Skip to comments.

"January Effect" an omen for 2015? --Investment & Finance Thread - Jan. 4

Weekly investment & finance thread ^

| Jan. 4, 2015

| Freeper Investors

Posted on 01/04/2015 9:26:15 AM PST by expat_panama

A good January for stocks promises big gains for the year --or so goes the story goes (from Down January for stocks is bad omen for 2014 - USA Today) "How stocks fare in January often sets the tone for the full year". A lot of work's been done on this, and TradingSim reports that

When the S&P500 has a net positive gain in the first five trading days of the year, there is about an 86% chance that the stock market will rise for the year, it has worked in 31 out of the last 36 years (as of 2006). The five exceptions to this rule were in 1966, 1973, 1990, 1994, and 2002. Four out of these five years were war related, while 1994 was a flat market. As history suggests, the markets average nearly 14% gains when the January Effect is triggered.

--but the downside is:

A down January is a bad omen for the stock market. Yale Hirsch of the The Stock Traders Almanac suggests that since 1950, every down January in the S&P500 preceded a new or extended bear market, or in some cases, a flat market. They go on to further suggest that down January’s are followed by substantial declines averaging -13%.

| |

|

|

|

|

|

| |

|

% above avg. months |

% times the following year is above avg. |

% times month predicts following year |

|

| |

|

|

|

|

|

| |

January |

55% |

66% |

59% |

|

| |

February |

48% |

66% |

55% |

|

| |

March |

60% |

66% |

56% |

|

| |

April |

53% |

62% |

55% |

|

| |

May |

47% |

63% |

60% |

|

| |

June |

44% |

62% |

53% |

|

| |

July |

57% |

63% |

55% |

|

| |

August |

59% |

62% |

55% |

|

| |

September |

38% |

62% |

49% |

|

| |

October |

51% |

66% |

51% |

|

| |

November |

56% |

62% |

57% |

|

| |

December |

67% |

64% |

58% |

|

| |

|

|

|

|

|

| |

average |

53% |

64% |

55% |

|

| |

|

|

|

|

|

That's nice, but let's do our own thinking.

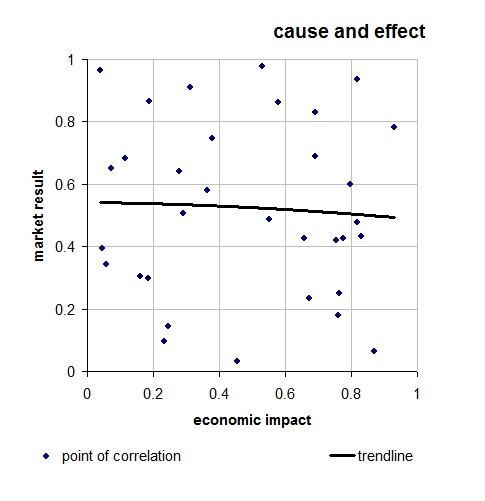

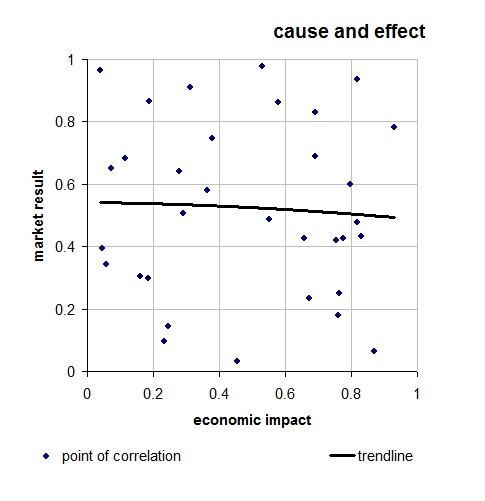

On the left is what we get when we look at the Dow Jones average monthly change for each month since 1896 and compare the month's performance with the total returns for the subsequent 12 months. The idea is to see if January is any better at predicting the up comming year any better than say February or March or...

