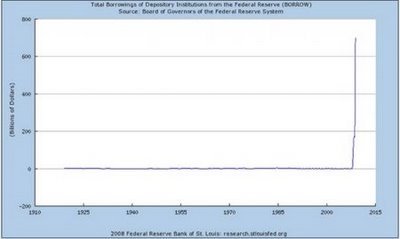

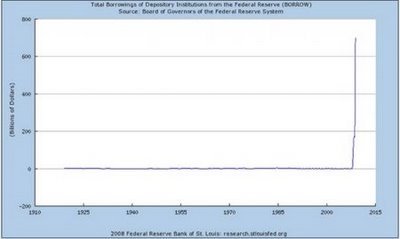

They need to print money to fund the already passed ‘stimulus’.

Now, that's some superfine blow this guy's doing.

While there will be some devaluation, I don’t see it in the extreme case that he is pointing out for one reason- value is the subjective rate of exchange. In other words, the value of the dollar in relation to xx- generally measured against other currencies. In the case of this ratio, other countries are going through a similar spending spree and debt increase like we are so the relationship has a similar movement.

Don’t worry. BO and our esteemed Treasury Secretary will save us.

It is going to get ugly

http://www.businessinsider.com/henry-blodget-the-social-security-bomb-2009-4

http://www.businessinsider.com/aig-bucks-the-big-bang-2009-4

http://www.businessinsider.com/can-we-loot-social-security-to-pay-for-the-stimulus-2009-2

http://www.businessinsider.com/henry-blodget-is-obama-in-wall-streets-pocket-2009-4

This was such a howler, and so easily sourced and discredited, it very much casts suspicion on the rest of the article:

“Also, the US is a net importer of food, so food shortages would take place.”

see:

http://www.ers.usda.gov/AmberWaves/February08/DataFeature/

Japan’s been monetizing their debt every year for 20 years.

Anyone care to comment on how far the Yen has been devalued?

Bump for later.

I think this song sums-up my feelings on the matters of all these bailouts:

http://www.youtube.com/watch?v=HmeRd-AF7gI

He's expecting his tax rate to be lower in retirement? That's a red flag. I don't think my tax rate will ever go down even after I'm dead.

any reason for delay in posting a Mar. article?

With respect to currencies, all of the major ones are being mismanaged for political reasons, with the possible exception of the Chinese currency (I just don't understand all of the issues there). So, the "compared to what" is the right comment when one talks about devaluation of the dollar. I think that if we compare to gold, or commodities, or assets that are tied to something physical, a significant devaluation is in the cards, because I believe that the government will succeed in reflating. But that's not the same thing as the more traditional idea of a formal currency devaluation by the government against the other currencies. Instead, what we have is the potential for a mass devaluation of virtually all fiat currencies by markdown against the real world.

I doubt it. The USD has been strong so far and 0bomo just made it stronger with the hostage rescue

I read Jim Willie all the time over at 321gold.com. He is very interesting, but consistently the most alarmist of anyone one the site. And, considering the site is full of gold bugs who are totally pessamisstic, that is saying something.

Which isn’t to say that he isn’t right, perhaps he is.

Still, I don’t see the mechanisms in place to ALLOW us to devalue the dollar. The last great devalution of the dollar was FDR’s taking the USA off the Gold Standard in 1932. That’s the one everyone points to, and with all the talk of “the worst economy since the depression” it’s an obvious touch point.

But, lets look at what happened in 1932. Gold coins and paper money circutlated at the same time. Both Officially and practically US paper money was “as good as gold” because you could go to a bank, give them a $20 bill, and get a $20 gold piece in exchange.

FRD hated that. He couldn’t inflate the money supply to run his endless socialist policies. So he ordered all gold turned into FedGov. (Imagine the hubris of this man!)

and made the dollar non-convertable to gold for US Citizens.

However foreign governments could still exchange paper dollars for gold at the rate of $20 per oz.

After FRD had all the gold turned in he devalued the dollar by telling foreign dollar holders that they could now turn in their dollars at hte rate of $35 per oz of gold.

So that was a massive devaluation. If you were a US citizen foreign goods cost more, but of course imports had slowed drastically in the depression.

In 1971 Nixon ended the convertability of the US Dollar into gold, at any rate.

Since then we have had a pure fiat currency.

Now comes the talk of devaluation? How would that be accomplished? The US Dollar ‘floats’ against all other currencies. The rate to buy Dollars in Yen, or sell Dollars for Euros is set in the FX markets.

Given this for the USA to “devalue” the dollar, in the classical sense” they would first need to re-aquire control to “value” the dollar, which is currently not in their control. In other words the USA would have to try to put the dollar back on a fixed exchange rate system.

This is not something I’ve heard suggested by anyone, nor is it clear that the rest of the world would even go along with it. Color me extremely sceptical about this coming to pass.

Unless and until this step is taken talk of formal eliberate “devaluation” is meaningless!

Of course there still could be rampant money creation, leading to massive inflation, which would have the same effective result as a formal devaluation. But such a process (and there is a lot of reason to think we’re already well into it) would lack the planned, deliberate central control that is the basis of Jim Willie’s thesis.

There will not be a specific date when banks are closed. Why? That would only upset people. The whole plan of the Fed and FedGov is to continually reassure people.

In other words, boiling the frog (ie: debasing the currency via inflation) is working just fine. No one is screaming about it. Why would you even consider going to any other plan.

So, as much as I like JW, I think he’s way off base on this and basically indulging his paranoid fantasies in this essay.

ping

While his prediction of economic disaster is possibly correct, his solution is flawed. He makes no distinction between the international behavior of the US dollar and the national behavior of the dollar. In practice they are like two different currencies.

Even if every other country on the world stops backing our gigantic debts, all this means is that the price of *imports* will jump. But what does this mean, really? If the price of carrots from Mexico become $30 a pound, but the price of carrots from California remain $1.50 a pound, whose carrots are you going to buy?

But the rest of the world can stamp its feet all it wants. If it gets too aggressive, the the US could just default on its national debt. The end result would be about the same, that is, imports would dry up.

Now, he is correct that the government may try hanky-panky like having bank holidays. However, this only works if you keep all of your money in the bank—something I don’t recommend for anyone right now. Instead, if you keep a few thousand dollars of cash at home, in a safe place, it is safe from the hornswagglers.

And if they go hog wild, with massive inflation and nonsense like that, individual States, cities, and even cooperatives of the people can just issue “scrip”, which is an alternative currency. As long as everybody agrees to use it, the US government can go pound sand. Scrip is legal, even if it isn’t legal tender, and some cities used it during the Great Depression, which made their life easier.

The author is wrong about something else, as well. The US is only a net importer of *specialty* foods. We produce way more staple foods than we consume, and many other nations are reliant on us for them.

Food is something we have in abundance, as well as housing, and police and military security. With those three things, we are well situated to weather an awful lot of problems.

Sure, things can get tight for a while. But W. Bush filled up the US Strategic Petroleum Reserve to 98% full, and if congress will just lighten up (under threat of torches and pitchforks), and lets the oil industry do its job, then we will have plenty oil for what we want to do.

Bump to find later