Skip to comments.

Stock Run-up 3 Weeks Old, Experts Confused-- Investor Thread March 1, 2015

Weekly investment & finance thread ^

| Mar. 1, 2015

| Freeper Investors

Posted on 03/01/2015 5:34:21 AM PST by expat_panama

[excerpt from Stock-market crash of 2016: The countdown begins] [excerpt from Stock-market crash of 2016: The countdown begins]Dow will drop 50% as market replays 2008, 2000 and 1929. That will translate into the DJIA crashing from today’s 18,117 down 50% to about 9,000. Ouch, the Dow crashing all the way below 10,000. Unimaginable. Bulls will hate it. No wonder our brains tune out, turn off. Instead, we prefer the happy talk that will just keep coming out of Wall Street and Washington till the 2016 collapse. We’ll just keep denying reality ... till it’s too late, and we suffer another $10 trillion loss is on the books.

Deja vu 2000: irrational exuberance, dot-com technologies

Remember 1999. Just 16 years ago. Roaring hot “irrational exuberance.” Renewed stock market mania. Wall Street was hot. Stocks roaring. Back then investors demanded insane annual returns during the worldwide millennium celebrations: the top 19 mutual funds had 179% to 323% annual returns.

Yes, dot-com stockholders expected 100% plus returns on zero revenues...

[snip]

...Deja vu the Crash of 1929: and the long Great Depression...

[snip]

...Yikes, it took 13 long years to break even from Wall Street’s losses of 2000 and 2008. And now investors are being warned that the Crash of 2016 will be even worse, with new losses of 50%. In short, the market really is bad news.

But still, here we are again, panicking: Fearing that 2016 will repeat 1929, fearing that Wall Street and Main Street, tens of millions of Americans, plus the Fed, the SEC, Washington politicians in both parties will refuse to prepare for the Crash of 2016. Will deny hearing the warnings ... of the Crash of 2016, one that promises in the end to become bigger and badder and far more dangerous than 2008, 1999 and 1929 combined. Listen closely, the countdown to the Crash of 2016 has started. |

|

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’] [excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]DI’ll give veteran MarketWatch columnist Paul B. Farrell his due: The man knows how to draw clicks.

It’s hard to avoid an article with the headline: “Stock Market Crash of 2016: The Countdown Begins.”

While many seasoned consumers of financial journalism might be inclined to dismiss an article with such a bombastic headline right off the bat, I’m always willing to at least consider the arguments behind such a claim.

If such a crash is a year off, it’s important to start preparing. A 50% decline in stock-market value is a sharper drop than we endured in 2008.

Fortunately for long investors everywhere, there is little about the article that should send anyone cashing out of stocks...

[snip]

...The bigger issue on trial here is the idea that investors should make big asset bets based on bold market forecasts, whether by professional money managers or journalists....

[snip]

...“Sure, they suffered steep losses (and likely lost some serious sleep) as stocks cratered during the financial crisis,” Egan writes. “Yet they also enjoyed a dramatic rebound in U.S. stocks as the system stabilized. The S&P 500 is up over 200% since the bottoming out in March 2009.”

He adds that it may be tempting to stay on the sidelines. However, holding too much cash for fear of a market crash will almost certainly cause you to miss extended periods when markets perform well.

|

More precision confusion from experienced professionals:

More precision confusion from experienced professionals:

* * * * * * * * * * * * * * * * * *

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-86 next last

To: expat_panama

21

posted on

03/01/2015 7:17:53 AM PST

by

pwatson

To: expat_panama

A balloon is always its biggest just before it pops.

