Posted on 07/01/2025 6:07:10 PM PDT by thegagline

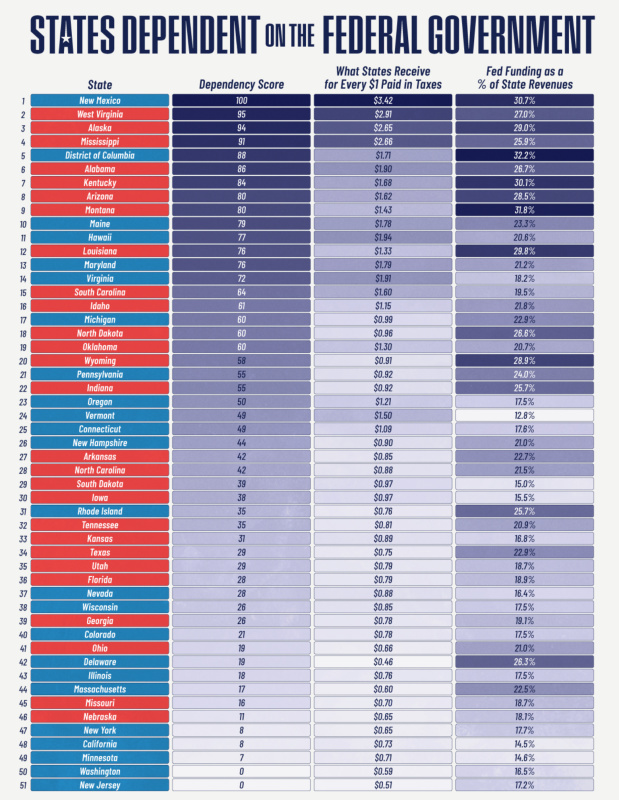

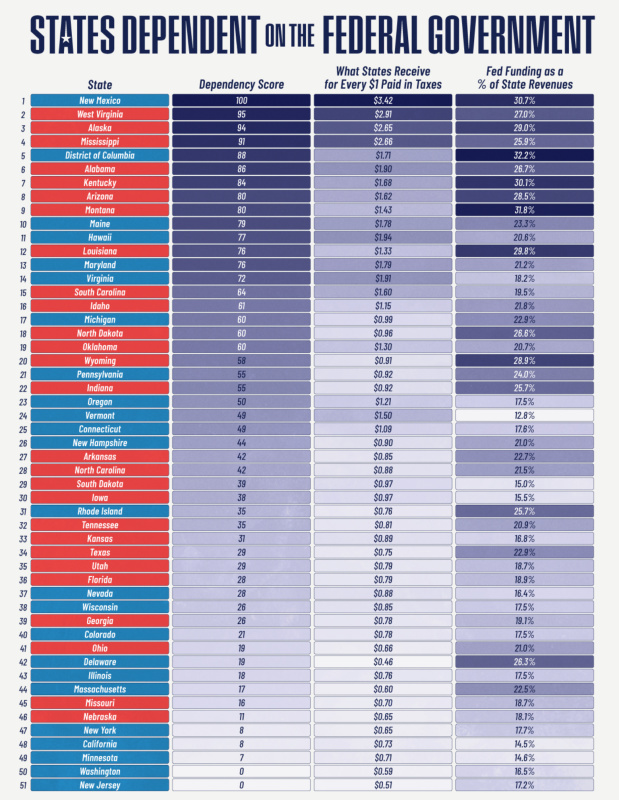

How reliant is your state on Uncle Sam’s wallet?

Every year, billions in federal tax dollars are redistributed to the 50 states and the District of Columbia through grants, contracts, and benefit programs. ***

Their dependency score blends two metrics: the state’s return‐on‐taxes ratio and the share of state revenues coming from federal sources. Importantly, this data does not include Medicaid payments.

Finally, a state’s political affiliation is based on its voting history in the past five presidential elections. New Mexico tops the 2024 list for states most dependent on the federal government, with a perfect score of 100.

Its residents receive $3.42 for every tax dollar they send to Washington, while the state covers nearly a third of its budget with federal funds.

***

Federal Dependency: Red vs. Blue States MoneyGeek’s ranking reveals a partisan tilt: seven of the states with the top 10 dependency scores are red, including conservative strongholds such as Alabama, Kentucky, and Montana.

Meanwhile, 11 of the 20 net tax recipient states have voted Republican in at least three of the past five presidential elections.

Yet political color is not destiny. Deep-blue New Mexico and D.C. also sit near the top.

MoneyGeek’s analysis points to economic structure rather than ideology: energy extraction, military installations, and a high share of retirees often correlate with greater federal inflows.

The Big List of Donor States At the opposite end, New Jersey and Washington score zero, receiving roughly half a dollar back for every dollar paid their residents pay in taxes.

California, New York, and Minnesota also run sizable “deficits,” each collecting less than 75 cents on the dollar.

These donor states tend to have large, diversified economies and higher-than-average household incomes, boosting tax receipts while limiting eligibility for certain federal aid programs. ***

(Excerpt) Read more at visualcapitalist.com ...

Then, many move to an area they never worked in, raised kids in or were part of a community for decades and get the benefit of merely retiring there. They walk into the area getting homestead via their age. Lots of areas are like that.

You mean the unfunded mandates foisted on the states

Does this table include military bases as Federal revenue?

What about Federal lands value in the state? Is that subtracted from the total?

How much is it worth to New Jersey to have nuclear weapons based in a Red state?

“Importantly, this data does not include Medicaid payments.”

SNORT.

Not surprised to see Kentucky there. It makes you wonder why the KY pols (Paul, McConnell, etc.) don’t spend more time fixing their state than finding new ways to stir up trouble for all of us.

Apparently, you did not notice that I put the word “deadbeats“ in quotation marks. It was not meant as an insult to retirees. It suggested that is how the left looks at retirees.

The only thing this list tells us is where military bases and government labs are located.

The federal government supplies 26.7 % of Alabama’s budget. Coincidentally, 27% of Alabama is black. Here in Alabama, most of the blacks are from rural areas where they used to share crop, but modern agriculture has put and end to that. The rural counties have no industry and never will; its just too rural. They could move where the jobs are and many did in the 1920-40s. But those that remain have to be taken care of.

The other federally dependent states also have large percentages of Indians, Eskimos, Hispanics, blacks and out of work coal miners.

Welfare benefits gobble up mountains of moneys.

High income numbers and the taxes paid from individuals & the businesses they own in states close to financial and trade hubs is a huge factor. Many of these states are in political control of Democrats.

Military spending is another way the liberals who slant these studies create a media narrative to their advantage. They’ve created the red state “moocher & taker myth” that makes federal military spending a red state spending benefit....which is BS.

Lastly, liberals have set up federal system where the most impoverished Americans get federal financial assistance. Many states that vote Republican are in this position because of a globalized economy that doesn’t really benefit them, minority groups that lack money, environmental policies, and geography.

States don’t pay federal taxes, people do. Likewise states don’t receive welfare money, people do. I live in Mississippi and I can assure you I don’t benefit a dime from any federal money while I pay far beyond my “fair share” because I’m a single, moderately high wage earner. My state is a “red state”, the people voting red aren’t where the money is going. We get tired of watching the 40% who never worked a day in their lives waddle into Walmart with their six kids by six baby daddies whip out their EBT cards and help themselves to steak using our tax dollars. Right now we’ve got enough people who pay taxes and are sick of seeing that, when we get to the point where the majority are welfare parasites the state will turn blue overnight.

Of course, a state with higher incomes and a large population (such as NJ) will generate more federal tax revenue than a state with lower incomes and a smaller population. The report just shows the federal government receives much more money from some states than it spends in those states.

Here's a chart that shows Federal Tax Revenue by State in 2024. (I'm not a big fan of Wikipedia, but the numbers on that chart match the numbers on the IRS report of Gross Collections by State.)

Ding Ding Ding!!!! Ya done broke the code.

1. If the figures include Social Security and Medicare taxes and expenditures, then states that are major retirement destinations will be higher on the list. People who relocate for retirement pay their taxes during peak earning years in one state while collecting retirement benefits on another.

2. Most of the stares at the top of the list have few, if any, large urban centers. Cities have higher living costs than rural areas, which means they have large numbers of middle-class taxpayers in higher tax brackets.

About the same as it is to have nuclear weapons stored at Earle NWS which is in NJ.

“I can assure you I don’t benefit a dime from any federal money”

So you never use a public highway, drive across a bridge or turn on electricity ??? All of those have been or are subsidized by Federal government grants or loans to Mississippi.

Please see my post #31 above.

The report at the top of this thread compares federal tax revenue to federal spending by state.

And the federal government collects much more tax revenue from states with higher incomes (such as NJ).

I agree that Medicaid should be included in the numbers. But it probably won’t change the results much, if at all.

It’s not about blue states vs. red states. New Mexico is a blue state, and it’s at the top of the list.

It’s all about income and the progressive tax system.

Every time these reports come out, the people in red states don’t want to believe the numbers.

It’s all about income. A state (such as NJ) with higher incomes (and a larger population) generates more federal tax revenue.

But, if you want a breakdown by race, consider this...

In NJ, the median household income for “black/African American” is about the same as the median household income for “white” in Alabama, Louisiana, and Mississippi. And it’s $10,000 higher than the income for “white” in West Virginia.

The average income in NJ is higher. The average income in those other states is lower.

https://www.neilsberg.com/insights/new-jersey-median-household-income-by-race/

https://www.neilsberg.com/insights/alabama-median-household-income-by-race/

https://www.neilsberg.com/insights/louisiana-median-household-income-by-race/

https://www.neilsberg.com/insights/mississippi-median-household-income-by-race/

NY has almost no military facilities. So I suspect most of its Federal dollars go to retirees, colleges and universities and, especially, welfare for the de-industrialized upstate and its hordes of parasites in NYC. In other words, Federal dollars from the middle class supporting the corrupt social arrangements that bolster the Dems.

Agreed !!!

Also some folks don’t realize that a state like New Jersey funds almost 100% of roadway construction and maintenance through state taxes and tolls. It receives almost no Federal funding for highways. Whereas a state like Mississippi only funds about 50% of its highway transportation obligations at the state level and the other 50% is largely funded by Federal Department of Transportation grants or loans.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.