Skip to comments.

Baby boomers are refusing to sell and will age like a fine wine in their homes.

Dr Housing Bubble ^

Posted on 08/15/2017 6:42:18 AM PDT by Lorianne

Older Americans own half of the houses in the market. Many are simply refusing to sell and others have adult “kids” moving back in since they can’t afford a place to rent or buy. It is a Catch 22 and many people are looking at countries like Italy where the number of adults that live at home is enormous. Multi-generational families just don’t coincide with the “rugged American” worldview where you go out on your own and you make it with your own two hands. Of course, many house humpers had mom and dad chip in but that doesn’t make for such a sexy story. In the end, however there are many baby boomers that simply are not selling. This is actually an interesting problem that is not going away.

Refusing to sell

Housing used to be a young person’s game. The U.S. housing market and to a large extent, the economy was driven by home buying and big ticket purchases. But that has definitely changed since the housing market imploded with the 2000s. It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.

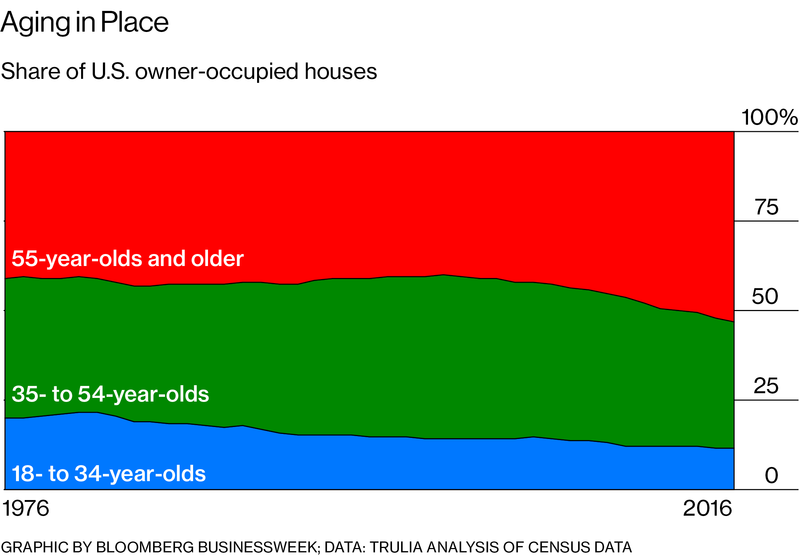

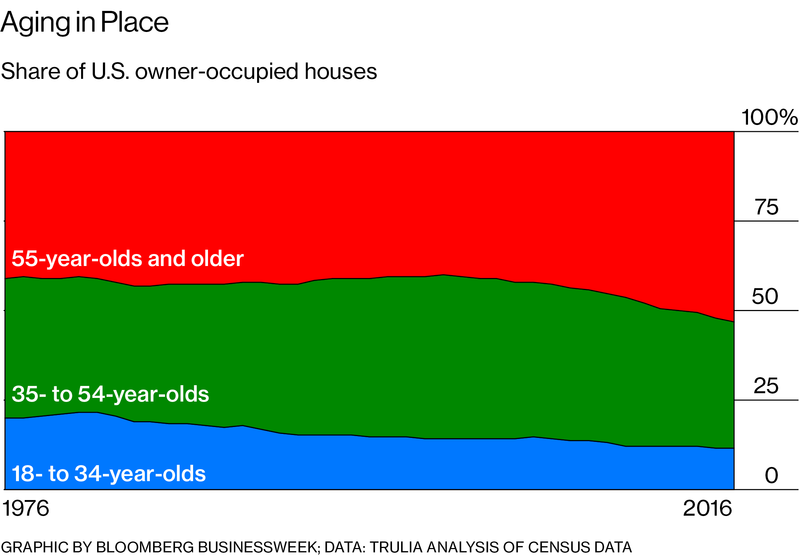

The oldies but goodies are now occupying a larger share of housing:

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

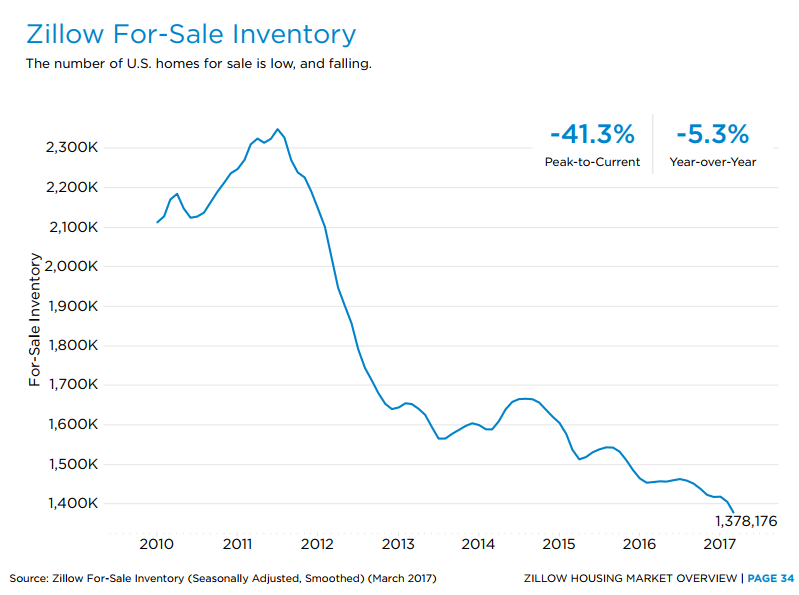

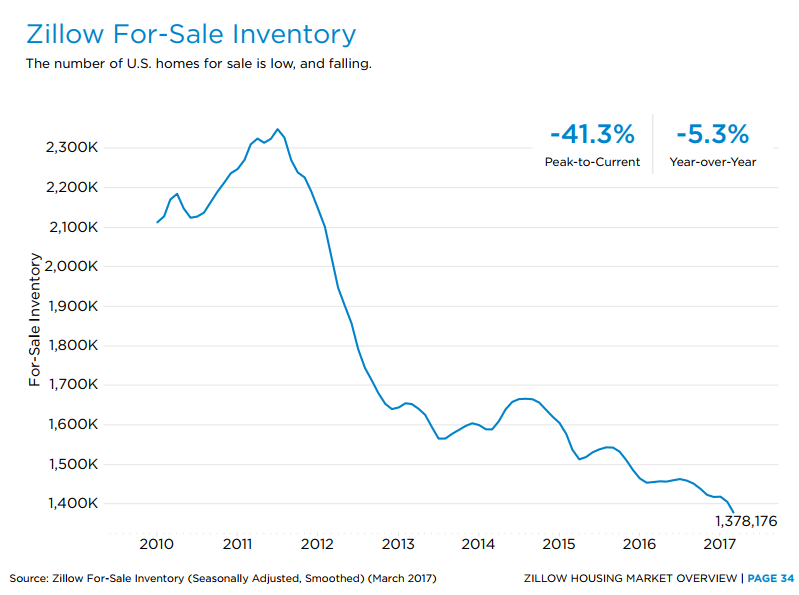

But housing has gotten more expensive across all U.S. metro areas so this is a much larger trend. It has absolutely crushed the available inventory out on the market:

SNIP

TOPICS: Business/Economy

KEYWORDS: babyboomers; elderly; housing; seniors; trends

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 next last

To: mewzilla

School tax breaks for seniors is an excellent thing for society.

It is most excellent!!

Screw that collectivist nonsense.

The Smallest Minority on earth is the individual. -Ayn Rand.

To: Lorianne

I am sure California skews that number a fair amount. Older folks there have no incentive to downsize because of the property tax penalty to trading houses for those who have been in the same place for decades. Housing prices have increased by more than an order of magnitude in the last 30 years but for people who bought them the property tax rate is locked in at the time of purchase. There is no value to trading to a smaller home because any savings in maintenance is more than offset by the increase in property taxes on the new home. The effect of this is to lock up housing inventory in markets that desperately need houses for young families.

When I lived there is was cheaper, by far, to pay rent than the cost of mortgage interest and taxes. Older folks would sit on million dollar properties until they died than their children would inherit the house with a low tax bill. A lady at church bought out half her mother’s house from her sister after the mother died and said the increase in the tax bill for the just the half purchased from here sister nearly gave her a heart attack.

To: Obadiah

Here in the Phoenix area, rental payments are often more than mortgage payments. My niece and her husband were paying $950 per month for a 800 sq ft two bedroom apartment, nothing fancy, and they have 3 little kids. A few months ago they bought an old simple 1300 sq ft home for $206,000. Their mortgage and interest payment is about $740 per month.

According to Zillow, we could get around $1750 per month rent for our 2000 sq ft home. If we took out a mortgage on our home the, P&I would be $1,169 per month.

83

posted on

08/15/2017 8:53:54 AM PDT

by

RooRoobird20

("Democrats haven't been this angry since Republicans freed the slaves.")

To: TexasGator

The homestead tax ceiling is a state law:

It is a limit on the amount of taxes you must pay on your residence. If you qualify your home for an age 65 or older or disabled person homestead exemption for school taxes, the school taxes on that home cannot increase as long as you own and live in that home. The tax ceiling is the amount you pay in the year that you qualified for the age 65 or older or disabled person exemption. The school taxes on your home may go below the ceiling but not above the amount of the ceiling. However, if you improve the home (other than normal repairs or maintenance), the tax ceiling may go higher because of the new additions. For example, if you add on a garage or game room to the house after you have established a tax ceiling, the ceiling will be adjusted to a higher level to reflect the value of that addition

To: Lorianne

Our mortgage is $660 per month. Rents in our neighborhood are $1000-$1200 per month. The house has increased in value. We will shortly sell and pay cash for something smaller in the mountains. Win win.

85

posted on

08/15/2017 8:57:21 AM PDT

by

Georgia Girl 2

(The only purpose of a pistol is to fight your way back to the rifle you should never have dropped)

To: TexasGator

Good topic. Good responses. Great site!

