Posted on 07/29/2020 7:25:45 AM PDT by Diana in Wisconsin

Covid-19 continues to unleash economic havoc across the world. The financial destruction being caused by the pandemic is shattering already fragile household budgets. In the deep levels of this fog, Millennials continue to face extra layers of pressure from this crisis. This has come in the form of massive levels of student debt, a higher proportion of gig work and retail work, and ultimately no financial cushion of wealth. While some older generations have made it a sport to bash Millennials, they forget that many decades ago a one-income household was enough to purchase a home or that you could work a blue collar job and support a family. Today, blue collar work might keep the lights on but forget about buying a home in most large cities in the U.S. You also have the added layer of the cost of college. A generation ago, you could work summer jobs on a paper route and pay your way to school. Good luck doing that today when some colleges charge $60,000 a year just for a 4-year degree. Many Millennials are being caught in a two-recession trap.

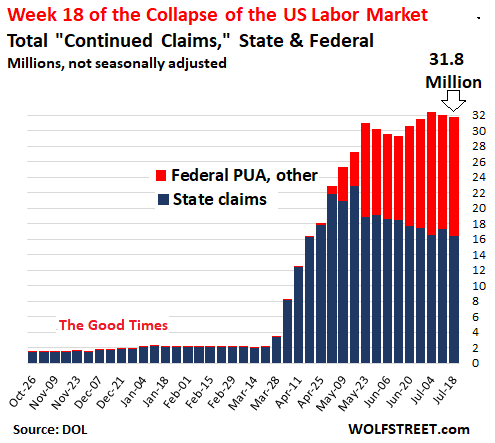

First, the economy has not recovered and we are still at high levels of unemployment. Take a look at the latest figures:

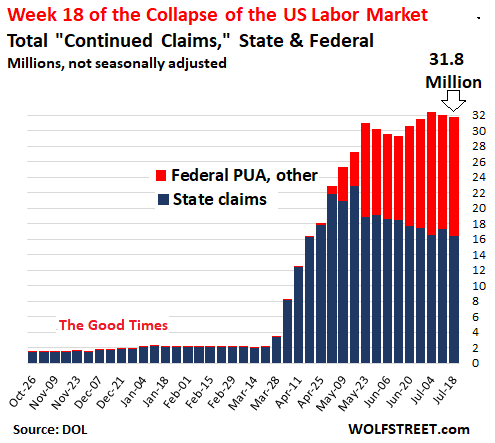

31.8 million people continue to collect unemployment benefits. That is an astronomically large number. But when you look at what jobs are being impacted the most, those in retail, food services, and gig work much of this is done by younger workers:

Retail trade and accommodation and food services are heavily filled with younger workers. These industries require face-to-face interaction for the most part and do not provide a good venue for working from home arrangements – which a large number of white-collar jobs allow (and most require a college degree – see student debt above for this Catch 22). So a vicious cycle emerges here. In order to break into the corporate world, you need a college degree. But not any degree, a degree in a highly sought-after field from a good school (keep in mind there are over 4,000 colleges and universities in the U.S. and many are not worth the money they charge). A 17 or 18 year old has a hard time deciphering the long-term ROI on a college degree but many colleges are happy to stick a person like this into a $60,000 a year degree for general education undergraduate courses. And many this year will not get the in-person experience in the fall.

