Skip to comments.

Baby boomers are refusing to sell and will age like a fine wine in their homes.

Dr Housing Bubble ^

Posted on 08/15/2017 6:42:18 AM PDT by Lorianne

Older Americans own half of the houses in the market. Many are simply refusing to sell and others have adult “kids” moving back in since they can’t afford a place to rent or buy. It is a Catch 22 and many people are looking at countries like Italy where the number of adults that live at home is enormous. Multi-generational families just don’t coincide with the “rugged American” worldview where you go out on your own and you make it with your own two hands. Of course, many house humpers had mom and dad chip in but that doesn’t make for such a sexy story. In the end, however there are many baby boomers that simply are not selling. This is actually an interesting problem that is not going away.

Refusing to sell

Housing used to be a young person’s game. The U.S. housing market and to a large extent, the economy was driven by home buying and big ticket purchases. But that has definitely changed since the housing market imploded with the 2000s. It has also changed in terms of people marrying later, having fewer kids, and basically preferring to live in city centers versus suburbs. In other words, not a big need for McMansions.

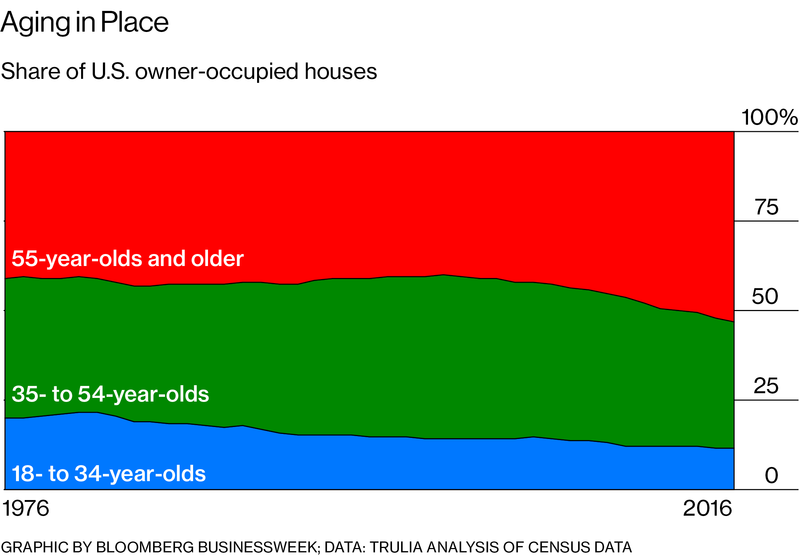

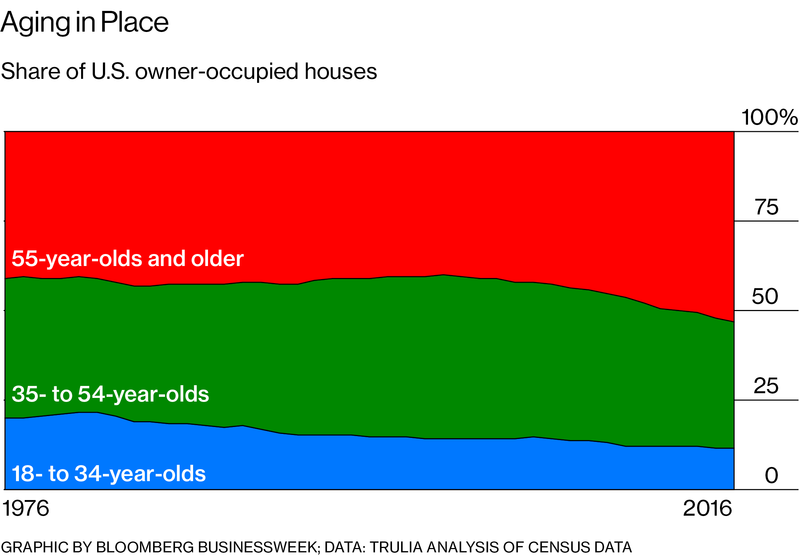

The oldies but goodies are now occupying a larger share of housing:

