Posted on 10/02/2011 4:05:19 PM PDT by blam

The Stock Market Smells Deflation

Stock-Markets / Stock Markets 2011

Oct 02, 2011 - 11:06 AM

By: Clif Droke

In previous commentaries we've talked about how the 6-year cycle is scheduled to peak around Oct. 1. That now appears to be all but certain following the last few trading sessions. Although the cycle has a 1-2 week standard deviation (plus or minus), it appears that it peaked on schedule last week and that the stock market has lost the last remaining cyclical support it had throughout most of September.

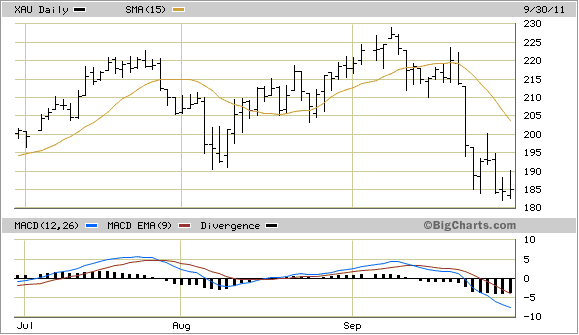

Interestingly, it was the commodity stocks that performed the strongest in the last cyclical bull market from late 2008/early 2009 until earlier this year. But in the last few months these stocks have been under heavy distribution and have lately led the way lower for the broad market. The gold/silver stocks took a big hit earlier this month as you can see in the chart of the XAU Gold Silver Index shown here.

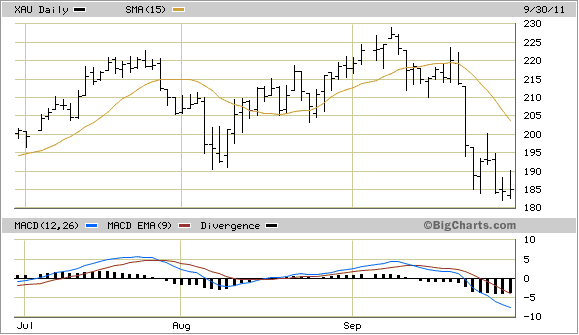

The oil and gas stocks haven't fared much better and still haven't confirmed a bottom. Even the gasoline futures price is showing signs of weakness and is on its way to giving back virtually all the gains it made since the Federal Reserve's QE2 monetary easing program began last fall. While this would be beneficial for everyone (except the oil companies), it underscores an important point that I'll be making in tonight's report, namely that deflation is starting to rear its ugly head again.

Looking at the list of stocks on the NYSE new 52-week lows list on Friday you will see a conspicuously high number of companies who either mine, explore or manufacture commodities or else service commodity related industries: Agrium (AGU), Alcoa (AA), Apache (APA), Ashland (ASH), DuPont (DD), Dow Chemical (DOW), Forest Oil (FST), Franco-Nevada (FNV), Hecla Mining (HL), National Fuel Gas (NFG), 3M (MMM), Potash of Saskatchewan (POT), Rio Tinto (RIO) and Teck Resources (TCK) just to give you an idea. This is a classic collection of industrial and hard asset related companies and many of these stocks have built up a tremendous amount of downside momentum in recent weeks and months. Never mind the near term stock market outlook, this doesn't speak well at all about the global economic outlook.

Throughout the year we've read story after story in the business and financial press about how so many U.S. based companies had decided to focus their energies on growing their business in the emerging markets overseas. Well it looks like those high hopes will have to be put on hold as the overseas markets are slowing down and will soon be entering an economic slowdown on par with the one the U.S. is currently suffering.