What we end up with is the fact that most months are up, most years are up so most months predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

* * * * * * *

My personal take is that this is random and the problem we face is that it's sooo easy to see trends in purely random numbers. Check out the plot on the right of how an imaginary econ impact can affect my imaginary market. We end up with a trend line that slopes slightly downward. We could even exaggerate the scale and use it to "prove" a correlation.

My point is that all the numbers plotted there are random, and random numbers can always slow some kind of trend line. What's not random though is that people are productive and over the years they create wealth and if we invest in them we get rich. I can live with that.

TOPICS: Business/Economy; Government; News/Current Events

KEYWORDS: economy; financial; stockmarket; wallstreet

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-118 next last

To: abb

Good stuff. Thanks.

I think once it hits 440/bbl the Saudi’s cut production to stabilize.

BHI shows rig counts peaking at 1609 in October and falling 8% to 1482 last week.

To: abb

I really hope you didn’t do that. The oil stocks, according to Cramer, and I think he’s quite right on this one, will follow down for two or three quarters. Their profits will be adversly affected for those quarters and they won’t adjust to the new normal for at least 2 quarters.

Hold off if you can. (just my 2 cents).

82

posted on

01/07/2015 10:15:07 AM PST

by

Rich21IE

To: Rich21IE

If BP breaks 35, I’m buying - again. I’ve bought a total of 800 shares so far in the past couple of months, from 39 to 35. With the dividend it pays, I’m comfortable with my decision.

I’m also closely following XOM and CAT, and plan to add those to my portfolio within the next few months.

I had been taking profits over the past couple of years, in anticipation of buying opportunities.

As I’ve been an investor (as opposed to a trader) for 40 years, I understand the risks and opportunities.

83

posted on

01/07/2015 10:36:13 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Rich21IE

Also, I hardly ever pay any attention to Cramer. The man is merely another loudmouthed frontrunner, who the SEC won’t touch because he’s politically connected.

IMHO.

84

posted on

01/07/2015 10:54:44 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

The TARP was '08 BernankeTARP was Paulson/Bush. Bernanke was QE.

85

posted on

01/07/2015 10:59:23 AM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: Toddsterpatriot

Yeah those guys were there too, but our issue is how too many people confuse TARP with the massive tax’n’spending programs that started in ‘09. While it’s easy to label the entire policy package as “bailouts”, the fact remains that TARP and the ‘09 deficit spending excesses shouldn’t be equated.

To: abb

Well, you sound like you’ve got the experience. I’ve been at this for 45 years myself, but this fall off in the commodity space is worrisome.

What’s really strange is the deflation in Europe. That sounds like it could be a problem.

87

posted on

01/07/2015 1:13:03 PM PST

by

Rich21IE

To: Rich21IE

Money and investing is much more an emotional function, rather than simple arithmetic. Time and again, we have seen that the best time to buy is when the markets are in a panic and prices are low - 1974, 1982, 1987, 2003, 2009. In hindsight, it seems obvious.

But it takes a crazy person to go against the herd and place an order to buy or sell contrary to everyone else.

Several months ago, I read a bio of Hetty Green, “The Richest Woman on Wall Street.” She managed to master her fears and buy distressed companies and made a fortune doing it.

I’ve made plenty investing mistakes, but fortunately I learned very early on that short-term trading was NOT the way to build wealth.

Historically, integrated energy companies (not the drillers or small service companies) have been a sound long-term investment. And they’re kinda on sale now.

I may be buying a bit too early - I’ve done that before - but I’m patient enough to see it through.

88

posted on

01/07/2015 1:44:29 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: expat_panama

expat, I'm betting you've touched on this already & if you have I apologize. Can you explain to me why the market is behaving negatively in response to the lower cost of oil?

I'm guessing it has to do with the strength of the dollar but that doesn't make a lot of sense either.

Can you give me a little insight?