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

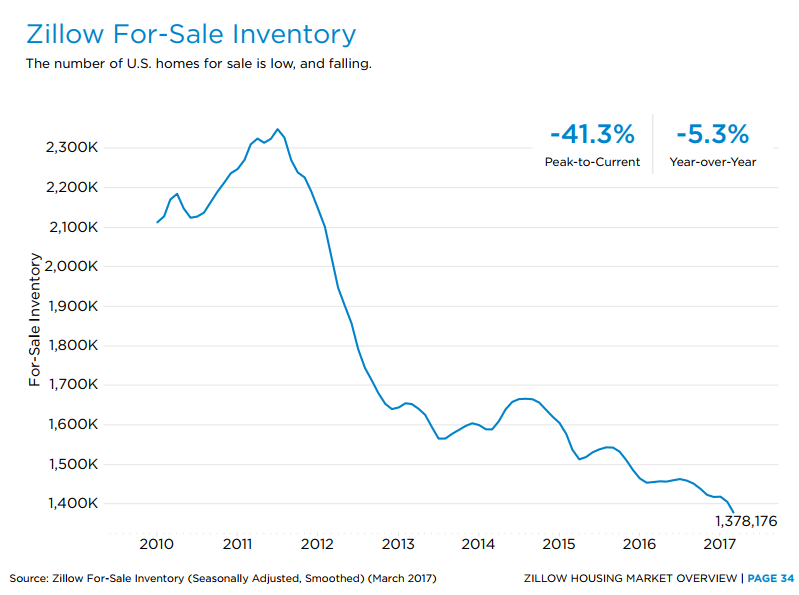

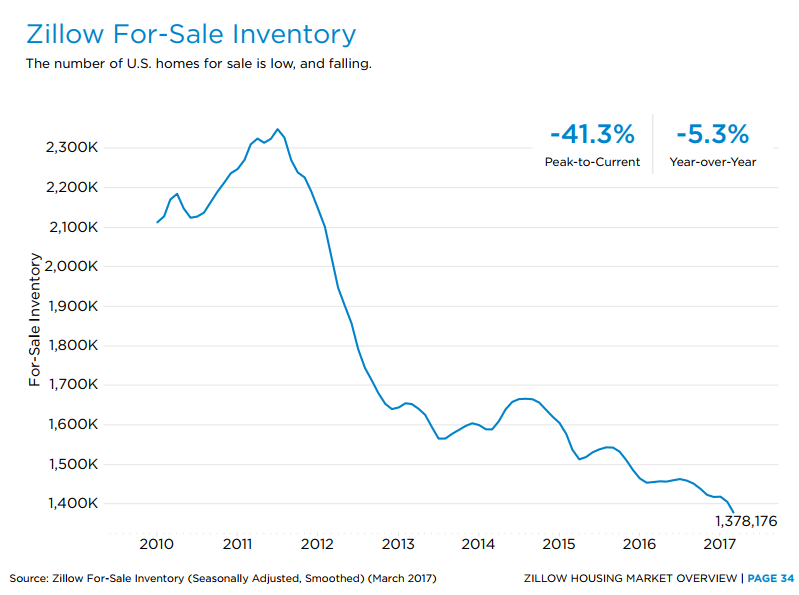

But housing has gotten more expensive across all U.S. metro areas so this is a much larger trend. It has absolutely crushed the available inventory out on the market:

SNIP

TOPICS: Business/Economy

KEYWORDS: babyboomers; elderly; housing; seniors; trends

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-139 next last

To: Lorianne

And when they find out they need to downsize, that home will be an albatross.

41

posted on

08/15/2017 7:14:59 AM PDT

by

OpusatFR

To: Texas Eagle

42

posted on

08/15/2017 7:15:54 AM PDT

by

BBB333

(The Power Of Trump Compels You!)

To: txrefugee

My 99 year old mother(as of today) has been in assisted living for 9 years and the cost is approaching $10,000 a month. I would encourage anyone who can avoid these places to do so. They’re money making machines and from what i can see not worth the expense. The problem is that have you by the throat and they know it.

43

posted on

08/15/2017 7:16:15 AM PDT

by

surrey

To: txrefugee

My 99 year old mother(as of today) has been in assisted living for 9 years and the cost is approaching $10,000 a month. I would encourage anyone who can avoid these places to do so. They’re money making machines and from what i can see not worth the expense. The problem is that have you by the throat and they know it.

44

posted on

08/15/2017 7:16:25 AM PDT

by

surrey

To: MSF BU

I’m looking at a home in Maine today. Good price, lower real estate taxes than where I am in now although I’m concerned that they’ll grow by leaps and bounds in the blue state.

