Posted on 05/29/2021 5:32:22 PM PDT by SeekAndFind

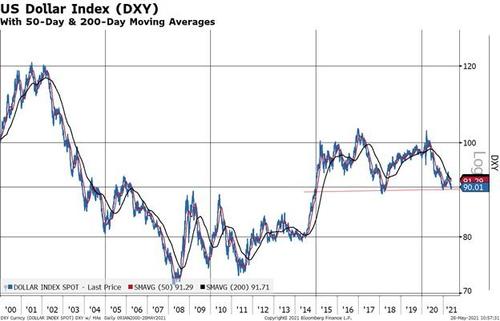

The US dollar is on the verge of breaking down to the lowest level since 2014.

This is not all that surprising. After all, the US money supply continues to grow at a rapid pace relative to other countries and quantitative easing is likely to continue at full pace through the end of 2021. Meanwhile, other countries like the UK, Canada and others are already telegraphing rate hikes. Not only that, but the US budget deficit as a percent of GDP – which has a tight correlation with the level of the US dollar index – is set to explode through 2022 and beyond. The ballooning budget deficit suggests a level of 70 or 80 on the US dollar index over the coming years would not be out of the realm of possibilities. That would equate to a further decline of 11% to 22% from here.

If the US dollar drops below the 90 “line in the sand” and starts on a path toward 80 in the back half of 2021, that would have fairly large ramifications for stocks.

In this post we’ll briefly highlight one.

For the last 15 years or so one of the most persistent trends in the equity market was the relative outperformance of US technology companies vs basic materials companies. The red line in the chart below shows the relative performance of materials vs tech. Since 2005 the red line has gone nowhere but down – meaning tech was outperforming materials – until recently. The blue line in the chart is the US dollar index, inverted. As tech was outperforming materials, the US dollar index was going up most of the time…until recently. The tight correlation between the US dollar index and tech/materials relative performance suggests further weakness in the US dollar will be accompanies by a rather large and important rotation out of tech and into materials. For passive investors this is tricky and risky because the tech+ sector accounts for more than 40% of the S&P 500.

There’s also a fundamental case to be made for such a rotation. The relative valuation level of materials companies vs tech companies is well below average. The next two charts display the price/earnings ratio and price/book value ratio, respectively, for materials vs tech companies. The green line shows the average relative valuation since 2006.

Valuations must always be put in the context of earnings growth. Tech stocks are supposed to be the high growth engines of the market, so they should, in theory, receive a higher valuation than other lower growth companies. However, the relative growth between materials and tech companies is normalizing and is currently above the historic average. This doesn’t mean that materials companies will grow faster than tech companies (even though that could certainly happen), just that growth rate difference between the two groups is shrinking.

In sum, we have poor trends in the US dollar that are being driven by fundamental factors of money supply growth and budget deficits. These factors could push the US dollar down to 70 or 80 in the coming years, which would have substantial effects on financial markets. One of those effects could be to see a continued rotation out of tech and into materials, which is a trend supported not only by a weak US dollar but also changing valuation and fundamental trends between the two sectors. That kind of rotation is likely to be more difficult for passive investors than active ones given the rather large weighting of tech and tech-like companies in the major indexes.

In reply to the author mr coward, Maybe you should look for a Silver lining ?

Or a cryptic lining?

RE: Maybe you should look for a Silver lining ?

Gold is money. Everything else is credit. - J. P. Morgan

Thank you for this.

So we could be headed for stagflation... if so, what’s the best way to protect one’s investments if inflation takes off at the same time as stocks fall? I noticed that the Mint is no longer allowing preorders on silver....

I started that exact rotation about 5 weeks ago. Also raised cash by taking some profits. Just nibbling now.

Weak $ = Expensive imports = Cost-push inflation.

And the * administration wants to offshore raw material supplies. And move us back to dependence on foreign oil.

As if we didn’t have enough trouble.

If * wanted to destroy our economy, what would he do differently?

.

The dollar is based or backed on the belief and faith in the US government. Just wait until the Maricopa County audit comes out and people around the world realize that our election was fixed. The dollar will dive hard. You ain’t seen nothing yet.

and guess which Master of Economic Disaster was president then?

The findings will be ignored and life will go on. The media is not on the side of republicans at all. It will be called a political witch hunt and gone faster then a black man’s mass shooter incident.

For a lot of other areas as well. IMO, "The Great Reset" is a code word for the coming devaluation vis a vis gold. "We now declare that gold is released from its old, outmoded valuation of $45 an ounce and is now worth $10,000 per ounce. Therefore the dollar is sound."

For the past few years, foreign central banks have been quietly amassing gold and expending effort to keep the price down to avoid alarming the public. At some point the lid will be off, intentionally or otherwise, and then it will be "Katy Bar The Door".

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.