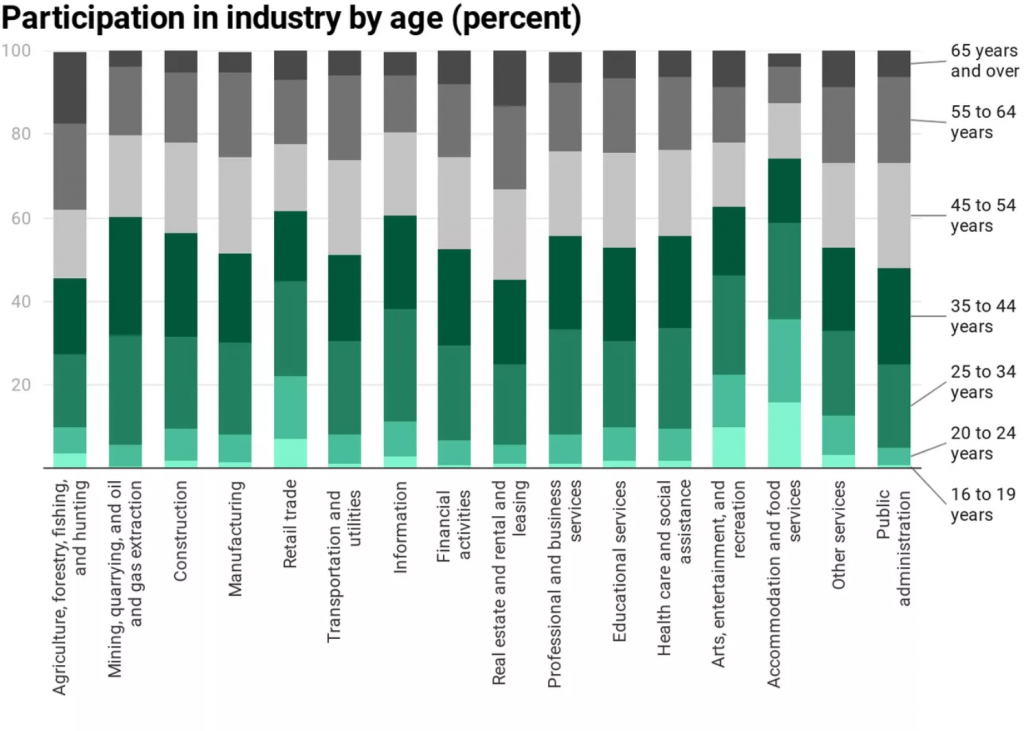

Going back to the impacted fields, these also employ the highest number of Americans:

Therefore the unemployment figures are off the charts if we really measure them correctly. The unemployment insurance claims paint a very grim picture. Many Millennials graduated college into the Great Recession of 2007 to 2009 and never really recovered since then. This “booming” economy recently was largely driven by inflated asset values (Millennials own relatively little stock and real estate which are the top drivers of wealth) so missed out on this latest bull run. Even now, the stock market is doing relatively well given the reality that we are in a deep depression and the economy is operating on crutches. But hey, you can drive a fancy Tesla (bought with debt), order a box of toys from Amazon (on a credit card), and do it all from your iPhone (financed by your cell provider). There is nothing wrong with these companies or their products but they do not represent the majority of the economy.

