"Make no mistake about it, it's not revenge he's after...it's a reckoning".

Posted on 05/17/2018 4:17:01 PM PDT by re_tail20

Before the ink was dry on our new tax bill, outraged blue states were screaming about the cap on the deductibility of state and local taxes. Their governments were also frantically seeking ways around it, and small wonder. For decades, high-tax states with a lot of wealthy residents enjoyed a hefty subsidy from the rest of America. Legislators were understandably panicked over what voters might do when handed the rest of the bill.

That panic generated some desperate ideas. The most popular, currently, is allowing people to convert tax payments above the $10,000 cap into a "charitable donation." New York, New Jersey and Connecticut have already passed laws to allow this.

While charmingly innovative, this approach is likely to fall afoul of tax courts, as will the other proposed tactics. Blue-state taxpayers may finally have to confront the full cost of the government they want. And Democrats will finally have to confront the tension between what those voters want government to do and what they're willing to pay for.

That reckoning is long overdue.

Remember the Bush tax cuts, first passed in 2001? A heartless giveaway to the rich that did nothing for the middle class, Democrats said. But when their expiration date approached, President Barack Obama called for raising taxes only on families making more than $250,000 annually — that being, apparently, what it now takes to call yourself "rich."

This absurdity is no accident. It's a function of the ideological beliefs of the Democratic activist base clashing with the geographic and demographic distribution of their voters.

Over the past few decades, the United States has undergone "the Big Sort," the clumping of the electorate into demographically, professionally and politically homogeneous neighborhoods. Hillary Clinton voters have their ZIP codes, and Donald Trump voters theirs, and ever more rarely do...

(Excerpt) Read more at chicagotribune.com ...

I believe they could do this, when these state tax deductions were permitted.

Right -- because millionaires and billionaires all support these stupid tax laws. What kind of idiocy is that?

I never thought I'd see this kind of class warfare on FreeRepublic, but then I guess you learn something new every day.

These people need to hold their “representatives” responsible for this new tax law that was passed while they were all trying to obstruct the president instead of help with the law. They did nothing to help and were all crying when a bill passed that they didn’t like. Suck it up.

Good article.

I is one of the few that seem to be honest about the subject.

They can have their Utopia, just belly up to the tax man and pay for it yourselves.

But AC, you are conflating Federal and State taxes.

Post your studies, I call BS. I bet they don’t include things like welfare, food stamps, schools and other federally funded programs.

It's not just a function of progressive income tax brackets, either. They'd be paying more than their "fair share" even with a flat income tax rate.

The state legislature in New Jersey had to pass a mid-year budget adjustment a couple of years ago after ONE TAXPAYER moved out of the state. He was a Wall Street hedge fund guy, and it was estimated that he paid something like $100 million to $120 million in state income taxes for the last year he lived in New Jersey. There's no way in hell a single taxpayer uses $100M+ in taxpayer-funded services no matter how you look at it. So, yeah -- he was paying far more than his "fair share."

Huh? Go back and read my post. I'm not conflating anything. The numbers I posted there only show FEDERAL income taxes paid per person by state.

“It’s about the deductibility of state taxes on Federal tax returns.“

Exactly. It’s a subsidy in all but name.

Now pay up, sucker.

L

This is an argument about State taxes and who is responsible for paying them. Federal taxes(and deductions) have nothing to do with it.

Here's one that was published just last week -- focused on food stamps in particular:

These 15 States Have the Most People on Food Stamps

It lists the top 15 states for food stamp recipients, measured by percentage of population.