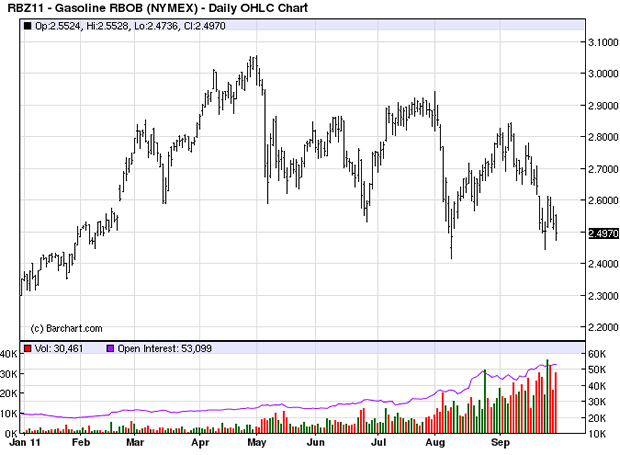

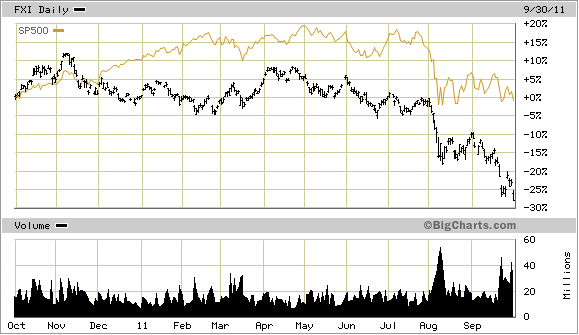

The darling of the emerging markets crowd is China and it has become an article of faith that China will someday soon eclipse the U.S. as the world's leading economic superpower. That day will have to wait as China's stock market continues to spiral lower, drastically underperforming the U.S. equities market. Keep in mind that the stock market is a barometer of future business conditions since it discounts corporate earnings 6-9 months in advance and is a reflection of where the economy is headed.

To illustrate this, below is a chart of the China 25 Index Fund ETF (FXI) in relation to the S&P 500 Index (SPX). China has been in a bear market since its stock market peaked last November. The country is suffering from a glut of commercial and residential real estate and unnecessary public works thanks to a massive stimulus on the part of China's Communist Party after the credit crisis of 2008.

China's financial sector is in major decline and already we're seeing a corresponding decline in demand for the commodities which fueled the country's mega boom. This diminishing appetite for commodities will continue as we approach the 60-year Grand Super Cycle bottom in 2014.

Meanwhile on the home front, the peaking of the 6-year cycle has taken away the last remaining cyclical pillar of support for the artificial, Fed-induced inflation of the past couple of years. Fed chief Bernanke has made no imminent plans for another round of financial stimulus. The Fed's latest gambit to revive the U.S. economy has been dubbed "Operation Twist" and involves nothing more than swapping short-term Treasuries for longer dated ones. This will register little more than a blip on the economic radar screen and will do nothing to increase aggregate demand in the U.S. economy. The Fed is likely underestimating the degree to which deflation will ravage the economy as we head closer to the long-term cycle bottom. Each passing year beginning with 2012 should bring a greater degree of deflation and it's doubtful either the Fed or the U.S. government can do anything to stop it.

It has been said that avalanches can start with insignificant snowballs rolling down the hill. In a similar vein economic collapse typically begins with financial market weakness, which tends to be overlooked by economists. While economists focus on GDP and other "big picture" lagging indicators, the real action takes place at or just below the economic surface in the financial market, which discounts economic activity by several months in advance.

As important as the commodity related companies have become in recent years, when there is as much weakness in the commodity company stocks as we're seeing right now it should give economists pause for thought. The message that the recent commodity stock liquidation is sending is that deflation is coming. Instead of discussing constructive ways of dealing with this problem, Congress is debating the merits of a potential tax increase on Americans - a policy which can only exacerbate the negative impact that deflation will have on the economy. The Fed meanwhile is whistling past the proverbial graveyard in a meager attempt at keeping the interest rate low. Both the Fed and the Congress will be taken by surprise when deflation descends with its full force and fury in the next several months.

Deflation in salary is right small companies not offering benefits healthcare.Healthcare up 6-9% and rising.Small companies cutting all benefits out and cutting salaries and the bank wants they’re mortgage money but it all went into the gas tank and stomachs.

FUBO

And there is a headline on drudge that some paid protesters on BOA want totalitarianism and Obama re elected.

Thank you all.

People aren’t buying. Nor “buying” into this scheming. Now think for a moment:

What happens if govt. pensions, govt. contractors, govt. dependents (in the trillions) also go south? Where goes their retirements?

Don’t think they don’t know this.

The counterfeit market will be propped (or deceptively bailed out)....UNTIL ..... the massive leverage of Vampire-”Care”. Look out for Vampire-”Care”.

[anybody with an ounce of a brain knows what is going on right now. ]

True - but unfortunately the majority of the population lacks even an ounce.

The sheeple on the left are waiting for their free government pie.

Those on the right are waiting for the Rapture to rescue them before the ARM on the McMansion explodes.

Neither are taking RESPONSIBILITY for their role in manufacturing the reality that exists behind the dialectic facade - and oligarchic kleptocrats like Penny Pritzker (billionaire Obama Campaign National Finance Chairwoman) & Co are quietly fanning the flames and waiting for the fire sale.

“Deflation?”

-No

“How is that possible?”

-It’s not

“With all the extra money being pumped into the economy via QE I, QE II and now soon-to-be-announced, QE III, we shall be AFLOAT in Monopoly money.”

-Absolutely correct. Real estate is still coming out of it’s ridiculous bubble. Dollars will be printed in an effort to drive up the costs of everything non-credit related (houses, etc.), to make sure you ncan’t afford anything without government assistance, and that people lose their jobs (through regulations, etc.) and cannot afford the falling real estate, which will in turn be snapped up and used as housing projects to ensure more votes for socialism.

“Anything we can/should do now?”

Stock up for what you will need ahead, now. Don’t expect anything you have (Real estate, especially) to go up in price (it’s still in a bubble, and will drop until it reaches levels people can afford, between 50%-20% of what they cost now—that is, barring the Chinese,e tc. buying the rest of the real estate). Things will cost more if you need them (necessities), and initially, less if you don’t (luxuries), until the necessities cost more money than you have and everything else is unavailable.

Be in debt as little debt as possible as cash will be more valuable. Get in cash as much as you can.

I had been putting away spare cash in nickels as it was a no-risk "investment", even if in a chump-change way. I started as the nickel was slightly above melt value and went all the way to 7c, so I figured I was going to do OK via inflation. Lately nickel has collapsed and it's down to 4.7c melt, the lowest I've seen it in a couple of years. It now sure looks like deflationary times are ahead, even as many are still worried about inflation.

Yeah, I know groceries are still going up, but that might be a lagging indicator - or perhaps stagflation. Whichever way it goes, a couple of months canned/dried food is a good investment as well.

Like you, I fully expected the fan to get dirty in the mid 1990s and remember trying to warn anyone and everyone who would listen to me rant about it. They didn't and when things turned around they laughed.

Well...no one is laughing right now, not after the near daily market beatings they're learning to deal with.

Interesting times...

Sure, we'll see an occasional upside fake so the big institutions can try to get out, but deflation and cash are KING.

Gold at $1200 by the end of the year...and $600 by the end of 2012.

The Fed is not capable of injecting enough money into the economy to create real demand inflation unless they issue a check for $10k or more to every man, woman and child in the country. Even then many folks would pay debt and save it rather than spend it.

The Velocity of Money is in the toilette taking the Fed out of the game.

Debt Deflation on a scale nobody alive has ever seen before.

The simple answer: during deflation, hold cash because its purchasing power increases.

During inflation, purchase hard goods because dollar purchasing power decreases.

So if the leading citizens of the world go through with the deflationary squish, we’ll have more freedom. If they chicken out, we’ll have more time to prepare. Whichever...