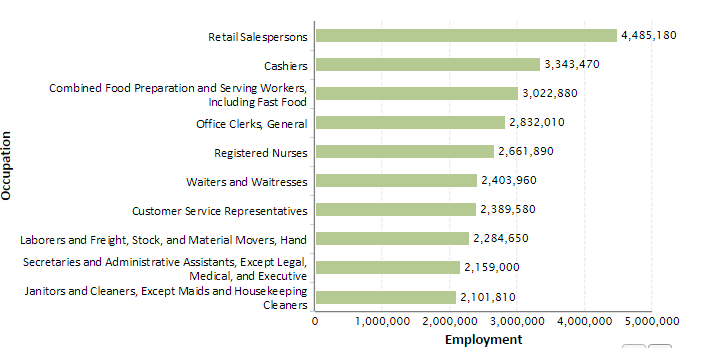

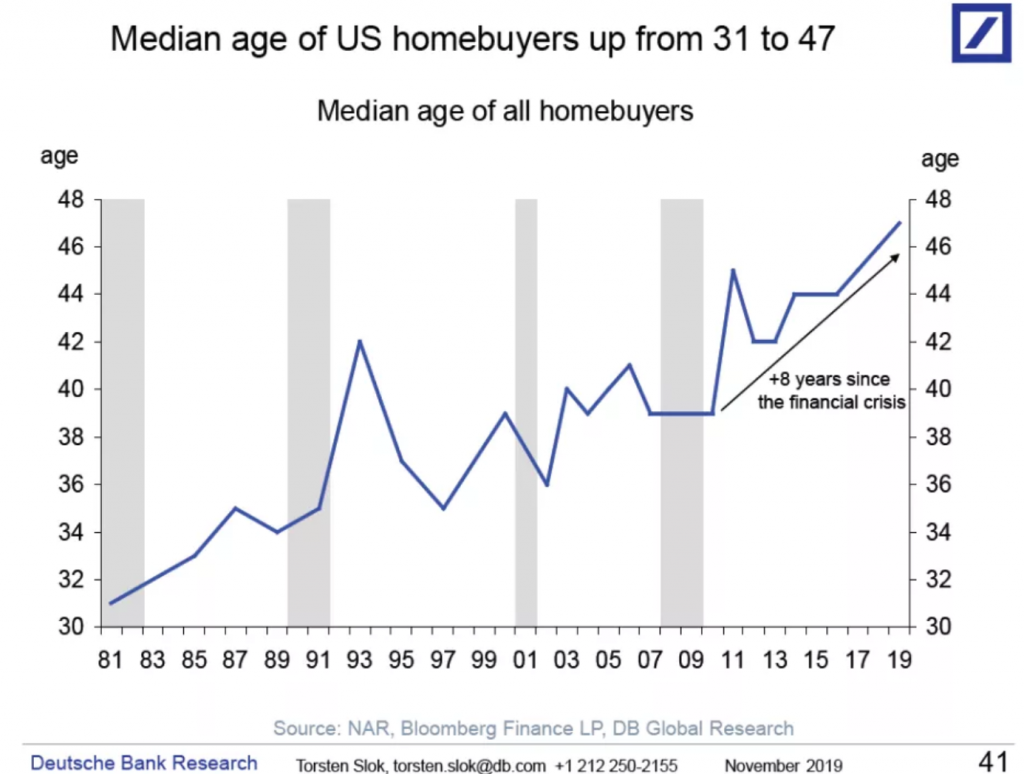

And speaking of wealth building, the biggest asset to build wealth for American families is housing. And Millennials keep falling further behind on this one:

In 1981, the median age of a home buyer was 31. Today it is 47. People usually bought homes when they felt ready to settle down and start a family. Today, many simply do not have that security (see previous jobs of younger Americans) and yet somehow older generations berate Millennials. The irony is many go off on Millennials via digital platforms run and operated by Millennials.

Why is this important?

This pandemic is hitting people hard across all age ranges, but younger people are facing a much tougher economic situation. Recessions are wealth destroyers and Millennials are now living through two of the worst recessions in the last 100 years. And as America gets older and many will rely on Social Security and Medicare, older generations should be working hard to ensure there is a good economy for young workers so they can pay taxes to support the needs that are coming downstream. Given how poorly we prepared for this pandemic with fair warning, we need to get on the same page and start planning now for this next phase.

Sorry you dont believe me. *shrug*

But the Electrical Lineman program, for instance, had an average 1st year wage of $84,000 in 2016. And that’s just one of TSTC many highly in demand degrees. Most students make more than their professors do straight out of school.

But, I’ll go back to Fairytail Texas, since you dont believe me.

But you are missing something. They fail NOT because they don’t make money, but not “enough” money to justify the time for those that give up.

You are assuming fail = bankrupt. And that’s not the case.

Example: A guy is working a typical 40 hours job for someone else. He goes home at the end of the day and gets off weekends and holiday and earns 50K. The guy thinks! HEY! I know! I will start my own business and then sit around on my ass all day long like the boss does and hire some kid to do all the work for pennies! I’ll be rich and fishing all the time! WOOT!

So he opens his own business and makes $50,000 a year profit! BUT.. he had to work long hours into the night and weekends and never gets off a holiday... and he one day wakes up and says.. WTH! it was easier working for someone else and closes the business! that is the typical situation, the business was making money, but the person didn’t want to work that hard or want the responsibility. But here’s the catch.. that was PROFIT! after BILLS! he was too stupid to realize that he was paying off that building and was building equity in it and would eventually own it along with the equipment and that the business would grow over time.

“I am so blessed both those generations didnt think like you”

My wife and I own 3 co’s. I know what it takes. You got in a gov’t job at the right time and made yours before our system went South.

I work in employee benefits. I see the layoffs and downsizing of thousands of folks who are probably more educated and maybe even harder working than you. Not everyone is as lucky as you. And yes it is hard work but also plenty of luck and timing. Running 3 companies plenty of luck and timing helped us out as much as hard work...maybe more so.

Again it sucks for people just entering the job market over the last 15-20 years due to globalization.

The millennials and younger generation will not have it as nice or easy as we did or our parents. The stats prove it. Wait until automation kicks in.

"See your future. Be... your future. Make... make it!"

You don’t have to believe me, it’s no skin off my back if you don’t. I will just continue watching the graduations at the college where they ask all the graduates in certain fields to stand up who have already received a job offer, and 100% of them stand up every time, especially in fields like nursing, accounting, and certain technical fields that are highly in demand here in Texas. They are so desperate for accountants, that the come and wine and dine the students before they graduate begging them to come to their business and not their competition. These are big accounting firms like Deloitte, PWC, KPMG etc.

We started out in a basic starter home. We would periodically upgrade to a larger home in a nicer neighborhood when my husband’s income grew. Roughly 7-10 years before we could make the jump up and keep mortgage payments about the same. We also had only one car for quite some time. It wasn’t till we finished our payments on it that we could eventually afford to have two cars. The kids wore handmade, used, or hand me down clothes a lot, with the exception of a couple of new outfits for each season. I cook mostly from scratch, and use fresh produce daily. For many years, our family vacations were nearby, and very often involved camping. There are lots of ways to economize. You just have to have the determination to stick together through thick and thin. It might not be easy or luxurious, but it can and does happen. Oh, and now we are finally in our dream home.

I see the children are blaming everything but themselves.

Most ignorant, laziest, arrogant, self-absorbed vapid generation we’ve seen.

Let them cry to mommy.

“What many believe to have been an orchestrated financial collapse, followed by what many believe to be a sham health ‘crisis’.”

All by design, Comrade. All. By. Design. :(

So glad I was born and grew up when I did. (1960-Now) So glad I had an intact family, both sets of Depression-Era Grandparents and lots of Uncles that were cops and firemen. They all taught me so much about how to survive and thrive no matter what the circumstance/economy.

I joined the Army in the late 70’s because THERE WERE NO JOBS thanks to Carter. However, I adapted and overcame. I bought my first house at age 25 (inexpensive VA Loan; all 850 square feet of it was mine!) and always made money selling, then buying UP to sell again.

I still believe in America and that you CAN make it here more so than anywhere else on Earth. BUT, you have to want it, and you have to work for it. ;)

I found the chart that says people aren’t buying homes until age 47 to be surreal! I bought my first (tiny) house at age 25.

In 1985. I’m not even ON that chart, LOL!

“If you got a computer science or engineering degree you wouldn’t have these problems.”

Or you could farm. I hear that’s real easy. Any doofus can do it. ;) *SNORT*

You must be a real inspiration at family gatherings...

“See your future. Be... your future. Make... make it!”

I don’t have me head in the sand. Future generations will not have it as good as what we had. The stats are already proving it.

“Plan the work, and work the plan.”

You’re channeling my all-time favorite commanding officer, Colonel Clark H. Babl. RIP, Good Sir! :)

Well, I dont see you offering any solutions, so you might as well go Jim Jones Peoples Temple now and be done with it.

I don’t know where my husband heard the phrase, but he has used it practically all our lives. It was a reminder to stay focused on our goals. ;-)

Life has its own way of throwing curves into our circumstances. Sometimes you have to adjust and come up with a revised plan, that has the original goal as part of that plan. Eventually we have been able to get back on track whenever the unexpected happens.

As an example, my husband was unexpectedly laid off just before Thanksgiving 2018. We were stunned to our core. We were both nearing our 60th birthdays, which happened this year. We decided to tighten our belts again, like we have done so many times before. We cut back in so many ways. We had a decent savings, and figured we could last 6 months on it if we had to, but we really hoped that wouldn’t be necessary.

We were fortunate that he was given 2 months of severance pay. He reached out immediately to his network of coworkers through the years and found a couple of people who had some needs for short term contract work. The idea was that if he could get his foot in the door with a short term gig, somebody would eventually have room for him more permanently in the 2nd or 3rd quarter.

He was right, and he was offered a full time job in his field in mid-June last year. During those 6+ months, we managed to eke out paying our bills with whatever he earned from the several contracts that he was awarded. We never had to touch our savings! I guess all the practice we had when the kids were young was good training! Oh, and one other thing, we relied on our faith knowing that God would lead us through this rough patch just like He has always done. We always believed that He was (and is) with us every step of the way.

I made six figures in 1996 doing C/Unix. How many of those are foreign nationals?

Too many. No Americans even apply since those qualified are already employed.

We need more American kids getting stem educations instead of psychology and women studies degrees.

This is globalist BS. So why not let domestic market forces fix the problem? America is for Americans right???? We need to stop importing foreign nationals via H-1B (mostly from India) to lower wages and push away our best and brightest from STEM educations.

Fixed for you you globalist shill.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.