Skip to comments.

Current Oil Price Slump Far From Over

Yahoo Finance ^

| Jun 30, 2015

| Arthur Berman

Posted on 06/30/2015 5:45:36 AM PDT by expat_panama

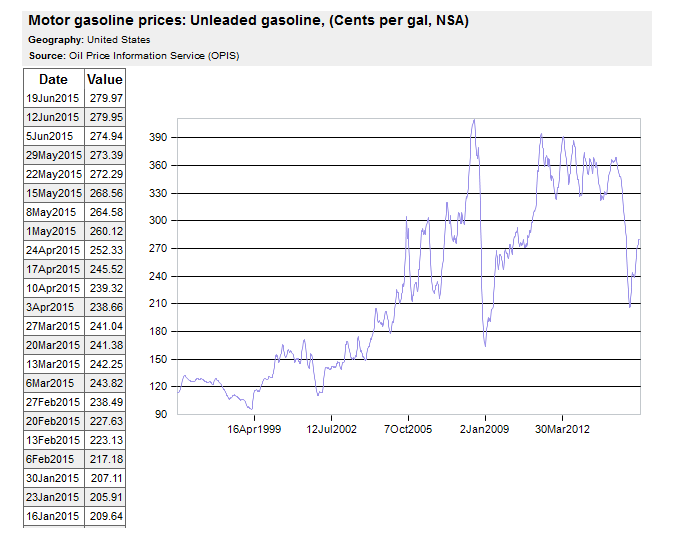

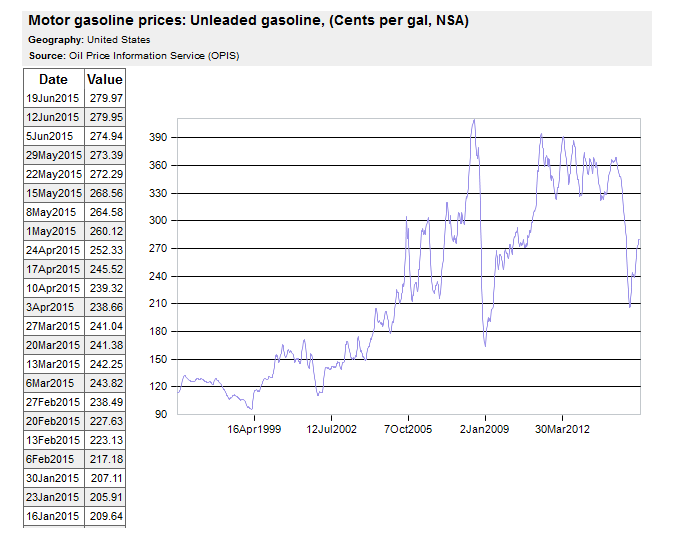

The oil price collapse of 2014-2015 began one year ago this month (Figure 1). The world crossed a boundary in which prices are not only lower now but will probably remain lower for some time. It represents a phase change like when water turns into ice: the composition is the same as before but the physical state and governing laws are different.*

[snip]

A New Supply Source and Over-Production

The main cause of the price collapse of 2014-2015 was over-production of oil. Most of the increase came from unconventional production in the United States and Canada–tight oil, oil sands and deep-water oil. From 2008 to 2015, U.S. and Canadian production increased 7.65 million barrels per day (mmpbd). During the same period, non-OPEC production less the U.S. and Canada decreased 2.85 mmbpd and OPEC production increased 1.79 mmbpd (Figure 2).

[snip]

Decreased Demand and Demand Destruction

OPEC is as concerned about long-term demand as it is about market share. Oil is the only major source of revenue for many OPEC countries and low demand, potential competition from other fuel sources, and the effect of a perceived link between oil use and climate change are existential threats. Related: BP Data Suggests We Are Reaching Peak Energy Demand Demand growth for oil has been declining since the late 1960s (Figure 5). OPEC hopes to stimulate demand ...

[snip]

Are Low Oil Prices Long or Short Term?

Oil price collapses in 1981-1986 and 2008-2009 are the only analogues for the present price situation (Figure 16). So far, the current price collapse seems more similar to 1981-1986 than to 2008-2009. [snip] We have had a year of lower oil prices. Based on available data, I see no end in sight yet. The market must balance before things get better and prices improve.

(Excerpt) Read more at finance.yahoo.com ...

TOPICS: Business/Economy; Foreign Affairs; News/Current Events

KEYWORDS: economy; energy; investing; oil

Navigation: use the links below to view more comments.

first 1-20, 21-37 next last

To: expat_panama

again this week, regular gas and diesel were at parity of $2.48 per gallon.

that is 6% above the low parity price of $2.34 a while back.

the seller is Sam’s Club

2

posted on

06/30/2015 5:49:56 AM PDT

by

bert

((K.E.; N.P.; GOPc.;+12, 73, ..... No peace? then no peace!)

To: expat_panama

Local news station in Metro Detroit are always reporting how gas prices today are still $1+ cheaper than last year at this time but they never mention that today’s gas prices are $1 MORE than they were six months ago.

3

posted on

06/30/2015 5:50:35 AM PDT

by

equaviator

(There's nothing like the universe to bring you down to earth.)

