Steen Jakobsen Warns Of Looming US Slowdown, "I'm Long Gold... And Adding"

Posted on 02/27/2015 11:07:24 AM PST by blam

EcoMatters

February 26, 2015

CPI Core Shows Inflation The drop in energy prices, had the knee jerk reaction that we were in a deflationary spiral, again markets get many things wrong on first blush. The drop in energy prices is inflationary in the overall economy, and today`s CPI report showed what a sophisticated analysis would forecast regarding inflation and the role that low energy prices play in the overall inflation equation. We are going to have a transfer from the food and energy components which rely heavily on energy costs into the core inflation reading as consumers have more money in their pockets for true discretionary spending, and all these components` prices are going to rise in the CPI Inflation Index.

Wages, Wages, Wages

What should really be worrying for the Fed is that wages have been spiking under the radar for 2014, up ahead of the overall inflation metric, and leading the way on inflation, and 2015 has seen an even greater surge in wage inflation, again you might not want what you wish for when it actually comes to fruition, with wages surging the Fed now has no choice but to raise rates, and raise them fast!

(snip)

(Excerpt) Read more at marketoracle.co.uk ...

"If this analysis is correct, it means a big deflationary spiral is dead ahead that will see market participants wide-eyed with fear. However, there should be a significant rally before then which will allow many to get their houses in order."

"And once this deflationary spiral has run its course, an inflationary bang of epic proportions should commence that will go down in history as one for the ages."

Wait ‘till they cut off the QE boondoggle.

There has to be inflation, eventually. It’s the only way the USA can service its debt without defaulting; pay back borrowed money with inflated money.

And of course the Fed will raise rates because with a Republican Congress, all bad things will be blamed on it. Not saying they shouldn’t be raised, but just that anything that was being avoided like the plague will now be done.

And the debt servicing costs for our national debt will explode.

Inflation due to low energy prices goes against my reasoning

The oil price drop is not inflationary. It will cause other prices to rise but that is not in itself inflation. There is a lot of inflation in the system but most of that monopoly money has gone into the stock market. Some prices rising while other prices fall is absolutely NOT inflation, unless, of course you got your economics education from a Keynesian survey course on the way to getting your MBA.

When the stock market bubble bursts then all prices outside of that will rise rapidly as the inflation that is already extant flows out of the NASDAQ and NYSE into the general economy where we actually buy stuff like food and clothes.

If rates go to 5-6%, then a huge portion of our budget goes to just servicing debt. We’ll be literally using ‘credit’ to pay on ‘credit cards’ at that point....

Baring a massive explosion of growth, or change of direction, we’re dead at that point.

The big push for minimum wage increases is to support price inflation. The FedGov needs it to do a little debt monetizing, even if in small increments.

Good point. Any increase in interest rates will make it more expensive for the US government to borrow money. Yet the government will continue to borrow, and borrow recklessly.

As I see it, there is only one way out for the government. They must allow inflation to occur, at a rate that makes it worthwhile to pay back real dollars with inflated dollars.

Of course all this will be hidden from the public. The real rate of inflation will be masked by all sorts of accounting tricks.

There's another way; it involves amending the Constitution:

| Section I The power of Congress to regulate the value of money is hereby rescinded; the unit of money of the United States is the Dollar. Section II The value of the Dollar shall be one fifteen-hundredth avoirdupois ounce of gold of which impurities do not exceed one part per thousand. Section III To guard against Congress using its authority over weights and measures to bypass Section I, the ounce in Section II is approximately 28.3495 grams (SI). Section IV The Secretary of the Treasury shall annually report the gold physically in its possession; this report shall be publicly available. Any five states may commission a third party audit to confirm this report at their own expense. Section V The power of the Congress to assume debt is hereby restricted: the congress shall assume no debt that shall cause the total obligations of the United States to exceed one hundred ten percent of the amount last reported by the Secretary of the Treasury. Section VI Any government agent, officer, judge, justice, employee, representative, or congressman causing gold, money, or real estate to be confiscated from a citizen shall be tried for theft and upon conviction shall: a. be removed from office (and fired, if an employee), b. forfeit all pension and retirement benefits, c. pay all legal costs, and d. restore to the bereaved twice the amount in controversy. Section VII The federal government shall assume no obligation lacking funding, neither shall it lay such obligation on any of the several States, any subdivision thereof, or any place under the jurisdiction of the United States. All unfunded liabilities heretofore assumed by the United States are void. Section VIII The federal government shall make all payments to its employees or the several states in physical gold. Misappropriation, malfeasance and/or misfeasance of funds shall be considered confiscation and theft. |

Inflation would be a real killer right now with wages and such so stagnant - adds to my suspicions that some really big entities will pull some strings that finish off the Middle Class within a decade.

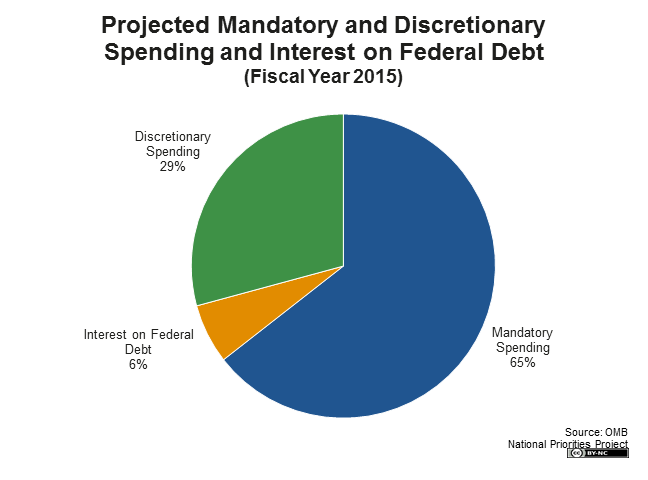

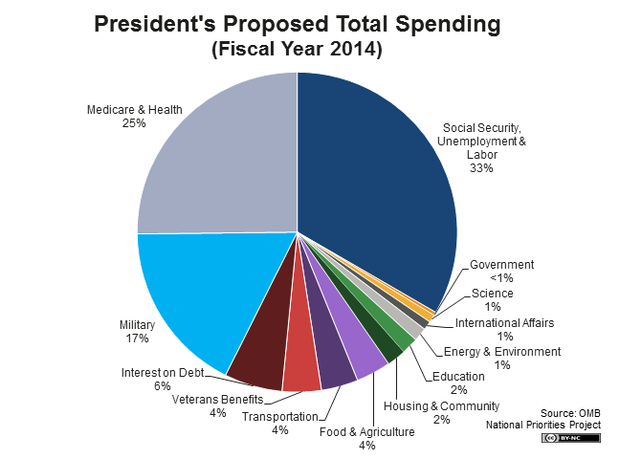

Pay it back with what? We are already spending more than we take in. And almost two thirds of the budget is on automatic pilot with the entitlement programs, other "mandatories" and debt servicing costs. These costs will also explode with inflation since they are tied to the COLA and interest rates in the case of the debt. So-called discretionary spending will be squeezed including DOD.

When you survey the World, you can clearly see that virtually every major economy is fighting DEFLATION !!!!

They are fighting this with the ONLY tool they have which is with INFLATION by printing money.

The "Race to the Bottom" is still in play but it's not working.

There are two types of "Inflation", one is from excessive economic growth and the other from excessive amounts of money.

There's only one type of "DEFLATION" and it's a bitch. It's a cycle of less that when it takes hold is a negative feedback loop.

No amount of money, regardless of what Keynes says, can fix this. The only thing the FED can do is try and buy sometime.

I forgot to note that 10,000 baby boomers are retiring every day and will for the next 20 years. The population over 65 will double in the next 20 years. These will add costs to the entitlement programs.

Excellent argument yours. The Fed will eventually have to perform a delicate balancing act. They will have to allow inflation to advance, and at a rate that will allow them to service the debt with inflated dollars. But it can't be at a rate such that the COLA's will break the budget.

And that's doable, IMHO. The government need only apply accounting tricks to mask the true rate of inflation. So inflation will devalue the dollar, but COLA's would be only minimally affected. Very doable. Look at the way inflation is calculated now. Food and energy costs are excluded. That's laughable, yet they get away with it.

If baby boomers and older are forced to burn through their savings in retirement, that's a lot of accumulated wealth that doesn't get to the next generation. If public sector jobs end up with their savings in federal annuities, that's the end of those savings outlasting the savers.

What's being destroyed is a permanent middle class that accumulates wealth. Those with government jobs and a few other fortunate sectors will have assets for middle class lives and comfortable retirement, but not anything that gets carried down to the next generation. Only the very wealthy and the very financially savvy will be able to that.

That's all opinion. It's what I'm seeing happening as people deal with the new economic realities.

I'd think old 90% silver coins and easily identifiable bullion would be easier to maintain and to use or cash in if necessary.

Correct me, please, if the direction I'm leaning toward isn't good.

Disclaimer: Opinions posted on Free Republic are those of the individual posters and do not necessarily represent the opinion of Free Republic or its management. All materials posted herein are protected by copyright law and the exemption for fair use of copyrighted works.