Posted on 01/13/2022 5:10:48 PM PST by blam

During an interview with CNBC Thursday afternoon, Hayman Capital founder Kyle Bass joined Jeffrey Gundlach and other astute observers of the market by postulating that the Fed won’t be able to succeed with its planned 4 interest-rate hikes by the end of the year.

“Gundlach said that the Fed could get to 1.5% on the Fed funds rate, which might happen in the next 12 to 18 months. But that would trigger a recession,” he said.

But by the time the Fed gets to the second hike, markets will tank, forcing the central bank to backtrack.

Kyle Bass agrees with Gundlach (and the market): “The Fed can’t raise rates more than a 100-125 bps before they have to stop”

— zerohedge (@zerohedge) January 13, 2022

Speaking during his first CNBC interview of the year, Bass argued that there’s a “huge mismatch, I think, between policy and reality…when you look at the reality of hydrocarbon demand…the reality is that…we’ve been pulling CapEx out of the oil patch because we so desperately want to switch to alternative energy. The problem is you can’t just turn off hydrocarbons. It takes 40 or 50 years to switch fuel sources,” Bass explained.

And as the global economy shakes off the impact of the pandemic, Bass predicted that “the same forces that applied to bring oil below zero [back in April 2020] will apply on the upside. We will get the world reopened by the middle of the year…you can’t just flip on an oil well…the only people funding the oil patch are family offices.”

As demand for oil intensifies, the dynamic will send prices on front-month contracts “well above” $100/barrel”, Bass projected.

“There are so few people out there funding CapEx…if we reopen, you’re going to see numbers that people aren’t ready for.”

Bass’s interlocutors then opted to switch gears with some questions about China. After Wilfred Frost gently accused Bass of being a China bear, Bass insisted that he considers himself a “China realist” before launching into a discussion of China’s real-estate market.

As many investors may have learned from all the reporting about Evergrande and other deeply indebted China developers in recent months, roughly one-third of China’s economy is driven by real estate.

The surge in prices has contributed to China’s demographic nightmare, Bass said. “…the average birth rate of women in China fell below 1.2…you had an aggressive population decline because men can’t afford to buy homes because they’re priced at 20x to 30x their annual income.”

This has become a problem for China’s leaders.

“Xi needs real estate prices down and he needs them to stay down,” Bass said.

As for those who are betting on a bounce in Chinese stocks, Bass characterized this as “a fool’s game.”

As for whether or not he’d ever invest in Chinese stocks again, Bass replied:

“Fool me once but you’re not going to fool me twice…I feel like people who are investing in Chinese equities are breaking their fiduciary duty to their investors.”

Circling back to a discussion about the Fed, Bass pointed to Goldman’s call for 4 hikes this year. When the Fed does deliver on the rate hikes it has led the market to expect, “the curve is going to flatten, the long end of the curve will invert and the Fed” will likely need to throw it in reverse.

“My personal view is they can’t raise short rates more than 100-125 basis points before they have to stop,” Bass said.

Once this happens, a recession in the US will likely follow.

“I think they’re going to have to back away from that plan once they start hiking…that’s my view.

With all this in mind, “there’s no way the stock market goes up this year and it probably goes down pretty aggressively,” Bass concluded.

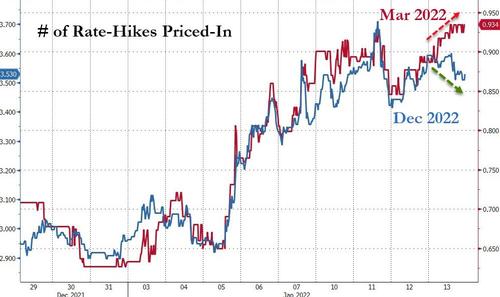

And once the Fed starts hiking rates, this, compounded by surging oil prices “will compound people’s inflation problems.” And that is already very modestly bring priced in… March rate-hike odds are rising to cycle highs but the odds of 4 rate-hikes by year-end are sliding…

So, after more than a decade of easy money policies, 2022 is shaping up to be a difficult year for American consumers.

Pay off debts, of course.

Never said that it would be a reality - just letting folks know of the important concept that paying off debt reduces the money supply in the amount of the paid off debt (assuming it's bank-owned debt).

The Fed bought corporate debt that was worthless - bad loans. They bought this debt at face value - acting like it was AAA rated.

Nobody will buy it now. It has no value. It's safe enough on the Fed's balance sheet - but there's no way to disburse of it going forward.

Oil didn't skyrocket in 2008. In fact, in the economic newsletter I was writing back then I forecast oil to drop to $30.

A complete unwinding of all debt would result in zero money. Not saying it would happen - just showing the mathematical fact.

The Fed is holding a lot more than bonds right now. They're also holding corporate debt - they never had done that.

Pay off debts, of course.

There is more savings than debt. Of course.

When? How much?

That's exactly why they can't and won't. We're seeing price inflation in the face of monetary deflation.

They won't raise in that scenario - unless they're blooming idiots that want to destroy our markets (that are unhealthy to begin with).

One of the largest problems we have right now is taking out bank loans (creating new money) and directly putting that money into equities. Nothing is tangible in that scenario. It does nothing but create an enormous balloon that will pop at some point. There's no getting around it.

You haven't read the link I posted from the Bank of England.

Your premise is a faulty one.

I heard you the first time. So you can't explain how or why my $20s would go away.

I posted the link to the latest H.4.1 report. It's trillions of bad debt, being held as bank reserves.

In return, the Fed gave the institutions that originally owned the toxic waste newly created money - represented the full face-value of the toxic notes.

I actually explained it quite clearly.

Meanwhile, you throw out your single sentences that fail to disprove what I've been saying.

You work for the banking sector? You seem very defensive of it.

I don't need to read the entire paper to know that savings are larger than debts.

I always look forward to these exchanges.

As far as I can see, all the corporate bonds from the COVID programs are gone. They were never close to $1 trillion, let alone multiple trillions.

Page 6 of the H.4.1

$2.6 trillion in MBS

Doesn't look like government debt to me.

“It’s trillions of bad debt, being held as bank reserves.”

So why is that a problem? What effect does it have?

“$2.6 trillion in MBS”

Sounds like Mortgage Backed Securities. Is that Fannie and Freddie paper?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.