Have Risen Less Than a Penny a Year Since 1973

In real (inflation-adjusted) terms, people are making no more than they did 48 years ago (yellow line).

Nominal wages have soared but have barely kept up with inflation, assuming of course you believe inflation is not understated.

My housing-adjusted CPI measure stands at 9.31%.

Try buying a house now on an additional half-penny per hour. It was actually possible factoring in a second wage earner per household until the year 1999 or so.

For details, please see Every Measure of Real Interest Rates Shows the Fed is Out of Control.

Meanwhile most Zoomers have to find a partner, live at home, or have roommates. I will see if I can get Yardi to conduct a survey on roommates.

* * *

bkmk

You’re right, never thought of that

Who in their right mind wants to live in a Blue city run my a Dem mayor and a Soros DA?

"Do I even need to say it?"

This guy Jimmy McMillan is a real hoot. I wonder where he is.... If he’ll give New Yorkers more freedom from the vaccine mandate, I’ll even take him over Kathy Hochul for governor.

I'll miss him when he's gone.

I won't miss his facial hair though.

I wish I could unsee his beard.

Anyone under the age of fifty has never experienced inflation. The generations of kids you speak of are not going to be able to deal with it.

These are the same little brats who ten years ago could be seen standing in the middle of an isle in Walmart screaming their heads off because “Mommy I want it NOW!!’’ are the little punks who are now burning down the Walmart after looting it.

There is the problem of property taxes.

Most home buyers today will pay more in property taxes than in mortgage payments over a 30-year mortgage term.

The solution is to do away with ad valorem taxation.

A $100,000 three-bedroom apartment should pay about the same school property tax as a $1.4 million six-bedroom house.

In your area there might be a sound rationale for limiting how many people can live there. But where I live in the Chicago metro there is none. The areas I speak of all have public utilities and with Lake Michigan providing the water, there is no shortage. But those who already have their slice of pie are all too happy to restrict the opportunity for the next generation. One of the funny things about real estate is that Elizabeth Warren of all people identified this problem a long time ago. She wrote a book called The Two-Income Trap: Why Middle-Class Mothers and Fathers Are Going Broke.

While I did not read that book, I found an hour long lecture by her about it. She noted that the share of household disposable income went down from 50% in 1970 to 25% in 2000. That alone is an astounding figure. And I wonder what it is now using 2020 data. The conclusion was that almost everything stayed the same price adjusted for inflation except two things. And those were taxes and housing. Housing she explained had largely gone up due to self segregation. And this segregation was based on moving into areas with “good schools.” I’m not sure I agree with that, but nonetheless taxes and higher housing were the main cause for the reduced share of income being disposable.

I'd take Pat Paulson, at least I think he loved his country.

“Stagnant wages are a choice.”

No, I’m sorry, but we are talking about aggregate economic measures here, not individual choices. Nobody’s individual choices are going to raise the entire economy out of stagnation, save for the few people who control the reins of the economy, and they aren’t budging from their foolishness.

“I make a measly 30k in a factory, and I have my own home with all the trimmings.”

Sounds like you live in an area where the cost of living is on the low end, no? So maybe your experience is not applicable to most.

2019

Southampton, NY

median household income $122K

median property value $1.23M

https://datausa.io/profile/geo/southampton-ny

There’s a lot of people who might be paying 20 to 30% of their income in property tax and many people that are paying over 50% of their income in property tax.

“They’re all afraid they can’t afford a rent payment or a mortgage payment, plus all the related other bills, because they are used to blowing all their earnings on frivolity.”

My wife walked out of vet school in the 80’s with 8000.00 of student debt. Her summer job at Hamilton Stamping each summer nearly paid all her schooling.

Vet students are now walking out with $200k and they work 2 jobs in the summer.

Us old folks had the gravy train while you will admit it or not. Young y and z’s are screwed.

“I make a measly 30k in a factory, and I have my own home with all the trimmings. Don’t tell me it can’t be done”

How old are you and when did you buy your house?

When even two incomes can’t afford a home, the only buyers will be families with three or more incomes.

https://www.realtor.com/realestateandhomes-search/Waukegan_IL

It’s just about seven miles from Lake Forest, Illinois.

I believe there’s METRA train service to Chicago.

Hard to save for a home when your yearly expenses include a $2000 IPhone, $5000 Alienware/Macbook pro, multiple Onlyfans subscriptions and a sex change operation!

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.