89

posted on

01/07/2015 2:27:56 PM PST

by

A Cyrenian

(Don't worry about stuffing the bus or filling the fridge. Try filling the Church.)

To: A Cyrenian

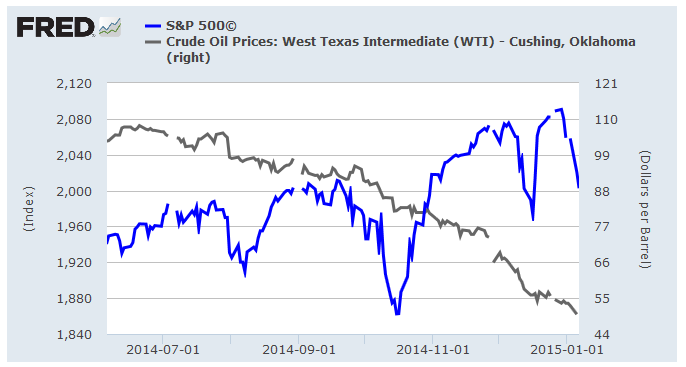

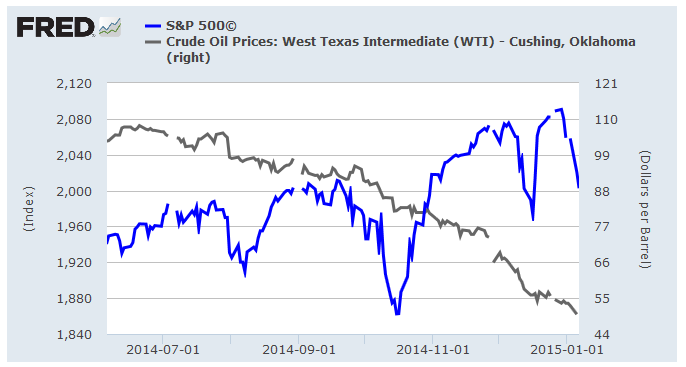

why the market is behaving negatively in response to the lower cost of oil? That's what we've been hearing but honestly it's just not what I've been seeing:

My take is that while the price of oil has fallen stocks have been climbing, and they've fluctuated for (imho) other reasons.

To: Wyatt's Torch; All

http://www.wsj.com/articles/brent-crude-falls-below-50-a-barrel-1420609392

Oil-Product Prices Fall as Supplies Climb

U.S. Inventory Data Confirm the Market Is Still Oversupplied

By Nicole Friedman

Updated Jan. 7, 2015 7:06 p.m. ET

Prices at the gas pump are heading even lower.

Gasoline futures fell to nearly a six-year low on Wednesday after U.S. government data showed oil and fuel supplies rising to a record high last week, the latest evidence of a petroleum glut that has rattled financial markets and raised questions about the strength of global economic growth.

U.S. crude-oil prices rose modestly, but there was little indication that the market, which has plunged by 55% since late June, has hit a bottom.

Weekly inventory data released by the federal Energy Information Administration reinforced the belief among many investors and traders that increasing oil output continues to overwhelm the growth in demand, a situation that is likely to further undercut prices across the board.

U.S. stockpiles of crude oil, refined fuels and other types of petroleum rose 0.9% to 1.149 billion barrels in the week ended Jan. 2, according to the EIA. That is the highest level ever in weekly data dating back to 1990, and beats the previous high set in June 2013. The total doesn’t count the barrels held in the nation’s strategic petroleum reserve.

“There is no shortage, anywhere, at the moment,” said Donald Morton, senior vice president of Herbert J. Sims & Co., who oversees an energy-trading desk at the Fairfield, Conn., investment bank. “Our inventories are getting high.”

91

posted on

01/07/2015 4:54:32 PM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: 1010RD; A Cyrenian; abb; Abigail Adams; abigail2; AK_47_7.62x39; Aliska; aposiopetic; Aquamarine; ..