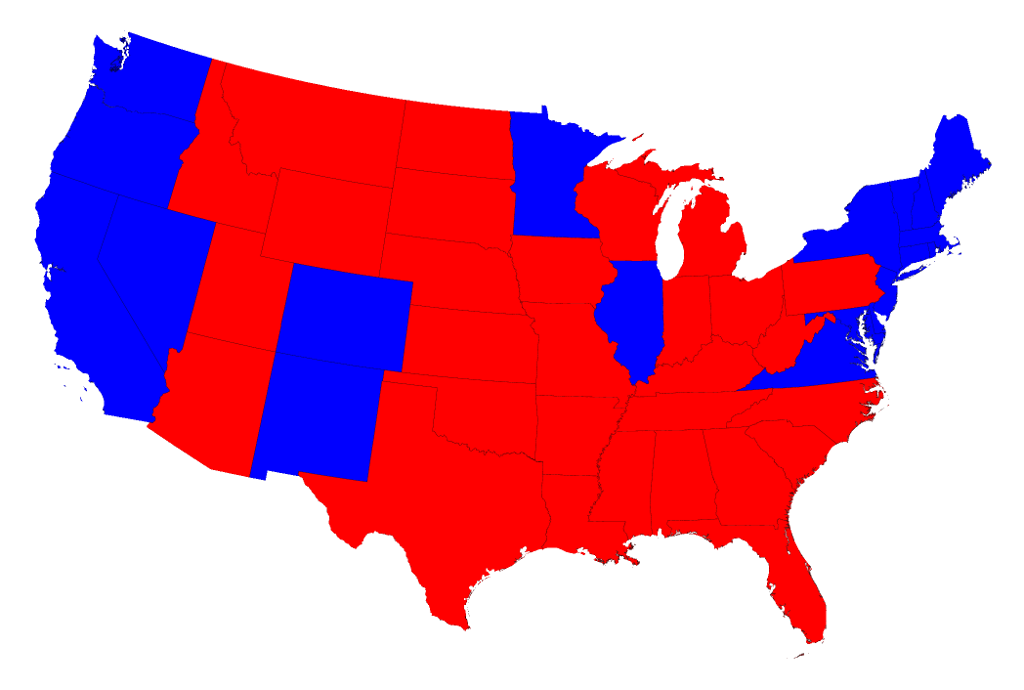

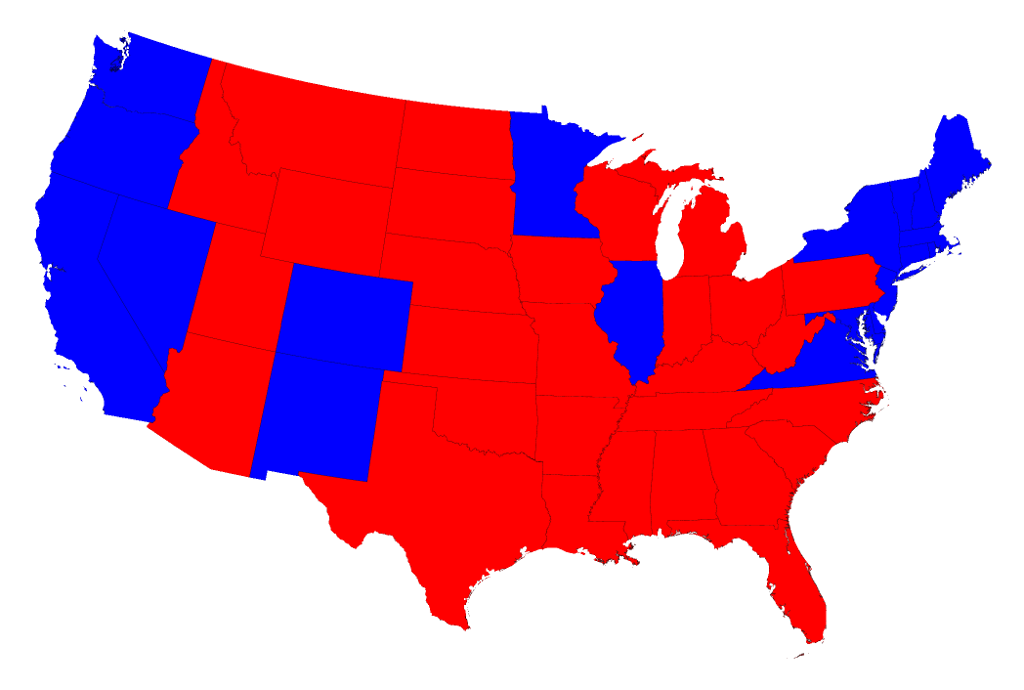

Here's the list. You'll notice that most of these (9 out of the 15, to be exact) are "red" states, based on the 2016 presidential election. There isn't a single New England state among them, even though they are among the top states in the U.S. in terms of Federal income taxes paid.

1. New Mexico (20.25%)

2. Louisiana (19.05%)

3. West Virginia (18.27%)

4. District of Columbia (18.06%)

5. Oregon (17.73%)

6. Mississippi (17.68%)

7. Alabama (16.31%)

8. Georgia (15.58%)

9. Tennessee (15.55%)

10. Delaware (15.42%)

11. Oklahoma (15.3%)

12. Florida (15.20%)

13. Nevada (15.06%)

14. Kentucky (14.67%)

15. Illinois (14.6%)

"Make no mistake about it, it's not revenge he's after...it's a reckoning".

Maybe to you it is. My original point specifically addressed the first paragraph in the article where the author claimed that high-tax "blue" states are being subsidized by the rest of the country. They're not.

That point has nothing to do with who pays state taxes, and everything to do with who is paying FEDERAL taxes.

No, I wouldn't.

When t comes to California to a fact that the vast majority support socialized programs

Very few any more support true constitutional laws

Look I live in Ca and I I know good conservative millionaires who support the new tax code

My father in law is one. Because he knows that it’s the only way to change the things in California

Maybe to me? I would say the vast majority. That is why there was a cut on deductions.

Here again, this does not support your statement that blue states get less in federal funds per federal tax dollar paid. A percentage of populations says noting about the absolute number. For example I would guess there are 100 times as many people in California then in Wyoming. So 20% of Wyoming’s population 0.2% of California’s.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.