Posted on 07/04/2015 3:47:12 AM PDT by 2ndDivisionVet

In 2011, new Republican Gov. Scott Walker set the creation of 250,000 jobs as the benchmark for success of his new administration. Walker missed that goal by a wide margin over his first term despite an embrace of sweeping tax cuts aimed at stimulating growth. Instead, the cuts helped dig a more than $2 billion hole in the state budget.

Wisconsin ranked 36th among the states and District of Columbia in the pace of private-sector job growth during Walker’s term, trailing all Rust Belt states and all but one other state in the Midwest.

A PROJECTED SURPLUS TURNS INTO A DEFICIT

JANUARY 2014: Report from the Wisconsin Legislative Fiscal Bureau

The report predicts that by the end of June 2015, the state’s general fund will have a $1.04 billion balance. This estimate is based in part on the anticipation of an $892.7 million increase in tax collections....

(Excerpt) Read more at chicagotribune.com ...

A better headline: Wisconsin economy lags after Obama spends us into oblivion.

That said,

GO CRUZ!!!

HEY, Chig Trib,

It ain’t your frickin money!!!

Lets dive in to statistical malpractice, to disprove tax cuts, so we can support a candidate who is more oriented towards tax cuts.

Makes sense.

The alternative? Spend with abandon Wisconsin! Keep shoveling out that tasty largesse, especially to the education mill. The spending party can last forever...

Hey Chitcago Trib look at your own rotgut state of ILL-n-annoy for budget dysfunction, failed raised tax burdens on productive citizens and pending layoffs of teachers in Chitcago. Some leftist model state to follow ay?

Yet many of those states highlighted have Republican governors (like Michigan, Indiana, etc). Are they doing this just to try to discredit Walker personally, forgive me? I am sure that they are doing other things with data that at a closer look would make their methods questionable, contradictory or even fraudulent.

It seems obvious that if you cut taxes (revenue) you have to curtail spending, go into the hole. If he did not cut the spending but kept it at the prior pace sure, he came up short and left himself vulnerable to his opponents who cannot wait to accuse him of being stupid.

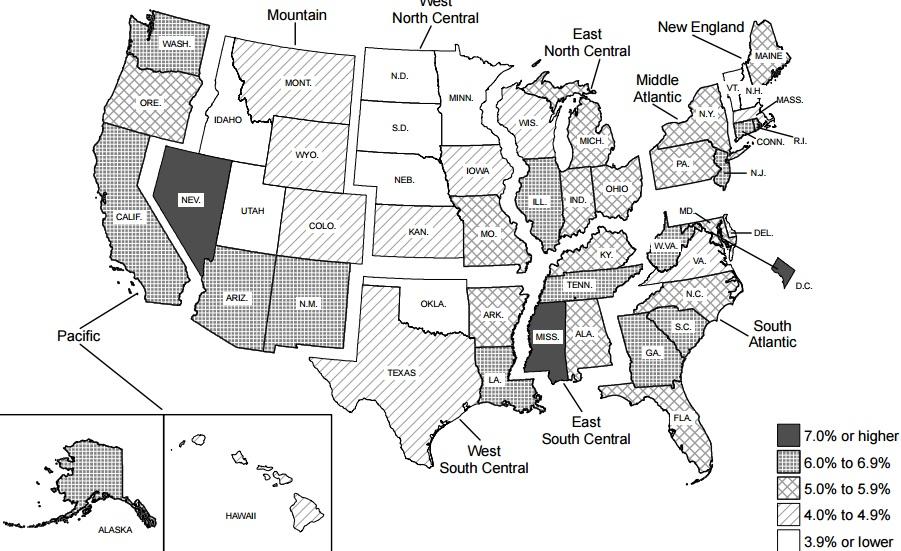

Compared with Illinois, Michigan, Indiana and Ohio, Wisconsin has the lowest unemployment rate.

http://www.bls.gov/web/laus/laumstrk.htm

This headline comes after Wis Dems have done everything in their power to prevent job creation in Wis, including the building of an iron mine in impoverished northern Wis.

Actually, cutting taxes tends to increase revenues...so while spending cuts are good, they do not have to be used to “offset” tax cuts....increased economic growth will offset the cuts.

Yep, nailed it....

That doesn't seem to have been the case in states like Kansas or Louisiana. Their tax cuts have led to round after round of spending cuts.

Actually, cutting taxes tends to increase revenues...so while spending cuts are good, they do not have to be used to “offset” tax cuts....increased economic growth will offset the cuts.Cutting the right taxes can increase revenues. But, unless accompanied by spending cuts or freeze, the spending will always outpace the revenue gain.

The principle still stands....but nothing happens in a vacuum.....and it’s hard for states to make happen because most taxes are Federal taxes, and the state’s individuals and businesses don’t get any federal cuts just because they get state cuts.

Think: what do businesses do when they want to boost sales? They CUT the price. Taxes are the price of commerce.

I”m not talking about the spending side.....I am saying they are two different sides and do not depend on one another.

A proper tax cut will ENHANCE the REVENUE side, period. This can be done with or without spending cuts.

I agree that the theory still stands but when put into practice then the results are mixed. Sometimes it works, sometimes it doesn't.

It’s not how many jobs you create. It’s how many PRIVATE SECTOR jobs you create.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.