86

posted on

08/15/2017 8:58:44 AM PDT

by

DIRTYSECRET

(urope. Why do they put up with this.)

To: subterfuge

Italy is a beautiful country that has done a tremendous job preserving its history and antiquities. Hubby and I have visited Italy five times, have spent almost a total of 4 months there.

A typical middle class Italian family lives the same or lower standard of living that the working poor (and even welfare lifers) live in the U.S.: extremely small homes, usually no yards, no air conditioners or clothes dryers, most can’t afford cars, etc.

It’s a fabulous “life in the slow lane” place to visit, but I would not want to be stuck living there all the time.

87

posted on

08/15/2017 9:02:16 AM PDT

by

RooRoobird20

("Democrats haven't been this angry since Republicans freed the slaves.")

To: TexasFreeper2009

“The homestead tax ceiling is a state law:”

This gives you an exemption of a few thousand but is minor if you house is valued at hundreds of thousands and does NOT limit increases in your tax bill.

“It is a limit on the amount of taxes you must pay on your residence. If you qualify your home for an age 65 or older or disabled person homestead exemption for school taxes, the school taxes on that home cannot increase as long as you own and live in that home.”

True, the school tax is capped but NOT the other many county taxes.

I know. I lived in Texas over the age of 65 and did formal protests each year so I learned the system pretty well.

To: TexasFreeper2009

“However, if you improve the home (other than normal repairs or maintenance), the tax ceiling may go higher because of the new additions. “

If your house appraised value goes up or the tax rates go up your taxes will go up!

To: Texas Eagle

"It took us some time but we finally figured out how stupid the whole concept of paying a mortgage to get the tax deduction is." You have to live somewhere. If you don't buy a place then you rent. With a 30 year fixed mortgage you are locking in the monthly expense. Rent tends to increase with inflation. What tends to happen is the before long rent raises far above your old mortgage. I couldn't rent an apartment for what I pay on my mortgage now.

"I've never researched the definition of "mortgage" but I've been told it literally translates into "death grip." Even if that's not what it translates into, it's true."

A mortgage is just a low interest loan. There's nothing sinister about it.

90

posted on

08/15/2017 9:12:25 AM PDT

by

mlo

To: Terry L Smith

Are you an avid gun lover? No such thing can be had in an old folks home.LOL. A few days ago I was downtown and saw an elderly man walking down the street carrying a shotgun. Patrol car saw him too. They and I and everyone else on the street ignored him.

That's the trouble with assisted living facilities, they NEVER ignore you.

To: TexasGator

The key is not to make any major improvement to the property after you have been locked in (an addition, ect).

You buy something very new, or very recently renovated just prior to turning 65 that might even be under valued on the tax rolls... then apply to lock in the current rate as soon as you turn 65 and then dont make any major improvements to the property which will reset it.

here is an article about how the freeze is affecting cities budgets:

https://www.dallasnews.com/news/news/2010/01/17/Property-tax-cap-for-seniors-puts-8031

To: TexasFreeper2009

“The key is not to make any major improvement to the property after you have been locked in (an addition, ect).”

You are only locked in on school taxes. All the other many taxes can still increase. Been there, done that.

To: TexasFreeper2009

That cap is for municipal taxes, NOT county taxes!

To: Texas Eagle

I asked a friend why the hell he agreed to crazy alimony and he said “for the tax deduction.”!

95

posted on

08/15/2017 10:38:19 AM PDT

by

yldstrk

(My heroes have always been cowboys)

To: Texas Eagle

“It took us some time but we finally figured out how stupid the whole concept of paying a mortgage to get the tax deduction is.”

I don’t know what math you used, but it wasn’t correct if that is your conclusion. Even when renting, someone had to pay the taxes and mortgage and you pay beyond that.

96

posted on

08/15/2017 10:40:28 AM PDT

by

CodeToad

(AA)

To: MSF BU

“case not to pay off the mortgage because it is ‘cheap money’; personally I don’t agree with them”

If you earn more in investment more than you pay in interest, it makes sense to keep your money in the investments. It is as simple as that.

97

posted on

08/15/2017 10:41:17 AM PDT

by

CodeToad

(AA)

To: MSF BU

Slippery slope but some times you have to. We rolled our expensive debt into the mortgage. Had no choice really. But a bad practice to get into.

To: moovova

They're just gonna have to start dragging those wrinkled old while people outta their houses and giving the properties to more deserving folks of color.

"Yes, this is a better arrangement, Comrades. More just."

99

posted on

08/15/2017 10:43:05 AM PDT

by

dfwgator

To: Texas Eagle

Better numbers: Take what you pay in rent and write that down. It’s gone, no tax deductions for that.

Then, write down what you pay in a mortgage, subtract out what you save in taxes.

The mortgage will be smaller.

Not to mention the painfully obvious point that if buying properly there is also appreciation in the home that becomes free money when you sell.

I make more in appreciation every month than I pay in mortgage.

100

posted on

08/15/2017 10:43:40 AM PDT

by

CodeToad

(AA)

Navigation: use the links below to view more comments.

first previous 1-20 ... 61-80, 81-100, 101-120, 121-139 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.