Or they’ll resume enormous money printing after having temporarily lowered freight fuel and foreign prices on their Asian slaves’ junk. Yep. So we’ll get a little of both.

YUP.

So, we're in a Liquidity Trap?

[That’s some interesting reading:]

Thanks for the plug blam. I did some pretty innovative writing, I go into biflation, debt bondage, proxy armies, a whole lot of ways to look at a new style civil war.

However, it'll do in this case.

The bottom line is the Western Consumer is unable/unwilling to take on more debt. Western governments are politically unable to accelerate their assumption of debt and are being forced to cut back.

This causes the "loaned" money from the Fed to stop at the banks.

Of course the banks will take the opportunity to try to make a dime off of it...so they invest in commodities, stocks and foreign bonds/currencies.

Right now the markets, banks and governments are in one big circle jerk together...and the REAL economy continues to deflate.

Eventually, once all the QE monies stop moving...all these folks will turn around to find nothing but a cold wind at their back. NO BUYERS. They'll be left holding the bag and will start to liquidate at any price.

That's when the bubble burst will sound like a bomb going off.

Don't make the mistake so many are making...do NOT anticipate inflation in the mid-term or short term. It's not there. We have only temporary inflation in the markets due to QE.

If you want to know where the economy is going, watch the single largest asset class in the world: US Real Estate.

Daily. The Fed is trying to stimulate inflation daily, and failing just as badly as Japan which has been trying to gin up inflation there since 1989.

The money supply is all cash plus all credit. The problem with printing money in a credit-based economy is that it destroys leverage as private credit disappears commensurate with the money-printing.

Bankers, after all, don't want to lend today's valuable Dollars only to be repaid in debased currency next year.

Now, after you've destroyed all private credit availability, then yes, further money-printing would cause inflation because you would no longer have a credit-based economy.

Keep in mind, however, that our economy is 90% credit and 10% cash. You'd have to destroy 90% of the wealth in the U.S. first before even more money-printing would finally resemble Zimbabwe.

That's unlikely to happen as Revolutions are fought over much less.

In the meantime, money-printing simply dries up private credit.

Japan has printed far more money than has the U.S., and Japan has been doing it every year since 1989.

It's never worked. You don't get stimulus from money-printing in a credit-based economy.

Credit is the missing ingredient to the current global crisis soup. Destroying credit causes deflation. The yen, for example, is up.

Modern economists can't explain why the Yen is up after so much Japanese money-printing. They cite ridiculous things like export-economy, shrinking population, and a culture of savings even though the U.S. saves more than Japan (and has since 1999) and even though the Japanese are net importers from China now.

What the pin-heads can't grasp is the missing ingredient: credit.

Everyone sits around *wishing* that magic printing presses can stimulate global economies without anyone having to suffer any financial pain.

It's a fairy tale that has failed every year since 1989.

Government printing presses, whether running raw or via the convenient fiction of “borrowed” money, trigger deflation up until all private credit is destroyed.

Of course, at that point entire economies are vaporized and you are left with a Zimbabwean wasteland of a cash or barter economy.

Print money at your own peril; it won't stimulate. It won't solve the current global crisis.

On the contrary, printing more money will exacerbate the economic downturn.

The U.S. has legacy debt-overhang at the city/state/federal government level. Ditto for over-spending. Same again for over-regulation.

Those are structural issues that must be resolved.

The U.S. also has a severe real-estate problem. Commercial real-estate has greater than 20% vacancies nationwide. Residential real-estate has over 19 million vacant homes, millions more homes in default, and tens of million more homes underwater.

Pension plans are unfunded. Social Security is terminal. Fannie Mae and Freddie Mac are so far past “insolvent” that they must remain in government conservatorship, begging and stealing taxpayer funds in the Billions every month.

You could Stimulate until every woman in the country was orgasmic and still not put a dent in any of the above.

Thus, more Stimulus will simply fail (or make matters worse).

You have to resolve the above structural economic issues first before tossing money at the problem has a chance of working.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.