Yo! Futures @ 2 hrs before the bell: stock indexes punching up again 0.77%, metals off a bit to -0.07%, and energies  continuing freefall -0.15% --all this after yesterdays steady metals and soaring stocks in lower (but above average) volume. We're good! Reports this AM:

continuing freefall -0.15% --all this after yesterdays steady metals and soaring stocks in lower (but above average) volume. We're good! Reports this AM:

Challenger Job Cuts

Continuing Claims

Initial Claims

Natural Gas Inventories

Consumer Credit

--and a whole lot of brand new FR econ threads:

To: expat_panama

Dollar strongest since 2003... But but but HYPERINFLATION!!!!

To: Wyatt's Torch

Dollar strongest since 2003...--and this is how all the printing press QE bailouts have been devaluing the dollar...

To: expat_panama

Stop with the facts!! My mind is made up and you’re confusing the issue!!

/sarc

95

posted on

01/08/2015 7:22:59 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: abb

Right! Talking with folks upset about Fed bailouts is like trying to work with global warmers.

To: expat_panama; All

http://finance.yahoo.com/news/exclusive-oil-glut-spurs-top-161022997.html

Oil glut spurs top traders to book supertankers for storage at sea

Reuters

By Jonathan Saul, Claire Milhench and David Sheppard

LONDON (Reuters) - Some of the world’s largest oil traders have this week hired supertankers to store crude at sea, marking a milestone in the build-up of the global glut.

Trading firms including Vitol [VITOLV.UL], Trafigura [TRAFGF.UL] and energy major Shell (RDSa.L) have all booked crude tankers for up to 12 months, freight brokers and shipping sources told Reuters.

They said the flurry of long-term bookings was unusual and suggested traders could use the vessels to store excess crude at sea until prices rebound, repeating a popular 2009 trading gambit when prices last crashed.

The more than 50 percent fall in spot prices now allows traders to make money by storing the crude for delivery months down the line, when prices are expected to recover.

The price of Brent crude is now around $8 a barrel higher for delivery at the end of 2015, with its premium rising sharply over spot prices this week due to forecasts for a large surplus in the first half of this year, in a market structure known as contango.

97

posted on

01/08/2015 10:12:56 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

To: Wyatt's Torch

The gold price will soon = DJIA.

I heard it here first.

98

posted on

01/08/2015 10:16:12 AM PST

by

Toddsterpatriot

(Science is hard. Harder if you're stupid.)

To: abb

"...make money by storing the crude for delivery months down the line, when prices are expected to recover."We can tell a lot about the writer's thinking the way he's saying "when" and not "if".

To: expat_panama

LOL! One of my coffee buddies, who doesn’t believe in the “stock market” and says its too risky (I think he uses mason jars in the back yard), is always saying “when” the market crashes. Of course, one day he’ll be right. But if I press him as to a date, he splutters and comes up with something like “next fall” or “after the first of the year” or some such.

I’ve been baiting up him for the past two years, and asking him about his predictions all being wrong. Then he denies saying it, so I say I’m going to start bringing a tape recorder to morning coffee.

Great theater!

100

posted on

01/08/2015 10:37:37 AM PST

by

abb

("News reporting is too important to be left to the journalists." Walter Abbott (1950 -))

Navigation: use the links below to view more comments.

first previous 1-20 ... 41-60, 61-80, 81-100, 101-118 next last

Disclaimer:

Opinions posted on Free Republic are those of the individual

posters and do not necessarily represent the opinion of Free Republic or its

management. All materials posted herein are protected by copyright law and the

exemption for fair use of copyrighted works.

FreeRepublic.com is powered by software copyright 2000-2008 John Robinson

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

predict the following year. Since 1896 January has in fact predicted better than most, but our winner turns out to be May which is right 60% of the time vs. January's 59% score.

continuing freefall -0.15% --all this after yesterdays steady metals and soaring stocks in lower (but above average) volume. We're good! Reports this AM:

continuing freefall -0.15% --all this after yesterdays steady metals and soaring stocks in lower (but above average) volume. We're good! Reports this AM: