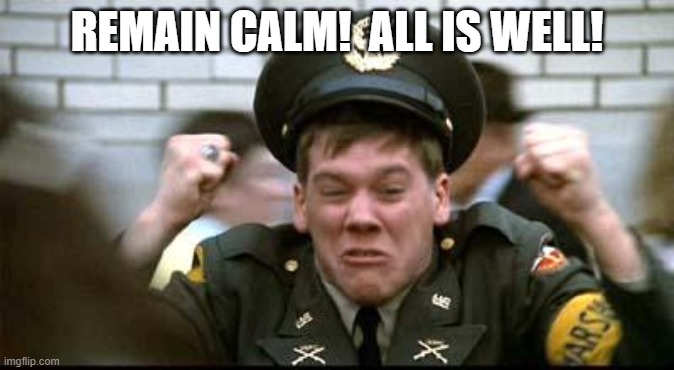

It's hard to calm down when they're after me.

Posted on 03/22/2025 7:24:37 PM PDT by delta7

Bitcoin uses blockchain technology which remains fully open and accessible to everyone. Due to the nature of the transparency of the blockchain, money flows can easily be tracked. But can government track bitcoin?

Can the Government Track Bitcoin, or is it Anonymous?: A central aspect of Bitcoin since its inception has always been privacy. Bitcoin originally exists as a peer-to-peer form of digital cash that retains privacy through the anonymity of public keys. Bitcoin famously grants privacy to its users, leveraging the ideals of security and autonomy in a digital world that seems extremely devoid of both things. But can the government track Bitcoin?

Since 2013, various studies have been conducted that look into tracking Bitcoin transactions and their associated identities. While it is possible to create a certain degree of anonymity with cryptocurrencies, sending transactions completely anonymously via the Bitcoin blockchain remains impossible.

Key takeaways: Bitcoin uses blockchain technology which remains fully open and accessible to everyone. Due to the nature of the transparency of the blockchain, money flows can easily be tracked.

Governments and law enforcement can use KYC documents uploaded to an exchange to identify both the sender and receiver of Bitcoin transactions.

Are Bitcoin transactions traceable? Experts have found Bitcoin to be pseudonymous instead of anonymous. Each Bitcoin has one public key and one private key code. While the former identifies it on the blockchain, without the latter one cannot send it from a digital wallet to another. This is due to the way the unknown creator has built Bitcoin. These functions aims to cut the trusted third party out of the transaction and allow the two parties to make trustless transactions.

Also Read: As Web3 Gaming Goes Mainstream, Lack Of Asset

In Bitcoin, each transaction is cryptographically time-stamped and written onto an unchangeable or immutable digital ledger. Double-spending is not possible as the information is publicly visible. This means each Bitcoin transaction can be easily tracked from the moment the token was created. However, the identity of the owner is not revealed.

In Bitcoin, proof of ownership comes in the form of the private key code, which is also required to initiate a transaction and send the Bitcoin to another person. Once sent, the code is burned, and a new one is created when the BTC is received. Thus, Bitcoin’s owners are hidden behind a public key code, and the proof of possession is provided by the private key code. It should be noted, however, that possessing the private key code is not the same as legal ownership.

A user can trace the amount sent and the addresses in a transaction. However, these transactions can only be traced to the user’s public key, which does not provide any personal information or real-world identification. In other words, blockchain explorers can help trace transactions and obtain wallet addresses, but they cannot find the identity linked to the address. This grants BTC users pseudo-anonymity.

Are Bitcoin transactions really anonymous? Only the public key, which is a string of alphanumeric characters, can be used to identify transactions on the blockchain. This means that nobody can ascertain the real-world identity behind the public keys, even though they can look at the transactions and their holdings. However, this changes when one needs to exchange their cryptocurrency for cash or other tokens or to get a cryptocurrency debit card.

Also read: What is a Merkle Tree In Blockchain

To do this, cryptocurrency users need to register with a centralized cryptocurrency exchange, crypto bank, or decentralized application. However, the majority of these platforms require new users to complete a KYC process. By doing so, one can create a link between real-world data and the public key of a wallet. Any individual can use this information to easily exploit and uncover details about the identity of the person behind a particular wallet’s public key.

Can the government track Bitcoin owner? Transactions in Bitcoin are easily accessible by the public due to the transparent nature of blockchain technology. The government may use law enforcement authorities to see what happens on the Bitcoin blockchain. This opens up opportunities for authorities such as the Federal Bureau of Investigation (FBI) and the Internal Revenue Service (IRS) to trace Bitcoin ownership.

Authorities can simply analyze the BTC addresses for transactions to find out where it came from and where it will reach. Because many BTC users reveal their identity at some point, government entities can trace Bitcoin ownership whenever transactions reach that point. With this information, governments can enforce tax liabilities on Bitcoin and other cryptocurrencies.

Can the government track Bitcoin? Authorities such as the police, the IRS, or the FBI can track Bitcoin. However, enforcers may not directly identify the parties involved in a BTC transaction. They can instead try to observe and analyze BTC movements and corresponding patterns in an effort to profile, de-anonymize, and identify those that are transacting.

Also Read: What is Physical NFT in Blockchain

It’s a fact that not all Bitcoin transactions have a link with criminal activities. However, enforcers such as the police and other entities are always on the lookout for people or organizations that use cryptocurrencies such as Bitcoin for illicit purposes, such as fraud and money laundering. Agencies responsible for tax collection also want to track BTC owners, traders, and investors to raise taxes from them.

Certain companies, such as Chainalysis, can provide services for blockchain analytics and monitoring. They can determine whether certain Bitcoin transfers between wallets have a link with criminal activity or not. They may share this data with authorities to help investigators track certain crypto funds on an international level.

Can anyone have an anonymous Bitcoin wallet? While it’s possible to have an anonymous Bitcoin wallet, it is not enough to ensure anonymity. When a transaction takes place, a link between a wallet and the identity develops. It has become increasingly challenging to conduct transactions in a completely anonymous way. due to tightening KYC rules for exchanges around the world.

However, there are certain cryptocurrency wallets that allow users to operate completely anonymously. An example of this is the Electrum wallet, which users can integrate with a hardware wallet as well. However, it won’t serve the purpose of the anonymous wallet that received BTC from an exchange with KYC.

Can Bitcoin transactions be anonymous? There are certain ways one can get around the limitations, but they are often technical and expensive. One can set up a special protocol to hide the origin of the transfer. Once that’s complete, the user has to regularly cycle through different wallets to achieve anonymity. Another way to maintain anonymity while using BTC is to buy it with cash using a Bitcoin ATM.

Final Words Bitcoin is pseudonymous in nature as it relies on public identifiers that are not always with civic identities. This makes Bitcoin transactions different from those involving cash or conventional digital transfers. Thus, anonymity is not a function of Bitcoin or blockchain technology. However, it is a practical achievement that rests on the crucial link between civic identities and Bitcoin addresses.

Of course they can track it.

If you want anonymous and 100% fungible you need to get piratecoin or zcash anonymous.

It’s not. It’s called a public ledger for a reason.

If anyone knows your “address” they can track everything in and out of it.

Blockchain is a totally transparent accounting system.

Everything is traceable. That’s the point.

https://coinledger.io/blog/can-the-irs-track-cryptocurrency

“ Can the IRS Track Cryptocurrency? (2025 Update)…

Key takeaways:

Major exchanges like Coinbase and Kraken report to the IRS through 1099 forms.

In addition, the IRS works with contractors like Chainalysis to analyze public blockchain transactions and match ‘anonymous’ wallets to known investors.

To avoid future trouble with the IRS, investors should report all taxable income from crypto on their tax return.

Trying to evade cryptocurrency taxes is a bad idea.

As the cryptocurrency ecosystem has grown in size, the federal government has dedicated more resources to crack down on crypto tax fraud.

In this guide, we’ll break down everything you need to know about how the IRS tracks cryptocurrency transactions. We’ll also share a simple method that can help you report your cryptocurrency on your tax return in minutes.

Is Bitcoin Traceable?

Yes, Bitcoin is traceable. All transactions are recorded on a public ledger (the blockchain), enabling governments and law enforcement agencies to track funds.

Here are a few examples of the federal government tracing BTC transactions:

FBI Seizure of Silk Road Bitcoin: In 2013, the FBI tracked and seized over 170,000 BTC linked to online marketplace Silk Road by analyzing blockchain data and identifying wallets associated with illegal activities.

Colonial Pipeline Ransomware Case: In 2021, the U.S. Department of Justice recovered $2.3 million in Bitcoin paid to hackers by tracing the ransom through wallet addresses and exploiting weak security.

IRS Crypto Investigations: The IRS has worked with contractors like Chainalysis to analyze blockchain data, uncover tax evasion schemes and track unreported cryptocurrency income.

Can the IRS track anonymous wallets?

Because cryptocurrency transactions are pseudo-anonymous, many investors believe that they cannot be traced. This is not true.

Most major blockchains have publicly visible transactions. That means that the IRS can track crypto transactions simply by matching ‘anonymous’ transactions to known individuals.

In recent years, the IRS has increased its budget to deal with tax fraud. In 2021, the IRS launched ‘Operation Hidden Treasure’ — a partnership between the IRS’s Office of Fraud Enforcement and Criminal Investigation Division aimed specifically at tax evasion on the blockchain.

In 2022, the IRS was granted an $80 billion budget increase to add 87,000 new agents, giving the agency more resources to crack down on crypto tax fraud.

Do major exchanges report to the IRS?

If you’ve signed up with a cryptocurrency exchange, you’ve likely given personal information such as your name, date of birth, and a copy of your personal ID. Major exchanges that operate within the United States are required by law to collect this information due to Know Your Customer (KYC) regulations.

When you sign up for major exchanges, you are required to provide the following information:

Name

Date of Birth

A photo of yourself alongside ID

The IRS can and has requested these records from exchanges. In the past, the IRS has issued John Doe Summons to exchanges like Coinbase and Kraken….

Your “address” is anonymous if you do Bitcoin correctly (no exchanges, no reusing an address, no “KYC” buying/selling).

It is peudonymous. “They” can track it (since it’s an open ledger), but don’t know who it is who traded it. But eventually, if “they” are agressive tracking it and put two and two together, from that point on will know who it is.

I have been buying bitcoin since 2013. I really don’t need a primer about it.

All I ask that you calm down your one person jihad and stick to facts.

I’d bet even non-US government, financial, and intelligence entities can put together who and what are behind it at any time.

“The blockchain, which is public information, maintains records of all bitcoin transactions, but names and addresses are not part of the blockchain.”

No but all your internet access and computing equipment can be traced directly to you.

Phone Carrier or internet provider account information including name and physical address. Unique device ID numbers which are associated with equipment warranties and sales records if it was purchased with a credit card or check which can also identify you. Even down to the unique device number of the USB stick holding your wallet if you use one instead of a hardware wallet. If there are any personal identity records associated with your devices or internet access they got you...

This reality is why I pay cash and no warranty for burn phones and refill cards and use it for my internet access modem. While they might get my phone number and be able to track my location they can’t get any personal ID associations. And my PC equipment is always used second and third hand.

It's hard to calm down when they're after me.

Yes, you should preemptively bend over and take it up the a** to avoid the Gestapo coming for you at 4 a.m.

Regards,

Very good advice!

IATG

Nakamoto translates to "center."

Central Intelligence?

Bitcoin transactions can be traced, but the process is complicated and requires many manhours of intense detective work. It all depends upon how well a Bitcoin owner covered his tracks.

The government has done so but only with the assistance of contracted private companies.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.