To: surrey

Yes, between 10-12 thousand a month. For it, you get a room, cleanliness and fairly bad food. And my mom was in a good one run by nuns straight out of The Sound of Music. My brother kept saying that for the money, we should have put her in the Ritz Carlton.

To: spokeshave

And who pays the tax when renting?

To: PAR35

Are you math impaired, or logic impaired? The only way your formula works is if the alternative is living in your car. Let's do the math together, shall we?

We'll use round numbers to make it easy. You do know what round numbers are, don't you?

Okay. Let's start.

Let's say your mortgage is $1,000.

There are 12 months in a year. With me so far?

12 x $1,000 (that little "x" represents "multiplied by" or "times") = $12,000. Write that number down somewhere. We will be coming back to it.

Still following?

Now, let's say the interest on that payment is $500.

Take that and multiply it by 12 and write that number down.

Now, subtract that number from the first number, $12,000.

Which number would your rather have in your bank account?

I must leave for work now, so you have 10 hours to work on this.

I'll be back to grade your answer tonight.

48

posted on

08/15/2017 7:23:46 AM PDT

by

Texas Eagle

(If it wasn't for double-standards, Liberals would have no standards at all -- Texas Eagle)

To: TexasFreeper2009

If that were true we would have stayed in Texas!

To: Lorianne

If you have a lot of money, the best strategy is not to build a McMansion, but instead build a smaller, quality home that is durable, with very low and easier maintenance, high efficiency, very conservative with water and power, and flexible enough for internal and external redesign.

The idea is to create a home that can function with little money for hundreds of years, in a place not prone to future development, relatively safe from natural disasters, and out of sight, out of mind of government.

50

posted on

08/15/2017 7:25:00 AM PDT

by

yefragetuwrabrumuy

(HitlerÂ’s Mein Kampf, translated into Arabic, is "My Jihad")

To: Lorianne

A few years after turning 70, my trophy wife for more than a half century, and I, decided that we lived in a great neighborhood and liked our neighbors. We lived in a good town and belonged to a good church. We decided a smaller home or a retirement center was not for us.

We decided that, we would be like a couple of our former neighbors and not leave our home, until we were carried out feet first by the coroner’s office.

Our home is basically one level with a few steps to get in from our carport and with only a few steps in a part of our home we only use for guests or dinner parties.

So we had a ramp put in for us and guests to get into our home from the carport. Had a new roof with heavy duty insulation, two ac/heating units, one for the area we don’t use that much and one for our family room, kitchen, and master bedroom. We keep the mostly unused area at 62 degrees. We have a Nest thermostat. where we spend most of our time. I can control the Nest with our android phone here or away.

Inspite of price increases on Gas and Electric, our PG&E bill is less per month than before the retro. The monthly printout shows we are doing better than newer so called highly efficient homes in our area.

We put in a walkin shower with tiled bench if we want to sit down, in the Master BedRoom area.

We had a large on demand natural gas water heater installed. It comes on 15 minutes before we up and stays on until about 9 am. It comes on before dinner time and stays on until about 7pm. Any other time, we can have hot water in less than a minute for shower or whatever. This saves a huge amount water as little is wasted to get hot water, and there is no constant heating to maintain hot water.

Then, we recarpeted our home with the heavy insulated padding to block cold from coming up to the floor. We have hardwood floors in our family room and kitchen, and we had insulation put under those floors for more comfort.

This morning is an example of great comfort. Our inside temp is 68 with no heating and an outside low of 54 and a temp of 58 now, close to 7:30 am. The inside temp will stay in that range without any heating or AC today.

We had the exterior of our home repainted with a 20 year paint.

Our kitchen had been retrofitted with new appliances a few years before. It still looks great and like new inspite of being used everyday we are home.

We have 3 couples and a widow lady on our cul de sac who have done the same as us, and they plan to stay here to their end. Two couples in retirement have moved to our block the past year, and they will stay in their new homes to the end. We are divided into 50% a little past Boomer age and about 50% Boomers with two families with children.

When this happens across the nation, the supply of homes can’t meet the demand. So, the value of our homes increase each year.

Our home is in a trust and should be a nice inheritance for our surviving adult children and grandkids. That will handle a lot more than our home loan and line of credit that paid for all of the above.

51

posted on

08/15/2017 7:26:11 AM PDT

by

Grampa Dave

(Voting for Trump to be our President, made 62+ million of us into Dumb Deplorable Colluders, MAGA!!!)

To: Lorianne

If one lives in a paid-for house in a nice neighborhood and can afford the bills, why move? The way things are going, who knows what would turn out to be a good move in the future. The first over-55 developments were okay, but the ripoffs that are being built now are overpriced, the monthly fees are out of sight, and they don't have the amenities of the originals.

They keep trying to put us in progressively smaller boxes. No thanks to that!

52

posted on

08/15/2017 7:26:53 AM PDT

by

grania

(Deplorable and Proud of It!)

To: Lorianne

More whiny millennials. People live longer healthier and there has been all of a 5% uptick in the share of homes owned by older folks in the last 40 years. Considering it takes young adults a decade longer to approach actual adulthood this is a negligible increase all around.

To: txrefugee

Someone had written an article about a woman who essentially lives on a cruise boat.

At about $1000 a week it was cheaper than an assisted living home, and someone cooks and cleans up and she travels all over.

54

posted on

08/15/2017 7:29:38 AM PDT

by

Mr. K

(***THERE IS NO CONSEQUENCE OF REPEALING OBAMACARE THAT IS WORSE THAN OBAMACARE ITSELF***)

To: yefragetuwrabrumuy

If you have a lot of money, the best strategy is not to build a McMansion, but instead build a smaller, quality home that is durable, with very low and easier maintenance, high efficiency, very conservative with water and power, and flexible enough for internal and external redesign. The idea is to create a home that can function with little money for hundreds of years, in a place not prone to future development, relatively safe from natural disasters, and out of sight, out of mind of government.

I have a recurring daydream of buying a lot of land in Texas or perhaps Tennessee and building one of those concrete dome homes for my golden years. One level, modest, secure. And not ridiculously expensive from the little bit of looking I've done online.

55

posted on

08/15/2017 7:29:56 AM PDT

by

LostInBayport

(When there are more people riding in the cart than there are pulling it, the cart stops moving...)

To: Obadiah

My wife and I are baby boomers "aging like fine wine" in our oversized suburban home. We've looked into apartment style living but it just doesn't appeal. It just seems like a hassle dealing with neighbors that close. It's still nice to pull into our own driveway and have nobody living on top of us (or under us). It does suck sometimes to mow your lawn and shovel snow but that's what we have landscapers and plow services for.

BTW, all our children are moved out and on their own. It's nice to come home to a quiet house and have all those extra bedrooms for guests. Having grown children living at home must get old rather quickly.

To: Lorianne

My Wife and I are 80/82. We sold our big home 4 years ago and downsized to 1900 sqft. Our Mortgage + Taxes + Insurance is $670./month. We don’t have enough Deductions to Itemize so Mortgage Interest has no affect on us Tax wise. This is best for us.

57

posted on

08/15/2017 7:31:13 AM PDT

by

TNoldman

(AN AMERICAN FOR A MUSLIM/BHO FREE AMERICA. (Owner of Stars and Bars Flags))

To: Texas Eagle

It took us some time but we finally figured out how stupid the whole concept of paying a mortgage to get the tax deduction is.

Yep. Spending a hundred dollars to get a $5 tax deduction is kinda, well, dumb.

We did get a mortgage but it was a 15 year one, at absurdly cheap interest rates, and what we needed to do to get our 32 acres and a house in central KY. And it cost less than a quarter what a 3 bedroom rambler in any major metropolitan city’s suburbs would cost.

And the annual property taxes are less than a single month’s car payment on a Toyota.

We will either die there or stay there until we go to assisted living. All the kids and grandkids are staking claims. :)

To: Texas Eagle

The only way your logic works is if you live out of your car!

To: MSF BU

There are financial planners who can make a case not to pay off the mortgage because it is ‘cheap money’;

Well, I guess if you are investing the money somewhere where it pays you more than you are paying for the money, they are right. Otherwise, it’s stupid.

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80 ... 121-139 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.

Over half of homeowners in the U.S. are now 55 and older. And this figure is only going to grow over time. In places like California, the Taco Tuesday baby boomers own the housing market. This is just a fact and has kept inventory to a very low level.