Posted on 01/06/2022 9:19:02 AM PST by SeekAndFind

Home prices and rent are soaring faster than wages. This shattered home buying plans of generations Y and Z and put them in a rent squeeze as well.

Things have really changed in three years according to Yardi's latest Generational Survey on Homeownership Dreams.

Three years ago Yardi found that Gen Z was enthusiastic about the prospect of owning a home, whereas Millennials were pessimistic about their homeownership outlook.

Nearly two years into the COVID-19 pandemic and its economic and societal fallout Yardi has different findings.

Affordability concerns have noticeably risen in the past 3 years, with home prices unaffordable for 66% of renters.

1 in 5 adults living with family say they can’t afford rental costs while 56% of non-owners have nothing saved for down payment.

Gen Z’s expectations for homeownership tempered in last 3 years with increasing concerns around credit scores & job security.

Millennials are still behind homeownership, with 55% of them dissatisfied with their current home – the lowest of any generation.

Nearly 40% of Millennials & Gen Z postponed buying a home due to the pandemic.

Suburbia becomes top option for Gen Z and even formerly city-minded Millennials, while Gen X’s interest in rural living grows

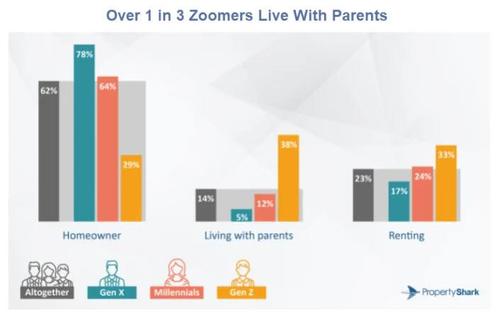

38% Live With Parents

33% Rent

29% are Homeowners

In the previous survey 83% of Zoomers expressed a desire and planned to buy a home within five years of 2018.

Only 29% of adult Zoomer respondents are now homeowners.

Millennials remain the most disgruntled generation, with respondents from this generation reporting the lowest levels of satisfaction with their homes (55%), as well as the highest levels of outright dissatisfaction (17%).

For Gen Xers, the home’s state of repairs is the most significant worry with one in five dissatisfied with it, while more than one in five Millennials and Gen Xers are unhappy with the size of their home.

26% of all respondents who were unhappy named the home being too small as the main factor. This was closely followed by insufficient space for work and insufficient space for recreational activities, while one in five named overcrowding as the main factor. Only 3% of our pool of respondents said that their home was too large.

Just over half (52%) reported no effects on their homeownership plans, while 41% of Millennials and 36% of Gen Z non-owners had to delay buying their own homes. Furthermore, 4% of all non-owners reported losing their homes due to COVID-19, with Millennials most affected at 5%.

With the eldest Gen Xers now 56 years old, elder Millennials looking at 41 this year, and the forefront of Gen Z hitting 27 in 2022, homeownership rates among respondents from the three generations stand at 78%, 64% and 29%, respectively.

So, what’s keeping 22% of Gen X, 36% of Millennials and 71% of adult Zoomers out of the housing market?

The main issue is affordability. Of all non-owners who participated in our survey, 53% view today’s housing market as just as inaccessible or even more inaccessible than in 2018, with Millennials most pessimistic. And, for those living with parents or other family members, the outlook is even more stark than it is for renters, with 59% of Millennials who live at home feeling that the prospect of homeownership is now even further removed.

No, but it sure didn't help either.

The real issue is wages have not kept up with prices making saving a nonpayment difficult if not impossible.

My charts show the problem.

Home prices have soared out of site. But rents are rising so fast that Zoomers and Millennials want out.

Home prices have seriously disconnected with rent.

But compounding the problem for Zoomers and Millennials, rent and OER (Owners' Equivalent Rent) have been rising way faster than the CPI and wages since 2013.

Earlier today I noted Real Hourly Wages Have Risen Less Than a Penny a Year Since 1973

In real (inflation-adjusted) terms, people are making no more than they did 48 years ago (yellow line).

Nominal wages have soared but have barely kept up with inflation, assuming of course you believe inflation is not understated.

My housing-adjusted CPI measure stands at 9.31%.

Try buying a house now on an additional half-penny per hour. It was actually possible factoring in a second wage earner per household until the year 1999 or so.

For details, please see Every Measure of Real Interest Rates Shows the Fed is Out of Control.

Meanwhile most Zoomers have to find a partner, live at home, or have roommates. I will see if I can get Yardi to conduct a survey on roommates.

* * *

The original bonds on these schools were 10 million, then 20 million then 50 million. Restricting single family home lot size controlled this growth. You couldn't raise property taxes fast enough.

Now, many new subdivisions a built as cluster developments.

Buy 20 acres. Build 10 houses all close together. Keep the surrounding and as common land. Each new house owns 1/10 of the surround land. The builders like it because it reduces their construction cost. The town conservation commission and abutters like it because it maintains open space.