22

posted on

03/01/2015 7:20:29 AM PST

by

wolfman

To: yefragetuwrabrumuy

The Quanitative easing has artificially sent all of the capital to Wall Street and Housing, as it did in 2008. The problem is that zero interest loans have enabled the Stock Market to rise on margin (as it did in the 1920’s) and allowed people to buy housing that they can not afford, based on zero or negative financing. All of this artificial manipulation is orchestrated by the Fed because of their belief in “Wealth Effect”, or, in other words, if people believe that they are more asset rich than they really are (e.g. inflated 401K’s and inflated housing), then they will spend more money. Therefore, the economy should be stimulated to the point that real unemployment should be dropping and the economy should be improving (it is not!) All of the percieved wealth is being transferred overseas because of derivative valuations, and a return of interest can be made overseas, not here. Therefore, the accumulated perceived value that is being manipulated is in excess of $300 Trillion dollars. People ask, what do we care what happens in Europe and Russia. The answer, when one base card is knocked out because of a crisis (could be Greece, Ukraine, or any number of hot spots), the whole house will come tumbling down. I don’t believe that we will make it to 2016. That card will be pulled while Obama is still president...Goodhart’s Law was published in 1975 by the Reserve Bank of Australia, and it states: “When a financial indicator becomes the object of policy, it ceases to function as an indicator.” Also, “Any observed statistical regularity will tend to collapse once pressure is placed upon it for control purposes.” ANYTHING that you hear in the media in the future will be for manipulation purposes, until it will collapse from it’s own weight. In other words, get your financial house in order—the balance on your 401K and the value that you think you have in your house are an illusion. Just Sayin’.

To: expat_panama

Hey we are just pointing out the fed manipulations not that it works perfect. All it does is stop all the what used to be a 10% correction every 12 to 18 months that are the normal market correction forces that used to keep the market aligned with the economy into large bubbles that have huge crashes.

24

posted on

03/01/2015 7:23:36 AM PST

by

pwatson

To: expat_panama

Why do we keep asking the federal reserve and monetary policy to pull us out of economic messes.

Ronald Reagan said (paraphrase) “government is not the solution to the problem, government is the problem”

The narrative from the government and the msm is to modify monetary policy. How about another strategy, the government getting out of the peoples and businesses way. Stop taxes, regulations, and social programs and watch our economy boom.

25

posted on

03/01/2015 7:48:25 AM PST

by

ForYourChildren

(Christian Education [ RomanRoadsMedia.com - a Classical Christian Approach to Homeschool ])

To: expat_panama

I like the headline: Experts Confused. But they’re experts!

26

posted on

03/01/2015 8:14:31 AM PST

by

1010RD

(First, Do No Harm)

To: pwatson

Jan 5, 2010 "...massive stock-market rally in the past nine months is mostly due to secret government buying of stock-index futures... ...the Federal Reserve and the Treasury (in league with top Wall Street firms) is rigging the stock market on a daily basis... ...The only logical explanation for the extent of the rally," It's not logical to say a trade is secret when everyone knows about it --unless the trade never happened and was made up. Thing is that if a share in a publicly listed corporation was bought or sold then there had to have been an actual record of who bought how many shares for how much and when. If the trade was imaginary then nobody knows the who, what, and when because it didn't happen.

To: 1010RD

Experts Confused. But they’re experts!Ah but we're talking super high quality elite big money confusion here. None of this small time penny ante confusion we see all the time in well, the markets...

To: expat_panama

29

posted on

03/01/2015 8:42:29 AM PST

by

yefragetuwrabrumuy

("Don't compare me to the almighty, compare me to the alternative." -Obama, 09-24-11)

