Ironic.

Posted on 03/10/2023 1:26:58 PM PST by nickcarraway

If you looked at the performance of the financial sector over the past week or two you’d be excused for feeling a bit of panic. The deterioration in share prices slowly accelerated into a crushing run on two banks in two days. Given the way markets have been fluctuating over the past 18 months and the pressure the Fed has been putting on the market, we can understand how some people might jump to conclusions and think the financial system is finally cracking under the pressure of rate hikes and inflation.

We’re going to dive into this deeper, but lets start this reaction piece off by pressing pause on any panic you might be feeling.

Why Is The Financial Sector Under Pressure

The financial sector has been under pressure as rate hike expectations have come back into focus. While we’ve had plenty of speculation around rate hikes over the past 18 months, the past week or two has seen the 2s – 10s spread expand rapidly. The 2s-10s spread is the gap between 2 year treasury yields and 10 year treasury yields. In normal markets conditions, longer maturity yields are typically higher than short maturity yields – governments or companies who issue debt have to pay more for investors to feel comfortable locking their money up for longer periods of time. However, in the current environment where rapid rate hikes are expected to be temporary, the yield of treasury bonds with shorter maturities is higher than the yield on treasuries with longer maturities.

This spread is important because the spread between long term and short term maturities can have a significant impact on bank profitability. Banks fundamentally operate in the business of borrowing short term money and lending it out to people for longer term projects.

(Excerpt) Read more at forbes.com ...

I was right splitting money that was left.

When the depression hit bankers just left town with all the banks money in the middle of the night.

Had grand parents that had a lumber business they went to the bank after the word of banks closing theirs was shut down they never found the banker they went broke.

some things never change.

One important rule of thumb is that you should never have a sizable amount of your investment tied up in your employer’s stock. If things go bad, your investment could collapse right at the same time you lose your job.

I never heard of this bank before yesterday.

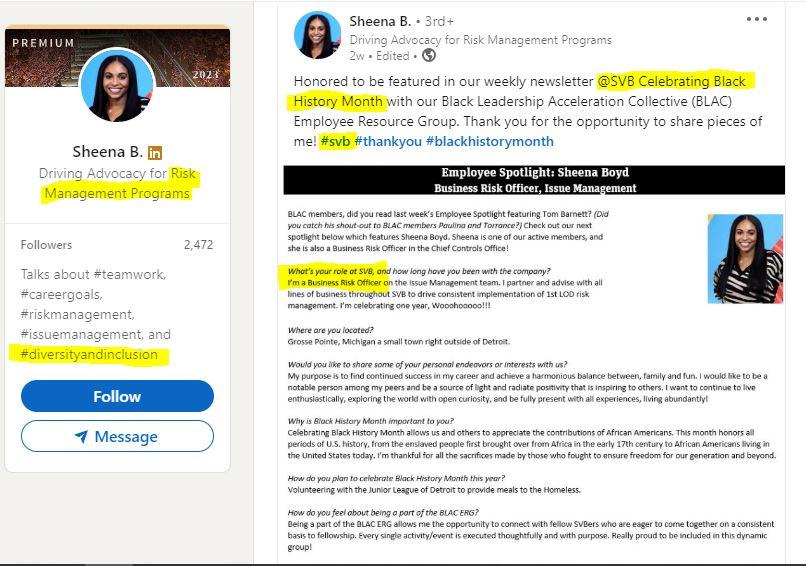

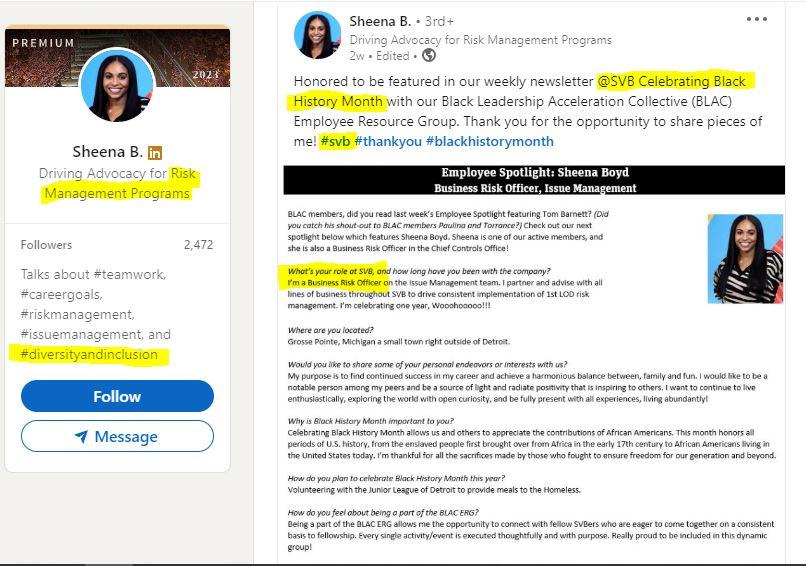

I banked with them when I was a Silicon Valley guy. Looks like they dumped my Morgan Hill branch. Here’s a thing from their website that they seem proud of:

SVB included in 2022 Bloomberg Gender-Equality Index

SVB continues work to advance gender equality and build a diverse and inclusive workplace.

Glad to see that leftist Forbes is telling its leftist readers that all is ok.

The rate increases are putting all bank assets underwater.

*************

And incentivizing people and businesses to pull their money out and invest in T bills. Better rates and better tax treatment.

LOL. Move along now. Nothing to see here....

Really? Forbes has been thoroughly compromised!

Yup if you don’t keep people trusting in the system it all falls apart

Ironic.

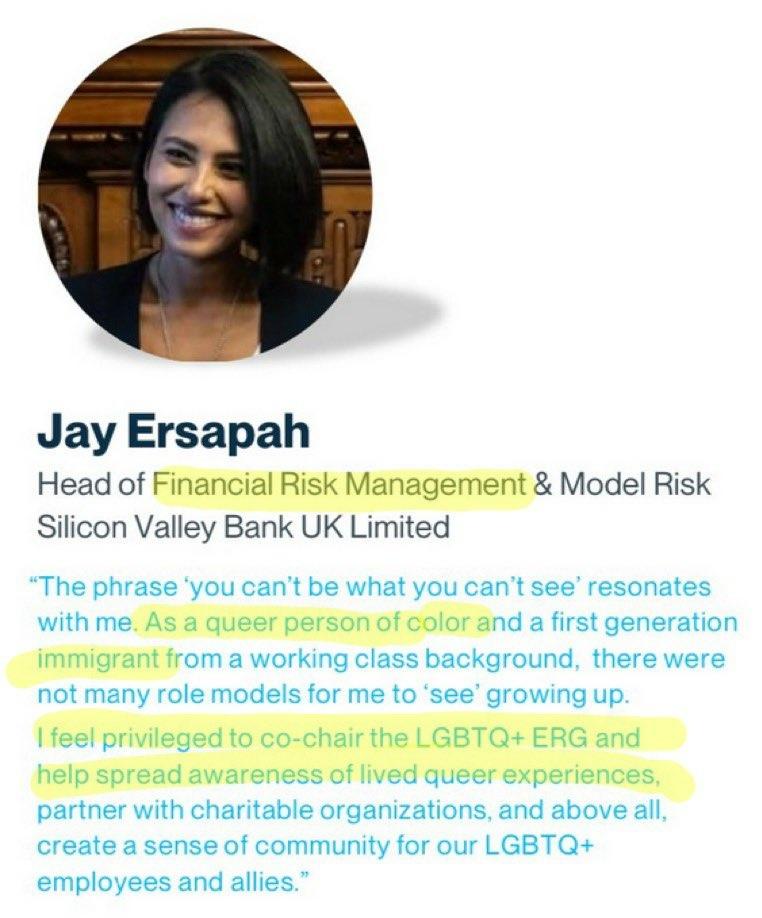

Jeez…. it seems she did a PATHETIC JOB OF RISK MANAGEMENT.

I’m guessing bankruptcy is a “LIVED QUEER EXPERIENCE”. You can’t make this stuff up.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.