"We earrrrrrrn it!"

Posted on 12/02/2018 12:13:44 PM PST by blam

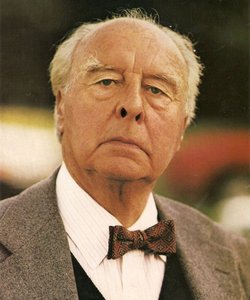

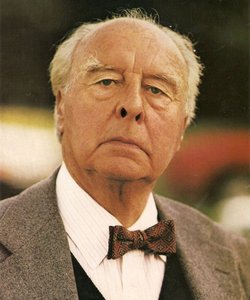

* John Hussman — the outspoken investor and former professor who's been predicting a stock crash — says traditionally diversified portfolios are set to offer their worst returns since the Great Depression over the next 12 years.

* Hussman explains why he sees a US stock market drop of more than 60% coming, and breaks down why the Federal Reserve's past actions have created the situation.

There's never been a worse time to be a conventional portfolio manager.

Well, maybe back in the deepest, darkest throes of the Great Depression that crushed the US economy way back in 1929. But not for the past 90-or-so years.

At least that's what John Hussman thinks. The former economics professor and current president of the Hussman Investment Trust has crunched the numbers and found that the future looks historically bleak for investors who aim for a traditionally diversified mix of holdings.

His methodology looks at a portfolio with 60% invested in the S&P 500, 30% in Treasury bonds, and 10% in Treasury bills — and it's designed to assess the expected total return over a forward 12-year horizon.

Hussman finds that at the stock market's all-time peak in September, this mix of investments was set to produce total returns of just 0.48% over that 12-year period. As you can see below — as signified by the blue line — that's the lowest since the Great Depression era of 1929.

Even though bond yields recently climbed and US stocks took a 10% hit, Hussman notes that the expected return climbed to just 1.29%, still Great Depression lows. This fact shows just how far stretched the market is right now —

(snip)

(Excerpt) Read more at businessinsider.com ...

Inflation is sneaking up. Not depression or Great Recession on it’s way, but things should naturally tighten. It’s just the way cycles work.

"We earrrrrrrn it!"

Could we stipulate that David Stockman is a Krank? What’s the difference between Stockman and this guy? is there a hairs breadth of difference between the two? I don;t see it if there is. Recessions involve stock pullbacks of much larger amounts than most people think - 40, 50, 60% etc.

And that if you say the sky is falling everyday for 45 years, that on the day it finally falls, its got nothing to do with your predictive powers?

Could we stipulate that David Stockman is a Krank? What’s the difference between Stockman and this guy? is there a hairs breadth of difference between the two? I don;t see it if there is. Recessions involve stock pullbacks of much larger amounts than most people think - 40, 50, 60% etc.

And that if you say the sky is falling everyday for 45 years, that on the day it finally falls, its got nothing to do with your predictive powers?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.