Posted on 05/09/2022 6:35:37 AM PDT by Red Badger

The $30-per month charge from ISPs is covered by a federal subsidy.

President Joe Biden's administration reached a deal with 20 U.S. internet service providers to provide free internet access to Americans living in low-income areas Monday.

ISPs such as AT&T, Verizon, Comcast and others agreed to provide "high-speed" internet access for $30 per month. The Biden administration also announced a federal subsidy for low-income households that will pay up to $30 for internet access, effectively making the plan free for qualifying households.

(Excerpt) Read more at foxnews.com ...

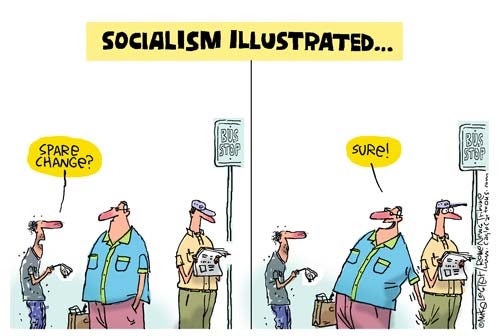

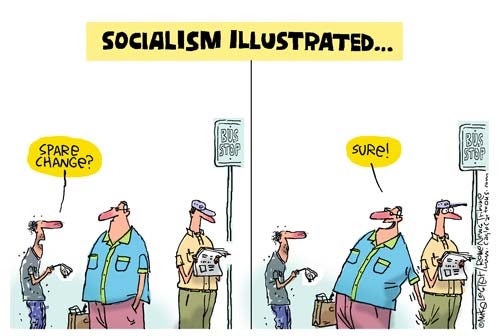

Using your tax dollars to buy votes. Nice scam.

They can broadcast them pro-government and brownshirt BLM propaganda all day long

This is old news as the internet plane went into effect back in Feb this year.

How about free liquor and pot? That’s bound to be popular with certain voters.

Free Kools and Newports and free Malt liquor?...............

No enumerated power....

Free housing, free food, free heat and air conditioning, free Obamaphones, now free internet. Now you can sit on your ass all day and not work and never leave home. Other than to vote Dem on Election Day, of course. If you don’t do that, everything gets cut off.

Yep, next it will be a free computer as well. They already have free college tuition and guaranteed acceptance.

more free stuff

makes you wonder what the hell kind of fool you are to work?

So we all get free internet? Next, free computers to access it and new Obama phones?

Hey Joe, how about getting coverage in rural spaces. We have folks not 5 miles from our house who couldn’t use your damn subsidy……there is no frighten service to use.

Good old Scranton Joe, always was a joke, now he is a joke with a diaper

No need for that either; they'll do it for you.

Free Baby Formula too.

Lock it down to job sites only.

Job sites probably already have free wifi, as do schools. Plenty of opportunity to use during breaks and study halls.

It's not just tax dollars; each internet subscriber has a fee added to their monthly bill to subsidize these users, just like the Obamaphones.

We have the most spoiled, luxuriated “poor” people on the planet.

Being increasing alarmed at the growth of the social state and national debt, then after I read today that “Congress created the Affordable Connectivity Program, a new long-term, $14 billion program, with “new ways to qualify for the Affordable Connectivity Program such as: receiving WIC benefits or having an income at or below 200% of the Federal Poverty Guidelines [levels],” then I decided to investigate and expose some of this growing dependency upon government.

Note that while the national debt presently stands at over 29 trillion dollars and rising, yet partly due to Covid-19 and supererogatory measures (both are judgments from God) to control it, 61% of Americans paid no federal income taxes in 2020.

Reading “200% of the Federal Poverty Guidelines” promoted me to investigate that first, and which means, for instance, that while for a household of three the Federal Poverty Level (FPL) would be $21,960 yet 200% of the FPL would be $43,920 (compared with $29,646 last year), and would qualify that household for $30 a month discount for high-speed Internet and “eligible households also can receive a onetime discount of up to $100 to purchase a laptop, desktop computer or tablet from participating providers if the consumer contributes $10 to $50 toward the purchase price.” “The $14.2 billion Affordable Connectivity Program is just a part of roughly $65 billion to improve access to high-quality, high-speed internet access contained in the bipartisan infrastructure bill that President Joe Biden signed into law Nov. 15.” (https://www.aarp.org/home-family/personal-technology/info-2021/fcc-subsidy-helps-broadband-internet-access.html)

However, as reported here, the official poverty measure is based on cash income only, which fails to capture all the resources available to a family including tax credits and in-kind transfers. Also, the official measure of family resources is biased due to under-reporting of certain types of income that are commonly received by those with low reported income.

What are Federal Poverty Guidelines/Levels (FPL)?

The Federal Poverty Guidelines are federally set “poverty lines” that indicate the minimum amount of annual income that an individual / family needs to pay for essentials, such as housing, utilities, clothing, food, and transportation. These guidelines, also called Federal Poverty Levels (FPLs), are based on the size of a household and the state in which one resides. FPLs are the same in 48 of the 50 states. The two exceptions are Alaska and Hawaii, which have higher Federal Poverty Levels due to the higher cost of living. As an example, in 2021, the annual FPL for an individual in Alaska is $16,090, in Hawaii it is $14,820, and in the remainder of the states it is $12,880...

The exact percentage of the FPL used for eligibility purposes varies based on the program and the state...

# of Persons in Household | 2021 Federal Poverty Level for the 48 Contiguous States (Annual Income) | ||||||

100% | 133% | 138% | 150% | 200% | 300% | 400% | |

1 | $12,880 | $17,130 | $17,774 | $19,320 | $25,760 | $38,640 | $51,520 |

2 | $17,420 | $23,169 | $24,040 | $26,130 | $34,840 | $52,260 | $69,680 |

3 | $21,960 | $29,207 | $30,305 | $32,940 | $43,920 | $65,880 | $87,840 |

4 | $26,500 | $35,245 | $36,570 | $39,750 | $53,000 | $79,500 | $106,000 |

5 | $31,040 | $41,283 | $42,835 | $46,560 | $62,080 | $93,120 | $124,160 |

6 | $35,580 | $47,321 | $49,100 | $53,370 | $71,160 | $106,740 | $142,320 |

7 | $40,120 | $53,360 | $55,366 | $60,180 | $80,240 | $120,360 | $160,480 |

8 | $44,660 | $59,398 | $61,631 | $66,990 | $89,320 | $133,980 | $178,640 |

Add $4,540 for each person in household over 8 persons | |||||||

The Federal Benefit Rate, abbreviated as FBR, is the maximum amount to which an aged, blind or disabled person who qualifies for Supplemental Security Income (SSI) is able to receive in monthly cash benefits. In 2021, the maximum FBR is $794 for a single individual and $1,191 for a married couple...(https://www.medicaidplanningassistance.org/federal-poverty-guidelines)

What programs use FPL guidelines?

Several programs use either 100% of the poverty guidelines or a percentage multiple of the guidelines. For example, some programs use 125%, 150%, or 185% of the guidelines to determine eligibility. (https://www.medicareplanfinder.com/medicare/federal-poverty-level/#What-programs-use-FPL-guidelines)

[AT LEAST 30 PROGRAMS USE THE FPL.]

Some examples of federal programs that use the poverty guidelines in determining eligibility include the following:

Department of Health and Human Services: Community Services Block Grant, Head Start, Low-Income Home Energy Assistance

Department of Agriculture: Supplemental Nutrition Assistance Program (SNAP, formerly Food Stamp Program), National School Lunch Program, Child and Adult Care Food Program

Department of Energy: Weatherization Assistance for Low-Income Persons Federal Poverty Levels do not count Noncash benefits (e.g. food stamps and housing subsidies)

Department of Labor: Job Corps, National Farmworker Jobs Program, Workforce Investment Act Youth Activities (https://www.irp.wisc.edu/resources/what-are-poverty-thresholds-and-poverty-guidelines/)

Examples of Automotive Help Programs

New Car Program for Those in Need

Bad Credit Auto Loans

Extended Auto Warranties

Job Access and Reverse Commute

Disability Transportation

{https://reliefbenefits.com/government-assistance)

What income is not counted? [for SNAP benefits]

You must meet the SNAP income tests to get SNAP benefits. There is no asset test for most Massachusetts households....

Here are examples of income that does not count for SNAP:

VISTA, Youthbuild, AmeriCorps, and Foster Grandparent allowances, earnings, or payments for persons otherwise eligible.

U.S. temporary Census earnings, for the 2020 Census count.

Lump sum payments...

Reimbursements – money you get to pay you back for expenses,.

Senior Community Service Employment Program (SCSEP)...

Anything you do not get as cash... paid directly to a landlord or utility company...that has no legal obligation to do so....

Veterans Services (M.G.L. c 115) payments made by vendor payment directly to your landlord or utility company.

Money earned by a child under age 18 who..lives with a parent or other responsible adult.

Much more: https://www.masslegalhelp.org/income-benefits/food-stamps/advocacy-guide/part3/q69-income-not-counted; Produced by Patricia Baker and Victoria Negus, Massachusetts Law Reform Institute Reviewed January 2020

[Below are some more benefit programs and services, but which also include local, state and federal programs as well as some private organizations.]

GOVERNMENT ASSISTANCE PROGRAMS OR FINANCIAL HELP FROM LOCAL ORGANIZATIONS...

Government mortgage and foreclosure assistance is available...

Rent help from assistance programs is available from a number of sources.

Government mortgage and foreclosure assistance...

Rent help from assistance programs i..

a variety of additional low income assistance programs ..

Housing Choice Voucher Program...

Disability assistance is administered by most state governments..

Human or social service offices ...

Financial assistance from your utility company may be available...

Telephone assistance programs..

Water bill assistance programs..

Federal government grants are provided to states and local governments as part of low income energy (LIHEAP)...

Free weatherization programs are also available nationwide...

Medical bill assistance..

Prescription drug assistance programs ..

Government funded community clinics..

Find dental care from free clinics...Many accept both state or federal government assistance and public health insurance for payment..

Free government health care programs..

Government sponsored welfare programs are available nationally as well as locally....

Free food from assistance programs are offered by the state as well as federal government...

Charities, churches and other organizations that offer financial assistance or small amounts of money from the government can sometimes help you with paying bills or debts...

Older adults and senior citizens.. There are government funded agencies that focus on their needs..

Several federal government agencies are focused on supporting people and helping them find a job or gain new skills. ..

Day and child care assistance is available in all states.... Government child care vouchers and subsidies can be obtained

State & Local Resources[;] Rent Assistance[;]

Free Food Pantries[;] Utility Bill Help[;]

Free Stuff and Money[;] Extra Income and Home Work;

Public Assistance[;] Disability Programs[;] Section 8 Housing[;] Senior Assistance[;] Emergency Rent Assistance[;] Free Job Training[;] Free Money[;] Grants For Bills[;] Free Clothes & Supplies[;] LIHEAP Assistance[;] elephone Assistance[;] Help with Water Bills[;] Charity Assistance[;] Church Assistance[;] Community Action Agencies[;] Medical Bills[;] Free Healthcare[;] Free Prescriptions[;] Free Community Clinics[;] Free Dental Clinics[;] Loans For Bills[;] Automobile Loan Assistance[;] Free Cash Loans[;] Debt Help[;] Mortgage Help[;] ...

How much CASH assistance will I get?The amount of cash assistance available in each state listed below varies...the dollar amounts will always change from year to year... 8 highest vs. 8 lowest I found]

Alaska $923; New York $789; California $704; Connecticut $698; New Hampshire $675; Wisconsin $653; Massachusetts $618; Hawaii $610';

Mississippi $170; Tennessee $185; Alabama $215; Arkansas $204; Louisiana $240; Kentucky $262; Georgia $280; Texas $285 (https://www.needhelppayingbills.com/html/how_much_cash_assistance.html)

Paying For Child Care

Child care subsidies (also called vouchers and fee assistance):

Head Start and Early Head Start:

State-funded prekindergarten:

Military fee assistance programs:

Assistance for high school students:

College or university child care:

Employer-assisted dependent care:

Other employer resources:

Sliding fee scale:

Local assistance and scholarships:

Sibling discount:

Military discount:

American Indian and Alaska Native Assistance:

Native Hawaiian child care and preschool programs:

Child and dependent care tax credit

Earned income tax credit (https://childcare.gov/consumer-education/get-help-paying-for-child-care)

What types of federal student loans are available?

Direct Subsidized Loans .

Direct Unsubsidized Loans

Direct PLUS Loans

Direct Consolidation Loans

(https://studentaid.gov/understand-aid/types/loans)

Social Security Survivors Benefits

Eligible survivors include:...

COVID funeral reimbursement now $9,000

If a relative of yours died from COVID-19, you may be able to get reimbursed up to $9,000 for funeral expenses. ..In 2019, the median national cost of a funeral with a viewing and a burial was $7,640 (https://www.cnet.com/personal-finance/covid-funeral-reimbursement-now-9000-heres-how-to-apply-today/)

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.