Posted on 11/08/2021 6:13:17 AM PST by entropy12

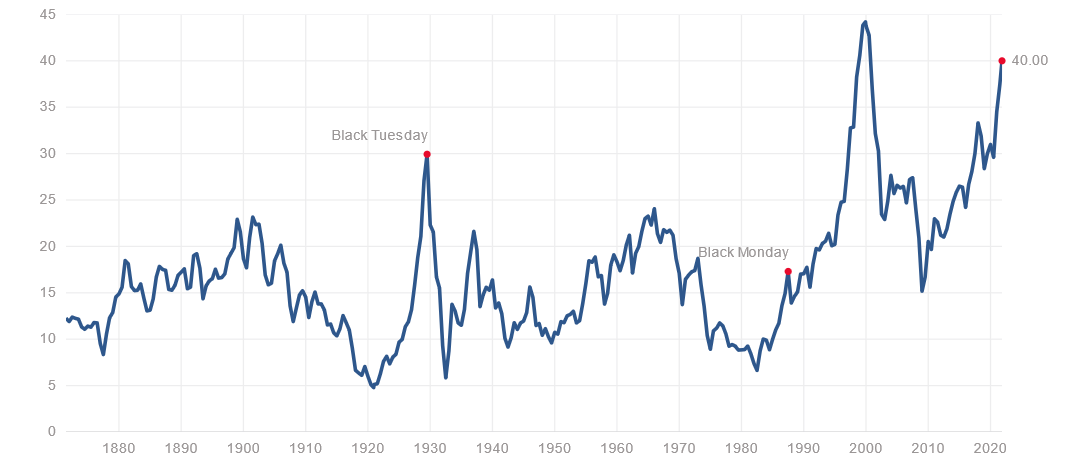

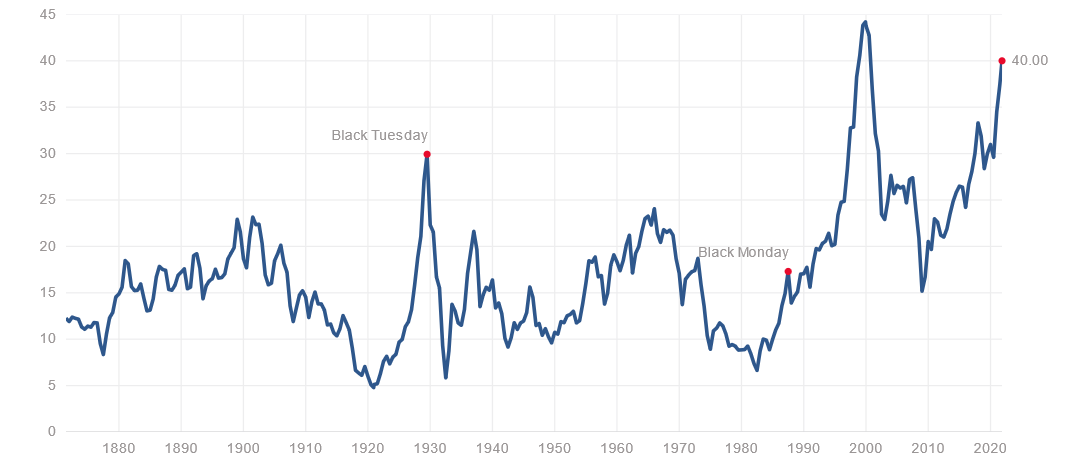

This chart shows we are nearing the internet bubble territory.

Yes.

Yes.

Yes (see ‘meltup’; circa 2008)

As a concerned observer, I’ve come to the conclusion that no one really knows. I’m nearing retirement, so it’s time to play defense.

Don’t need a chart. Use your experience. Maybe not your experience, but past history. Up and down, things go up and down. Like a dingy adrift. Or a rubber duck in a tub, in the case of others.

It has been for a long time. But it doesn’t seem to matter. We are in an extended phase of “irrational exuberance”.

Buying gold in a mutual fund(paper). Is that smart?

What’s the vertical axis measuring? P/E ratio?

It has ALWAYS been ‘overvalued’. That’s why it’s a ‘market’......................

Yes. I hate to say it, but we are in need of a good recession. Recessions fix government intervention, and all of that stimulus money for non-production has inflated prices and pushed the economy to the limit. Once that money finishes rippling through the economy, we’ll see a crash. The only way to prevent a crash is to stimulate (borrow more money from our future). We need to face a recession head-on to get a proper reset.

It’s not about the stock market being over-valued. It’s about the ridiculously-low interest rates bonds and CDs are paying. If you’re saving or investing, the risky stock market is now (unfortunately) the only place to be. You’ve really got no other choice.

Disclaimer: AOC has one more degree in Economics than I do. So what do I know?

No.

The stock values are not going up, the value of the dollar is going down.

This is inflation.

most would be surprised at the

larger number and size of the derivative

markets and dark pools used to steal retail’s money.

if they knew, the value would drop.

if there was accountability, it would not have happened.

The market is the best way to determine the value of anything.

It is a little worrisome. I tell myself that the evil left is out to crush Main Street, not Wall Street. They will keep their big corporate buddies afloat.

Are you planning on using the 4% rule? If so, it might be important, depending on how much you have, to keep a substantial amount in stocks so that you don't outlive your money.

For example, let's use a million dollars as a round number. You would withdraw $40,000 the first year (adding in inflation each subsequent year). This would last you about 20 years unless you had some growth.

Even if you had a 50/50 split and you had a half million in stocks growing at the average annual return of the past 30 years (just over 8%), you should be able to keep your total portfolio around $1 million for the next 30 years.

One of the biggest mistake retirees make is taking all their investment out of the stock market. This sets them up to run out of money later, depending of course on how much you have in the first place and how long you actually live.

If I had $5 million saved, I would not worry so much about growing it further, unless it's important to you to leave a legacy behind for your children or your favorite charity. But one million and even two million will be difficult to live on in a normal retirement (20+ years) unless you have a good part of it growing.

Good luck. I'm in the same situation as you and running the various scenarios.

If you took all of the economists in the world and laid them end to end, I wouldn’t be surprised.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.