[excerpt from Yahoo Finance]

NEW YORK (Reuters) - U.S. stocks are poised for more upward momentum even as uncertainty over oil prices and Greek debt negotiations keeps the market on tenterhooks, analysts say.

Strong fourth-quarter U.S. company earnings and signs of an overall improving economy, alongside what appears to be the start of a bottoming in crude oil prices, have given equities support.

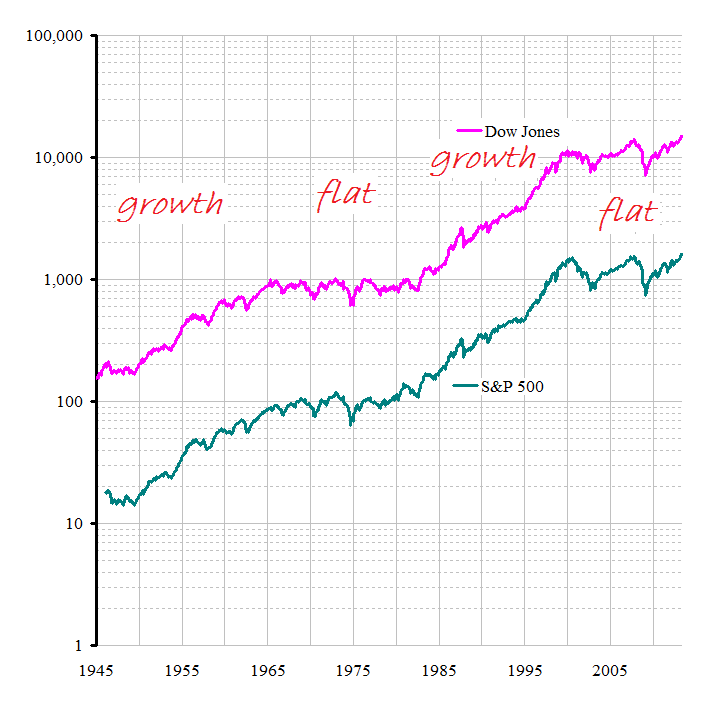

After starting 2015 with its sharpest monthly drop in a year and a spike in volatility, the benchmark S&P 500 (.SPX) hit an intraday record on Friday while the Dow Jones Industrial Average (.DJI) reached its highest point so far this year.

As "stocks have found a footing, people aren't as afraid of the potential negative" stemming from recent instability in oil prices and Greece, said Wayne Kaufman, chief market analyst at Phoenix Financial Services in New York.

"That's allowed stocks to start breaking out of the channel that they've been stuck in since the beginning of the year," he said.

Volatility seems to abating....

{snip]

...market participants will be paying close attention to developments in Greece - which, alongside oil prices, have been at the root of the volatility seen in the market this year.

Greece's new leftist government and euro zone finance ministers failed to agree this week on the next step for the country's bailout, leaving negotiations on the table for next week as they inch closer to a Feb. 28 deadline. The Greek government promised to do "whatever we can" to secure a deal with international creditors.

While U.S. exposure to Greek debt is "pretty minor," uncertainty over the situation and the impact on broader markets adds to volatility, according to Charles Lieberman, chief investment officer of Advisors Capital Management LLC in New Jersey.

"It's more in the nature of psychology than real substance," he said.

Also in the news:

[excerpt from NASDAQ Oil Prices: Freaking Investors Out for 150 Years and Counting..  ]

]

Whenever I read or watch financial media coverage of oil prices lately, the image that comes to mind is a bunch of kids who just ate half their weight in candy, washed it down with a gallon of Red Bull, and then run around the playground at warp speed. They both move so fast and sporadically that is almost impossible to keep up with them. Here is just a small example of headlines that have been found at major financial media outlets in just the past week:

- Citi: Oil Could Plunge to $20, and This Might Be 'the End of OPEC'

- OPEC sees oil prices exploding to $200 a barrel

- Oil at $55 per barrel is here to stay

- Gas prices may double by year's end: Analyst

What is absolutely mind-boggling about these statements is that these sorts of predictions are accompanied with the dumbest thing that anyone can say about commodities: This time it's different .

No it's not, and we have 150 years worth of oil price panics to prove it.

Also keep in mind, these are just the change in annual price averages. So it's very likely that these big price pops and plunges are even more frequent than what this chart shows.

Investing in energy takes more stomach than brains...

{snip]

...However, if you had made an investment in ExxonMobil in 1980 and just held onto it, your total return -- share price appreciation plus dividends -- would look a little something like this.

so these questions boil down to what we need and what we're willing to do.

so these questions boil down to what we need and what we're willing to do.