Ignoring history, Obama falsely claims that raising the capital gains tax yields higher tax revenue

The Washington Times recently reported:

Obama’s State of the Union speech to include $320B tax hike proposal

President wants capital gains rate, bank fees raised

President Obama will propose $320 billion in higher taxes in his State of the Union address, mostly by raising the rate on capital gains and closing tax loopholes for wealthier families, senior administration officials said Saturday.

Previewing Mr. Obama’s State of the Union address to Congress on Tuesday night, aides said the president will propose raising the top tax rate on capital gains to 28 percent, from the current 23.8 percent (20 percent, plus a 3.8 percent tax on unearned income to fund Obamacare) for individual taxpayers with an adjusted gross income of $200,000 or more.

Obama is ignoring the fact that in the real world, raising the capital gains tax in the past has resulted in lower tax revenues.

In December 2012, Investor’s Business Daily wrote:

Capital Gains Tax: Revenue Has Risen After Rates Are Cut

Since 1981, every four-year period after the capital gains tax rate was reduced saw an increase in the amount of capital gains revenue the government received.

“Raising the capital gains rate will most likely reduce revenue,” said Will McBride, chief economist at the conservative Tax Foundation. “That’s based on a long history of capital gains changes since World War II.

The one time the capital gains tax rate was increased since 1981 was in 1987, from 20% to 28%. From 1987-90, capital gains revenue fell from $33.7 billion to $27.8 billion, with an average annual decline of -12.8%.

Capital gains tax rates were cut from 28% to 20% in 1981, again from 28% to 20% in 1997, and from 20% to 15% in 2003. Capital gains tax revenues grew by an annual average of 15.8% from 1981-84, 17.8% from 1997-2000, and 25.5% from 2003-06.

“One of the worst things you can tax is capital formation,” said McBride. “When you increase the capital gains rate, you increase the tax on using equities to finance investing.

When the capital gains rate was reduced from 20% to 15% in 2003, capital gains revenue grew about $2 billion from 2002. In 2004, when the 15% rate was in effect for a full year, capital gains revenue rose to $73 billion, a nearly $22 billion increase from 2003. Capital gains revenue continued to rise, peaking at $137 billion in 2007. From 2003-07, the U.S. government collected about $155 billion more in capital gains revenue than the Congressional Budget Office had predicted.

Going back further than 1981 shows a similar effect. From 1968-76, the capital gains rate rose each year, going from 25% to 39.875%. During that period, the average annual growth rate in cap ital gains taxes was 9.8%. From 1954-67, the capital gains rate stayed at 25% every year. Average annual growth during that span was a more-robust 14.1%.

Raising capital gains rates isn’t just a loser for the federal budget.

“It’s a bigger loser for the private economy,” said McBride. “Our simulations find that by far and away, the biggest danger to the economy in the fiscal cliff is an increase in the capital gains and dividend rate.

In September 2013, Forbes wrote:

To Raise The Capital Gains Tax Rate Is To Not Raise Capital Gains Taxes

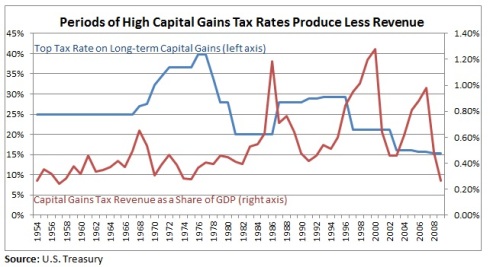

The following chart shows the latest data from Treasury on the capital gains top tax rate and tax revenue as a share of GDP since 1954:

The same article then showed this chart:

The same article then continued:

The chart clearly shows an inverse relationship between the top tax rate and revenue, indicating that high tax rates bring in less revenue. In fact, there is a negative correlation of 0.39.

Further, all tax rate changes since the 1970s are consistent with a revenue maximizing rate of less than the current 23.8 percent.

Essentially, we still don’t have enough data on the low end of tax rates to conclude where the revenue maximizing top capital gains tax rate is. It may be below 15 percent. But we do have strong evidence indicating it is less than the current 23.8 percent.

So, if the goal is to maximize tax revenue from the capital gains tax, we should lower, not raise, the capital gains tax rate.

On the other hand, if the goal is to discourage private investment and private sector job creation, then, and only then, should we raise the capital gains tax rate.

During an April 2008 debate moderated by ABC News anchor Charles Gibson, Obama said that even if raising the capital gains tax rate did result in lower tax revenues, he still favored raising it “for purposes of fairness.” This is the transcript from that debate:

Gibson: All right. You have, however, said you would favor an increase in the capital gains tax. As a matter of fact, you said on CNBC, and I quote, “I certainly would not go above what existed under Bill Clinton,” which was 28 percent. It’s now 15 percent. That’s almost a doubling, if you went to 28 percent.

But actually, Bill Clinton, in 1997, signed legislation that dropped the capital gains tax to 20 percent.

Obama: Right.

Gibson: And George Bush has taken it down to 15 percent.

Obama: Right.

Gibson: And in each instance, when the rate dropped, revenues from the tax increased; the government took in more money. And in the 1980s, when the tax was increased to 28 percent, the revenues went down.

So why raise it at all, especially given the fact that 100 million people in this country own stock and would be affected?

Obama: Well, Charlie, what I’ve said is that I would look at raising the capital gains tax for purposes of fairness.

Here’s video of Obama from that debate:

https://www.youtube.com/watch?v=gJimLZRC9N8

So, even though it would result in lower tax revenues, less private investment, and less private sector job creation, i.e., even though it would hurt everyone, and not help anyone, Obama still wants to raise the capital gains tax rate “for purposes of fairness.”

If a policy makes everyone worse off, and doesn’t make anyone better off, Obama still favors that policy, because such a policy is “fair.”

And remember, that was in April 2008, during a Democratic primary debate. It was after this debate that Democrats chose Obama in the primary, and it was after that that Obama got elected, and then reelected, as President.

The American people chose to put someone into the most powerful office in the world, who had previously said that he favors a particular policy, even if that policy makes everyone worse off, because such a policy is “fair.”

Here is another real world example of how people respond to incentives. In 1990, the U.S. government passed a luxury tax. Congress estimated that it would collect $31 million from this tax. But this estimation was based on the false belief that people do not respond to incentives.

In the real world, people do respond to incentives. After the luxury tax was passed, people bought fewer of the items that were taxed, and the amount of tax that was collected was only $16.6 million.

Even worse, because people bought fewer of the items that were taxed, many jobs in those industries were destroyed, including 25,000 jobs in the yacht building industry. So now, instead of paying income taxes, those workers were now collecting unemployment insurance from the government. This combination of unemployment insurance and lost income tax ended up costing the government more than $24 million.

So, instead of causing an increase in government revenue, the luxury tax actually ended up causing a net loss in revenue for the government.

In 1993, the luxury tax was repealed.

Here’s another example of how people respond to incentives. In 2006, the Washington Post wrote:

Old Money, New Money Flee France and Its Wealth Tax

Eric Pinchet, author of a French tax guide, estimates the wealth tax earns the government about $2.6 billion a year but has cost the country more than $125 billion in capital flight since 1998.

Mathematically illiterate, class warfare liberals think that that tax is a good idea. But any normal person understands the harm that it causes.