“multiple generations of little cowards, afraid to move out of their parent’s homes”

Wages being stagnant, now entering the 6th decade in a row, is not the fault of “little cowards”, no matter how much you wish that were true.

Which REITs do you like?

What do you think of these two?

Crowdstrike?

Fundrise?

“Oh wait, I guess that makes me a communist, I better get ready to vote for Comrade Biden. Thanks for clearing that up for me.”

Don’t take it out on me. Your contemporaries have largely been indoctrinated. Doesn’t matter what you think, you’re out numbered.

“Doesn’t matter what you think, you’re out numbered.”

Cool. Can’t beat em so I better join them. Thanks for convincing me that I should be a commie.

It's very different from other generations. This upcoming one is dealing with:

-jobs outsourced to foreign countries

-jobs, and tax money, given to illegal aliens

-jobs given to token hires

-decaying infrastructure

-skyrocketing property taxes

-a currency that's reduced to fiat status

-a disproportionate burden of $300T of debt they didn't accrue

-Democrat Socialist governments actively siding with Communists to destroy cities and municipalities

You just explained why home prices have increased faster than wages in your area. See it is caused by government. Enabled by those who already have their home. When you are young and renting you want low prices. Then somewhere along the way many people become homeowners and flip. Instead of wanting more and affordable options they want fewer new homes built. Maybe zero.

IMO that’s none of anyone’s business. let the market be free to decide the right type of housing buyers want. And if that happens, the market will offer all the affordable housing needed.

“Thanks for convincing me that I should be a commie.”

Oh, you’re one of those. Ok, you go ahead and “fight”. Mash those keys on your keyboard and show the world you’re mad as heck and not going to take it anymore.

Wow, a real fighter, I’m impressed.

Who’s fighting? I accept your argument is irrefutable so I’ll just go join the commies since that’s where everyone from my generation is supposed to be aligned with. I’m not arguing with your impeccable logic.

“Wages being stagnant, now entering the 6th decade in a row,”

Stagnant wages are a choice. 1) Learn new skills 2) Get training 3) Look for a better field 4) start a business 5) Hang out with successful people

We live in the greatest nation on earth, opportunities are there.

I make a measly 30k in a factory, and I have my own home with all the trimmings. Don’t tell me it can’t be done. I’ve witnessed my share of millenials and the way they behave. Every generation always thinks they have it the worst.

” I’m not arguing with your impeccable logic.”

I notice that the commies tend to be snarky morons. I’m not saying you’ll fit in, but I’m not saying you won’t.

I lived at home until I got married and not because I was a coward, but because it was financially beneficial to do so. I had a full time job, my own car, traveled, paid room and board, helped around the house, and saved money.

My parents didn’t give me grief about what I did and I didn’t give them grief with poor life choices.

It was a good deal because I came out ahead financially and there was always someone around. No need to worry for either me or my parents about the house being vacant when you went on vacation. Matter of fact, when my parents went on vacation for a couple weeks, my brother and I finished tiling the back hall for them as a surprise.

Sometimes kids live at home for reasons other than that they are basement dwelling losers sucking off mommy’s bank account.

you can thank Slow Joe and the democrats for what is happening with prices and wages.

RE: you can thank Slow Joe and the democrats for what is happening with prices and wages.

OK, here’s the question .... weren’t home prices already surging even before Slow Joe was sworn in?

The smart folks bought cars and homes (if the need was coming up) last year, the earlier the better. One of my sons started building a new home last Feb and are moving in this month. It has already been appraised for 13g more than the closing price. Totally nuts!

they were starting to yes.

it’s a great time to sell.

buy?

not so much.

Yes, we have controlled growth in the small towns.

The cities of Nashua, Manchester, Concord, Portsmouth and a larger towns allow more multifamily construction.

In my town they have also built several 50 and over communities. These are a good fit because they DO NOT affect the local school system.

What I also failed to explain is that in almost all of these southern NH small towns there is NO town water or town sewer. Therefore, any new or existing home is on well and septic. This means you need a larger lot size to allow both.

For example, the three houses I have owned since 1990 all had between 2.4 and as much as 12 acres. They also had 200-660’ of road frontage. All had drilled wells between 150 to 250 feet deep. I have not replaced a septic system, but have been quoted $12K IF it needs to be done.

None of these houses had a natural gas line in front either.

Electric, cable TV and telephone are the only services provided.

I could never understand why they keep saying that when housing prices go up, it’s a good thing for the seller. But once the seller sells, they now become a buyer who has to pay more for the house they want to buy.

RE: But once the seller sells, they now become a buyer who has to pay more for the house they want to buy.

The only seller I see who benefits is the one who owns MORE THAN ONE property and rents the ones he doesn’t live in out to others ( Bernie Sanders, who owns three large ones looks like one of them ).

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.