Posted on 01/16/2016 10:19:48 AM PST by SkyPilot

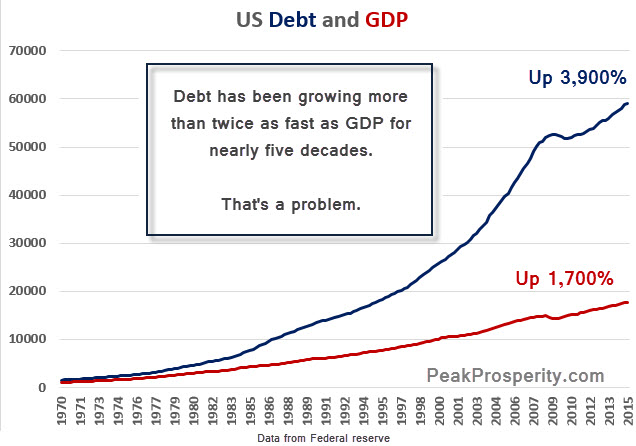

As we’ve been warning for quite a while (too long for my taste): the world’s grand experiment with debt has come to an end. And it’s now unraveling.

Just in the two weeks since the start of 2016, the US equity markets are down almost 10%. Their worst start to the year in history. Many other markets across the world are suffering worse.

If you watched stock prices today, you likely had flashbacks to the financial crisis of 2008. At one point the Dow was down over 500 points, the S&P cracked below key support at 1,900, and the price of oil dropped below $30/barrel. Scared investors are wondering: What the heck is happening? Many are also fearfully asking: Are we re-entering another crisis?

Sadly, we think so. While there may be a market rescue that provide some relief in the near term, looking at the next few years, we will experience this as a time of unprecedented financial market turmoil, political upheaval and social unrest. The losses will be staggering. Markets are going to crash, wealth will be transferred from the unwary to the well-connected, and life for most people will get harder as measured against the recent past.

It’s nothing personal; it’s just math. This is simply the way things go when a prolonged series of very bad decisions have been made. Not by you or me, mind you. Most of the bad decisions that will haunt our future were made by the Federal Reserve in its ridiculous attempts to sustain the unsustainable.

(Excerpt) Read more at zerohedge.com ...

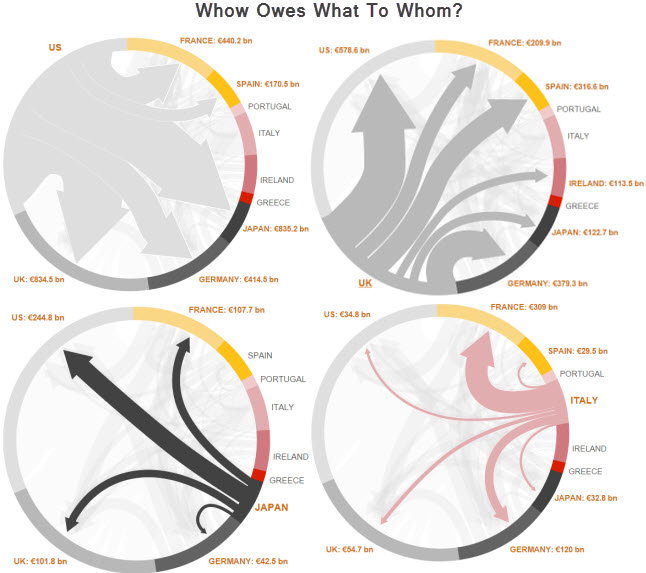

I think its hard to track all debt. It may be government debt. But its not fed government to fed government. If it is then its just showing currency balancing. Which is governments buying each others debt to hold up their own currencies or to stop their currencies from getting too strong.

So far so good.

The loan defaults and the house is devalued to $100. Now they only have assets at $100 (the house) and $100 in reserves.

Okay.

The depositors demand their money back, all $500. How much can they give them? Only $100, and if they manage to sell the house it will cover some of their losses.

You bet.

So they did loan out more money than they have for demand deposits.

No. You said deposits were $500 and they loaned out $400.

“So, who do we blame for this one?”

Uh, let’s see now, lemme figger a minit, ummm, Bush?

As Ayn Rand said, the only reason money has any value is that someone at some point WORKED FOR IT. There is a whole industry now of trying to pretend that that is not true but it is true.

I wish somebody would tell me just how wrong I am and why but nobody can. You’re not making it any better.

As for correction. 8% is the long cycle RoR and we are about right there right now. A correction moves things to where they belong and with obongo we have not created any value in a long time.

Amazon is profitable, Google maybe, Facebook I don’t get. Just like another phone with more bells ans whistles, just how much marketing data and how much focused marketing do you need?

We have tech peaked with gadgetry in my opinion. How many more unreliable bells and whistles do you need on a vehicle? The kid next door just spent about 3 grand having he motors in the transfer case on his truck replaced after the FWD left him stranded on a S. Texas ranch. Motors on the transfer case so you can have on the dash push button FWD engagement. My Dodge has a manual lever and it works just fine thank you. Ditto for the eyesight mess on Subarus and so many other cars now. Why? Have we all gone vision impaired?

From my vantage point I see a market for old, restored and reliable stuff. But I’m probably wrong since I don’t relate to what many people want.

Money is not a solid object anymore. It is ones and zeros in a computer memory, created by a bank, and supported more by psychology than anything else.

In other words, something is worth what people are willing to pay for it.

To some, a $300 silk tie from Nieman Marcus is worth it.

To others, the $300 would be better spent on heroin.

The U.S. dollar is also a commodity, exactly like that—based on perception—except that we have so far caused the oil powers to require it in return for their necessary commodity.

As an aside: The attack on oil is actually an attack on the American economy, which for the past few decades has been based upon the export of dollars . . . ultimately, for oil.

I like your point about cars today. Also, we bought an old sowing machine and apple peeler at a flea market. These products were manufactured to work reliably and last 1,000 years.

Because consumption also takes place. What is a hundred dollars we of groceries worth 2 weeks later?

Where did the “reserves” come from to expand lending during the previous housing bubble? Where are they coming by from now?

C’mon Hamilton, you’d carry more water if there wasn’t far more leveraged debt than easily liqifiable assets...

Same place they always come from.

C'mon Hamilton, you'd carry more water if there wasn't far more leveraged debt than easily liqifiable assets...

Okay, Jefferson, explain what the proper ratio is between the two and why ...

BUMP!

I’m reconditioning two 60 year-old lathes. I have a John Deere that survived my Dad and will probably survive me. It will be reconditioned and it will probably survive my Son.

If you can get or make parts there are only certain things that wear. Eventually metal fatigue will be the machine’s demise but for so many things that experience low stress, things that are built heavy, they will just last and last and last.

Sleeved engines can be made almost like new again. They eventually fail under heavy use when the main bearing carriers fatigue. We had Cat 398s that the Cat rep hated because we just kept rebuilding them. They ran thousands of hours between overhauls several times.

They loaned out more than what needed to cover demand deposits. The semantics is not worth quibbling over. I was only putting in my two cents worth on a discussion on deflation, as my degree is in finance/accounting and I worked as management in various industries including banking.

Have a good evening!

At least the raisen growers won against the gov’t confiscating a good portion of their crop due to some law trying to keep the price of raisins up.

By your definition, any dollar lent out of a demand deposit is too much.

The semantics is not worth quibbling over.

What semantics? I said they can't lend more than they take in. You disagreed.

That is a very good point.

The second largest economy on the entire planet.

Where is it?

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.