To: bert

News to me. It’s been going up here in Pennsyltucky and is now over $3/gallon almost everyplace I go.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Zowie! Metals may have come off only a bit but stocks took a 2+% hit --albiet in lower volume. IBD won't say we're in a correction yet (distribution count's not high enough I guess) but right now stock future traders see a rebound: stock indexes +0.55% w/ metals -0.27%.

To: equaviator

Local news station in Metro Detroit are always reporting how gas prices today are still $1+ cheaper than last year at this time but they never mention that today’s gas prices are $1 MORE than they were six months ago. What area did you see a $1 increase in 6 months?

6

posted on

06/30/2015 5:56:21 AM PDT

by

thackney

(life is fragile, handle with prayer)

To: bert

"...regular gas and diesel were at parity of $2.48 per gallon. that is 6% above the low parity price of $2.34 a while back..."Nationwide that's pretty much been the trend this past half year, we'll see if the rebound lasts but imho the hard numbers are like in the article, lower demand and increased production mean future price cuts. For now...

To: thackney

To: thackney

Arghh! A FReeper with facts.

9

posted on

06/30/2015 6:07:12 AM PDT

by

1010RD

(First, Do No Harm)

To: expat_panama

The key is going to be US oil plays. If they can innovate their way back to positive cash flow then OPEC will simply continue to lose profits and market share at low prices. We have the capital and legal structure to make investing here much safer than drilling anywhere else in the world.

Toss in a GOP President who may open up more drilling areas on public lands (or more wisely, transfer those lands back to state control) and you’ve got more production available domestically. I don’t see how we lose, unless Dems return to power.

10

posted on

06/30/2015 6:09:40 AM PDT

by

1010RD

(First, Do No Harm)

To: Buckeye McFrog

Same here in Oregon. It’s $3.04 for reg. We’re always a little higher than the national average, but not $.30 higher. Weird.

To: expat_panama

Arthur “peak oil” Berman? Really?

12

posted on

06/30/2015 6:20:51 AM PDT

by

stinkerpot65

(Global warming is a Marxist lie.)

To: thackney

I paid 1.67 about 6-8 months ago for regular unleaded.

13

posted on

06/30/2015 6:21:27 AM PDT

by

equaviator

(There's nothing like the universe to bring you down to earth.)

To: equaviator

I paid 1.67 about 6-8 months ago for regular unleaded...

At a Kroger station in Macomb County, 25 miles N of Detroit.

14

posted on

06/30/2015 6:22:39 AM PDT

by

equaviator

(There's nothing like the universe to bring you down to earth.)

To: Buckeye McFrog

Yep. Here in SW Pennsylvania the price of gas is steadily creeping up. I paid 2.99 a gallon yesterday for Regular.

15

posted on

06/30/2015 6:43:37 AM PDT

by

4yearlurker

(So America died not with a bang but a whimper.)

To: expat_panama

“Oil is the only major source of revenue for many OPEC countries and low demand, potential competition from other fuel sources, and the effect of a perceived link between oil use and climate change are existential threats.”

Looks like it’s time for another Terrorist Attack on US soil from our ‘friends’ in the ME!

Bomb the EnviroWeenies!

16

posted on

06/30/2015 6:44:09 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: stinkerpot65

Arthur “peak oil” Berman? Really?Yeah, guess so. Even as late as last Jan. he was saying in OilPrice.com:

Many people think that the resurgence of U.S. oil production shows that Peak Oil was wrong. Peak oil doesn’t mean that we are running out of oil. It simply means that once conventional oil production begins to decline, future supply will have to come from more difficult sources that will be more expensive or of lower quality or both. This means production from deep water, shale and heavy oil. It seems to me that Peak Oil predictions are right on track.

Methinks his views have since been "evolving"...

To: Diana in Wisconsin

"...

only major source of revenue... ...time for another Terrorist Attack..."lol. That's following the idea that ME terrorism had anything to do w/ economics or poverty, but we all know that the leaders are already all filthy rich and they couldn't care less about money.

To: expat_panama

No, I just want the EnviroWeenies bombed out of existence! :)

19

posted on

06/30/2015 7:35:24 AM PDT

by

Diana in Wisconsin

(I don't have 'Hobbies.' I'm developing a robust Post-Apocalyptic skill set...)

To: thackney

What area did you see a $1 increase in 6 months?In my area, we saw a low around $1.64/gallon (Albuquerque metro), although New Mexico state averages hit $1.82 six months ago. Yesterday I paid $2.52/gallon. So for us, it was up about 88 cents/gallon over six months ago.

20

posted on

06/30/2015 7:47:50 AM PDT

by

IYAS9YAS

(Has anyone seen my tagline? It was here yesterday. I seem to have misplaced it.)

Navigation: use the links below to view more comments.

first 1-20, 21-37 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

Zowie! Metals may have come off only a bit but stocks took a 2+% hit --albiet in lower volume. IBD won't say we're in a correction yet (distribution count's not high enough I guess) but right now stock future traders see a rebound: stock indexes +0.55% w/ metals -0.27%.

Zowie! Metals may have come off only a bit but stocks took a 2+% hit --albiet in lower volume. IBD won't say we're in a correction yet (distribution count's not high enough I guess) but right now stock future traders see a rebound: stock indexes +0.55% w/ metals -0.27%.