To: wolfman

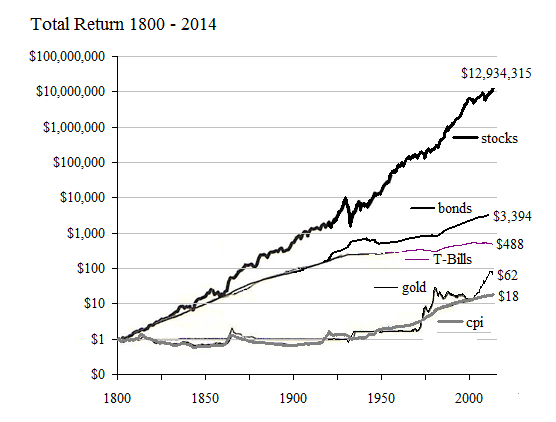

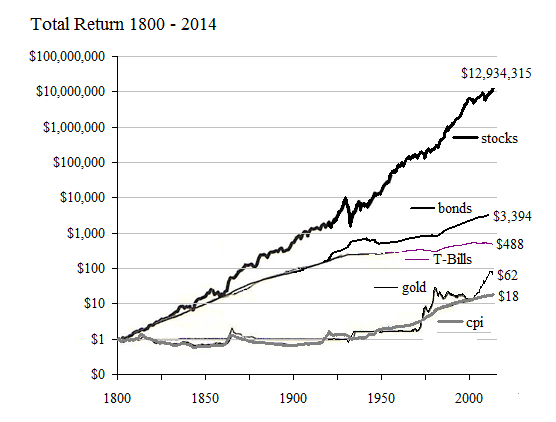

A balloon is always its biggest just before it pops.We got lots of things going on here. One is that market crashes happen --the record shows that in the 1930's 7/8 of the value of U.S. businesses was destroyed. Another is that for hundreds of years America's been a tremendous wealth creating force for good--

--and those who acted like America was an empty balloon ended up wishing they hadn't. The crash in the '30's seemed big at the time but it was erased in less than a decade.

Finally, while none of us know what's happening tomorrow, most of us put our money on being ahead ten years from now. Others buy into the kind of crash that happens once very 20 years or so, and the rest say the bubble's going to pop but they know better than to actually put their money on the idea.

To: expat_panama

experts confused.. lolol

I’m gonna make a killing in Maalox.

31

posted on

03/01/2015 9:12:20 AM PST

by

NormsRevenge

(Semper Fi - Revolution is a'brewin!!!)

To: expat_panama

32

posted on

03/01/2015 9:28:48 AM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

Neat! [bookmarking site]. They say it’s possible to post the graphs on the web but I can’t get their info to work. At any rate, there’re still a lot of other ways to make it work.

To: expat_panama

It looks like there is a wealth of info there I’m just not having much luck at finding a rational way of finding it.

34

posted on

03/01/2015 12:01:25 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

That may be due to my irrationality.

35

posted on

03/01/2015 12:02:35 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

That’s my problem too. Seems it’s Google’s extreme leftist slant. They got categories for ‘poverty’ but none for ‘riches’. I’m trying to find median incomes and all I can find is median suffering at the hands of the ecology ruining businessmen.

To: expat_panama

37

posted on

03/01/2015 12:55:24 PM PST

by

Lurkina.n.Learnin

(It's a shame nobama truly doesn't care about any of this. Our country, our future, he doesn't care)

To: Lurkina.n.Learnin

yuk... Just when I thot they couldn’t get worse.

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Happy New Month to all! Last Friday ended February dropping a fraction in higher volume --a sign of institutional selling-- but today's futures are upbeat seeing metals +0.11% and stock indexes +0.09%. The BEA and BLS are hitting the ground running today with--

Personal Income

Personal Spending

PCE Prices - Core

ISM Index

Construction Spending

--while the news media are giving us--

Europe shares hold at seven-year highs, China rate cut lifts Asia Reuters - 9 hours ago LONDON (Reuters) - European shares clung to seven-year highs on Monday, lifted by merger activity in the telecoms sector, while Asian stocks edged up after China cut interest rates at the weekend.

Dollar near 11-yr high after Chinese rate cut CNBC

To: All

Decided I couldn't wait. Everyone's invited to the food fight at

Navigation: use the links below to view more comments.

first previous 1-20, 21-40, 41-60, 61-80, 81-86 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

[excerpt from Stock-market crash of 2016: The countdown begins]

[excerpt from Stock-market crash of 2016: The countdown begins]

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]

[excerpt from Barron's rebuttal Considering the ‘Stock Market Crash of 2016’]

More precision confusion from experienced professionals:

More precision confusion from experienced professionals: